Table of Contents

Since March 2022, the US Federal Reserve has consistently raised interest rates, prompting a shift in market sentiment. Investors seeking higher returns than bonds turned to banks, triggering a mass bond sell-off and subsequent price decline. However, by Q4 2023, expectations of a more accommodative stance from the Fed led investors back to the bond market, anticipating gains as prices rebound at the end of the rate hike cycle.

In 2023, global financial markets faced turbulence, marked by the collapse of Silicon Valley Bank and a crisis at Credit Suisse. UBS Group’s acquisition of Credit Suisse unexpectedly led to the cancellation of all previously issued Credit Suisse Additional Tier-1 (AT1) bonds, causing substantial losses for investors. While some stability returned with Sumitomo Mitsui Financial Group’s successful sale of $1 billion yen-denominated AT1 bonds, the Credit Suisse incident remains a market focal point.

This article explores the nature of AT1 bonds, why investors engage during interest rate hikes, the impact of bond cancellations, and strategies to avoid pitfalls, shedding light on the hidden risks behind their high yields.

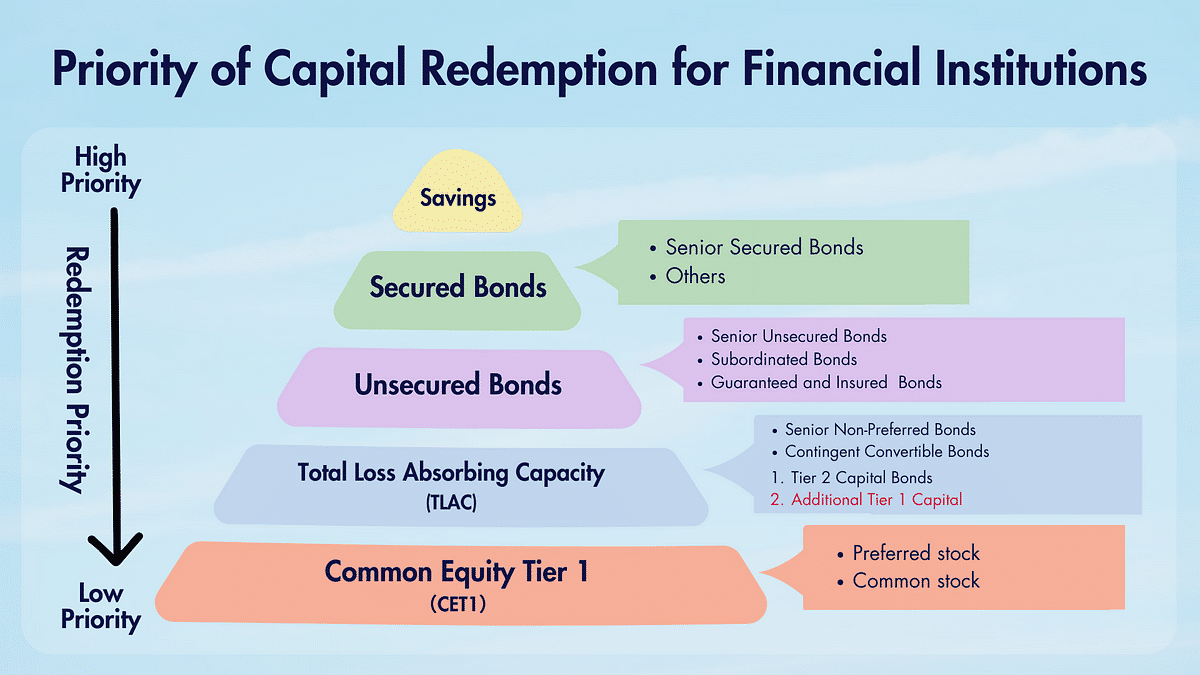

In 2023, UBS Group’s acquisition of Credit Suisse unexpectedly led to the cancellation of all previously issued Credit Suisse AT1 bonds. However, looking at the bank’s capital redemption order, stocks have the lowest priority for redemption; even in the case of cancellation, stocks should be addressed first. This move surprised the market. Nevertheless, AT1 bonds have their uniqueness; although categorized as bonds, their issuance reasons and conditions differ significantly from commonly seen bonds.

AT1 bonds, or Additional Tier 1 Capital Bonds, fall under the category of Contingent Convertible bonds, also known as CoCo Bonds. CoCo Bonds serve to avert a bank’s operational crisis that could lead to bankruptcy due to a rapid increase in liabilities. In times of crisis, CoCo Bonds can be forcibly converted into common stocks, allowing bondholders and shareholders to share losses, thereby reducing the debt ratio and obtaining more substantial capital buffers. This mechanism prevents the escalation of systemic risks and safeguards the entire financial system.

Basel III, published by regulatory authorities in 2010, imposed stricter regulations and mandated systemically important banks to meet capital requirements. AT1 bonds represent a form of Total Loss Absorbing Capacity (TLAC) and are part of Basel III’s stipulation for “banks issuing long-term debt instruments with conversion terms to common stocks,” aimed at absorbing losses in times of crisis. These instruments contribute to minimizing the impact on the overall market during periods of bad debt or bankruptcy risks.