Table of Contents

For students who want to use TQuant Lab, in addition to the original GitHub installation tutorial, we now offer a faster and simpler way to use it directly on Google Colab. The tutorial on running TQuant Lab in Google Colab eliminates the need to set up a virtual environment, significantly lowering the barrier to entry.

!pip install zipline-tej

ERROR: pip's dependency resolver does not currently take into account all the packages that are installed. This behaviour is the source of the following dependency conflicts.

cudf-cu12 24.4.1 requires pandas<2.2.2dev0,>=2.0, but you have pandas 1.5.3 which is incompatible.

google-colab 1.0.0 requires pandas==2.0.3, but you have pandas 1.5.3 which is incompatible.import os

os.environ['TEJAPI_BASE'] = 'https://api.tej.com.tw'

os.environ['TEJAPI_KEY'] = 'Your_Key'

import datetime

import tejapi

import pandas as pd

import numpy as npfrom zipline.sources.TEJ_Api_Data import get_universe

pool = get_universe(start = '2022-07-02',

end = '2023-07-02',

mkt_bd_e = 'TSE',

stktp_e = 'Common Stock',

sub_ind_e=['M2324 Semiconductor', 'M2325 Computer and Peripheral Equipment'])import TejToolAPI

start_time = pd.Timestamp('2022-07-02')

end_time = pd.Timestamp('2023-07-02')

data = TejToolAPI.get_history_data(start = start_time,

end = end_time,

ticker = pool,

fin_type = 'A',

columns = ['營業總收入'],

transfer_to_chinese = True)

data = data.drop_duplicates(subset=['股票代碼'], keep='last').reset_index(drop=True)

data = data.nlargest(5, '營業總收入_A') #select the top five highest

data| stock | date | Total_Operating_Income_A | |

|---|---|---|---|

| 6 | 2330 | 2023-06-30 | 508632973.0 |

| 90 | 4938 | 2023-06-30 | 318136546.0 |

| 27 | 2382 | 2023-06-30 | 266180950.0 |

| 67 | 3231 | 2023-06-30 | 212000207.0 |

| 4 | 2324 | 2023-06-30 | 209458784.0 |

tickers = data['股票代碼'].unique()start = '2023-07-03'

end = '2024-07-02'

os.environ['mdate'] = start + ' ' + end

os.environ['ticker'] = ' '.join(tickers) + ' ' + 'IR0001'

!zipline ingest -b tquant

from zipline.data import bundles

bundle_data = bundles.load('tquant')

from zipline.api import *

from zipline.finance import commission, slippage

def initialize(context):

context.day = 0

context.tickers = tickers

set_slippage(slippage.VolumeShareSlippage(volume_limit = 0.025, price_impact = 0.1))

set_commission(commission.Custom_TW_Commission(min_trade_cost = 20, discount = 1.0, tax = 0.003))

set_benchmark(symbol('IR0001'))

set_liquidity_risk_management_rule(['全額交割股票(Full-Cash Delivery Securities)', '漲停股票(Limit Up)', '跌停股票(Limit Down)', '開盤即鎖死(Limited Whole Day)'])

def handle_data(context, data):

if context.day == 0:

for ticker in context.tickers:

order_percent(symbol(ticker), 1 / len(tickers))

context.day += 1

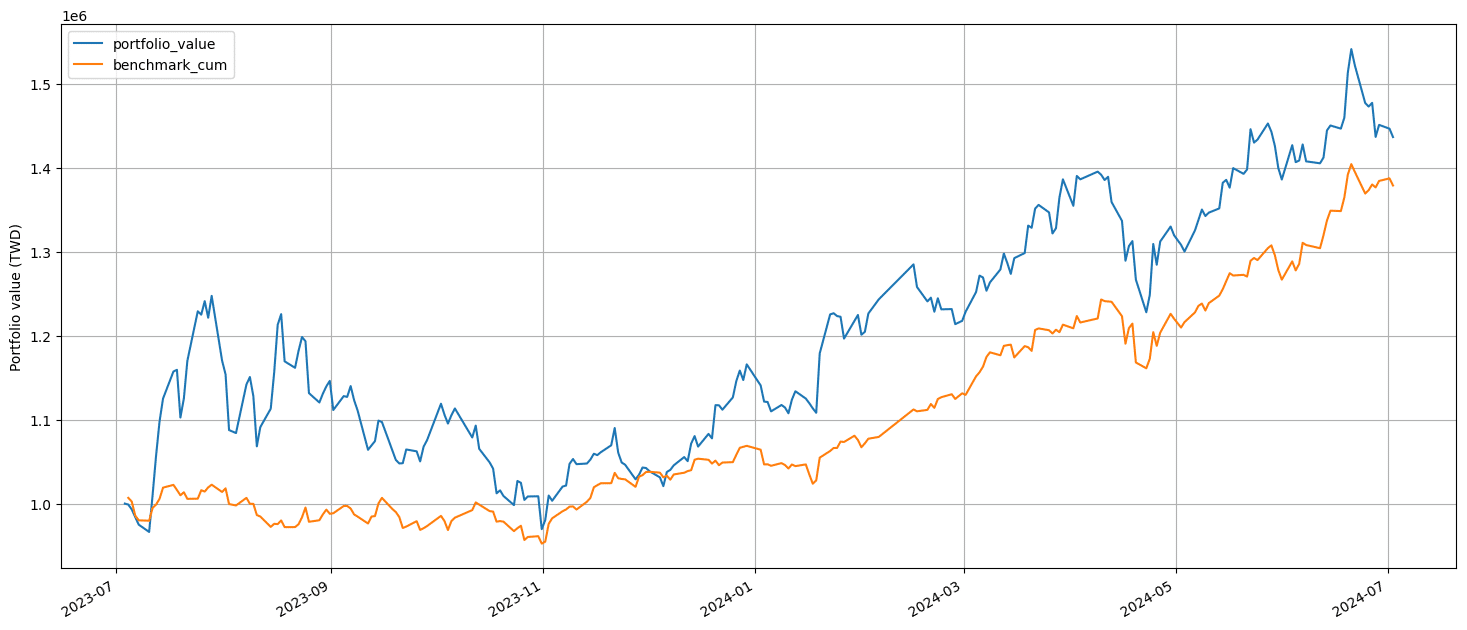

import matplotlib.pyplot as plt

capital_base = 1e6

def analyze(context, results):

fig = plt.figure()

ax1 = fig.add_subplot(111)

results['benchmark_cum'] = results.benchmark_return.add(1).cumprod() * capital_base

results[['portfolio_value', 'benchmark_cum']].plot(ax = ax1, label = 'Portfolio Value($)')

ax1.set_ylabel('Portfolio value (TWD)')

plt.legend(loc = 'upper left')

plt.gcf().set_size_inches(18, 8)

plt.grid()

plt.show()

from zipline import run_algorithm

start_date = pd.Timestamp('20230703', tz = 'utc')

end_date = pd.Timestamp('20240702', tz = 'utc')

results = run_algorithm(

start = start_date,

end = end_date,

initialize = initialize,

handle_data = handle_data,

analyze = analyze,

bundle = 'tquant',

capital_base = capital_base,

)

results

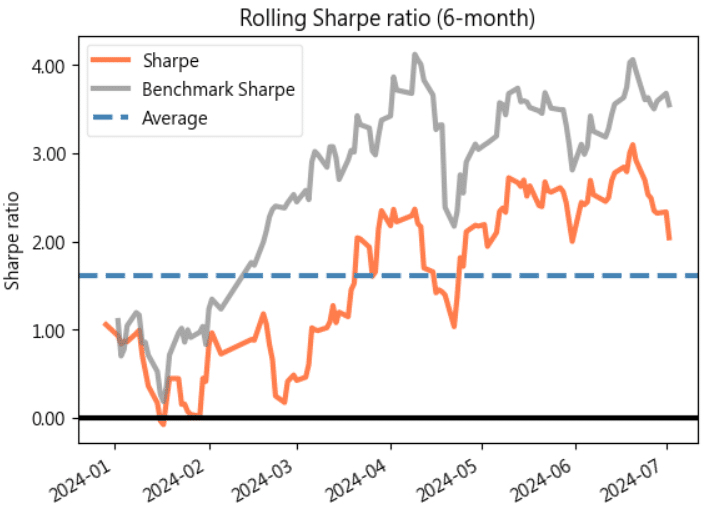

from pyfolio.utils import extract_rets_pos_txn_from_zipline

import pyfolio as pf

returns, positions, transactions = extract_rets_pos_txn_from_zipline(results)

benchmark_rets = results.benchmark_return

from pyfolio.plotting import plot_rolling_sharpe

plot_rolling_sharpe(returns, factor_returns=benchmark_rets)WARNING:matplotlib.font_manager:findfont: Generic family 'sans-serif' not found because none of the following families were found: Microsoft JhengHei

WARNING:matplotlib.font_manager:findfont: Generic family 'sans-serif' not found because none of the following families were found: Microsoft JhengHei

WARNING:matplotlib.font_manager:findfont: Generic family 'sans-serif' not found because none of the following families were found: Microsoft JhengHei

WARNING:matplotlib.font_manager:findfont: Generic family 'sans-serif' not found because none of the following families were found: Microsoft JhengHei

WARNING:matplotlib.font_manager:findfont: Generic family 'sans-serif' not found because none of the following families were found: Microsoft JhengHei

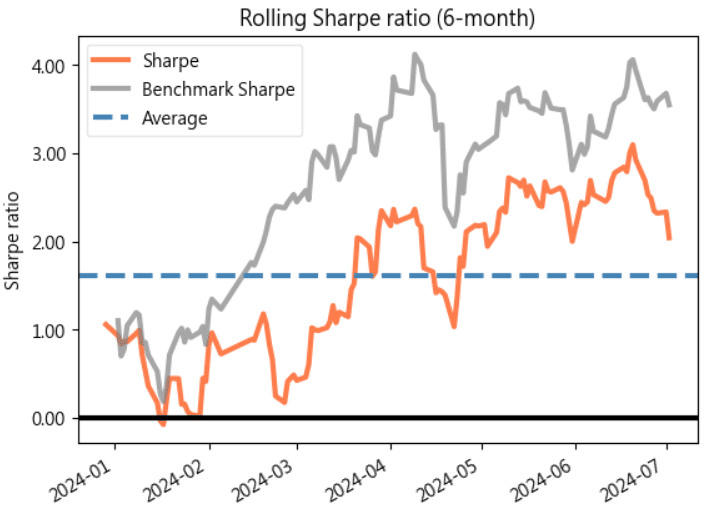

import matplotlib

import matplotlib.font_manager as fm

!wget -O MicrosoftJhengHei.ttf https://github.com/a7532ariel/ms-web/raw/master/Microsoft-JhengHei.ttf

!wget -O ArialUnicodeMS.ttf https://github.com/texttechnologylab/DHd2019BoA/raw/master/fonts/Arial%20Unicode%20MS.TTF

fm.fontManager.addfont('MicrosoftJhengHei.ttf')

matplotlib.rc('font', family='Microsoft Jheng Hei')

fm.fontManager.addfont('ArialUnicodeMS.ttf')

matplotlib.rc('font', family='Arial Unicode MS')plot_rolling_sharpe(returns, factor_returns=benchmark_rets)

This introduction’s testing section mostly references the code from the article “TQuant Lab Warren E. Buffett’s Business Investment Rules.” You can refer to the original extended reading content if you have any questions.

Additionally, this introduction allows everyone to use TQuant without needing extra virtual environment installations and extensive settings. It’s much more convenient to get started right away and follow this recommended approach.

【TQuant Lab Backtesting System】Solving Your Quantitative Finance Challenges

Providing Comprehensive Tools for Trading Backtesting