Table of Contents

When a company announces a stock buyback, it is often perceived as a bullish signal, attracting investors. However, what motivates a company to buy back its own shares? Before following the trend, what key factors should investors consider? This article provides a comprehensive yet accessible explanation of treasury stock and its implications.

Before delving into treasury stock, it is essential to understand the requirements for companies to be listed in Taiwan. A company must have a minimum capital of NT$600 million and issue at least 30 million common shares. Once listed, these shares are publicly traded on the secondary market, where investors can buy and sell them as outstanding shares.

So, what exactly is treasury stock? Simply put, treasury stock refers to shares that a company repurchases using its own cash. These shares can either be held for future issuance or retired permanently, removing them from market circulation. Typically, companies set an upper limit on the number of shares they plan to buy back. However, the actual number of shares repurchased determines the execution rate—the ratio of shares actually repurchased to the total planned buyback volume. A high execution rate indicates aggressive buybacks, whereas a low execution rate suggests the company may be exercising caution based on market conditions.

Companies repurchase treasury stock for several strategic reasons, including capital structure optimization, employee incentives, shareholder returns, and defense against hostile takeovers. Here are the most common motivations:

Companies may repurchase shares to support the conversion of certain securities into common stock, such as convertible bonds, convertible preferred stock, and stock warrants. Holding treasury shares in reserve for such conversions helps prevent financial losses, maintain capital structure flexibility, and ensure market liquidity. By doing so, companies can stabilize their financial position and enhance investor confidence, making treasury stock a key instrument in managing market fluctuations.

Treasury shares are often used as part of employee compensation programs, such as stock options and profit-sharing plans. By distributing repurchased shares to employees, companies can boost morale, increase employee commitment, and align their interests with the company’s long-term growth. Employees who hold company shares are more motivated to contribute to the firm’s success, reducing agency problems by ensuring that both management and employees work toward common goals.

In the U.S. stock market, share buybacks are a widely adopted method of returning value to shareholders, often preferred over dividend distributions. Many large multinational corporations attract significant foreign investment, but under U.S. tax laws, dividends paid to foreign investors are subject to a 30% withholding tax. As a result, companies frequently opt for share repurchases to increase stock prices, allowing investors to benefit through capital gains instead of taxable dividends.

Treasury stock can serve as a defensive measure against hostile takeovers. When faced with the threat of unwanted acquisitions, companies can buy back shares to reduce the number of outstanding shares, thereby increasing the ownership percentage of existing shareholders and strengthening control. By consolidating voting power within trusted stakeholders, companies can prevent external investors from acquiring a controlling stake, safeguarding corporate autonomy.

When a company decides to repurchase treasury stock, it requires a significant cash outflow, which may impact liquidity management. In the short term, substantial cash expenditures can tighten the company’s cash flow, potentially affecting operational funding or investment plans. If the buyback is large, the company may need to reallocate financial resources or cut spending in other areas to maintain financial stability.

Additionally, holding a large amount of treasury stock can become a financial burden if market conditions deteriorate or if the company faces unexpected liquidity needs. Therefore, companies must carefully assess their cash flow situation before initiating a buyback program to avoid disruptions to core business operations or an inability to respond to sudden financial demands.

A share buyback announcement is often perceived by the market as a bullish signal, suggesting that the company’s stock is undervalued. The announcement can drive short-term price increases. However, such buyback-induced price surges are not always sustainable.

There are instances where stock prices continue to decline despite buyback efforts. A notable example is HTC (TW: 2498) in Q3 2013, when the company initiated a repurchase plan amid poor financial performance. HTC’s stock continued to decline despite the buyback, demonstrating that if a company’s fundamentals do not improve, buybacks alone cannot support long-term price growth.

For investors, this means exercising caution when interpreting stock repurchases as a sign of strength. While buybacks may provide temporary price support, long-term stock performance ultimately depends on the company’s financial health and operational success. If fundamentals remain weak, stock prices may fall back once market sentiment cools, potentially dropping below pre-buyback levels, rendering the short-term buyback effect meaningless.

After discussing the various functions of treasury stock, you might be wondering—what should companies be aware of when repurchasing their own shares? Below, we’ve compiled some of the most common questions and their answers!

Publicly listed companies must comply with the “Regulations Governing Share Repurchases by Listed and OTC Companies” and report the repurchase plan to the Financial Supervisory Commission (FSC). The buyback details, including purpose, type, total budget, planned period, quantity, price range, and method, must also be disclosed via the Market Observation Post System (MOPS).

Setting the buyback price range is a key concern for the market. Companies consider multiple factors, such as the current stock price, historical averages, volatility, reason for repurchase, and buyback timeline, to ensure the price range is reasonable and does not mislead investors.

According to FSC guidelines, the buyback price should typically fall within 150% of the highest average closing price from the past 10 or 30 trading days prior to the board resolution, and 70% of the closing price on the resolution day. If the stock price moves beyond the set range, the company must suspend the repurchase unless the board has previously resolved that purchases can continue even below the lower limit. If necessary, the company can adjust the price range and disclose the revised buyback plan before proceeding.

Yes. Once a company repurchases at least 2% of its total outstanding shares or spends over NT$300 million, it must publicly disclose this information within two days. If the buyback continues and reaches the same threshold again (another 2% or NT$300 million), further announcements are required.

Companies must provide regular updates to keep investors informed of the latest treasury stock activities. Suppose a company does not fully execute the repurchase plan within the designated period. In that case, it must obtain a new board resolution to continue the buyback and make the necessary disclosures in accordance with the regulations.

According to Article 28-2 of the Securities and Exchange Act, companies must transfer repurchased shares to employees within five years. If the shares are not transferred within this period, they will be deemed unissued shares and must be canceled through a capital reduction and registration update.

The most common way to monitor treasury stock transactions is through the Market Observation Post System (MOPS). Navigate to “Investment Section” → “Treasury Stock Information” → “Treasury Stock Summary Report” to access key details such as the purpose, type, total budget, planned buyback period, and quantity of treasury stock repurchases. This platform provides essential data for investors to track a company’s buyback activities effectively.

Figure 1, MOPS website

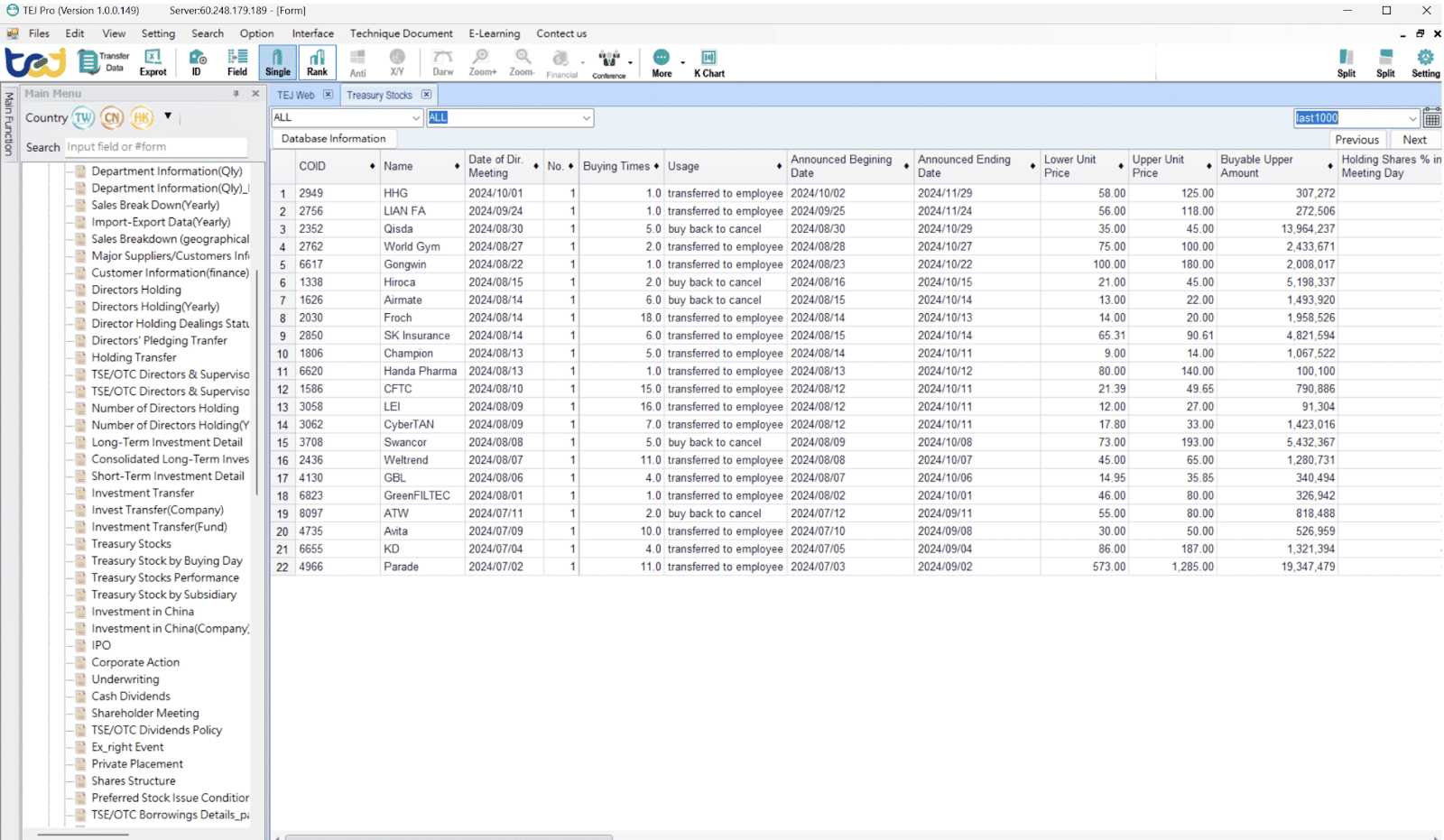

TEJ Event-Driven Data is an excellent resource for a more in-depth analysis of how treasury stock buybacks impact stock prices. Unlike the basic information available on the MOPS, TEJ provides additional key data, including:

Moreover, TEJ provides a comprehensive dataset for quantitative analysis, enhancing the accuracy of your research. It also offers customizable search filters, enabling more efficient and precise tracking of treasury stock buyback activities.

Event-driven investments offer profitable opportunities but require careful execution. Hence, high-quality data becomes essential for identifying opportunities and making informed investment decisions to generate returns.

As a reliable financial and economic data provider, TEJ offers comprehensive solutions tailored for event-driven strategies. Our dataset encompasses crucial information, including treasury stock transactions, dividend policies, corporate mergers, spin-offs, equity changes, and more, allowing investors to create precise strategies targeted at the Taiwanese stock market.

Besides, established upon the Point in Time Architecture (PTA) approach, TEJ’s database preserves the corporate event’s full chronology, tracking each stage from announcement to completion. TEJ also retains accurate information about the dates and processes of every event. As such, investors can implement rigorous analysis for effective event-driven strategies.

Additionally, TEJ ensures that all data is updated in a timely manner, allowing investors to identify market fluctuations and capture opportunities. With these prompt updates, investors can also adjust their investment strategies accordingly to ensure their portfolios are up-to-date.

Ready to get started? Explore TEJ’s event-driven data solutions today and refine your investment approach!