Use trial database to determine the weight of your portfolio.

Table of Contents

Most people often have hard time to determine the weight of portfolio. However, Harry Markowitz, the Nobel Prize winner in economics, gives us a theory based on the volatility and correlation of stocks. Simulated by different weights on portfolio, we can put the restrictions like given the total risk is the same, to find the highest expected rate of return. In this way, we can choose the weight distribution of portfolio according to our own risk tolerance!

Mac OS and Jupyter Notebook

# basic

import numpy as np

import pandas as pd

# plot

import matplotlib.pyplot as plt

import matplotlib

import plotly.express as px

import plotly.graph_objects as go

# API

import tejapi

tejapi.ApiConfig.api_key = 'Your Key'

tejapi.ApiConfig.ignoretz = True

Step 1. We use TSMC (2330), Evergreen (2603), and President Chain Store (2912) as examples of investment portfolios. The date is selected for 2020, and the option columns selected roi.

data = tejapi.get('TRAIL/TAPRCD',

coid=['2330', '2603', '2912'],

mdate={'gte': '2020-01-01', 'lte': '2020-12-

31'},

opts={"sort": "mdate.desc", 'columns': [

'coid', 'mdate', 'roi']},

paginate=True)

Step 2. Reset index value, data pivot, column name with stock code

data = data.set_index('mdate')

returns = data.pivot(columns='coid')

returns.columns = [columns[1] for columns in returns.columns]

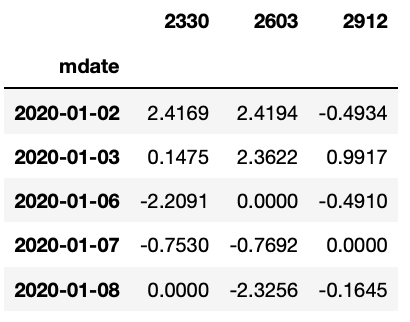

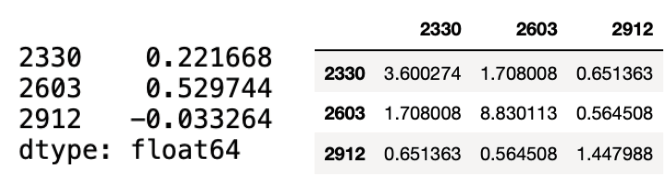

Step 3. Calculate average return, covariance matrix

mean_returns = returns.mean()

cov_matrix = returns.cov()

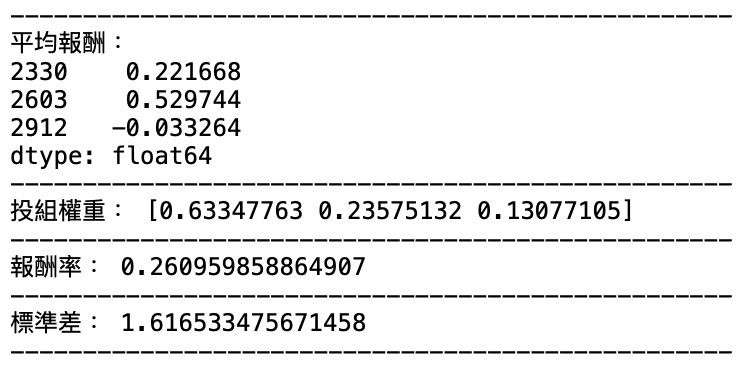

We need to randomly generate portfolio weights and use a large number of simulations to find the efficiency frontier. We need to record its return, standard deviation, and weight for each investment group.

def portfolio_performance(weights, mean_returns, cov_matrix):

returns = np.sum(mean_returns*weights )

std = np.sqrt(np.dot(weights.T, np.dot(cov_matrix, weights)))

return std, returns

The number of portfolios we want to simulate.

num_portfolios = 5000

Put the function into the function which calculate random investment portfolio to get the results of each investment portfolio.

def random_portfolios(num_portfolios, mean_returns, cov_matrix):

results = np.zeros((3,num_portfolios))

weights_record = []

for i in range(num_portfolios):

weights = np.random.random(len(coid))

weights /= np.sum(weights)

weights_record.append(weights)

portfolio_std_dev, portfolio_return =

portfolio_performance(weights, mean_returns, cov_matrix)

results[0,i] = portfolio_std_dev

results[1,i] = portfolio_return

results[2,i] = (portfolio_return) / portfolio_std_dev

return results, weights_record

Start the simulation and save the results in results and weights_record

results = np.zeros((3,num_portfolios))

weights_record = []

for i in range(num_portfolios):

weights = np.random.random(len(coid))

weights /= np.sum(weights)

weights_record.append(weights)

portfolio_std_dev, portfolio_return =

portfolio_performance(weights, mean_returns, cov_matrix)

results[0,i] = portfolio_std_dev

results[1,i] = portfolio_return

results[2,i] = (portfolio_return) / portfolio_std_dev

Visualization: The first number of the text box represents the risk, the second number represents the reward, and the second row of the array represents the weight of the investment.

def protfolios_allocation(mean_returns, cov_matrix,

num_portfolios):

results, weights = random_portfolios(

num_portfolios, mean_returns, cov_matrix)

fig = go.Figure(data=go.Scatter(x=results[0, :],

y=results[1, :],

mode='markers',

text = weights_record,

))

fig.update_layout(title='投資組合表現分佈',

xaxis_title="投資組合總風險",

yaxis_title="預期平均報酬率",)fig.update_xaxes(showspikes=True,spikecolor="grey",

spikethickness=1, spikedash='solid')fig.update_yaxes(showspikes=True,spikecolor="grey",

spikethickness=1, spikedash='solid')fig.show()

There are two conditions:

This type of condition is equivalent to finding the extreme value, we can use optimize under the scipy module to calculate the minimum value.

import scipy.optimize as sco

Here we define four calculation functions

def portfolio_volatility(weights, mean_returns, cov_matrix):

return portfolio_performance(weights,mean_returns, cov_matrix)[0]

We use the optimize calculation under the scipy module to take the extreme value of the Volatility function under the weight limit of 0 to 1, and the algorithm selects SLSQP (Sequential Least Squares Programming) nonlinear programming

fun:objective function

args:parameters that can be set for the objective function

method:Optimal algorithm

bounds:Range of each x

constraints:the input is a tuple composed of a dictionary, the dictionary is mainly composed of’type’ and’fun’, type can be’eq’ and’ineq’, which are equality constraints and inequality constraints, respectively, fun is the corresponding constraint The condition can be a lambda function.

def min_variance(mean_returns, cov_matrix):

num_assets = len(mean_returns)

args = (mean_returns, cov_matrix)

constraints = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1})

bound = (0,1)

bounds = tuple(bound for asset in range(num_assets))

result = sco.minimize(portfolio_volatility, num_assets*

[1/num_assets,], args=args,

method='SLSQP', bounds=bounds,

constraints=constraints)

return result

Mainly Due to the difference in constraint conditions, the returns should be fixed to a number, and find the minimum of risk.

def efficient_return(mean_returns, cov_matrix, target):

num_assets = len(mean_returns)

args = (mean_returns, cov_matrix)def portfolio_return(weights):

return portfolio_performance(weights, mean_returns,

cov_matrix)[1]constraints = ({'type': 'eq', 'fun': lambda x:

portfolio_return(x) - target},

{'type': 'eq', 'fun': lambda x: np.sum(x) - 1})bounds = tuple((0,1) for asset in range(num_assets))

result = sco.minimize(portfolio_volatility, num_assets*

[1/num_assets,], args=args,

method='SLSQP', bounds=bounds,

constraints=constraints)

return result

def efficient_profolios(mean_returns, cov_matrix, returns_range):

efficients = []

for ret in returns_range:

efficients.append(efficient_return(mean_returns,

cov_matrix, ret))

return efficients

The overall structure of the efficient frontier is actually not difficult to understand. Using a large number of simulation calculations to obtain the weighted, you can set the expected return you want and choose the investment portfolio with the least risk. The Plotly interactive chart allows us to move the mouse on chart, it will show the weight distribution of the current investment portfolio. Of course, the truth remained unchanged is “High returns with high risks.” If you want a higher return on investment, you need to bear greater volatility. The result of these weights is based on the time of selecting the database, the volatility of the stock at that time, so the efficiency frontier obtained will continue to change over time, so the weight needs to be adjusted for a period of time.