Table of Contents

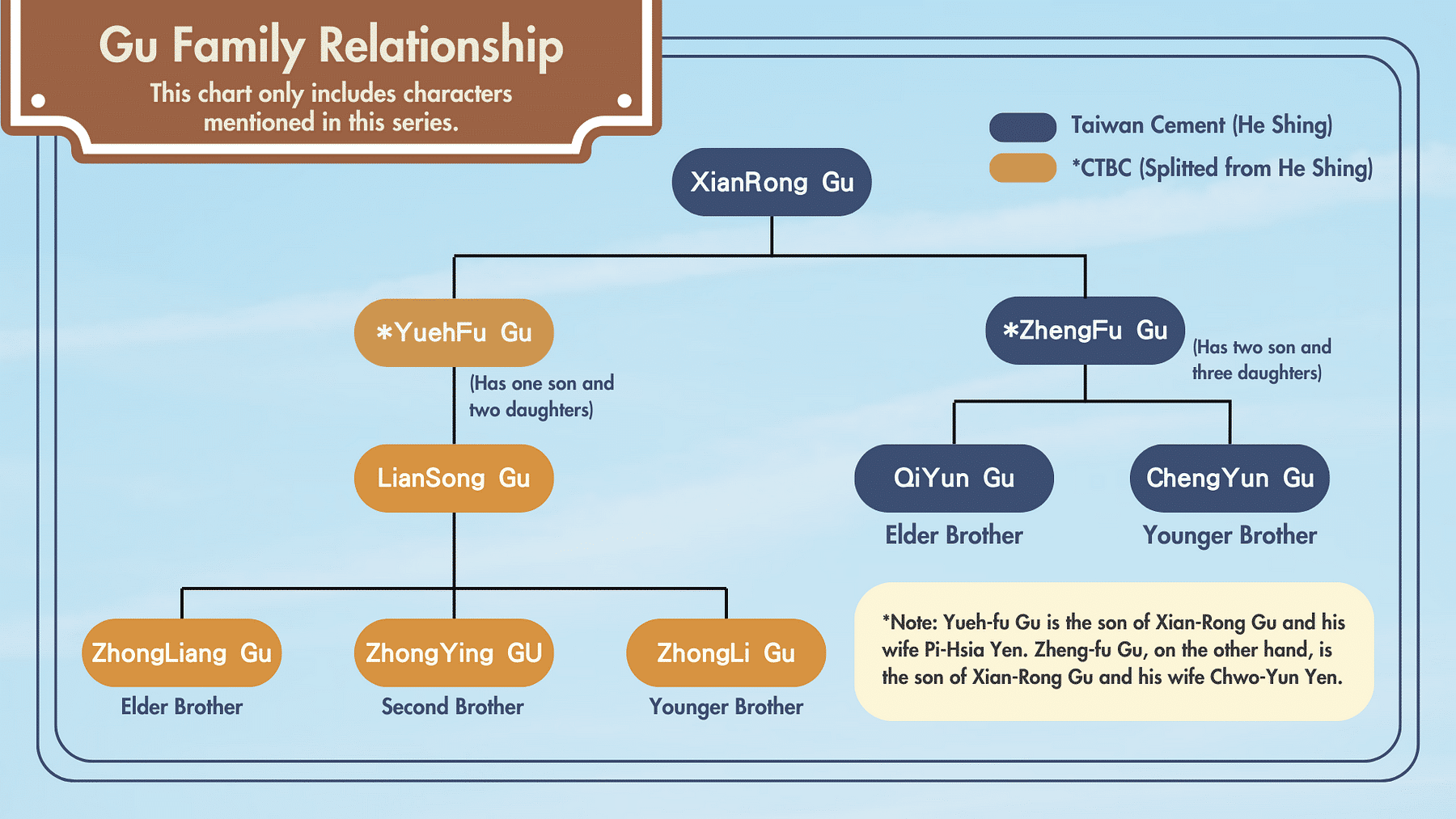

The Lukang Gu family is one of the renowned Big Five families. Its roots trace back to the era when XianRong Gu facilitated the entry of the Japanese army into Taipei, gaining numerous privileges and business rights during the Japanese occupation. In 1937, with China’s full-scale resistance against Japan, XianRong Gu passed away due to illness. Breaking from the tradition of direct inheritance, the 20-year-old son, ZhenFu Gu, took over. Later, ZhenFu Gu married ZhuoYun Yan, and the couple moved to Hong Kong.

In 1953, responding to the government’s “Land to the Tiller” policy, ZhenFu Gu returned from Hong Kong and took the initiative to exchange the vast family land for shares in Taiwan Cement. Serving as an advisor to the Ministry of Economic Affairs, he assisted in privatizing Taiwan Cement. Subsequently, he gradually overcame other regional powers, such as the Chen family in Kaohsiung and the Lin family. Through intricate stock investments, ZhenFu Gu expanded and developed the group corporation into the He Shing Group (former Taiwan Cement group). This firmly established the Gu family’s dominance within Taiwan Cement and constructed an impregnable kingdom in the cement industry.

In this series on the Gu family’s separation, we will introduce the family’s separation process and narrate the development of the two resulting groups — Taiwan Cement and CTBC. This article will focus on the initial separation of the Gu family and the subsequent development of the Taiwan Cement group. It will outline the timeline of Taiwan Cement’s formation and growth, providing you with a deeper understanding of the Gu family and Taiwan Cement’s developmental journey!

As LianSong Gu grew up, a situation emerged where he, as the eldest grandson and his fifth uncle, ZhenFu Gu, simultaneously took center stage in the family’s inheritance. ZhenFu Gu chose not to have his son inherit the family business to safeguard the greater family interests. Instead, he designed a succession system involving the “ZhenFu Gu — LianSong Gu — QiYun Gu (ZhenFu Gu’s eldest son) — ZhongLiang Gu (LianSong Gu’s eldest son)” uncle-nephew succession.

Since 1999, issues have arisen in the businesses managed by QiYun Gu. Firstly, a domestic financial crisis erupted, forcing the management of a debt of 3 billion NTD. As a result, Chinalife turned from a profit to a loss of 2.4 billion NTD. Additionally, the stock price of the U.S.-listed internet company GigaMedia dropped from $90 to below $1 within two months, experiencing a significant market value contraction. The cable television empire, established with tens of billions of NTD, suffered a massive loss of 6 billion NTD. Faced with QiYun Gu’s business challenges, LianSong Gu chose not to clean up the mess but, instead, sought self-preservation, disrupting ZhenFu Gu’s succession plan.

In 2001, QiYun Gu was diagnosed with bile duct cancer, leading the Gu family towards a path of separation. Through negotiations between ZhenFu Gu and LianSong Gu, an agreement was reached to ensure that the listed companies under their control were not adversely affected. They transferred the ownership of shares held initially by QiYun Gu to LianSong Gu, completely severing ties with the listed companies. The traditional businesses, primarily led by Taiwan Cement, were managed by ZhenFu Gu’s second son, ChengYun Gu. The financial industry, mainly consisting of CTBC, was spearheaded by LianSong Gu and his son. The leasing group was entrusted to LianSong Gu’s third son, ZhongLi Gu.

Taiwan Cement Corporation traces its roots back to the Japanese colonial period, founded in May 1946, with its primary business focused on cement production. Initially established as a public enterprise, it was officially registered in December 1950. Due to the government’s implementation of the “Land to the Tiller” policy, Taiwan Cement, along with the other three major industries — agriculture and forestry, mining and industry, and paper — was used as compensation for landowners in the form of stocks. Consequently, in November 1954, it underwent privatization, and the management rights were acquired by the Gu family from Lukang. In 1962, Taiwan Cement became the first publicly listed company in Taiwan under stock code 1101.

According to data from TEJ as early as June 1996, the Gu family held approximately 8% of the shares, making them the second-largest shareholder below the government. They secured three of the 20 director seats, with ZhenFu Gu serving as the Chairman. Since pre-privatization data is unavailable, and considering that the Gu family has been leading the company since privatization, TEJ used the registration date of December 1950 as the point when Taiwan Cement was incorporated into the Gu family-controlled group.