In 2023, under inflation, high interest rates, and excessive inventory level, the demand for consumer electronics products weakened, resulting in a sustained decline in the panel industry. The touch panel sector also faced profit erosion due to competition. Consequently, touch panel manufacturers have been actively diversifying into new business areas, despite the impact still remains relatively low at present. This article will briefly outline Taiwan’s touch panel industry’s new business plans, progress, and the industry outlook for the first half of 2024.

Table of Contents

Depending on the sensing method, touch panels can be categorized into various types, including resistive, projected capacitive, surface capacitive, surface acoustic wave, infrared, and optical. Additionally, based on the location of the touch sensor, they can be further divided into external (add-on) and embedded (integrated) types.

Add-on touch panels (ATP) are supplied by specialized touch panel manufacturers, while embedded touch panels are primarily produced by panel manufacturers. since embedded touch panels integrate touch sensors within the panel structure, reducing the module thickness and weight but also improving light transmittance.

According to the GIS-KY annual report, embedded touch technology accounts for over 50% of the market share. However, in the early stages, due to technical issues, integrating touch modules into the panel made them susceptible to signal interference, resulting in lower yield rates. But with technological advancements, embedded touch panels offer more advantages compared to add-on touch modules, and their adoption rate is gradually increasing. Currently, embedded touch has become the mainstream application for smartphones and is also making inroads into larger-sized display panels. Additionally, touch panel manufacturers are diversifying into other areas as their touch business continues to face competition from display manufacturers. Furthermore, their operations are closely tied to economic conditions, prompting them to actively explore new fields to mitigate the impact of economic fluctuations on revenue.

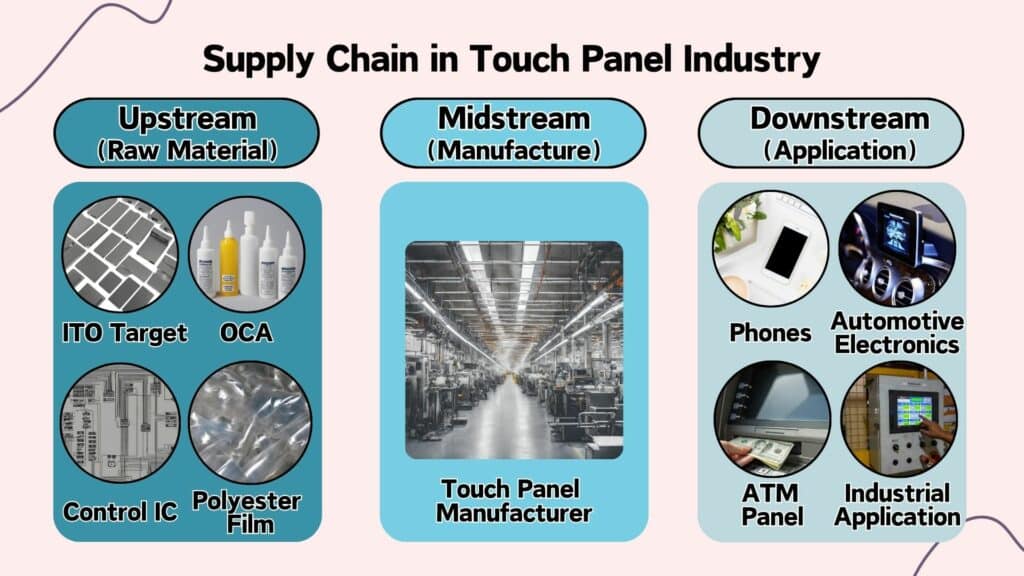

According to the Industry Chain Information Platform of TWSE, the supply chain for the touch panel industry can be divided into upstream, midstream, and downstream segments:

Click here to have more insights on different Taiwanese industries!

The touch panel industry experienced a significant decline in 2023, primarily due to the inventory adjustment in the industry cycle and overall sluggish demand in consumer electronics. The major players affected by this downturn were GIS-KY and TPK-KY, both prominent touch panel manufacturers. With Apple, a major customer, experiencing a decline in overall shipments, these two companies faced substantial challenges. However, amidst the unfavorable environment, YOUNGFAST (3622.TW) and Transtouch (3623.TW) managed to achieve growth. YOUNGFAST’s revenue composition reveals that touch module revenue accounted for only 24%, while wire and cable revenue constituted 76%. Despite the decline in touch module revenue, YOUNGFAST offset the impact through domestic energy policies and increased power facility projects, resulting in a modest 6% revenue growth. On the other hand, Transtouch specializes in niche touch modules, benefiting from increased demand in aviation applications for new and upgraded aircraft, leading to a slight 3% revenue growth.

| ID / Company name | Revenue (Amount in billion) | ||

| 2023 | 2022 | YOY%/YOY dollar change | |

| 6456 GIS-KY | 71.3 | 125.5 | -42%/-54.1 |

| 3673 TPK-KY | 69.9 | 97.2 | -28%/-27.3 |

| 3622 YOUNGFAST | 1.6 | 1.6 | +6%/0.0 |

| 3049 HannsTouch | 1.3 | 2.4 | -45%/-1.1 |

| 4729 MILDEX | 1.1 | 1.4 | -20%/-0.3 |

| 5220 HIGGSTEC | 0.8 | 1.0 | -19%/-0.2 |

| 3623 Transtouch | 0.4 | 0.4 | +3%/0.0 |

| Total | 146.4 | 229.3 | -36%/-82.9 |

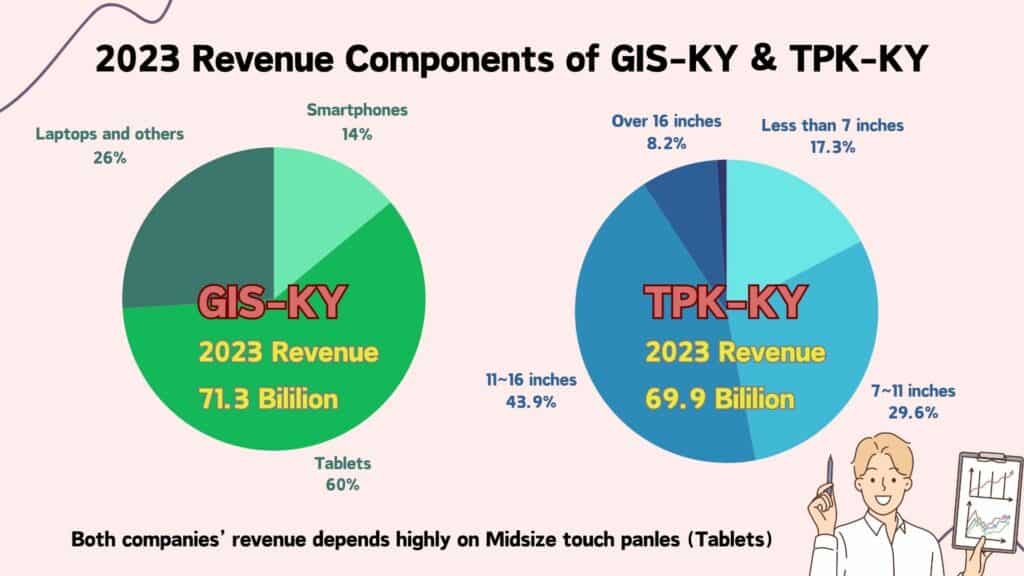

As we all know, GIS-KY (6456.TW) and TPK-KY (3673.TW) have long been the primary suppliers of touch panels for Apple devices, generating a stable revenue. According to 23Q4 financial report, it’s evident that both companies’ revenue shares in mobile touch panels are relatively low, hovering around 10%. Therefore, their main focus lies in supplying touch panels for laptops and tablets. Specifically, GIS-KY’s combined revenue share in tablets and laptops reaches 88%, while TPK-KY’s share in medium-sized panels (7-inch to 11-inch and 11-inch to 16-inch) also reaches 83%. Although revenue from mobile devices isn’t significant to both companies, smartphones play an essential role in modern society as a necessity and undergo rapid iterations. Compared to tablets and computers, the shorter lifecycle of smartphones and the trend of frequent upgrades directly reflect the overall recovery of the consumer electronics industry. Hence, this article will discuss smartphones separately from tablets and computers focusing on Apple products.

Based on IDC’s market research, global smartphone shipments grew by 7.8% in 2024 Q1, despite the challenging overall economic outlook. This marks the third consecutive quarter of shipment growth, indicating a successful recovery. However, from Apple’s perspective, the outlook might not be as optimistic. IPhone shipments fell to only 50 million units in 2024 Q1, declining by 9.6% compared to the same period in 2023. Although Apple’s market share remains second to Samsung, Xiaomi is closely trailing with a remarkable 33% growth in shipments during the same period, suggesting that iPhones may not be benefiting significantly from the economic recovery.

Another point of interest is whether the Chinese market is showing signs of bottoming out. Over the past two years, China’s policies have dampened demand and hindered production, making it the slowest in recovering of the world’s three major consumer markets. According to Counterpoint’s market research, China’s smartphone sales market grew by 1.5% in 2024 Q1 compared to the same period last year, achieving a 4.6% growth from the previous quarter. The trend of gradual recovery is emerging, but IPhone’s performance still remains concerning. Its market share declined from 19.7% in 2023 Q1 to 15.7% in 2024 Q1. Although GIS-KY and TPK-KY are not primarily focused on the smartphone market, their connection to the Apple ecosystem still leads to certain impacts.

During TSMC’s Q1 2024 earnings call, CEO C. C. Wei: “In terms of end applications, smartphones are growing steadily, while PCs are recovering more slowly. IoT and consumer electronics are still adjusting, and the automotive sector is also going through inventory destocking.” This suggests that PC growth performance won’t be as robust as that of smartphones. According to IDC’s research, PC shipments finally ended their two-year decline in 2024 Q1, growing by 1.5% compared to the same period last year. However, it’s essential to note that 2023 Q1 also marked the historical lowest point for PC shipments. Overall, PC shipments have roughly returned to pre-pandemic levels, with growth seen in the Americas and Europe. However, deflationary pressures in China have directly impacted the global PC market. Despite being the largest consumer of desktop PCs, weak demand in China led to another quarter of declines in global desktop shipments. As for MacBook’s performance, it benefited from the low base effect, showing 14.6% growth. However, future growth is expected to slow down, and Apple’s AI efforts are currently under scrutiny, potentially putting it at a disadvantage compared to other brands.

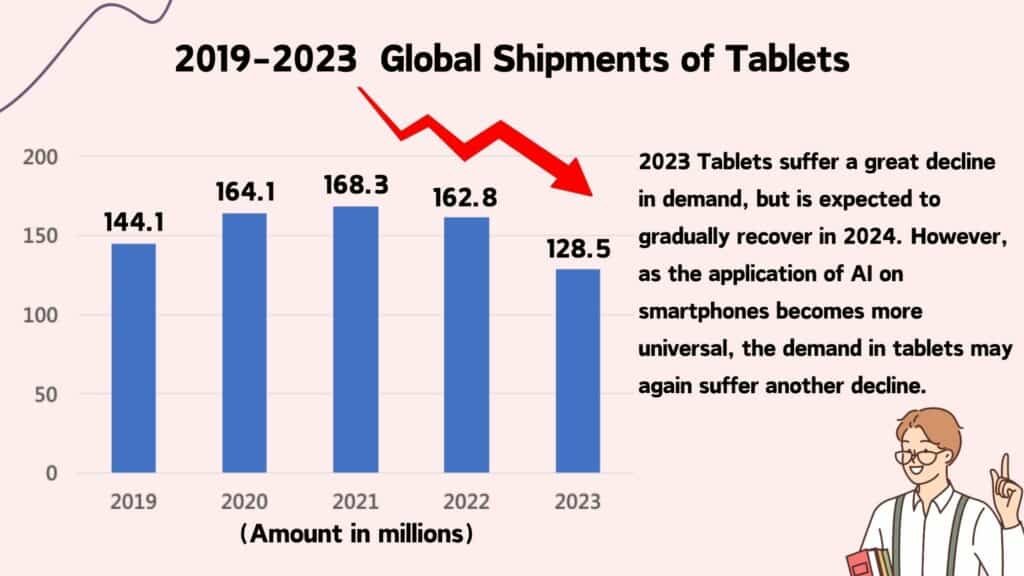

For tablets, unlike smartphones and computers, they lack the essential nature. When the economy is weak and inflation is high, budget allocations for tablets are often the first to be cut. According to IDC, tablet shipments for the entire year of 2023 declined by 20% compared to 2022, reaching the lowest annual volume since 2011. Apple, as the leader in the tablet market, shipped 12.5 million units but experienced a 15.1% year-over-year decline. Unlike previous years, Apple didn’t launch new models during Q3, which typically provides an uplift in the second half of the year. Additionally, the emergence of a new competitor, LENS (300433.SZ), further challenges GIS-KY and TPK-KY as a key supplier for Apple. To avoid over-reliance on a single product, various manufacturers have been preparing to adjust their product portfolios.

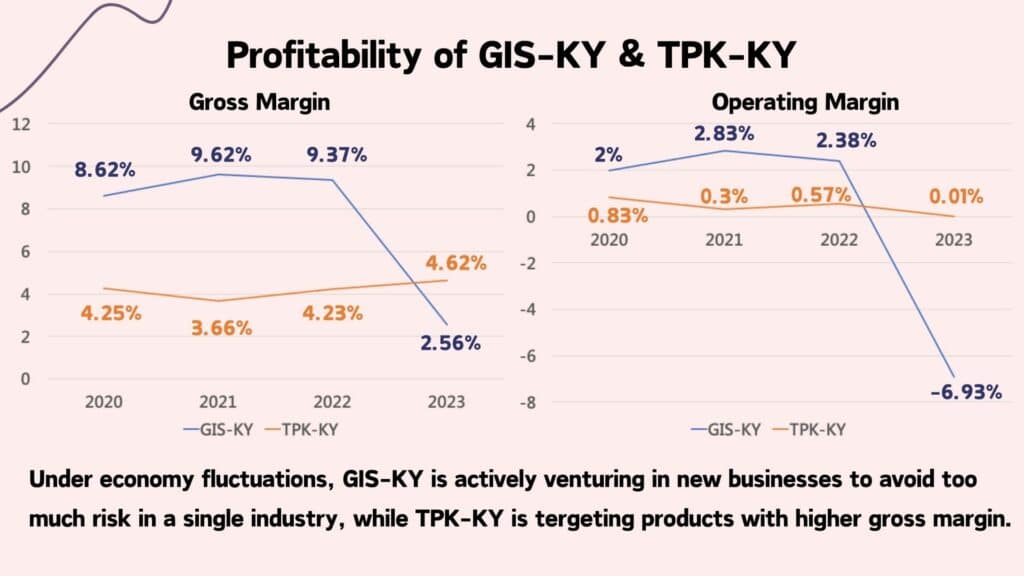

To avoid being too dependent on Apple’s supply chain, GIS-KY and TPK-KY have chosen to actively transform. Particularly for GIS-KY, the terrifying decline in gross profit margin is evident. In the past, GIS-KY could maintain a gross profit margin of 8-9%, but in 2023, it dwindled to a mere 2.56%. Operating profit has also turned negative. TPK-KY faced a similar situation in 2023 Q4, prompting them to make changes to their product portfolio.

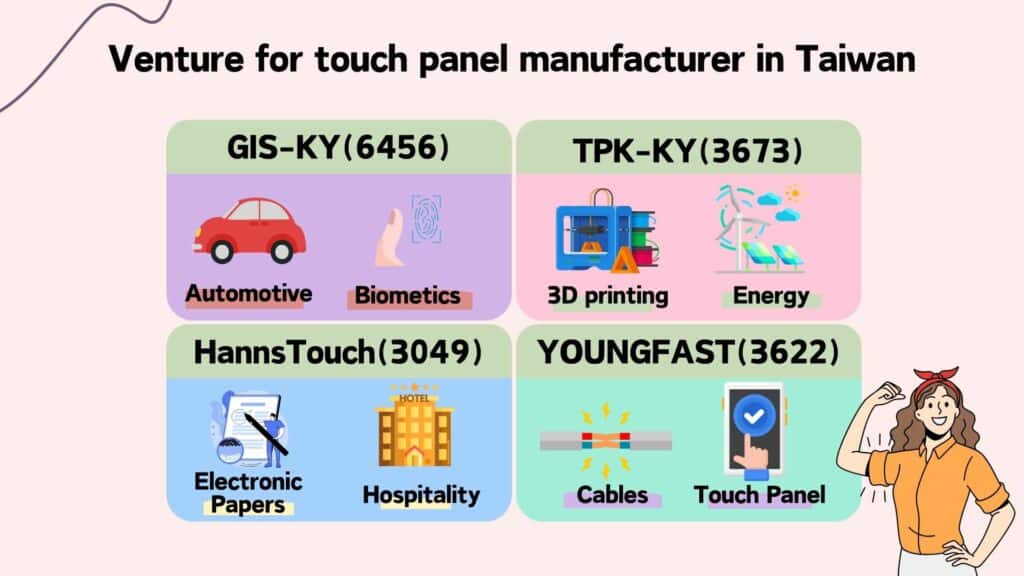

In addition to the original touch module business, GIS-KY is actively expanding into automotive and fingerprint recognition products. Their automotive products include monitors, central console touchscreens, and B-pillar facial recognition systems. Some of these products are expected to be integrated into electric vehicles under Foxconn brand, which has not yet officially launched electric cars, so the benefits remain to be observed.

As for fingerprint recognition products, they are primarily used for technologies such as ultrasonic under-screen fingerprint recognition and side-mounted capacitive fingerprint recognition. With the increasing reliance on smartphones, biometric identification technologies play a crucial role in ensuring information security and facilitating online transaction authentication. The demand for fingerprint recognition applications is expected to grow steadily over the coming years. According to the company’s statements during their financial results briefing, revenue contributions from automotive-related products were approximately 5% in 2023, and it is anticipated that this share will exceed 10% in the next three to five years. Meanwhile, fingerprint recognition accounted for 5% to 10% of revenue in 2023, with an estimated increase beyond 10% in 2024.

Apart from their touch panel business, TPK-KY is also involved in 3D printing, LiDAR, and energy-related ventures.

Besides the dominant players in the touch panel industry, other small Taiwanese manufacturers have also begun experimenting with different transformations to reduce industry risks. HannsTouch (3049) primarily produces touch products with active matrix organic light-emitting diode (AMOLED) displays. To align with the company’s long-term development strategy, they have started laying out products related to driver backplanes and are targeting niche markets. Electronic labels utilize e-paper display technology, offering advantages such as low power consumption, wide viewing angles, and readability. When combined with wireless control systems, retailers can instantly update label content on shelves, making it convenient for business operations. The company’s electronic label revenue accounted for 36% in the first three quarters of 2023, a 2.2% growth compared to the same period last year. This increase is mainly due to a significant decline in touch-related revenue. As the electronic label market continues to expand, revenue is expected to keep growing.

Additionally, HannsTouch has invested in the hospitality industry through its subsidiary, Glorystone Inc.. They have also partnered with 2 other companies to establish “Stand Cafebar”, venturing into the restaurant, hospitality, and catering business. The revenue share from these ventures accounted for approximately 14% in the first three quarters of 2023.

The touch module industry has faced erosion of its core business and revenue fluctuations due to economic cycles. As a result, various manufacturers have actively diversified into new ventures. However, the contribution from these new ventures remains small, and their impact is still in the early stages. Consequently, their ability to withstand economic volatility remains insufficient, leading to a significant decline of 36% in 2023. Looking ahead to the first half of 2024, while the overall economy has not yet shown clear signs of recovery, the lower base year in 2023 suggests that revenue may stabilize or experience modest growth. In the meantime, it’s essential to continue monitoring touch module manufacturers’ strategies and plans in exploring new industries.