Table of Contents

With the rapid growth of digital television and advancements in IoT, Wi-Fi, and low-earth orbit satellite technology, the satellite microwave communication industry has garnered significant attention. According to the Satellite Industry Association (SIA), the global space economy reached $384 billion in 2022, with the satellite sector contributing $281.1 billion (73%). Taiwan’s satellite communication industry, as per the National Space Organization, saw an output value of NT$215.8 billion in 2022, primarily driven by ground receiving equipment, accounting for 98.7%.

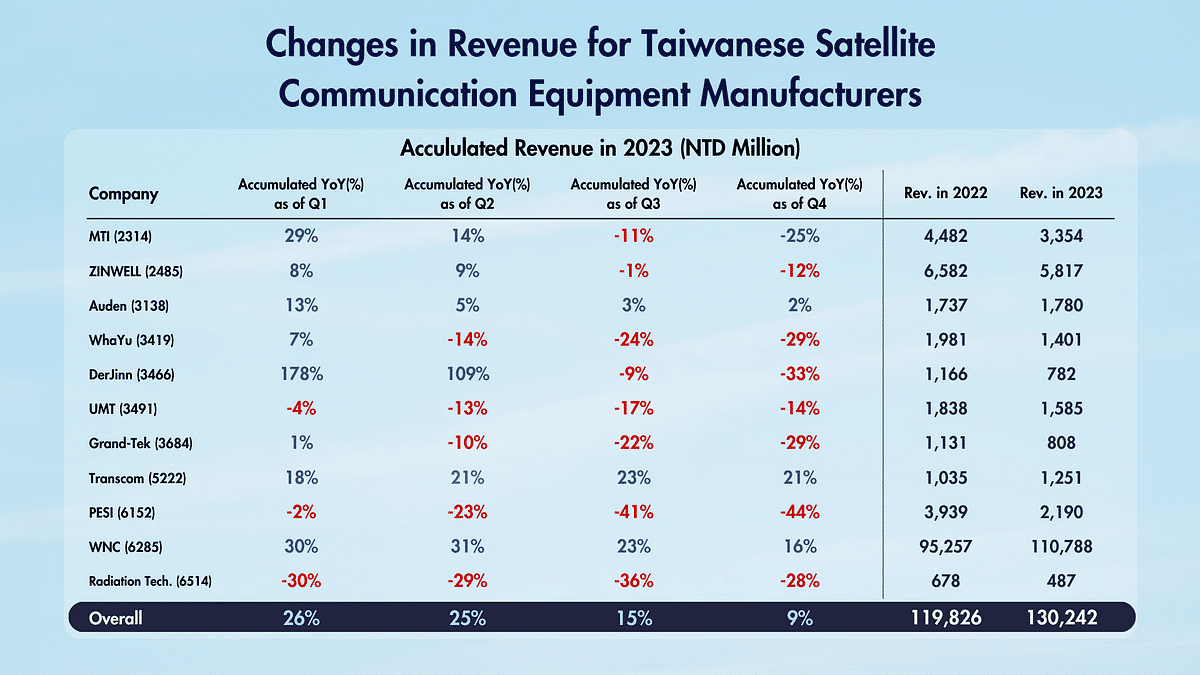

Despite external challenges like the US-China trade tensions and the COVID-19 pandemic, Taiwanese satellite communication equipment companies have maintained growth. Boosted by infrastructure project subsidies and satellite constellation initiatives, 11 listed companies saw revenues of NT$119.8 billion and NT$96.3 billion in the first three quarters of 2022 and 2023, respectively, marking 34% and 15% year-on-year growth.

This article will delve into Taiwan’s satellite communication industry, covering product introductions, industry dynamics, and Taiwanese manufacturers’ current status and prospects, providing readers with a concise understanding of this thriving sector.

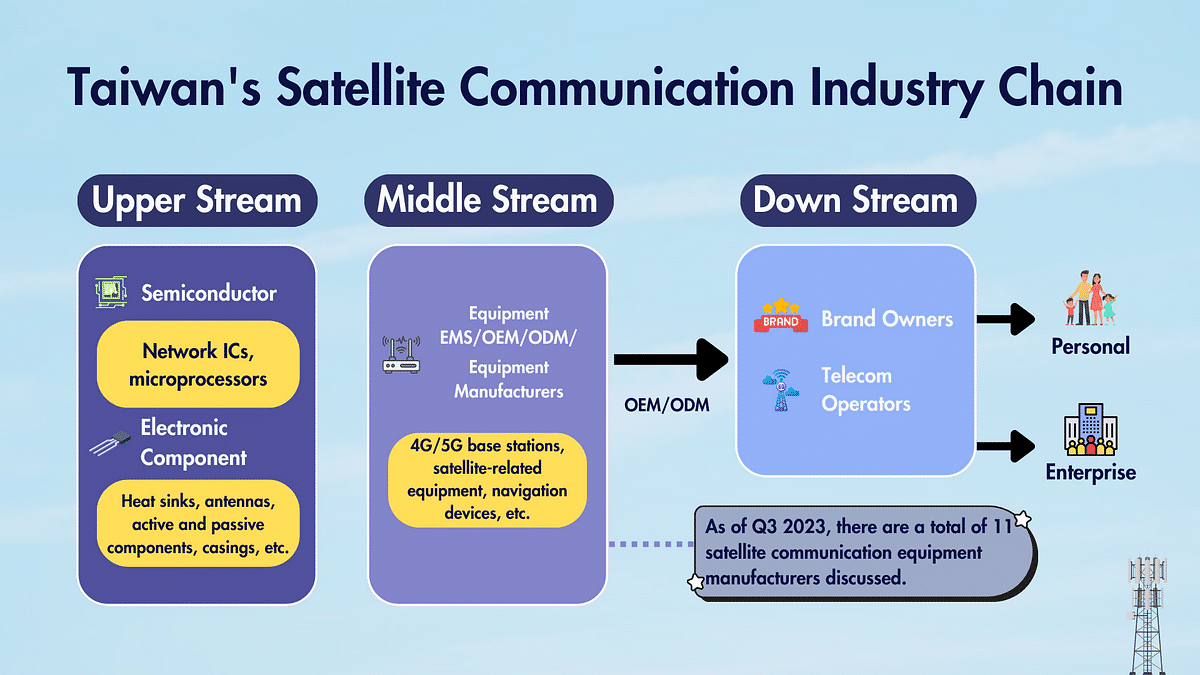

According to the Industry Value Chain Information Platform, Taiwan’s communication equipment industry structure is analyzed as follows: “Utilizing wired and wireless transmission to receive symbols, signals, text, images, sound, and other messages, combined with upstream components of various communication terminals and downstream applications and services, forming Taiwan’s network communication industry.” Satellite microwave communication is a part of this industry, with Taiwanese companies mainly engaged in manufacturing and OEM services. They often utilize ODM and OEM models to produce for major brands and telecom companies, while a few operate under the OBM model, catering to enterprises, governments, and major brands downstream.

In recent years, Taiwan has been actively promoting the development of its satellite communication industry in response to the advancement of the Internet and the challenges posed by the COVID-19 pandemic. As a result, technological advancements have been steadily on the rise. Concepts such as IoT, Wi-Fi 6/6E/7, satellite television, and low-earth orbit satellites are receiving attention from governments worldwide, leading Taiwan’s satellite communication manufacturing to focus primarily on digital set-top boxes and satellite receiving equipment. Key products include base stations, digital set-top boxes, antennas, and low-earth orbit satellites. These products contribute to 24% of the total revenue in the communication equipment industry.

Read More: Another Peak Ahead? The Thorough Analysis of Taiwan’s Netcom Industry

Looking back, Taiwan’s satellite communication industry has undergone significant developments, influenced by key events such as the US-China trade war in 2018, the surge in demand during the COVID-19 pandemic in 2020, and the easing of chip shortages in late 2022. The industry has seen a boost from the rapid growth of IoT and electric vehicle applications.

As of September 2023, there were 11 listed satellite communication equipment companies with a total revenue of NT$96.28 billion, marking a 15% YoY growth. Despite this growth, challenges persist due to the unfavorable macroeconomic environment. Downstream destocking and a higher revenue base year have limited revenue growth, with the growth rate declining from 25% in the first half of 2023 to 15% in the first three quarters of 2023.

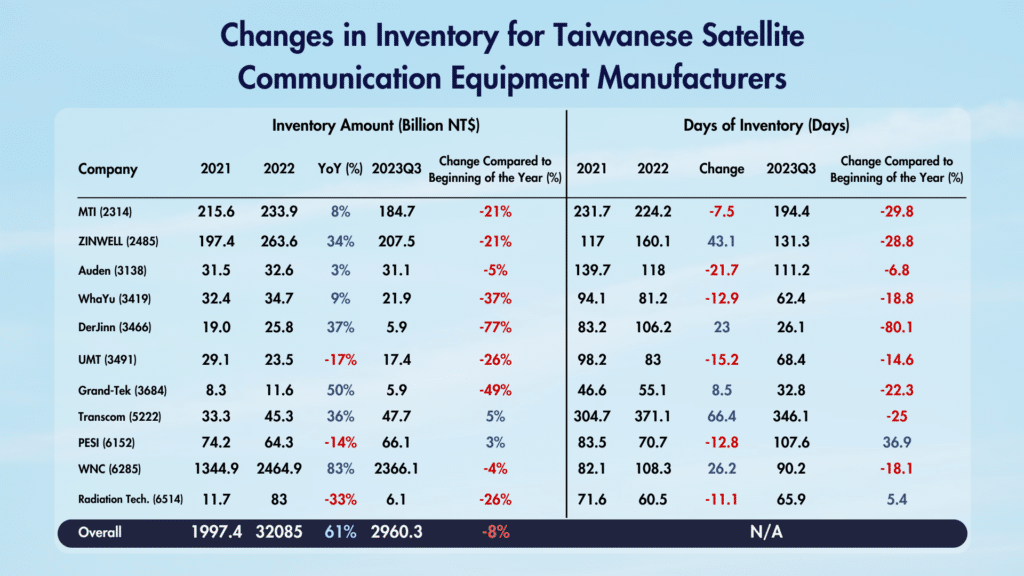

When observing inventory levels, Taiwanese satellite microwave manufacturers experienced an accumulation of orders until the latter half of 2022, resulting in high inventory levels for most companies. Notably, WNC saw the highest increase in year-end inventory, up by 83%, while Grand-Tek (3684) experienced over a 50% increase. In terms of inventory turnover days, ZINWELL (2485) and Transcom (5222) saw increases of 40 to 60 days.

In 2023, due to reduced orders from downstream manufacturers, midstream continued to execute inventory reduction operations. Among them, MTI (2314), ZINWELL (2485), WhaYu (3419), UMT (3491), Grand-Tek (3684), and Radiation Tech. (6514) all achieved inventory reduction levels of over 20%. DerJinn (3466) underwent transformation, resulting in the clearance of satellite TV manufacturing inventory. Transcom (5222) benefited from Taiwan’s defense procurement projects, leading to an increase rather than a decrease in inventory. WNC (6285) received orders related to North American infrastructure legislation, maintaining high inventory levels. Only PESI (6152), has yet to complete inventory reduction, with inventory turnover days still increasing by 37 days.

Boost your industry Insights with TEJ Databank Solution

Unveil All-encompassing Financial data today!

Satellite microwave communication involves diverse applications, like digital TV transmission via Set-Top Boxes and RF components for wireless communication. Taiwanese manufacturers focus on these areas, with developments and strategies analyzed below.

Digital TV Set-Top Boxes primarily connect digital TVs to external signal sources such as satellite broadcasts or physical cable lines. They process TV program signals into digital data, which are then transmitted to users’ homes via digital modulation technology. Taiwan’s key players in this field include ZINWELL, DerJinn, and PESI, with a combined revenue of NT$6.86 billion.

1. ZINWELL (2485)

ZINWELL mainly sells digital cable video transmission system products to North America and Europe. It has shifted focus to manufacturing communication network transmission equipment and developing new products for the digital convergence industry, such as distribution network amplifiers and outdoor splitters. However, as the satellite television industry matures, ZINWELL plans to prioritize the digital video converter and satellite low-noise block downconverter markets and collaborate with telecommunications operators to stay competitive. Its revenue in the first three quarters of 2023 was NT$4.56 billion, down 1% YoY

2. DerJinn (3466)

With a primary focus on producing digital set-top box series products, Dajin has seen its revenue decline by 9% in the first three quarters of 2023, as the satellite TV industry approaches maturity amid vigorous growth in recent years. As the market intensifies and competition increases, product prices are expected to decrease, thereby eroding sales profits. However, with a new management team in place,

DerJinn is moving towards the energy sector, having set up three energy service subsidiaries and acquired Guangshuo Energy in August 2023. Its focus is on solar photovoltaic installation, energy storage product development, and energy commodity sales. Revenue for the satellite TV division was NT$645 million, while the renewable energy division earned NT$4 million in the first three quarters of 2023. With a notable decrease in manufacturing inventory, the company’s transition towards the energy sector is expected.

3. PESI (6152)

With a focus on manufacturing and selling digital set-top boxes and low-noise block downconverters (LNBs), PESI primarily exports its products to Europe and the United States. In recent years, it has actively ventured into the field of AI artificial intelligence, developing products such as the iPhO AI phone secretary and AI-Care. To cope with the fiercely competitive digital set-top box market, it has adopted a strategy of developing customized and niche products for customers, such as DVB STBs and IP/OTT STBs with locking systems (CAS & DRM).

PESI has also strengthened its core technologies in AI voice and image recognition, expanding into new areas such as smart networking and smart homes. As of the first three quarters of 2023, its revenue amounted to NT$1.66 billion, representing a 41% decrease compared to the previous year.

Microwave energy transmission is widely used in modern human communication methods. Key products in this field include satellite receivers, RF components (antennas, filters, switches, etc.), ground stations, and base stations. Major players in this area in Taiwan include: MTI, Auden-Techno, WhaYu, UMT & Radiation Tech., Grand-Tek, Transcom, and WNC, totaling 8 companies, with a combined revenue of NT$89.41 billion.

1. WNC (6285)

WNC is the largest networking manufacturer in Taiwan, offering a wide range of products such as network communication, automotive modules, satellite broadcasting devices, and smart home solutions. In recent years, benefiting from the US infrastructure bill and the widespread adoption of 5G, along with the thriving development of automotive electronics in the global electric vehicle industry, its profitability has continuously increased. In the first three quarters of 2023, its revenue reached NT$81.1 billion, with a YoY growth of 23%, accounting for 70–75% of the entire satellite microwave communication industry. Looking ahead, WNC continues to expand its product applications and invest in new technologies, such as Wi-Fi 7, 5G O-RAN, and low-earth orbit satellites, to seize opportunities in upgraded network speeds, open network architectures, clean network trends, IoT, and AI applications.

2. MTI (2314)

MTI, a member of the Hon Hai (Foxconn) group, specializes in mobile communication base station equipment, low-noise block downconverters (LNBs), and satellite communication equipment. Its sales model adopts both ODM and OEM formats. In recent years, with the rise of 5G O-RAN, MTI, as a member of the alliance, leverages its past experience in manufacturing products for NOKIA. Moreover, its products are standardized by the Telecom Infra Project (TIP), positioning it well for future development in the white-label market. Its revenue for the first three quarters of 2023 was NT$2.91 billion, down 11% YoY.

3. UMT (3491) & Radiation Tech. (6514)

Radiation Tech. is a subsidiary of UMT, focusing on designing, manufacturing, processing, and selling RF antenna components, primarily for IoT applications. Meanwhile, UMT specializes in high-frequency passive communication components and antenna products used in wireless backhaul networks, satellite communication, broadband wireless transmission, and mobile communication base stations. In recent years, in response to the low-earth orbit satellite trend, it has concentrated on R&D projects related to low-earth orbit satellite communication components and expanded its business in the satellite sector. Combined revenue for the first three quarters of 2023 was NT$1.53 billion, down 39% YoY.

4. Auden-Techno (3138)

Auden-Techno specializes in manufacturing RF antennas and acting as a distributor for measurement equipment. Its subsidiary, Auray Tech, handles certification testing services. In recent years, the company has gradually shifted its production capacity to Vietnam after securing antenna module orders from a prominent US laptop brand. Moreover, in response to the growing trend of low-earth orbit satellite communications, Auden-Techno has focused on developing related ground receiving equipment. As of November 2023, these products have reached the verification stage, with expectations for official mass production and shipment in 2024. The company achieved a 3% YoY revenue increase, reaching NT$1.27 billion in the first three quarters of 2023.

5. Transcom (5222)

Transcom specializes in military power amplifiers (PA) and related microwave subsystems, primarily supplying them to Taiwan’s National Chung-Shan Institute of Science and Technology (NCSIST) for national defense purposes. With increasing defense awareness in recent years and support from the “Strong Bow Project,” Transcom has seen a boost in orders, resulting in a 23% YoY revenue increase to NT$880 million in the first three quarters of 2023.

Recently, amidst the ongoing conflict between Israel and Palestine, Transcom successfully developed high-frequency, high-power, high-efficiency gallium nitride (GaN) solid-state power amplifier products for Israeli customers. Additionally, they introduced military-grade unmanned aerial vehicle communication system transceiver products.

Inflationary pressures have dampened demand for consumer electronics, indirectly affecting the market for network communication equipment. Dell’Oro predicts a 7% decrease in global communication market expenditures in 2025 compared to 2022, reflecting poor revenue and global layoffs announced by major brands like Nokia and Ericsson. Taiwan’s satellite microwave industry, focused on manufacturing intermediate components like antennas and microwave millimeter-wave equipment, faces weakened demand for its end products, signaling a tough road ahead.

However, not all news for the satellite microwave industry is bleak. Globally, infrastructure bills continue to be enacted. For example, in 2021, the United States announced a $650 billion infrastructure bill spanning over five years, including broadband infrastructure. Countries in Central and South America are also implementing large-scale construction policies and upgrading measures to enhance their communication services. India introduced a six-year infrastructure bill in 2019, planning to invest $2 trillion, including network communication infrastructure for internet access. Moreover, recent clean network policies in Europe and the United States restrict the use of equipment from Chinese manufacturers like Huawei and ZTE, providing ample order opportunities for Taiwanese satellite microwave communication equipment manufacturers positioned in the intermediate market.

Looking ahead to 2024, the global economy remains stagnant, mirroring the conditions of the latter half of 2023. International communication equipment giants like ARRIS International and NOKIA are focused on cost reduction strategies to improve profitability amidst weak consumer demand. This could pose challenges for Taiwanese OEM and ODM manufacturers aiming for significant growth. However, the latter part of 2024 is expected to see improvement due to a lower base year and ongoing global infrastructure projects. Collaborations such as AT&T and Ericsson, Nokia and Deutsche Telekom’s Open RAN initiative are poised to inject vitality into the communication industry, particularly in the North American 5G wireless network market.

Nonetheless, as Taiwan’s manufacturers primarily serve as professional design and manufacturing outsourcing roles, they must contend with price competition from Japanese and Korean manufacturers. It remains to be seen whether they can seize opportunities in this landscape. Readers are encouraged to continue monitoring the situation.

Read More:

About us

⭐️ TEJ Website

⭐️ LinkedIn

✉️ E-mail: tej@tej.com.tw

☎️ Phone: +886–2–87681088