Table of Contents

TEJ [Chip Database] provides various information related to securities and chips, ranging from legal person transaction information, holding costs, broker entry and exit details, the spread of shareholdings under TDCC custody, and margin trading to securities borrowing and lending. With up to 35 sub-blocks, users can experience the most complete and accurate Taiwan securities chip information. This chapter, [Margin Trading]will be divided into three parts. The first part will guide readers in a simple and unburdened way to learn how to operate the [Margin Trading] database. It collects information on margin trade, securities borrowing, and lending, as announced by the Taiwan Stock Exchange and OTC Center daily. Second, after users are familiar with the operation of the database, they can further use the data to derive and construct models. Third, we will continue to lead you to dig deeper into the [Margin Trading] database, including sub-blocks in credit transactions and many chip databases, all providing more detailed information on credit transactions.

(1) Margin Purchase

Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more stock than you’d typically be able to buy. To trade on margin, you need a margin account. This differs from a regular cash account, in which you trade using the money in the account. Once the account is opened and operational, you can borrow up to 60%(Listed 60%, OTC 50%) of the purchase price of a stock. This portion of your deposit purchase price is known as the initial margin. Knowing that you don’t have to margin up to 60% is essential. You can borrow less, say 10% or 25%. For example, a listed company’s stock “A” trades at 100 shares. Now, you think it will still grow and have to buy it immediately. Unexpectedly, the funds are insufficient, so you can use Margin Purchase to buy now. Its Margin Multiplier is 60% for this stock, and you need to have 40% of your own funds. Therefore, when you use Margin Purchase to buy this stock, you only need to pay NTD 40,000 and pay the Margin Purchase interest. The annual interest rate of the Margin Purchase interest rate is about 6–7% per year(calculated on a daily basis).

— — — — — — — — — — —

Margin Multiplier = 60%

Margin Purchase interest rate = 6–7%

Margin Purchase interest = Margin Purchase x interest rate x days ÷ 365(days)

— — — — — — — — — — —

(2) Margin Short sales

With short selling, a seller opens a short position by borrowing shares, usually from a broker-dealer, hoping to repurchase them for a profit if the price declines. Shares must be borrowed because you cannot sell shares that do not exist. To close a short position, a trader repurchases the shares on the market — hopefully at a price less than what they borrowed the asset — and returns them to the lender or broker. Traders must account for any interest the broker charges or commissions on trades. To open a short position, a trader must have a margin account and will usually have to pay interest on the value of the borrowed shares while the position is open.

— — — — — — — — — — —

Margin Short sales Multiplier = 90%

Short sales margin = Margin Short sales x stock price x 90%

Margin Short sales interest rate = roughly 0.1–0.4%

Margin Short sales interest = Short sales margin x Margin Short sales interest rate x days ÷ 365

— — — — — — — — — — —

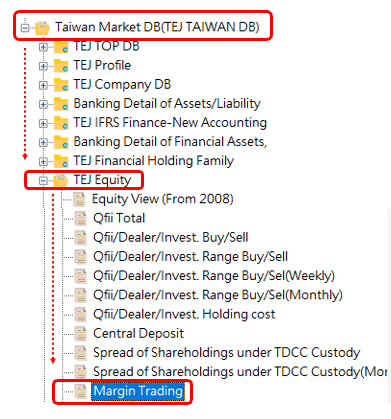

1️⃣ Select TEJ Company DB and click [TEJ Equity] and then choose [Margin Trading]

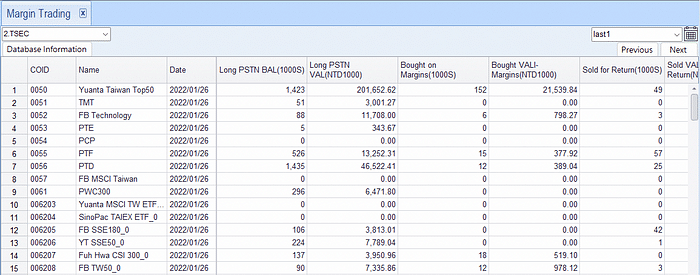

2️⃣ click [Margin Trading]

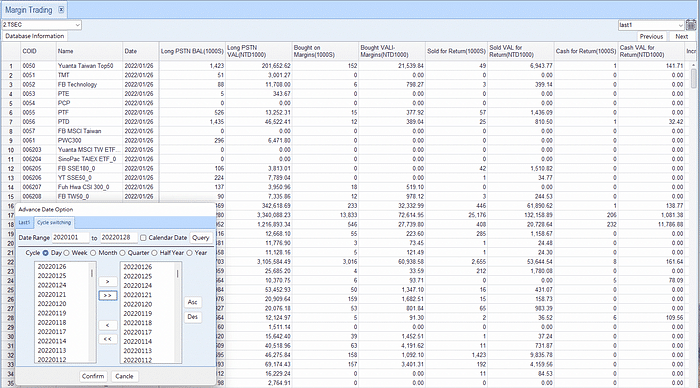

In this database, you can see the [Long PSTN BAL], [Bought on Margins/ Sold for Return], [Increase % -Long], [Long/Short Limit], [Short/Long], [Borrow PSTN BAL] and closing price (as shown in Figure 2.A), there are more than 50 sub-items for users to refer to. In addition, you can also select a stock and a specific range through the 🗓 calendar icon in the upper right corner to complete Data creation and query (Figure 2.B).

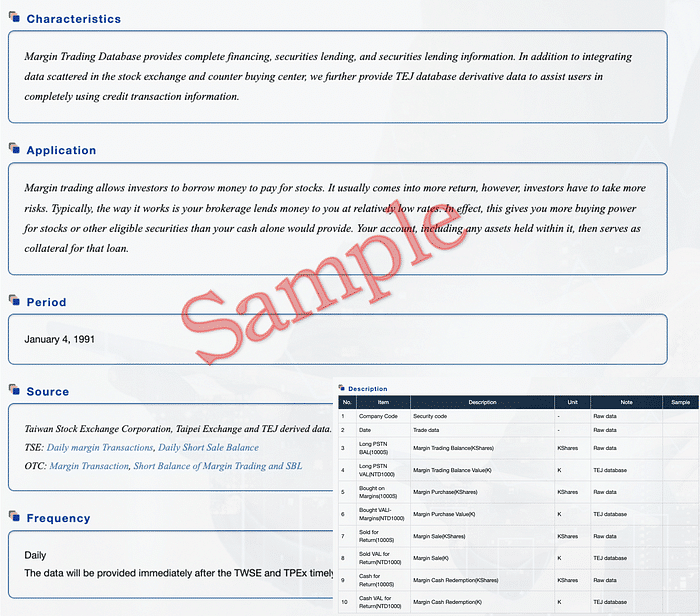

[Margin Trading] includes up to 50 data items, including the derived data calculated by TEJ. The above data will inevitably make it difficult for users to understand the data calculation standard. Users can click “Data Information” to enter the description page (Figure 3.A below) to understand the database application, characteristics, period, source, frequency, and description.

Through three articles, we want to guide readers into this relatively unfamiliar Margin Trading field. First, this article “Margin Trading (1)” introduces the meaning of Margin Purchase and Short sales and explains how to obtain information through basic database operations. Next, we will launch “Margin Trading (2)” to further demonstrate how to use the advanced [Margin Trading] data to observe stock price trends. If you have any further queries or suggestions regarding the TEJ database, please do not hesitate to contact us by phone or email.

☎️: 02–87681088

✉️: tej@tej.com.tw

⭐️TEJ official website

⭐️Medium TEJ-API

⭐️E-Shop

⭐️ TEJ Instagram: tej87681088