Table of Contents

Market makers, equipped with high-frequency trading capabilities, institutional-grade cost structures, and real-time creation/redemption privileges, are the primary participants in ETF premium–discount arbitrage. In contrast, Non-Institutional Participants face multiple constraints—including information latency and higher transaction frictions—which make it difficult to capture arbitrage opportunities promptly or profitably.

Using the Yuanta Taiwan 50 ETF (0050) as a primary case study, this research simulates the execution of premium–discount arbitrage for these two distinct market participants based on historical empirical data. By comparing performance under varying entry/exit thresholds and cost structures—and evaluating metrics such as hit rates, return distributions, and drawdown risks—we aim to clarify an essential question: In this seemingly “risk-free arbitrage,” who truly captures the opportunity and earns consistent alpha in the Taiwan market?

📊Use our Factor Library to find alpha and optimize investment strategies

The empirical analysis incorporates the following structural features unique to the Taiwan capital market:

AUM (Assets Under Management): As of January 2025, the AUM stood at approximately NT$ 440 billion, maintaining its position as the most liquid and benchmark-representative ETF in Taiwan.

Underlying Index: TSEC Taiwan 50 Index (comprising the top 50 companies by market capitalization).

The quantitative data retrieved via TEJ . This ensures cross-period consistency through standardized corporate actions and high-fidelity price adjustments.

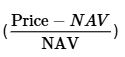

The strategy utilizes the Premium/Discount Ratio defined as follow, rather than absolute price spreads.

This approach normalizes the signal, ensuring consistent volatility sensitivity across the ETF’s decade-long price appreciation (from ~NT$50 to >NT$150).

To strictly mitigate look-ahead bias, the model employs a static parameter approach:

The strategy exploits Mean Reversion when the ratio deviates significantly from the historical mean. Two distinct thresholds are tested to reflect different cost structures:

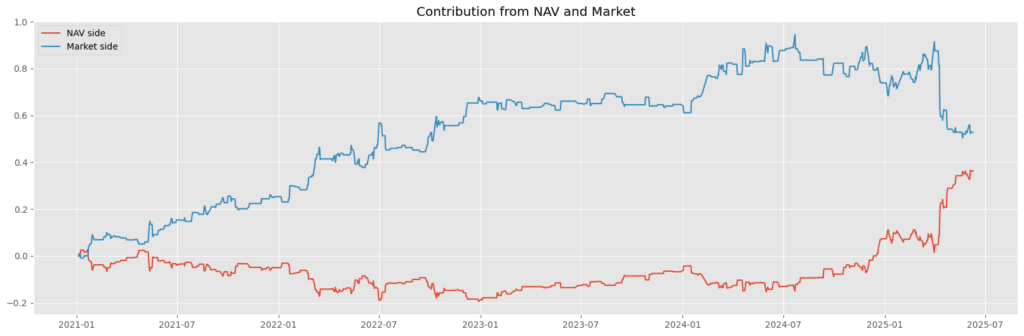

To isolate the source of Alpha, the strategy decomposes returns into two components:

This decomposition allows us to verify whether profits originate from fundamental value adjustments (NAV) or liquidity-driven price corrections (Market Price).

Figure 1: Long-Term Price & Premium/Discount Structure of Yuanta Taiwan 50 (0050)

💡Further Reading: TCRI Watchdog master credit risks with daily monitoring to bridge financial reporting gaps

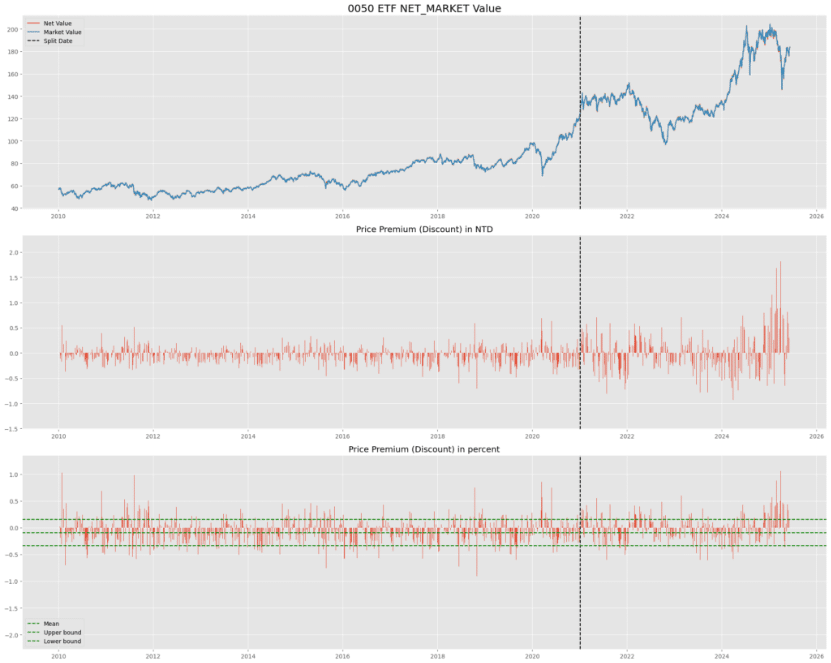

Market Makers (MM), benefiting from transaction tax exemptions and fee waivers, can effectively exploit minor deviations (±1σ).

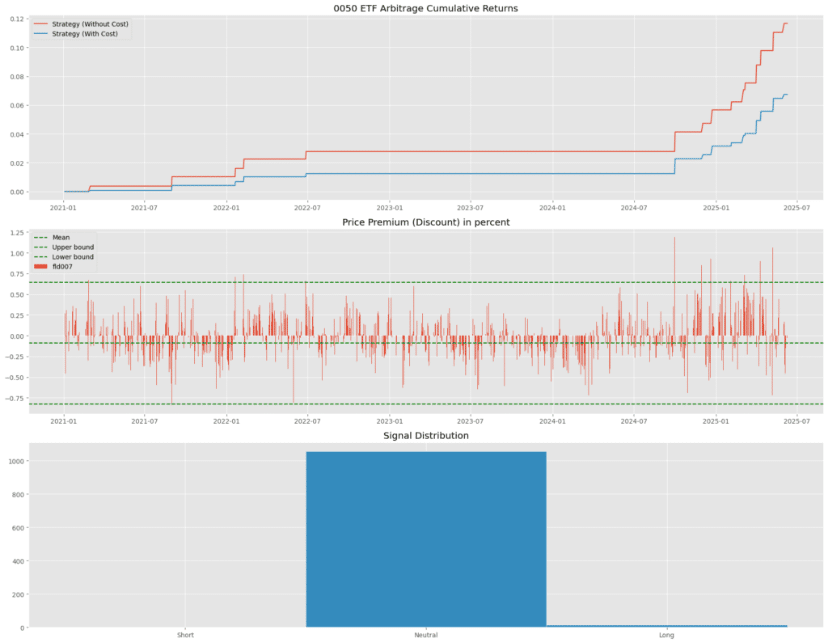

Figure 2: Market Maker Strategy Performance (1-SD Threshold)

Decomposing the profit sources reveals the mechanics of the arbitrage:

Figure 3: Return Attribution Analysis (NAV vs. Market Price)

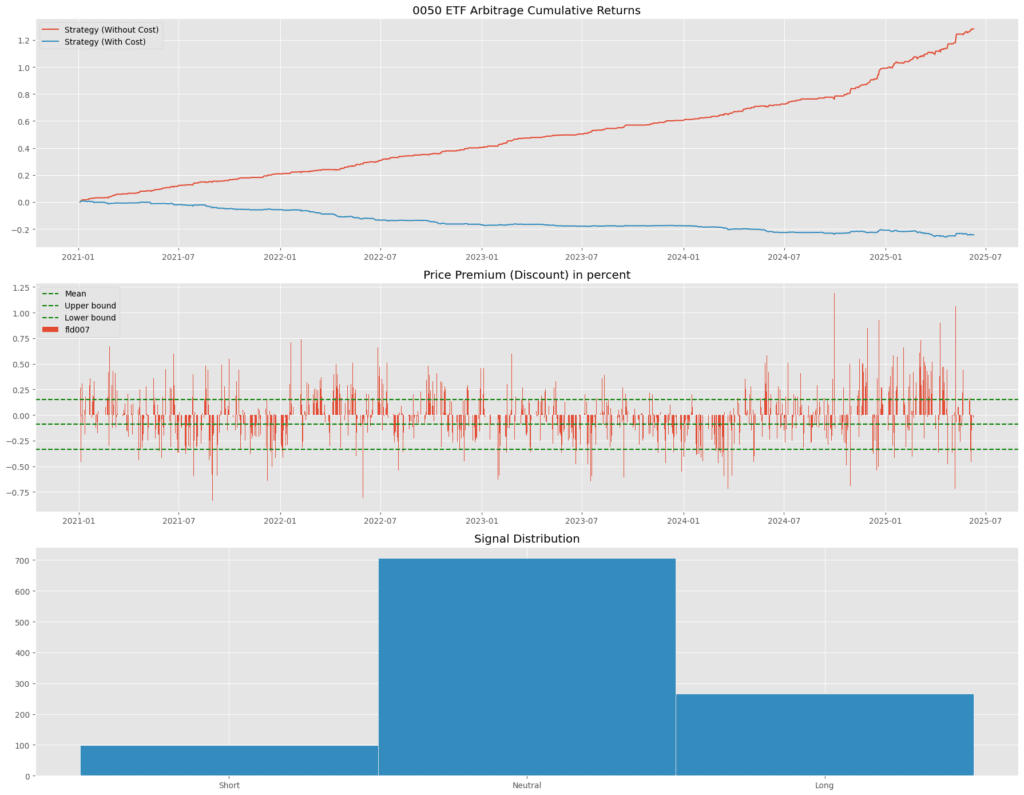

For Non-Institutional participants, the strategy tightens the entry threshold to 3 Standard Deviations to buffer against the 0.1% Tax and commissions.

Figure 4: Non-Institutional Strategy Performance (3-SD Threshold)

To synthesize the empirical findings, the following table contrasts the structural and operational divergences between the two participant categories:

| Metric | Market Maker (1-SD) | Non-Institutional (3-SD) |

|---|---|---|

| Primary Advantage | Tax/Fee Exemption | None (Standard Costs) |

| Trading Logic | High Frequency Liquidity Provision | Opportunistic / Sniper |

| Trade Frequency | High (Continuous) | Very Low (Sparse) |

| Win Rate (Hit Ratio) | High | 100% (Observed sample window) |

| Profit Source | Volume x Small Spread | Occasional Extreme Mispricing |

| Capital Efficiency | High (Constant turnover) | Low (Capital idle for long periods) |

| Strategic Viability | Core Strategy | Inefficient (Better alternatives exist) |

The empirical data from the Taiwan market validates that ETF premium/discount arbitrage is not a democratic strategy.

For Market Makers, it represents a consistent, high-probability income stream derived from liquidity provision and structural tax advantages.

For Non-Institutional Investors, the strategy exhibits a clear form of ‘Negative Asymmetry.’ Transaction costs in Taiwan—particularly the bid-ask spread and securities transaction tax—effectively gatekeep the majority of arbitrage profits.

Outside of rare, extreme dislocations or scenarios requiring sub-minute intraday execution capabilities, a standard end-of-day mean reversion approach offers insufficient risk-adjusted returns for non-institutional participants.

This research is empowered by TEJ Market Data—the authoritative source for Taiwan financial intelligence.

Ensure your models are built on truth with our precise Corporate Action Adjustments, Equity Pricing, and deep ETF Analytics.