Photo by Freepik

Table of Contents

In Part 1, we discussed the policy background driving the development of China’s IC design industry, including a comparison of the current status and trend analysis of selected IC firms in both Taiwan and China. In this section, we will further explore the development of the IC design industry from several perspectives, including a comparison of revenue trends between Taiwan and China. Additionally, we will examine the top 10 Taiwanese IC design companies with the highest and lowest R&D investments during the first three quarters of 2024, analyzing the differences in their R&D resource allocation. With the latest and most insightful analysis of the IC industry, you will not miss the hottest trends covered here.

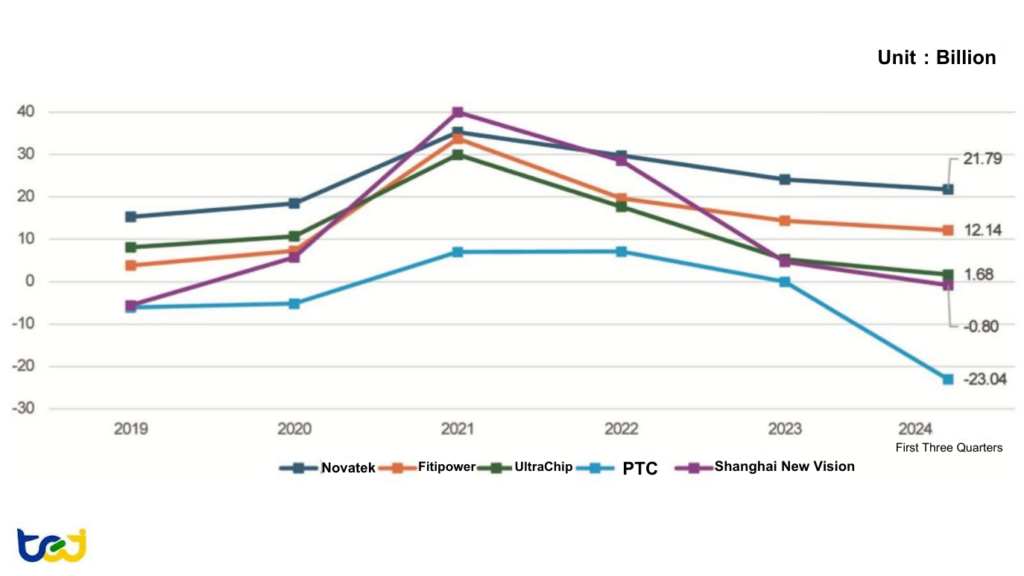

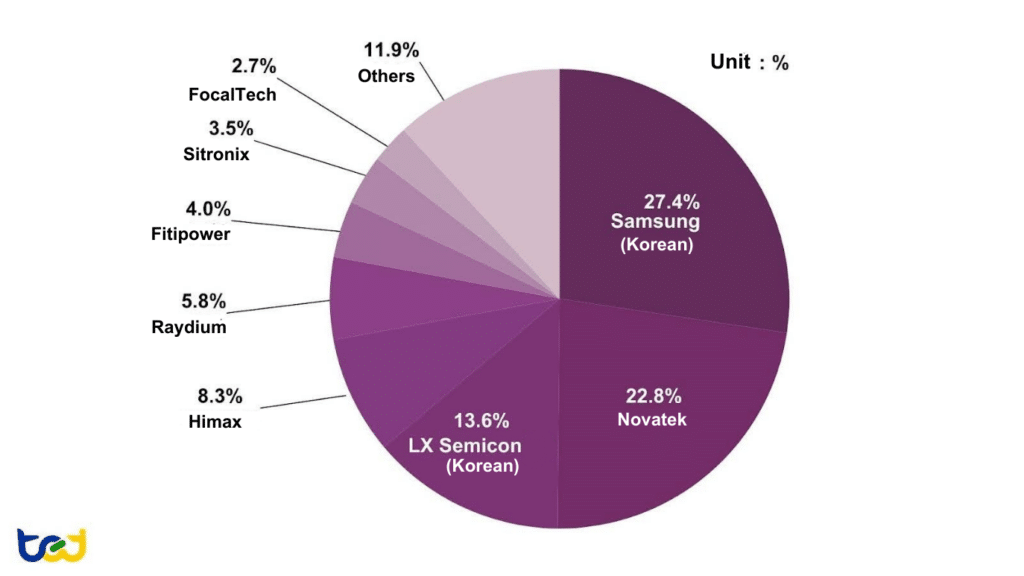

As Chinese panel manufacturers continue to expand their market share, significant opportunities have emerged for local display driver IC (DDIC) companies. Although Taiwanese DDIC vendors still maintain a leading position in terms of global market share (Figure 13) and remain at the forefront of OLED technology, competitive pressure from Chinese companies is gradually increasing. For instance, Chinese panel makers BOE and HKC are key clients of Taiwanese DDIC suppliers. However, according to a report by Shenwan Hongyuan Securities, ESWIN, a company founded by a former BOE executive, became BOE’s largest DDIC supplier in 2020. Additionally, Chipone has been steadily increasing its supply share to both BOE and HKC.

While ESWIN and Chipone are representative players in China’s DDIC market, they are not publicly listed, making their financial data difficult to access. Therefore, this section uses the publicly traded company Shanghai New Vision as a proxy for comparison. Shanghai New Vision operates on a smaller revenue scale and shows greater volatility in operating margins.

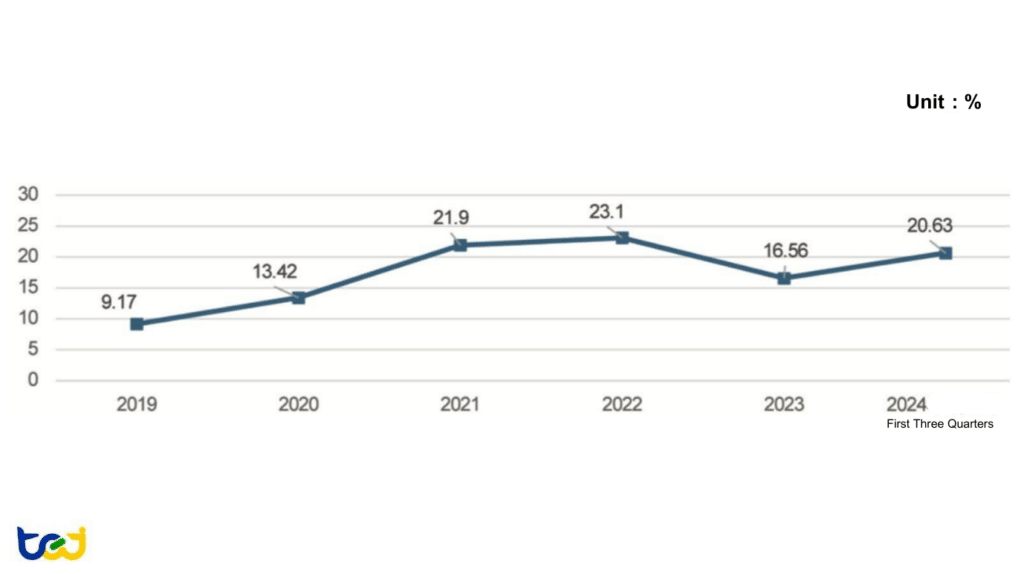

Among Taiwanese vendors, Novatek stands out as a market leader with stable revenue and operating margins, consistently maintaining an operating margin above 20% in recent years. PTC focuses on automotive DDICs, but its narrower application scope leads to greater business fluctuations. Both Fitipower and UltraChip have entered the e-paper segment. Fitipower has a more diversified product line and larger revenue scale, with operating margins consistently above 10%. In contrast, UltraChip focuses solely on e-paper applications, resulting in more volatile profit margins (Figures 11 and 12).

Figure 11: Revenue Trends of Display-related IC Design Companies

Source: TEJ Financial Database, and TEJ’s 2024 revenue estimates

Note 1: Due to large differences in revenue scale among companies, a logarithmic scale is used for the y-axis.

Note 2: As SinoWealth has not released a 2024 revenue forecast, the figure uses an estimate based on the first three quarters of 2024.

Figure 12 : Operating Margin Trends of Display-related IC Design Companies

Source: TEJ Financial Database

Figure 13 : Global Market Share of DDIC Companies

Source:Omdia 1-4Q 2023 Display Driver ICmarket tracker

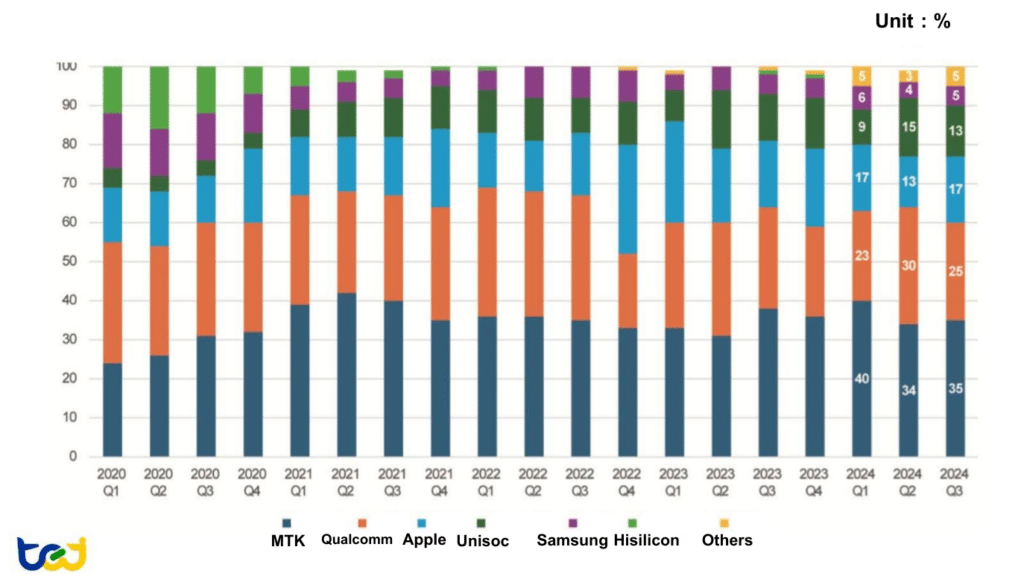

As shown in Figures 14, 15, and 16, MediaTek remains the market leader in smartphone processor shipments in 2024, with both revenue and operating margin showing an upward trend. On the other hand, HiSilicon’s shipment share has dropped to nearly zero due to U.S. sanctions. Although UNISOC has slightly improved its market share compared to 2020, it still lags significantly behind MediaTek.

In terms of client distribution, Xiaomi is MediaTek’s largest customer, accounting for 23% of its smartphone processor revenue, followed by Samsung at 21%, OPPO at 16%, and both Transsion and vivo at approximately 12%. Revenue from Chinese smartphone brands makes up at least 60% of MediaTek’s total, indicating a high dependence on the Chinese market.

It is noteworthy that Xiaomi, MediaTek’s main customer, recently announced it will begin mass-producing its self-developed 3nm smartphone SoC. However, its previous self-developed chip—the “Surge S1” launched in 2017—was ultimately replaced by Qualcomm chips due to overheating issues. Among other smartphone brands, OPPO has already scrapped its in-house chip development plans, while Transsion and vivo are only developing peripheral chips such as those for imaging and power management. This highlights the extremely high technical barriers to developing smartphone SoCs.

Despite these challenges, MediaTek remains technologically ahead of Chinese smartphone brands and IC design companies such as UNISOC and HiSilicon. Furthermore, U.S. export controls continue to hinder Chinese companies from acquiring advanced technologies. However, given the dominant market share of Chinese smartphone brands, future market shifts and potential competitive risks warrant close monitoring.

Figure 14: Revenue Trends of Mobile Communication IC Design Companies

Source: TEJ Financial Database

Figure 15: Operating Margin Trends of Mobile Communication IC Design Companies

Source: TEJ Financial Database

Figure 16: Market Share of Smartphone Processor Shipments

Source: Counterpoint Research, Statista

The IP sector is characterized by high technical barriers and the need for close collaboration with customers. Only after customer verification can IP products be brought to market. Success in this field cannot be achieved through capital investment alone. Moreover, there is considerable variation across IP types and companies, with each specializing in different domains—even within the same category, functional differences may exist. As a result, the IP industry is relatively less affected by China’s push for chip self-sufficiency.

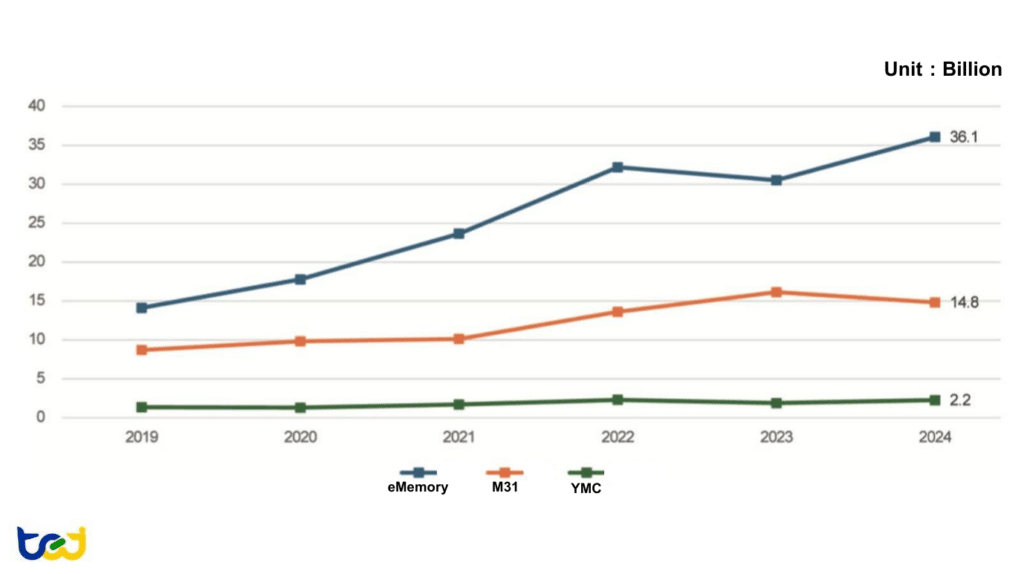

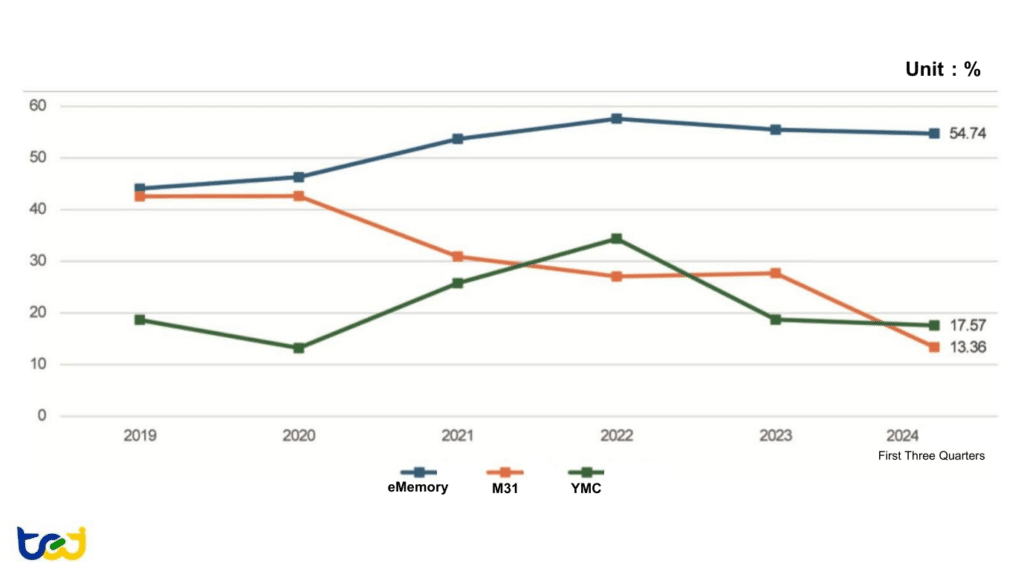

Chinese IP vendors such as Akrostar and MSquare focus on high-speed interface IPs. However, since they are not publicly listed, financial comparisons are difficult due to limited data availability. Among Taiwanese companies, eMemory and YMC primarily focus on memory-related IPs, while M31 Technology concentrates on interface IPs. eMemory has successfully commercialized multiple IPs for sub-7nm processes, resulting in relatively stable revenue and operating margins. YMC continues to specialize in IPs for mature processes above 16nm, leading to greater fluctuations in both revenue and margins. M31, originally offering only mature node IPs, has recently invested in advanced node IP development, with around 20% of revenue now coming from IPs below 8nm. However, increased R&D costs have significantly impacted its operating margin (Figures 17, 18).

Figures 17 : Revenue Trends of IP Design Companies

Source: TEJ Financial Database, 2024 Revenue Estimates Compiled by TEJ

Figures 18: Operating Margin Trends of IP Design Companies

Source: TEJ Financial Database

IC design service companies mainly offer NRE (Non-Recurring Engineering) and turnkey solutions. Like IP companies, they rely heavily on accumulated IP and technical capabilities and require close collaboration with customers. Additionally, because turnkey services depend on wafer foundry support, partnerships with foundries are a critical competitive factor. These characteristics make it difficult for new players to scale purely through capital investment.

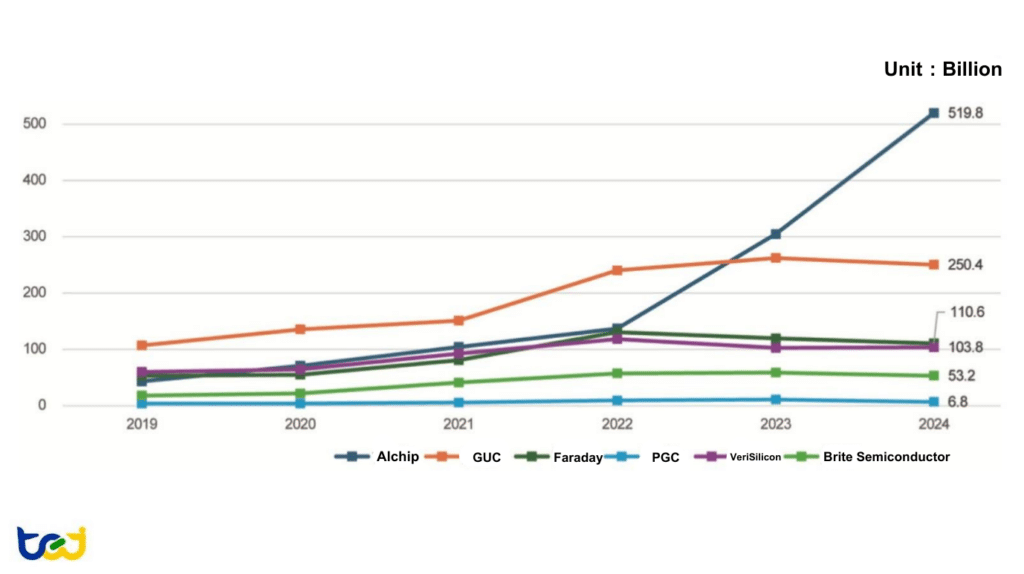

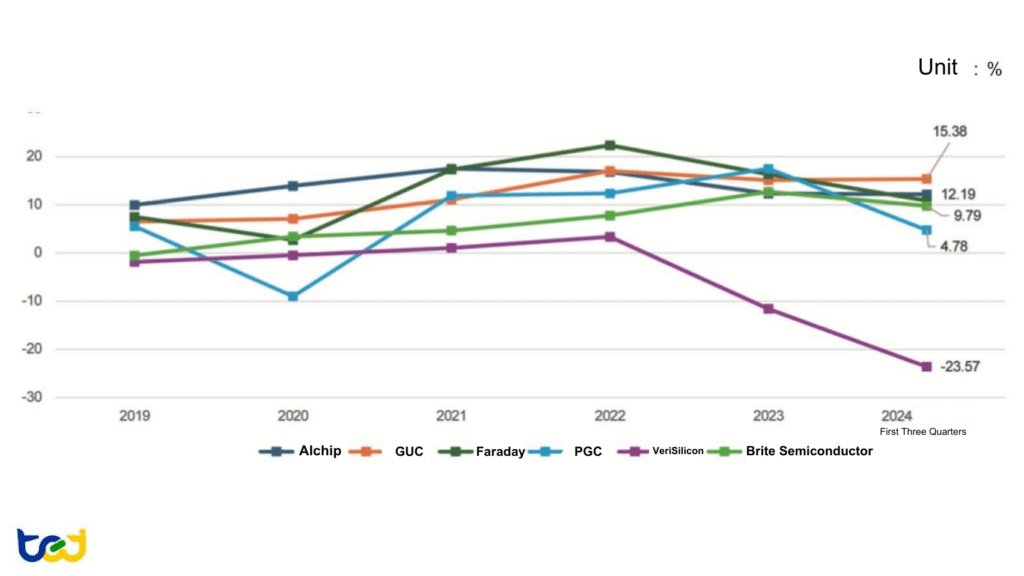

In China, VeriSilicon provides services ranging from AI chips to basic IP licensing and turnkey solutions. Although its revenue has grown steadily, the company remains unprofitable due to its emphasis on self-developed IP and its ventures into high-end chip development like processors, which incur high R&D costs. Meanwhile, Brite, backed by SMIC, has demonstrated more stable profitability. However, due to U.S. sanctions restricting SMIC’s access to advanced process technologies, Sanechips’ growth has been limited (Figures 19, 20).

In Taiwan, Alchip focuses primarily on sub-7nm advanced process nodes, which account for over 90% of its products. Thanks to large AI-related orders, its revenue has surged in recent years. Global Unichip (GUC) and Faraday leverage their long-standing IP and technical strengths and enjoy strong backing from TSMC and UMC, respectively. Although Faraday still primarily uses 16nm and above processes and its revenue growth lags behind GUC, both maintain stable operations. In contrast, PGC faces constraints in both product offerings and customer base. Without foundry support or competitive advantages in sub-7nm processes, PGC has struggled to scale up its revenue and has seen significant fluctuations in operating margins (Figures 19, 20).

Figures 19: Revenue Trends of IC Design Service Providers

Source: TEJ Financial Database, 2024 Revenue Estimates Compiled by TEJ

Note: Sanechips’ 2024 revenue is estimated based on the first three quarters due to the absence of full-year guidance.

Figure 20: Operating Margin Trends of IC Design Service Providers

Source: TEJ Financial Database

As analyzed earlier, the rapid development of Chinese IC design companies has impacted the operations of certain Taiwanese firms. Taiwanese companies that have performed well have either avoided areas where the Chinese government heavily invests, reducing direct competition, or they possess technological or product advantages that Chinese firms find difficult to surpass, thus maintaining a competitive edge.

Therefore, in the face of intensified competition from Chinese companies, the technological development and R&D investment of Taiwanese IC design companies become even more crucial. As Chinese competitors accelerate their progress, Taiwanese companies must continue increasing R&D investment to maintain their market competitiveness. This section will review the top 10 Taiwanese IC design companies with the highest and lowest R&D investment in the first three quarters of 2024 to analyze the differences in their R&D resource allocation.

Table 2: Taiwanese IC Design Companies with the Highest R&D Spending (Q1–Q3 2024)

| Code | Company | Revenue (NTD Bn) |

R&D Expenses (NTD Bn) |

R&D-to-Revenue Ratio (%) |

Category |

Revenue Composition |

|---|---|---|---|---|---|---|

| 2454 | MediaTek | 3,925 | 952 | 24.26 | Mobile | Mobile Phone(56%)、Smart Edge Platforms(38%)、Power IC(6%)。 |

| 2379 | Realtek | 870 | 261 | 29.96 | Networking | IIC Products (100%) |

| 3034 | Novatek | 775 | 125 | 16.09 | DDIC | DDIC(60%)、SoC(40%)。 |

| 8299 | Phison | 464 | 86 | 18.44 | Memory | Memory Modules (76%), Memory Controller Chips (24%) |

| 4919 | Nuvoton | 247 | 66 | 26.78 | MCU | General IC Products (92%), Foundry (6%), Others (2%) |

| 6526 | Airoha | 143 | 42 | 29.74 | Networking | Wireless & Broadband Communication Chips (100%) |

| 6415 | Silergy | 133 | 38 | 28.70 | Power | Consumer (38%), Industrial (31%), Info Products (15%), Automotive (11%), Networking (5%) |

| 3592 | Raydium | 187 | 29 | 15.60 | DDIC | MSDDI (54%), LDDI (31%), Automotive/Industrial DDIC (15%) |

| 3443 | Global Unichip | 190 | 24 | 12.70 | IC Design Service | Turnkey (63%), NRE (35%), Others (2%) |

| 4966 | Parade | 121 | 22 | 18.17 | Consumer | Transmission Interface (44%), DP (40%), Source Driver (13%), Touch (3%) |

Source: Company Financial Reports, Annual Reports, Earnings Calls, TEJ Compilation

Taiwanese IC design companies show significant variation in revenue size, and R&D spending is closely correlated with their revenue scale. Observing the companies with the top ten R&D expenditures (Table 2), it is evident that these companies are larger in terms of revenue, with the top three R&D spenders being MediaTek, Realtek, and Novatek.

On the other hand, the DDIC industry has limited transformation space, leading to relatively constrained R&D investments. Despite Realtek and Novatek being among the top ten in R&D expenditure, their R&D spending as a percentage of revenue is relatively low. Additionally, companies like ITH-KY, Fitipower, and Sitronix, despite having revenue over NTD 13 billion, did not make the top ten due to their lower R&D-to-revenue ratios.

It is also noteworthy that Alchip had double the revenue of Global Unichip in Q1-Q3 2024 but spent less on R&D. This is because Alchip’s revenue mainly comes from turnkey services, which have a higher proportion of products in the mass production phase, thus reducing R&D investment. In contrast, Global Unichip continues to invest heavily in R&D due to its NRE (Non-Recurring Engineering) business accounting for nearly 40%, reflecting its continued high R&D expenditure. Whether this discrepancy will impact Alchip’s future growth potential remains to be seen.

Table 3: Taiwanese IC Design Companies with the Lowest R&D Spending (Q1–Q3 2024)

| Code | Company | Revenue (NTD Bn) | R&D Expenses (NTD Bn) | R&D-to-Revenue Ratio (%) | Category | Revenue Composition |

|---|---|---|---|---|---|---|

| 3094 | DAVICOM | 1 | 0.4 | 34.71 | Networking | Regional Network Chipsets (77%), Others (23%) |

| 6291 | AIC | 14 | 0.4 | 2.91 | Power | Computer & Peripheral Products (67%), Networking Products (33%) |

| 6651 | Cystech | 11 | 0.4 | 3.50 | Power | MOSFET (82%), Transistors (10%), Diodes (7%), Others (1%) |

| 6229 | V-TAC | 13 | 0.3 | 2.14 | MCU | Image/Video IC (39%), MCU (25%), DDIC (16%), Others (20%) |

| 5302 | SYNTEK | 0.1 | 0.2 | 204.97 | Consumer | Network Video System SoC (64%), Digital Audio Headphones IC (26%), MCU (10%) |

| 6720 | Major Power | 4 | 0.2 | 5.79 | Consumer | HALL IC (98%)、POWER IC (1%)、MOSFET IC(1%)。 |

| 5487 | TONTEK | 1 | 0.2 | 15.13 | MCU | Touch Series (57%), Healthcare Series (18%), 3C Appliances, and Accessories (12%), Others (7%) |

| 3268 | Higher Way | 8 | 0.2 | 2.80 | MCU | Multimedia Control Chips (70%), Voice/Music Control Chips (10%), LCD Control Chips (10%), MCU (10%) |

| 3288 | SILICON TOUCH | 0.6 | 0.2 | 36.38 | Power | Static Detection & Drive Chips (97%), Motion Detection & Motor Drive Chips (3%) |

| 5468 | TMTECH | 0.9 | 0.04 | 4.78 | Networking | Fiber IC (76%), Energy (20%), Others (4%) |

Source: Company Financial Reports, Annual Reports, Earnings Calls, TEJ Compilation

Overall, companies with lower R&D investment are generally smaller in revenue size, with none of them exceeding NTD 2 billion in revenue in the first three quarters of 2024. Some companies even reported revenues of less than NTD 100 million. Among those with R&D spending accounting for less than 10% of their revenue:

Under the support of the Chinese government’s policies and funding, the Chinese IC design industry has risen rapidly, exerting competitive pressure on Taiwanese firms, particularly in sectors where the Chinese government has heavily invested, such as networking ICs and consumer ICs (MCUs, PMICs, sensors). However, certain Taiwanese IC design companies have maintained a competitive edge thanks to their technological advantages and product strategies. For example, companies like Nuvoton and Weltrend focus on automotive and industrial control markets, while MediaTek remains a global leader in the mobile phone processor market. Novatek has a strong position in the DDIC sector, and Fitipower focuses on e-paper, using a differentiated strategy to solidify its market position. Moreover, companies like eMemory, Alchip, and Global Unichip leverage advanced process technologies to retain a competitive advantage over Chinese firms.

However, the Taiwanese IC design industry still faces challenges related to insufficient R&D investment. Many small- and medium-sized companies have lower R&D spending as a percentage of revenue, especially in lower-tech fields such as MCUs and consumer electronics, which puts their competitive advantage at risk due to increasing pressure from Chinese competitors. On the other hand, with the rapid development of AI technologies, companies like MediaTek, Realtek, Nuvoton, and Airoha have already started positioning themselves in AI-related products. However, some companies have yet to define clear transformation strategies. If they fail to keep pace with these trends, they may face greater competitive pressure in the future.

In response to the rapid development of the Chinese IC design industry, Taiwanese companies should deepen technological innovation, expand product diversification, and enhance product- added value. They must actively tap into the AI field to seize rare market opportunities and ensure long-term competitiveness. At the same time, expanding into international markets to reduce dependency on a single market and closely monitoring changes in Chinese industrial policies and market conditions will be essential for adapting their strategies and maintaining an advantage in a fiercely competitive environment.

Explore the latest insights into Taiwan’s corporate landscape with the TEJ Watchdog Database. Our analysis of major events affecting Taiwan’s tech industry provides a clear and actionable perspective. Through a detailed evaluation of recent corporate news, we quantitatively assess the impact of these events on credit conditions, offering an event intensity rating from -3 to +3.

Stay informed about the dynamic changes in Taiwan’s technology sector, understand the factors influencing corporate credit risks, and make timely adjustments to your investment strategies. Visit the TEJ Watchdog Database today and gain the edge in navigating Taiwan’s evolving business environment.

➤ DeepSeek Launches Low-Cost AI — A Game-Changer for the Industry?