Photo by Freepik

Table of Contents

With the development of AI applications in recent years, many industries have benefited from it, and Taiwan’s semiconductor industry is no exception. However, as the Chinese government continues to follow up and use policies to support local industries, the pressure on Taiwan’s IC design companies is increasing day by day. How will Taiwanese manufacturers deal with the threat posed by the rapid rise of Chinese companies? This article is divided into two parts. The first part covers the policy background of China’s IC design industry development, and includes a comparison of the current status and trend analysis of selected IC firms in Taiwan and China.

Amid the rapid growth of AI, the semiconductor industry not only carries high-added value but is also gaining increasing strategic importance. For a long time, the United States has maintained a leading position in the global semiconductor industry, while China’s IC products have primarily relied on imports. To reduce dependence on foreign supply chains, the Chinese government has actively promoted semiconductor self-sufficiency for years, gradually issuing policies to strengthen the domestic industrial chain.

In 2014, China released the 《Outline for the Promotion of the National Integrated Circuit Industry Development》 and established the first phase of the “National IC Industry Investment Fund” (commonly known as the “Big Fund”). In 2015, the 《Made in China 2025》 strategy was launched, focusing on supporting the development of the semiconductor manufacturing sector. In 2016, with the “13th Five-Year Plan” advancement, the government began to enhance support for the IC design industry. In 2019, the second phase of the “Big Fund” was launched, with investments expanded to broader areas within the semiconductor field.

In 2024, China launched the third phase of the “Big Fund,” with a registered capital of RMB 344 billion—exceeding the combined total of the first and second phases. By the end of 2024, the fund had invested in “SINO-IC (Beijing) Equity Investment Fund” and “SDIC XINJI (Beijing) Equity Investment Fund,” with a combined scale of approximately RMB 164 billion. In early 2025, the “National Artificial Intelligence Industry Investment Fund” was established, with a capital scale of around RMB 60.1 billion. Although the third phase of the Big Fund has not yet made targeted investments in specific enterprises, its massive capital injection could profoundly impact on the development of China’s semiconductor industry and warrants ongoing observation.

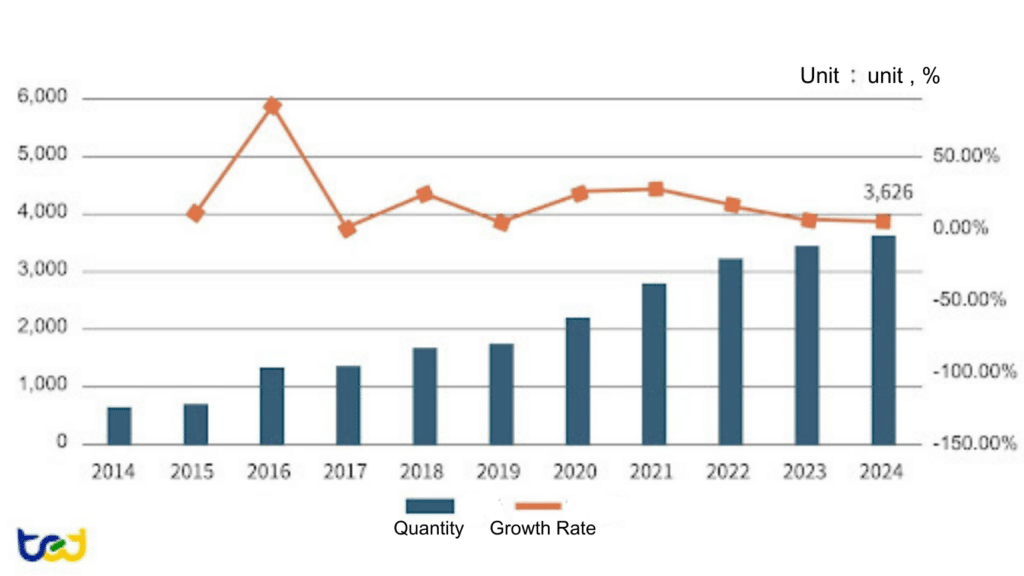

Driven by the aforementioned policies, the number of IC design companies in China has increased significantly (Figure 1), growing from 681 in 2014 to 3,626 in 2024, with a compound annual growth rate (CAGR) of 18%. Notably, following the implementation of the 13th Five-Year Plan in 2016, the annual growth rate surged to 85%. In contrast, the number of IC design companies in Taiwan grew more slowly—from 245 in 2014 to 270 in 2024—with a CAGR of less than 1%.

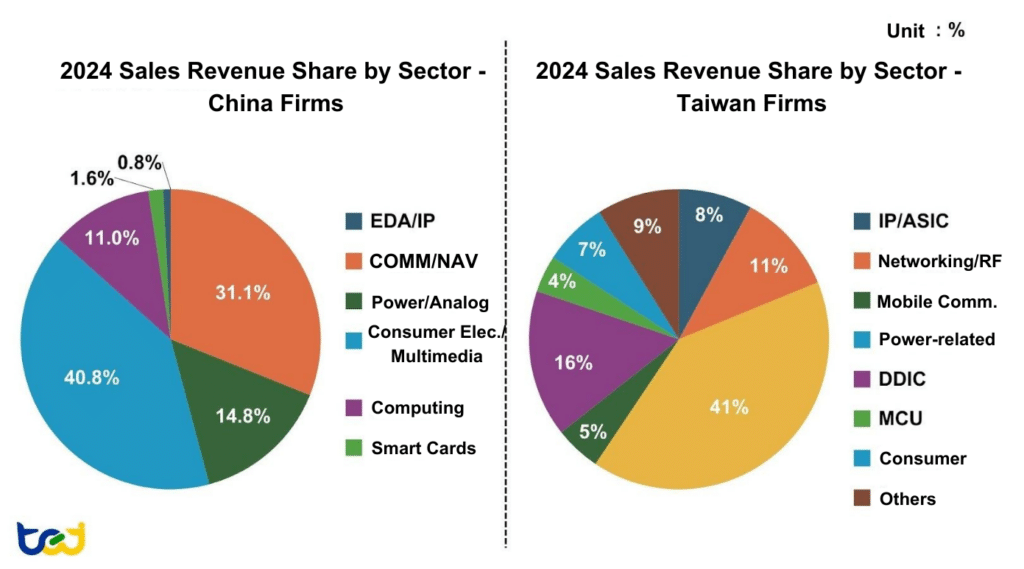

Regarding sales composition in China, consumer electronics holds the highest share, followed by communications/navigation, which includes networking, RF, and mobile communications.Due to the significant differences in company revenue scales in Taiwan, mobile communications are categorized separately from networking. The top three segments by sales share in Taiwan are mobile communications (led by MediaTek), DDIC (led by Novatek), and networking (led by Realtek) (Figure 2). The following sections will further explore the competitive landscape of each of these segments.

Figure 1: Number and Growth Rate of IC Design Companies in China(including non-listed companies)

Source: China Semiconductor Industry Association (Dec 2024), compiled by TEJ

Figure 2: Comparison of Major Categories of IC Design Companies in China and Taiwan

Source: China Semiconductor Industry Association (Dec 2024)、company financial statements, compiled by TEJ.

Note: The statistics for China include all IC design companies (including non-listed), while Taiwan’s data covers only listed and OTC companies.

According to the《White Paper on Taiwan’s IC Design Industry Policy》 jointly published in 2023 by the Taiwan Semiconductor Industry Association (TSIA) and DIGITIMES, China currently holds a 15% market share in the IC design industry, while Taiwan holds an 18% share. However, given the rapid rise of China’s IC design sector, China is projected to surpass Taiwan’s market share by 2026. The competitive dynamics of the industry should be closely monitored moving forward.

Driven by the rise of AI and a rebound in end-product demand, IC design companies in Taiwan have recently shown strong operational performance. In 2024, the overall revenue of Taiwan’s IC design companies (including non-listed firms) grew by approximately 15% year-on-year, outpacing the 12% growth rate of their counterparts in China (also including non-listed firms). Taiwan’s higher revenue growth can be attributed not only to the fact that many Chinese IC design companies still focus on lower value-added consumer products, but also to the revenue scale disparity among Taiwanese firms. For instance, MediaTek, which accounts for around 40% of the industry’s total revenue, posted relatively high revenue growth in 2024. Excluding MediaTek, the overall revenue growth rate of Taiwan’s IC design sector would decrease to about 10%.

On the other hand, given the diversity of IC design product categories and their wide range of applications, the operational performance of individual companies is highly influenced by changes in end-market demand and the specific characteristics of their sub-industries. Therefore, to further analyze how China’s semiconductor self-sufficiency strategy affects Taiwanese firms differently and to explore the possible reasons, the following section breaks down IC design companies by sub-sector and compares revenue and operating margin performance between representative firms from Taiwan and China (see Table 1).

Table 1:Latest Financial Informantion of IC Design Companies between Taiwan and China

| Category | Impact from China |

High-Performing (Rev. / Op. Margin) |

Underperforming (Rev. / Op. Margin) |

Major Competing Chinese Firms (Rev. / Op. Margin) |

|---|---|---|---|---|

| Networking IC | High | Realtek ( NT$113.4B / 12.2%),Airoha (NT$19.1B / 16.1%) | RichWave (NT$3.7B / 2.7%),ALi (NT$1.6B / -15.4%) | UNISOC (unlisted),Maxscend (NT$20.1B / 10.8%),Beken (NT$3.7B / -5.8%) |

| MCU | High | Nuvoton (NT$31.9B / 0.9%) | Holtek (NT$2.5B / -10.9%),Thine (NT$0.2B / -6.9%) | Espressif (NT$9.0B / 17.0%),Sino Wealth NT$6.2B / 5.9%) |

| Power IC | High | Richtek (NT$8.3B / 20.3%),Weltrend & Excelliance (NT$3.1B / 5.4%) | ilergy-KY (NT$18.5B / 10.1%) | Southchip (NT$12.5B / 14.3%),Injoinic (NT$6.6B / 9.0%) |

| Consumer IC | High | ASMedia (NT$8.1B / 32.8%),Elan (NT$12.7B / 24.3%) | Pixart (NT$1.7B / 1.6%),Egis (NT$4.8B / -22.6%) | Goodix (NT$19.5B / 16.2%),GalaxyCore (NT$29.5B / -1.1%) |

| Display IC | Moderate | Novatek (NT$102.8B / 21.8%),TCON (NT$19.2B / 12.1%) | Raydium (NT$1.5B / 1.7%),Orise (NT$1.2B / -23.0%) | Silead (unlisted),ESWIN (unlisted),Xingji (NT$2.1B / -0.8%) |

| Mobile Comm IC | Moderate | MediaTek (NT$530.6B / 20.6%) | – | UNISOC (unlisted),HiSilicon (Huawei, unlisted) |

| IP | Low | eMemory (NT$3.6B / 54.7%) | M31 (NT$1.5B / 13.4%),ITE Tech (NT$0.2B / 17.6%) | Innosilicon (unlisted),Verisilicon (unlisted) |

| Design Service(ASIC) | Low | Alchip-KY (NT$52.0B / 12.2%),Global Unichip (NT$25.0B / 15.4%),Faraday (NT$11.1B / 10.9%) | GUC (NT$0.7B / 4.8%) | Verisilicon (NT$10.4B / -23.6%), |

Source:TEJ

Note: Revenue scale refers to the total revenue for the full year of 2024, while the operating profit margin is based on data from the first three quarters of 2024

Networking-related IC companies include those involved in products such as Wi-Fi, Ethernet, switches, Bluetooth, and RF (radio frequency) components. Among these, RF ICs are key components in 5G modules. During the height of U.S.-China competition over 5G technologies, when various sanctions were imposed, the Chinese government actively supported domestic RF IC companies. Additionally, since smartphones are a major application for RF ICs—and Chinese smartphone brands currently have a significant market share—this has further enhanced the competitive edge of Chinese RF IC firms.

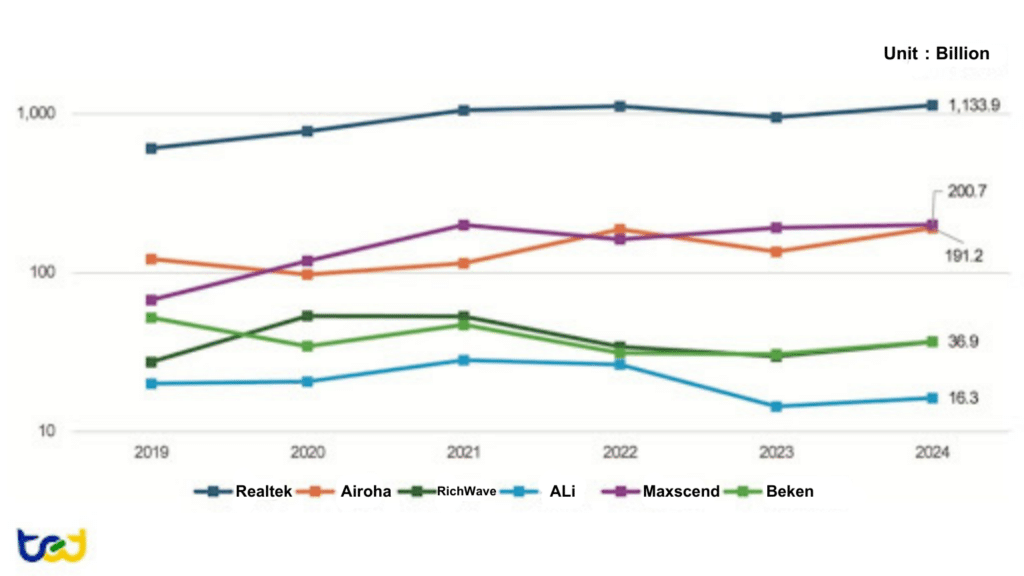

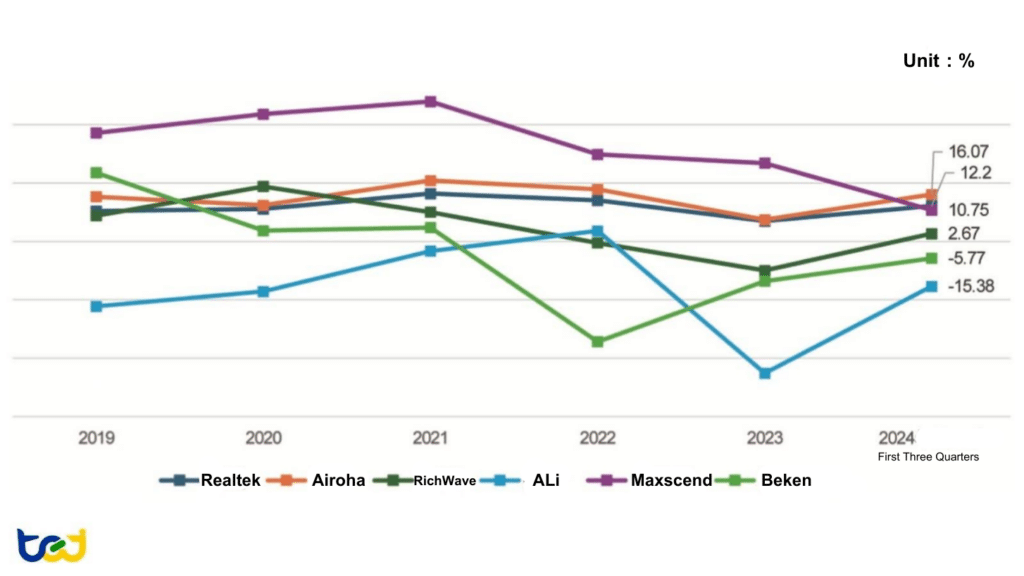

In terms of revenue trends (see Figures 3), China’s Maxscend has shown an upward trajectory, while Taiwanese players such as RichWave and ALi have seen declining revenues. As the number of government-supported RF IC firms in China increases, market competition has intensified, negatively impacting the operating margins of Maxscend, RichWave, and ALi (see Figures 4).

Moreover, major players in China’s networking IC market often rely on support from their parent companies. For example, HiSilicon (a Huawei subsidiary) and ZTE Microelectronics (under ZTE) mainly produce chips for their own networking equipment and do not publish standalone financial data. In contrast, Chinese networking IC companies without such backing tend to be smaller and less competitive.

Compared to their Chinese counterparts, Taiwanese networking IC companies typically have more diversified customer bases and broader product lines. For example, Realtek covers Ethernet, Wi-Fi, and switches, while Airoha has strong market positions in fixed broadband, satellite positioning, and Bluetooth. From a revenue and profitability perspective, Realtek and Airoha have demonstrated relatively stable performance. In contrast, China’s Beken has experienced a downward revenue trend and greater fluctuations in operating margins (see Figures 3 and 4).

▶️Taiwan’s Satellite Communication Industry: An Insightful Overview

Figures 3: Revenue Trends of Networking-Related IC Design Companies

Source: Company financial reports, 2024 revenue estimates by TEJ

Note 1: Due to significant differences in company revenue sizes, the Y-axis uses a logarithmic scale.

Figures 4: Operating Margin Trends of Networking-Related IC Design Companies

Source: Company financial reports, compiled by TEJ.

The MCU (Microcontroller Unit) market has long been dominated by major IDM (Integrated Device Manufacturer) companies from Europe and the United States. In contrast, manufacturers from Taiwan and China primarily focus on consumer applications, which generally have lower technological barriers. Additionally, since Taiwanese MCU companies are highly dependent on revenue from the Chinese market, they are more significantly affected by competition from domestic Chinese MCU manufacturers.

In the Chinese MCU market, GigaDevice is a representative player. However, due to the high proportion of its revenue from memory products, this section selects Espressif, which specializes in IoT MCUs, and Sino Wealth, a leading MCU supplier for home appliances in China, as comparison targets.

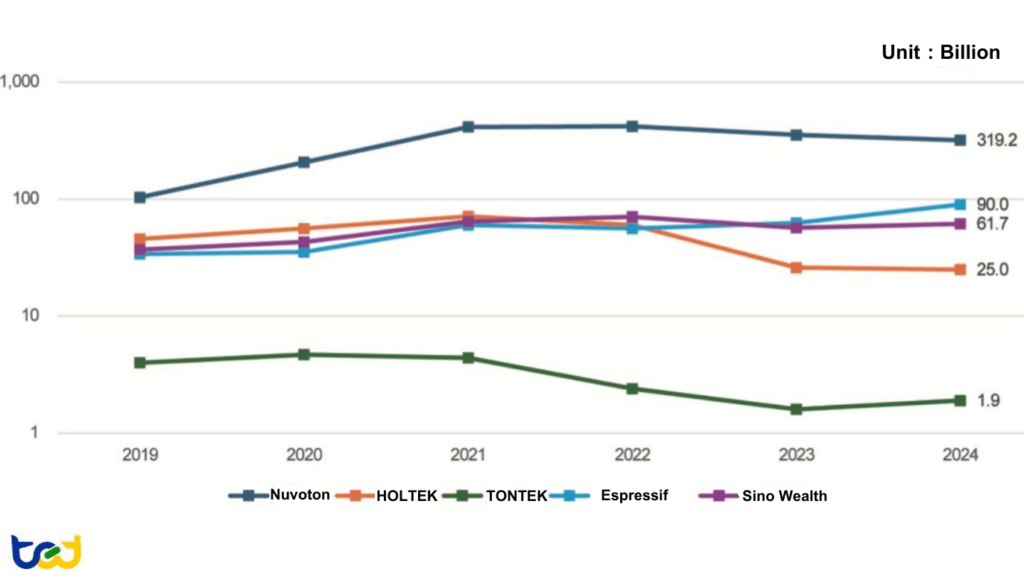

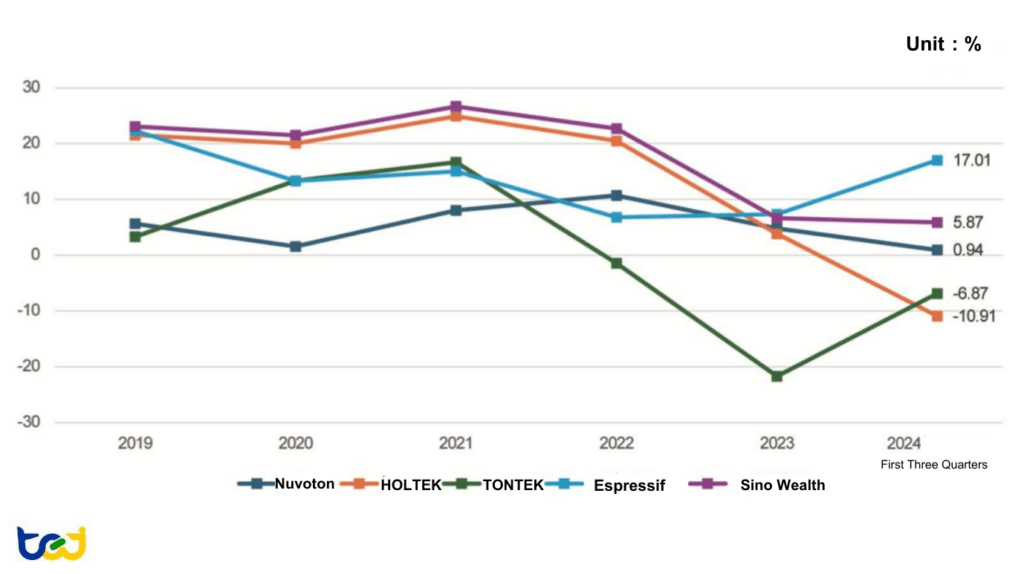

In terms of revenue performance (Figure 5), among Taiwanese companies, Nuvoton stands out for its relatively stable revenue, attributed to its acquisition of Panasonic’s semiconductor division, an increased share in automotive and industrial control applications, and lower revenue exposure to Chinese clients. In contrast, Holtek and TONTEK, which focus on the consumer market, have both shown a declining revenue trend. Notably, Holtek’s revenue now intersects with China’s Espressif and Sino Wealth.

In terms of operating margin performance (Figure 6), Holtek, TONTEK, and Sino Wealth—mainly focused on the consumer market—have all seen their profitability eroded due to intense market competition, whereas Nuvoton and Espressif have maintained relatively stable performance.

Figure 5:Revenue Trends of MCU Manufacturers

Source: TEJ Financial Database; 2024 revenue estimates compiled by TEJ

Note 1 : Due to significant differences in company revenue scale, the Y-axis in this chart uses a logarithmic scale.

Note 2 : Since Sino Wealth has not provided a 2024 revenue forecast, it is estimated based on the first three quarters of 2024.

Figure 6: Operating Margin Trends of MCU Manufacturers

Source: TEJ Financial Database; compiled by TEJ

The power management IC (PMIC) market has long been led by Texas Instruments (TI). However, due to the widespread application of PMICs in consumer electronics such as smartphones and computers, China has leveraged its large domestic demand to actively promote the development of local companies, significantly intensifying market competition in recent years.

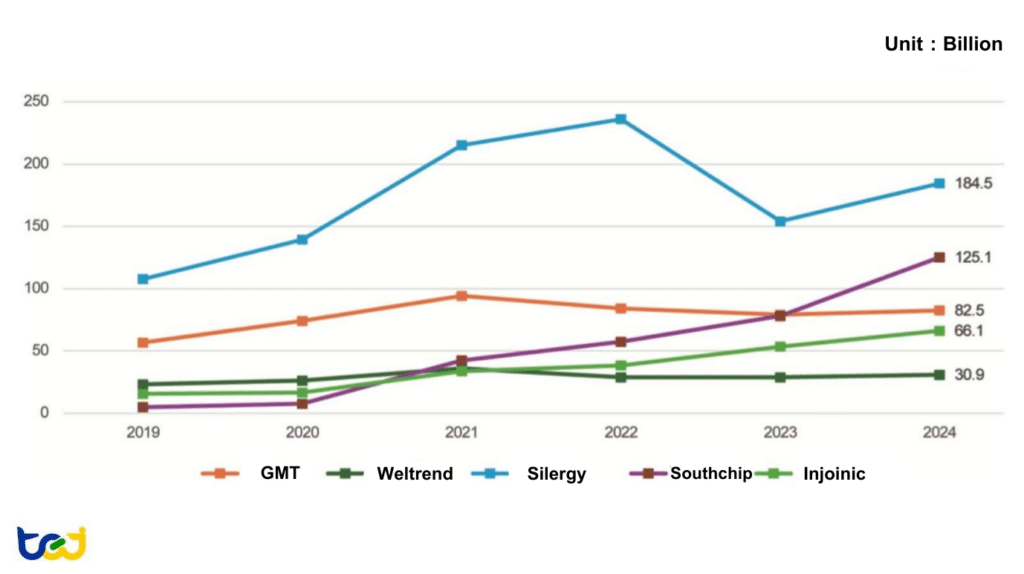

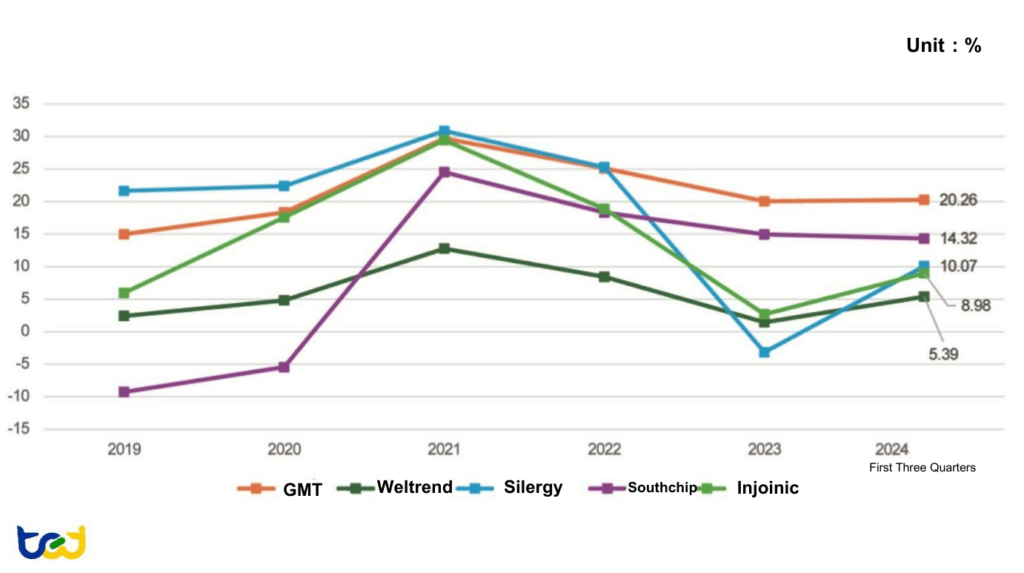

As shown in Figures 7 and 8, while leading PMIC companies such as Taiwan’s Silergy and China’s Injoinic have continuous revenue growth, their operating margins have shown a downward trend. On the other hand, companies like Richtek, which focuses is focusing on the DDR5 segment, and Global Mixed-mode Technology (GMT), which has entered the server fan supply chain, have demonstrated relatively stable revenue and operating margin performance.

Notably, China’s Southchip has seen steady growth in both revenue and operating margin since launching its mobile-targeted charge pump products in 2019. According to a 2021 study by Frost & Sullivan, Southchip became the world’s leading supplier of charge pump products by shipment volume, with its market influence continuing to expand.

Figure 7: Revenue Trends of Power Management IC Design Companies

Source: TEJ Financial Database; 2024 revenue estimates compiled by TEJ

Note 1: Since Southchip has not provided a 2024 revenue forecast, the estimate is based on revenue from the first three quarters of 2024.

Figures 8 : Operating Margin Trends of Power Management IC Design Companies

Source: TEJ Financial Database

Other consumer ICs refer to chips used in computers, mobile phones, and televisions (excluding companies mentioned in previous sections), including USB controllers, sensor chips, fingerprint recognition chips, and touch controller chips. Among these, Chinese companies are less involved in PC-related chips but have invested more heavily in sensor chips. Fingerprint recognition chips, on the other hand, have been mainly impacted by overall market contraction and are comparatively less affected by China’s localization push.

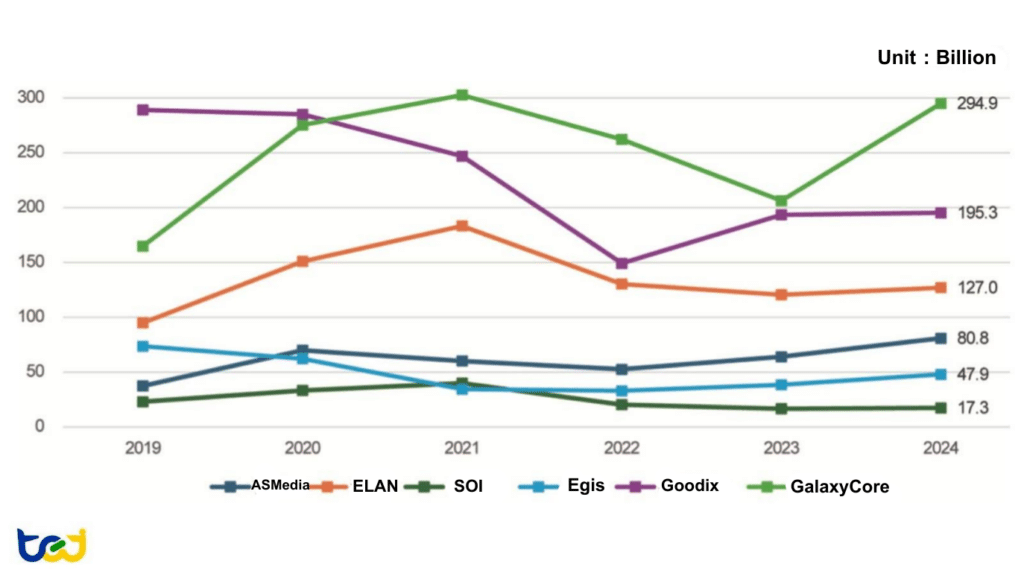

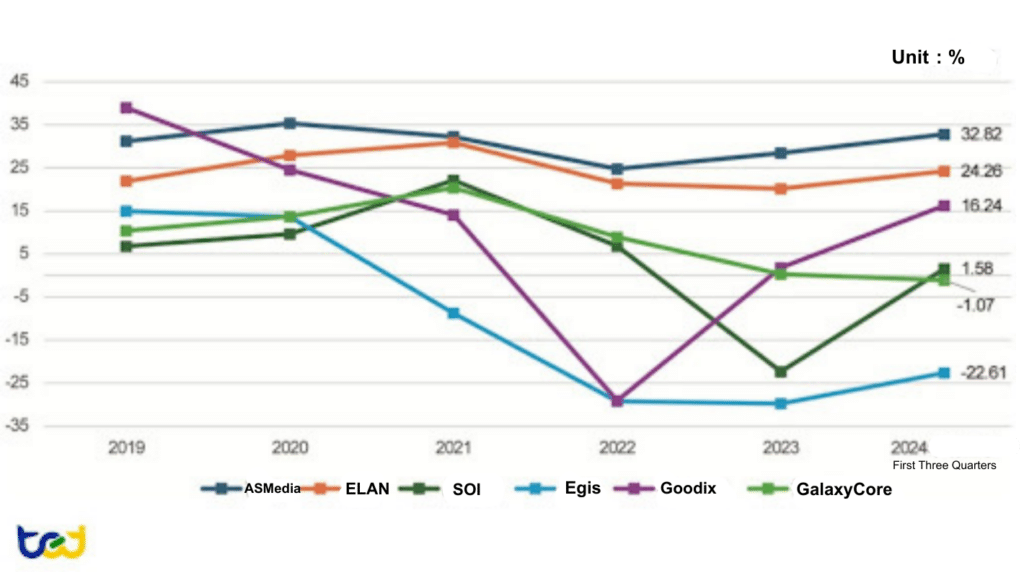

As shown in Figures 9 and 10, Taiwanese companies Asmedia and Elan, which mainly supply chips for PC applications, have shown relatively stable performance. Asmedia derives over 50% of its revenue from the Americas, with low reliance on the Chinese market. Elan holds a high market share in the notebook sector and has recently expanded into e-reader applications, resulting in diversified development and smaller fluctuations in both revenue and operating margin.

For sensor chip makers, both Taiwan’s Silicon Optronics and China’s GalaxyCore have experienced more significant revenue volatility and declining profit margins due to intensifying market competition. In the fingerprint recognition chip segment, Taiwan’s Egis and China’s Goodix are both facing revenue declines. However, it is worth noting that Goodix has been actively expanding into health sensor and Bluetooth SoC segments. Its operating margin has rebounded from the bottom and, in early 2025, the company announced plans to acquire panel driver IC company VIEWTRIX. Egis Technology, on the other hand, is transitioning into an IP and ASIC solution provider, though it is still in the transformation phase, resulting in continued margin decline.

Figure 9: Revenue Trends of Other Consumer IC Design Companies

Source: TEJ Financial Database, and TEJ’s 2024 revenue estimates

Figure 10: Operating Margin Trends of Other Consumer IC Design Companies

Source: TEJ Financial Database

Explore the latest insights into Taiwan’s corporate landscape with the TEJ Watchdog Database. Our analysis of major events affecting Taiwan’s tech industry provides a clear and actionable perspective. Through a detailed evaluation of recent corporate news, we quantitatively assess the impact of these events on credit conditions, offering an event intensity rating from -3 to +3.

Stay informed about the dynamic changes in Taiwan’s technology sector, understand the factors influencing corporate credit risks, and make timely adjustments to your investment strategies. Visit the TEJ Watchdog Database today and gain the edge in navigating Taiwan’s evolving business environment.

➤ DeepSeek Launches Low-Cost AI — A Game-Changer for the Industry?