Table of Contents

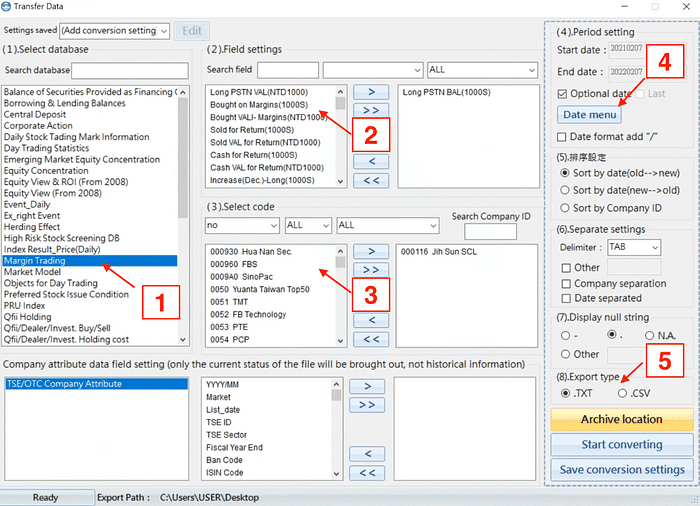

In the previous article, we understood how to enter the margin trading database, which is rich in data that can be utilized. Before we introduce the database application, we will show a simple way to export the data. In this article, we will show you how to export mutilated data with the “Transfer Data” function. Then, we will apply the data in the database to help users select fundamental indicators.

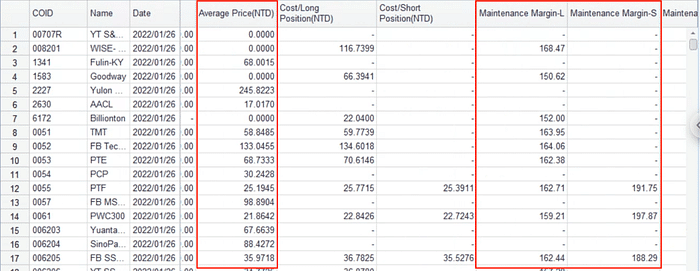

We need to learn how to export data at once before analyzing it. This is crucial whether it is for establishing backtesting data or preparing a simple observation spreadsheet. A good operation can save a lot of time.

Getting rid of the name of a stock rookie and starting to become a master!

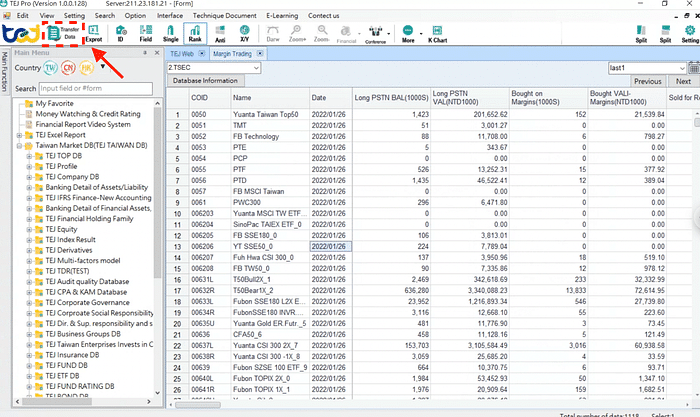

Observing the trend of retail investors, such as “Margin Trading Balance,” can help you not lose money in the market. While retail investors differ from institutional investors with abundant funds, retail investors may face insufficient funds. Therefore, they will choose “margin purchase” to deal with liquidity problems. That’s why “margin trading” can be used as an indicator to estimate the market hotness. We also provide many indicators that TEJ calculates. The following four points are the field descriptions from the margin trading database we selected as examples.

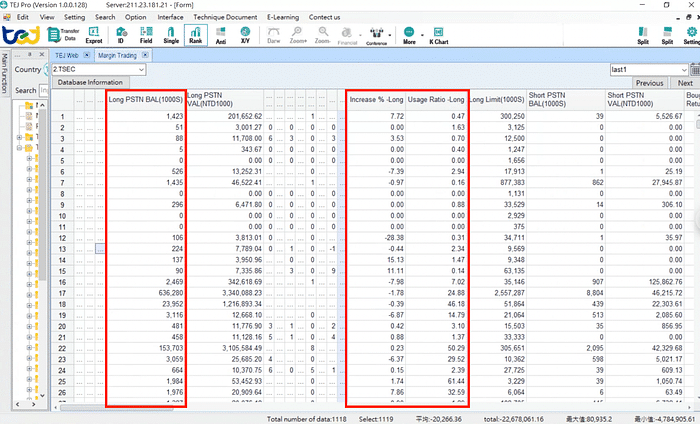

Margin trading balance means the sum of shares through margin trading. On the other hand, margin short sales balance is the sum of shares sold through margin short selling. We can further analyze their increase or decrease ratio to know if they are bull or bear. Investors can decide when to enter the market by observing them.

The increase in margin trading balance and the ratio of margin purchase typically means retail investors are entering the market, which causes the stock price to rise. On the opposite, their decrease normally implies that the volume of retail investors is decreasing. Besides, the increase of margin shot sales balance can also be considered as the retail investor’s expectation of a bear market.

It can be used to observe the hotness of the market. The increase in the ratio typically means a rise in margin short sales. And, if the stock price rises with no significant plug of the ratio, the price may increase because of a short squeeze. We can gain the ratio and the daily offset to observe the market’s margin trading situation (figure 3).

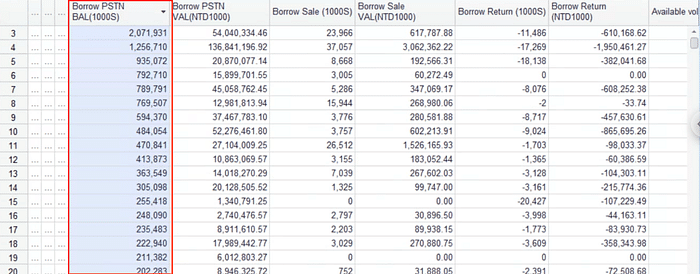

We also provide SBL short sales balance in the database. Generally, retail investors will borrow securities from brokers, which is a margin short sell. According to the regulation, institutional investors in Taiwan cannot be involved in margin short sell. Therefore, if institutional investors want to short stocks, they can just borrow securities from other investors. Securities firms will help them to borrow securities from other long-term investors, and borrowers need to pay interest to lenders.

The ratio of maintenance margin purchase or the ratio of maintenance margin short sales below 130% will get a margin call. The investor must sell positions, deposit funds, or securities to meet the margin call. In this field, users may find stocks below the required maintenance rate of 130%. We can analyze it with stock prices to see if it is a short squeeze.

In this article, we have shown how to export the data at once with the function of “Transfer Data.” It will help users save time with data treatment. Besides, we continue the previous article and introduce the meaning of some fields in the margin trading database. Through this data, we can build indicators to estimate the variety of markets. Users may utilize it based on what they need. The detailed information is described in “Database information” on the upper left side of the database. Click it if you want to gain more information. If you have any further queries or suggestions regarding the TEJ database, please do not hesitate to contact us by phone or email.

☎️: 02–87681088

✉️: tej@tej.com.tw

⭐️E-Shop