Whether you’re a seasoned expert in the stock market or a beginner just starting to invest, you might be curious about where many stock analysts get their “company information.” Most of this data is obtained from the Taiwan Stock Exchange (TWSE) website and the Market Observation Post System (MOPS). This includes financial statements, the number of issued shares for listed companies, recent dividend distributions, and more. You can even receive real-time updates on significant announcements from listed companies. It’s one of the must-visit websites for investors! As for why the Market Observation Post System exists and how to use its features and functions, let TEJ (Taiwan Economic Journal) explain it all to you!

Table of Contents

Many people wonder why there is such a convenient and free website where you can view data from various companies. The reason lies in the government’s adherence to the International Organization of Securities Commissions (IOSCO) principles. To ensure that investors can access public, transparent, and real-time information about listed and OTC companies simultaneously, the government collaborated with the Taiwan Stock Exchange Corporation (TWSE), the Taipei Exchange (TPEx), and other organizations. Under the guidance of the Securities and Futures Bureau of the Financial Supervisory Commission, the “original version” of the Market Observation Post System was established on August 1, 2002.

The Market Observation Post System’s current version is the “new version,” launched in July 2010. The upgrade was necessary because the original interface design was no longer sufficient, and the rise of various apps and web crawlers caused the old website to become slower and less visually appealing. The new version of MOPS allows investors to access a wide range of information on listed and OTC companies in one place. Moreover, with the introduction of the TWSE app, even those who are not stock analysts can receive real-time, critical market information for free.

After understanding the sources used by stock analysts and various stock-picking programs, it’s clear that the Market Observation Post System (MOPS) essentially has “everything.” The information most commonly searched by the public can generally be categorized into the following five types:

The most commonly searched information is, of course, basic company details. By entering the stock or company code, you can access information such as the company’s primary business operations, paid-in capital, and the number of common shares or the original shares issued for TDRs.

Monthly revenue is another frequently sought-after piece of information people use to evaluate a company’s fundamentals. IFRSs, or International Financial Reporting Standards, ensure accuracy and fairness in data assessment. Here, you can find essential information such as revenue increases or decreases and year-to-date accumulated revenue.

Taiwanese investors love high-yield investment targets that offer dividends. On the Market Observation Post System, you can check the dividend distribution status of listed and OTC companies, including net profit for the period, distributable earnings, and the distribution of cash dividends, as well as TDR ex-dividend announcements.

Knowing how to access financial statements is essential to become a successful fundamental analyst. The financial statements on MOPS are very comprehensive, including the balance sheet, statement of comprehensive income, cash flow statement, and statement of changes in equity. These four significant statements provide a solid basis for assessing the financial status of listed and OTC companies.

Investors can use the significant information search function on MOPS to check daily for any particular public information concerning listed and OTC companies. This allows them to see real-time market news for all companies. Additionally, this information is also readily available if you want to look up past significant events that may have affected stock prices.

From the above, we can see that the Market Observation Post System (MOPS) provides access to a wealth of useful information. Next, TEJ (Taiwan Economic Journal) will provide a detailed, step-by-step guide on how to search for ‘Monthly Revenue Information’ using MOPS, ensuring you can navigate the process with ease!

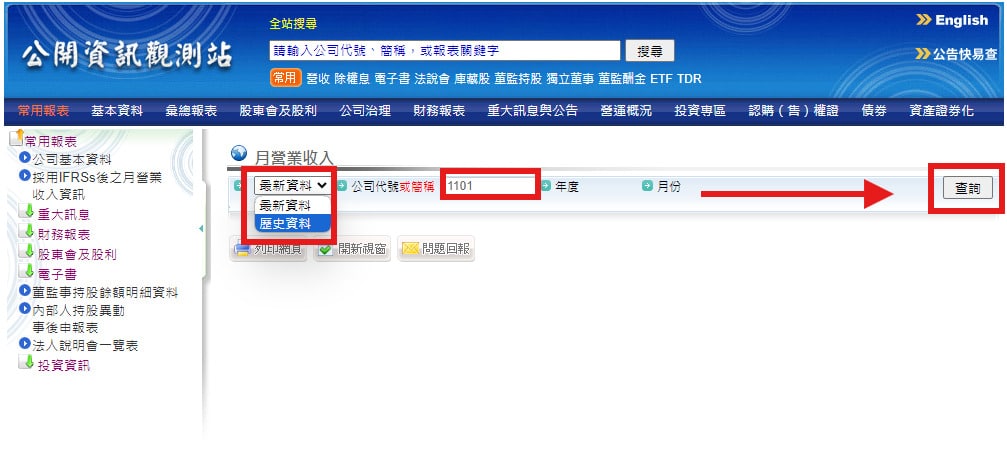

Step 1: Go to MOPS > Commonly Used Reports > Monthly Revenue Information

First, visit the Market Observation Post System (MOPS) website. Click on the “Commonly Used Reports” section in the upper left corner to open the drop-down menu, then select the second option, “Monthly Revenue Information.”

Step 2: Latest Data or Historical Data > Enter Company Code or Name > Search

Next, within the Monthly Revenue Information section, choose whether you want to view the latest data or historical data. Then, enter the company code or name. After confirming your selection, click the “Search” button on the right. The example below demonstrates using company code 1101 for Taiwan Cement (台泥).

Step 3: After Completing the Search, You Can Save or Print the Results

Once the search is complete, the company’s net revenue will be displayed, including crucial information such as the increase or decrease and the percentage change. If you need to save the data, you can download the webpage or click the print button on the left to print the information. It’s quite simple.

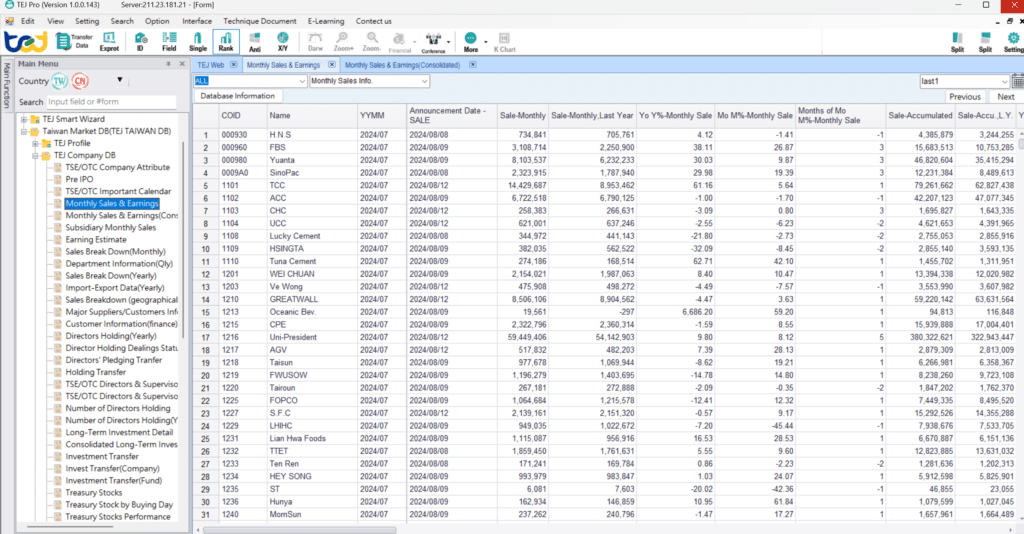

The introduction above taught us how to search for “Monthly Revenue Information” on the Market Observation Post System (MOPS). Next, TEJ (Taiwan Economic Journal) will present the “Monthly Revenue Information” TEJ offers, which is more detailed than what is available on MOPS. Let’s dive into the details together!

For fields related to medium and long-term comparisons, there are items such as cumulative revenue for the past 12 months, cumulative revenue for the past 12 months from last year, 12-month cumulative revenue growth rate, cumulative revenue for the past three months, cumulative revenue for the past 3 months from last year, 3-month cumulative revenue growth rate, comparison of cumulative revenue for the past three months with the previous month, 3-month cumulative revenue change rate, and so on.

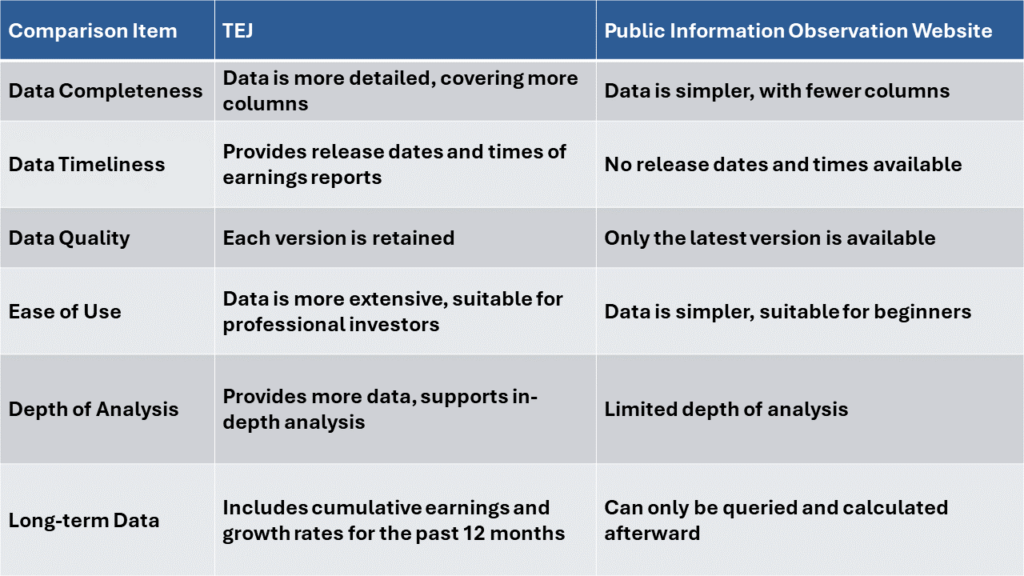

The most significant advantage of the MOPS interface is its simplicity, allowing users to search for monthly revenue in a specific month quickly. However, more detailed information is clearly needed for a professional investor or investment institution. They can effectively build large-scale and reliable investment portfolios through this detailed data. At TEJ (Taiwan Economic Journal), we understand that investors or institutions prefer minimal data discrepancies. Therefore, we offer various data enhancement and cleaning services, ensuring that investors can have confidence in the accuracy of their model data.

Below, TEJ (Taiwan Economic Journal) has outlined the benefits of the additional data fields we offer. One of the most important is the “Version Number,” also called the “Edition.” But how does the version number significantly impact data accuracy?

Firstly, a company may discover errors or need adjustments after the initial release of its monthly revenue, prompting the issuance of a revised version. These revisions might be due to calculation errors, omissions, logistical delays, or factory operational issues.

According to Taiwan’s securities regulations, listed companies must report their operational status by the 10th of the following month. However, only some companies can perfectly adjust their financial data within this timeframe. Therefore, the regulations flexibly allow companies to make corrections.

For example, in a particular quarter, Mitsubishi might initially report the delivery of 90,000 vehicles. However, after a more thorough audit, the revised data might show that 91,000 cars were delivered. The revised version would reflect this update, impacting the monthly revenue.

If a company proactively provides different versions of its revenue data, it demonstrates its commitment to data transparency. This helps build investor trust, as they can see how the company revises and updates its financial data.

In MOPS, you can view revision announcements, such as the example of Mego Biomedical Co., Ltd. (5398) on April 6, 2017. The company issued the third version of its monthly revenue, in which the revenue was adjusted downward. This action by Mego Biomedical, in disclosing the decline in revenue, plays a crucial role in enhancing investor trust in the transparency of the company’s financial performance.

Of course, Taiwan’s regulatory authorities also require companies to release revised financial data promptly when significant errors are discovered. Therefore, issuing data in different versions is also a part of regulatory compliance.

The second key difference is the “12-month Cumulative Revenue Growth Rate.” Compared to MOPS’s “Year-to-Date Growth Percentage,” MOPS only has data for one month in January and three months in March. However, TEJ continuously provides data covering 12 months. This difference leads to the following three impacts:

Since TEJ’s data consistently covers 12 months, researchers do not need to merge or sum data from different months. This helps to avoid potential errors that might occur during data processing due to human error. The simplified data handling process enhances data quality and improves analysis accuracy.

Without data transformation, researchers can immediately conduct various statistical analyses, regression analyses, and trend forecasts upon receiving the data. These analyses can provide researchers with the answers they need quickly, especially when fast investment decisions or market responses are required. This supports the development of quicker and more valuable investment strategies.

The Market Observation Post System (MOPS) is well-suited for novice investors due to its simple interface and quick search functions. However, professional investors and institutions require more detailed and in-depth data analysis, which is precisely what the additional data fields provided by TEJ are designed for. With these extra data points, investors can perform more accurate and faster market analyses and forecasts, enhancing their investment decisions’ precision and efficiency. In an increasingly complex financial market, choosing suitable data sources and analytical tools will be crucial to successful investing.

Mastering the Dynamics of Financial Data Sourcing: A Strategic Guide