Table of Contents

Taiwan recently announced the establishment of the “Taiwan Carbon Trading Platform.” With the joint efforts of the businesses and the government, this initiative aims to advance toward the goal of achieving Net-Zero carbon emissions by 2050. But what exactly is Taiwan’s carbon trading mechanism, and how does it benefit businesses? This article provides insights into the concepts of carbon credits and trading, highlighting the importance of the carbon trading platform for Taiwanese companies within international requirements.

Before delving into the topic, you can refer to this article to know all the key terms related to “carbon.”

https://medium.com/tej-can-help/tej-dictionary-where-is-the-value-of-carbon-take-a-look-59959cf05a1b

In the global trend towards carbon reduction, carbon credits and pricing have emerged as means to internalize the cost of carbon emissions. To facilitate the circulation of carbon credits, carbon markets, known as Emission Trading Systems (ETS), have been established.

Carbon credits can be classified into two categories based on the nature of the carbon market: “Mandatory Market with Cap-and-Trade” and “Voluntary Market with Carbon Offset.” The former involves selling unused carbon emissions allowances from one company to another that exceeds its quota, while the latter refers to issuing “reduction credits.” These reduction credits are obtained through voluntary activities like afforestation.

Recently announced, the upcoming establishment of Taiwan’s carbon trading platform will initially focus on international carbon credits, while domestic credits are expected to be available for trading around 2024. Unlike countries with emission caps, Taiwan’s carbon market operates voluntarily, using “reduction credits” for transactions.

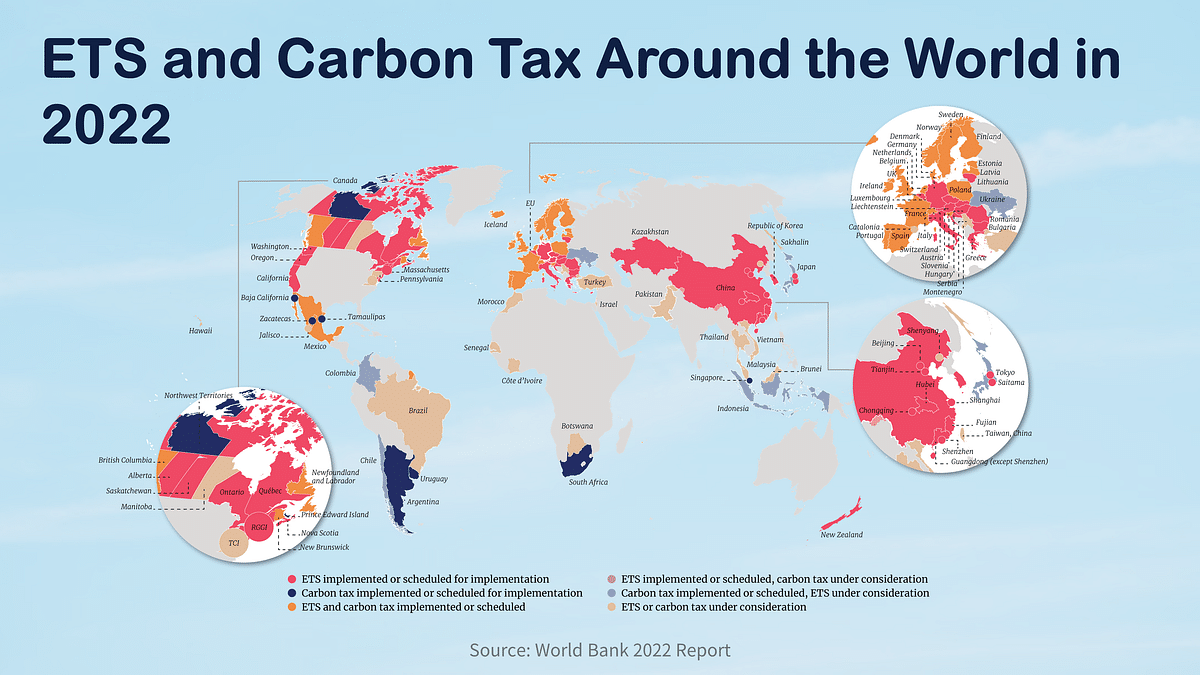

Similarly, countries adopting the Carbon Offset include Singapore and South Korea, while the United States and the European Union employ the Cap and Trade. How has those carbon trading market developed?

With the international commitment to achieve net-zero carbon emissions by 2050, businesses are not only focusing on reducing carbon emissions but also recognizing the increasing cost of carbon through carbon taxes or purchasing carbon credits.

The global carbon market has experienced significant growth in recent years, reaching a market value of 86.5 billion euros in 2022, according to Refinitiv.

This chart shows that major countries such as Europe, the United States, Singapore, and South Korea have already established carbon trading markets before 2022. Among these markets, the European Union (EU ETS) is the largest in scale. We will exemplify its market and national actions to achieve Net-Zero.

The EU’s carbon emissions trading system is a mandatory market, requiring the 27 states and approximately ten thousand power plants and industrial facilities to purchase emission allowances. It covers industries such as power generation, steel, cement, refining, and chemistry. These industries are allocated free allowances and can purchase additional carbon credits when exceeding their allocated quotas. However, there are plans to gradually reduce and eventually eliminate the free allowances given to high-emitting industries, expected to pressure high-carbon-emitting businesses to reduce emissions.

In addition, the “Carbon Border Adjustment Mechanism (CBAM),” expected to be implemented in October 2023, aims to regulate the carbon content of exported goods. If the carbon content exceeds the specified threshold, importers will not only need to purchase carbon allowances but also face carbon tariffs on the products. Since CBAM does not recognize voluntary carbon credits, Taiwan’s companies seeking to purchase carbon credits will still need to acquire carbon allowances from foreign carbon markets to avoid carbon taxes becoming a new burden.

Even so, with the local carbon trading platform, reducing carbon emissions for businesses will no longer be a burden or responsibility. Instead, it will become a new financial opportunity to circulate carbon trading and accelerate international green collaborations. The following are the types of businesses benefitting the most:

However, it is also important to note that purchasing carbon credits merely achieve superficial carbon reduction. Real and substantial carbon reduction should be the direction that businesses strive for. How have Taiwanese companies responded to the carbon reduction trend in recent years? Let’s take a look at their achievements in carbon reduction!

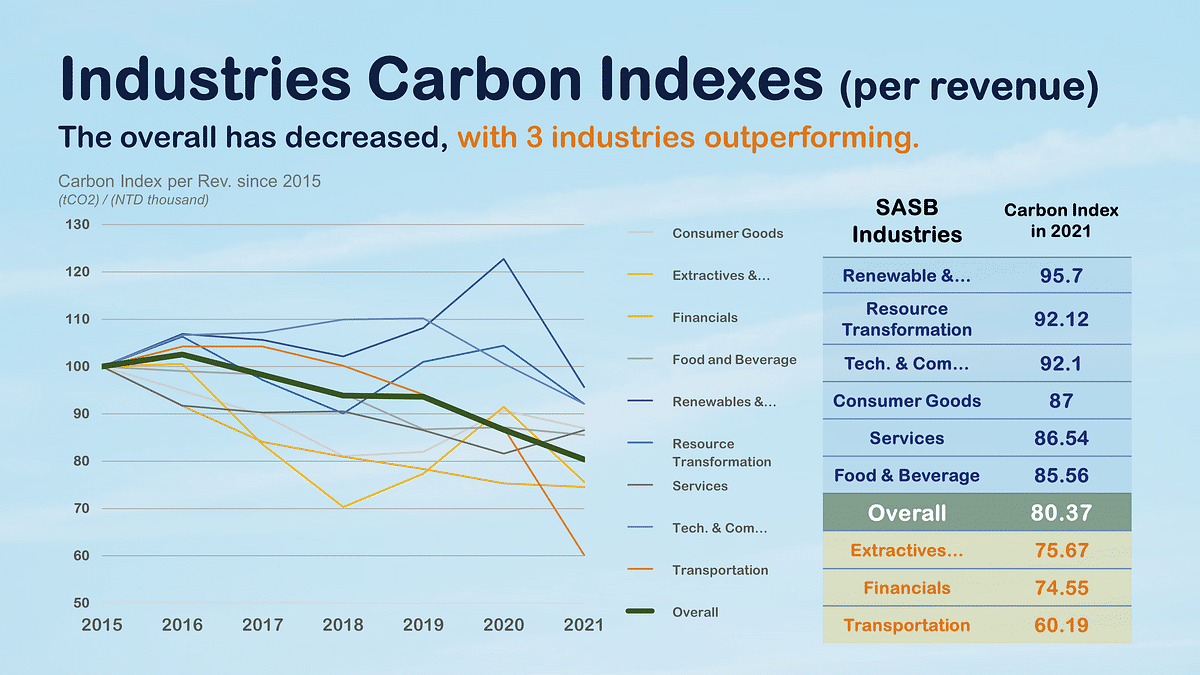

The TESG Sustainable Dataset integrates carbon emissions data from various industries and companies. Using 2015 as the base year (index of 100), it calculates the changes in carbon emissions for subsequent years. To facilitate comparisons among different industries or companies, the TESG Sustainable Dataset further provides carbon emission per revenue for each industry and company, as shown in the following graph:

In 2021, under the SASB industry classification, the Carbon Index of Taiwan’s businesses was lower than the base year (2015) across all industries, with an overall average of 80.37. Three industries outperformed the overall average: Extractives & Minerals Processing, Financials, and Transportation. The transportation industry, in particular, saw a decline in carbon emission since 2017, showcasing remarkable carbon reduction achievements of roughly 40% decrease. What’s more, the Technology & Communications also experienced a decrease in carbon emission starting in 2019, with a value of 92.1 in 2021, indicating progress in carbon reduction but still leaving room for improvement.

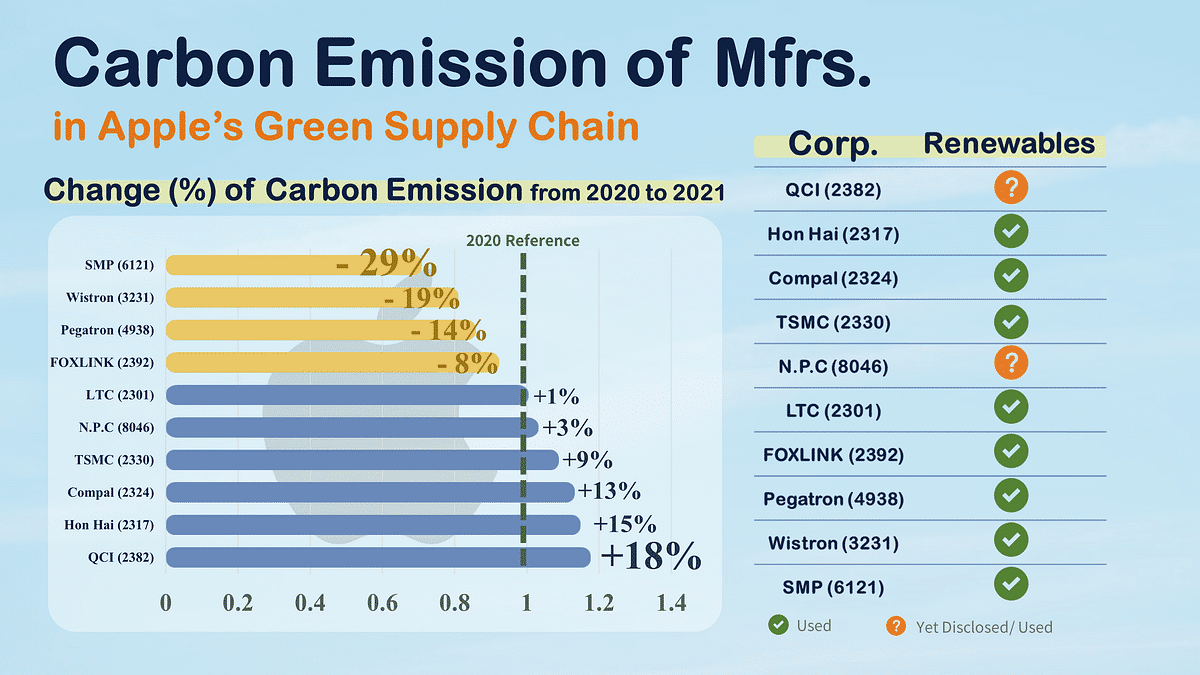

As for companies, we compiled data for selected Apple supply chain manufacturers to examine whether their carbon reduction efforts have improved after Apple announced its carbon neutrality policy. The graph below illustrates the results.

After Apple announced its Green Supply Chain program in 2020, four Taiwanese suppliers witnessed a reduction in carbon emissions in 2021, with leader SMP (6121. TWO) of a 29% decrease. Conversely, QCI (2382. TW) showed the most significant growth at 18%, indicating a lack of carbon reduction progress in response to the green supply chain policy. In addition, we gathered information on companies’ adoption of renewable energy. As shown in the graph, most of Apple’s supply chain manufacturers have utilized green energy to reduce their carbon emissions, with only N.P.C (8046. TW) and QCI (2382. TW) either not disclosing or not using green energy.

We can see QCI (2382. TW) not only exhibited the highest carbon emission growth but has yet to disclose its green energy usage. If the company has actively reduced carbon emissions and adopted green energy but still finds limitations, purchasing carbon credits through Taiwan’s ETS platform would be a viable solution. This highlights the significance of a carbon trading platform for international supply chain manufacturers.

Last but not least, it is necessary to follow whether the actual cost of carbon reduction exceeds the carbon price and to prevent the potential issue of Greenwashing. The early EU ETS serve as the best example, where the influx of international carbon credits led to a significant drop in prices. Taiwan can learn from this experience in its policy design to ensure that carbon trading remains effective in incentivizing companies to reduce their emissions.

Carbon trading mechanisms provide an opportunity for companies to transform their investments into addressing climate change. This not only represents the outcome of policy promotion but also signifies an important step for Taiwan to take practical actions in response to climate change. We expect that in the future, Taiwan’s carbon trading platform will gradually enhance its mechanisms and related legislation, allowing businesses to take a leading role in guiding Taiwan towards achieving net-zero by 2050.

Read More

Want to know more?

Interested in efficiently screening out investment targets that don’t align with ESG sustainability? Feel free to leave a comment, call, or mail us, accelerating your responsible investment process!

About us

⭐️ TEJ Website

⭐️ LinkedIn

✉️ E-mail: finasia@tej.com.tw

☎️ Phone: 02–87681088