The introduction of Taiwan’s domestic ESG database – TESG.

Table of Contents

Article Difficulty:★☆☆☆☆

Reading Recommendation: This article is divided into two parts, with the first part introducing the proportion of TESG ratings in popular domestic ESG ETF constituents within TEJ, and the second part will further utilize TESG ratings to construct an investment portfolio with growth potential and sustainable operations.

For example, Fubon Corporate Governance ETF (00692), one of the first ESG ETFs in Taiwan, focuses on the top 100 companies in corporate governance in Taiwan. Similarly, Cathay Sustainable High Dividend ETF (00878) combines high dividend yield with ESG criteria. These ETFs aim to track ESG indices introduced by domestic and international index providers.

Although each fund management company may specialize in different areas within the ESG domain, the common thread is the inclusion of ESG screening criteria. This inclusion places greater emphasis on the sustainability of the constituent stocks, allowing investors to invest in assets that prioritize both environmental sustainability and robust growth.

Behind each ESG index, the most critical factor is the mechanism for ESG ratings of individual stocks. The three most well-known international providers in this field are MSCI, FTSE Russell, and S&P.

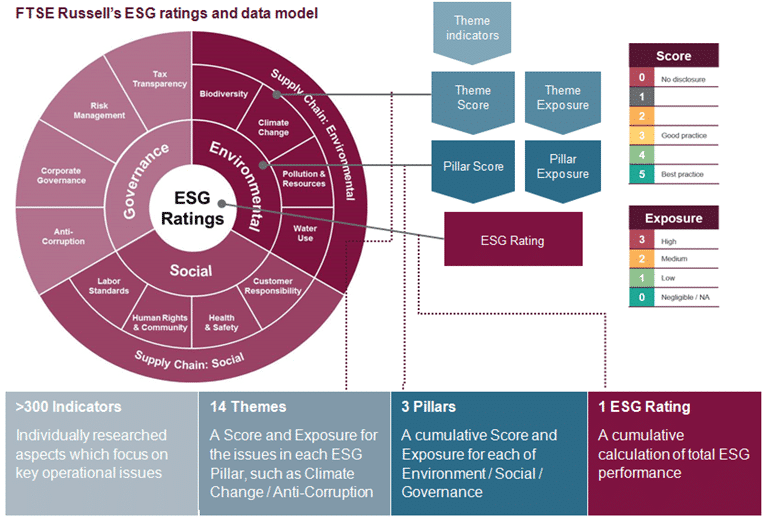

Here’s a brief introduction to FTSE Russell’s ESG rating framework: It is primarily divided into three major categories (Environmental, Social, Corporate Governance) and further split into 14 main themes, comprising a total of 300 indicators. These indicators calculate a company’s exposure level on these themes, ranging from 0 to 3 points (with higher numbers indicating higher exposure). A final score is then calculated using a weighted method.

那台灣有沒有本土的ESG評分機制呢?有,就在TEJ的TESG資料庫中。

Highlight One: Quantitative Analysis as the Primary Approach, International Standards as Supplementary

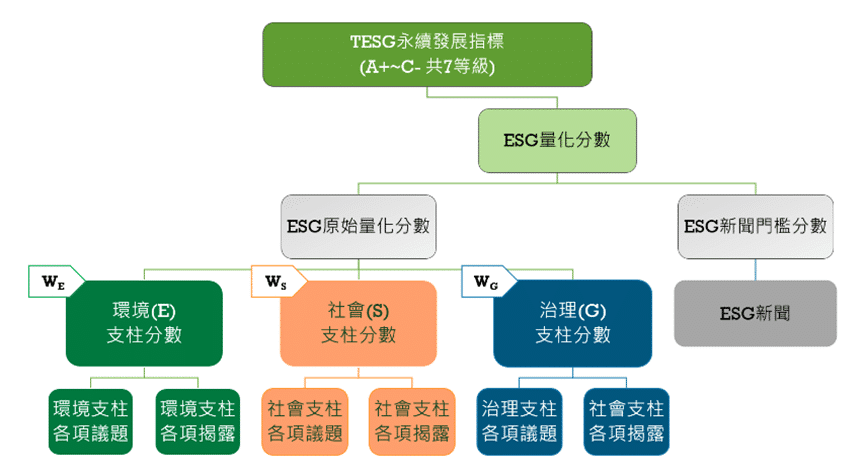

Unlike FTSE Russell’s assessment mechanism relying on research teams, TESG’s Sustainable Development Indicators are entirely quantitative. They leverage TEJ’s extensive database, complemented by GRI standards and Taiwan market data, while maintaining a balance between data volume and accuracy. TESG establishes three main pillars with 16 indicators in total, including quantifiable variables and the level of corporate data disclosure. The more detailed a company’s ESG information disclosure, the more it can be inferred that the company has planned or implemented ESG improvements. If a company’s disclosure has been verified, confirmed, or assured by an accountant or a third party, it will receive a higher rating.

Highlight Two: Inclusiveness of External Information and Diverse Assessment

Considering that most companies are not required to or proactively prepare CSR reports, the scope of inclusion goes beyond CSR reports and annual shareholder meeting reports. It also includes external information such as ISO certifications, Good Manufacturing Practice (GMP) certifications, participation in international initiatives, and employee welfare information from the Ministry of Labor. Even if a company has not prepared a CSR report, it can generate quantitative ESG ratings through the inclusion of other information.

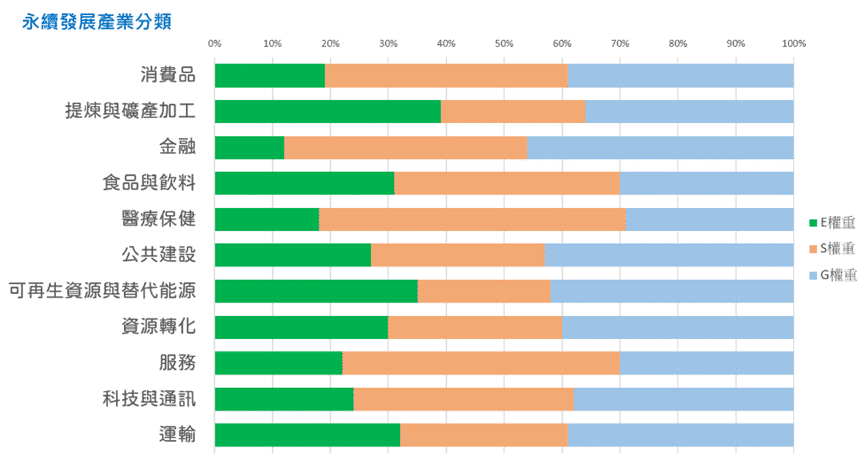

Highlight Three: Assigning Different ESG Weights Based on Sustainable Development Industry Classification

Different from common stock exchange industry classifications, TESG uses its exclusive Sustainable Development Industry Classification mechanism, categorizing Taiwanese companies into 11 major standard industry classifications for sustainable development. Different industries receive different ESG weights. For example, Taiwan Cement, as a company in the mining and mineral processing industry, has a higher environmental weight due to its higher carbon emissions and resource usage compared to typical companies. This higher weight reflects the industry’s characteristics, contrasting with lower weights assigned to industries such as finance, like Cathay Financial Holdings.

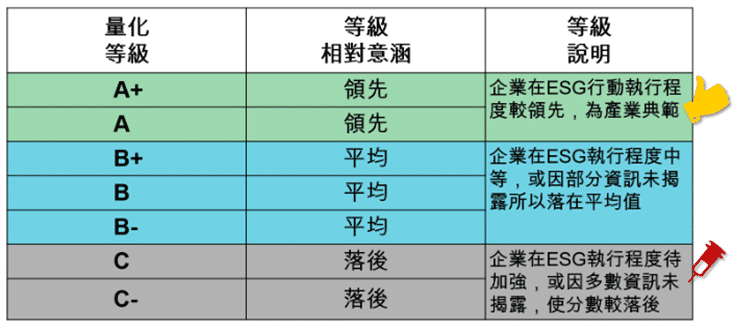

TESG Sustainable Development Indicators Rating

TESG’s development indicators are divided into seven levels and categorized into three groups: Leading, Average, and Lagging. Companies can understand their relative position in terms of ratings compared to other companies. They can delve into rankings within the same industry for each of the E/S/G pillars, identify which pillar has a lower score, and facilitate detailed score comparisons within the same industry. Cross-industry comparisons can be made using the quantitative rating levels.

Next, let’s take a look at the proportion of TESG ratings in several popular domestic ESG ETF constituents. This will allow us to observe whether TESG’s fully quantitative model produces similar results to the commonly used research team models from abroad.

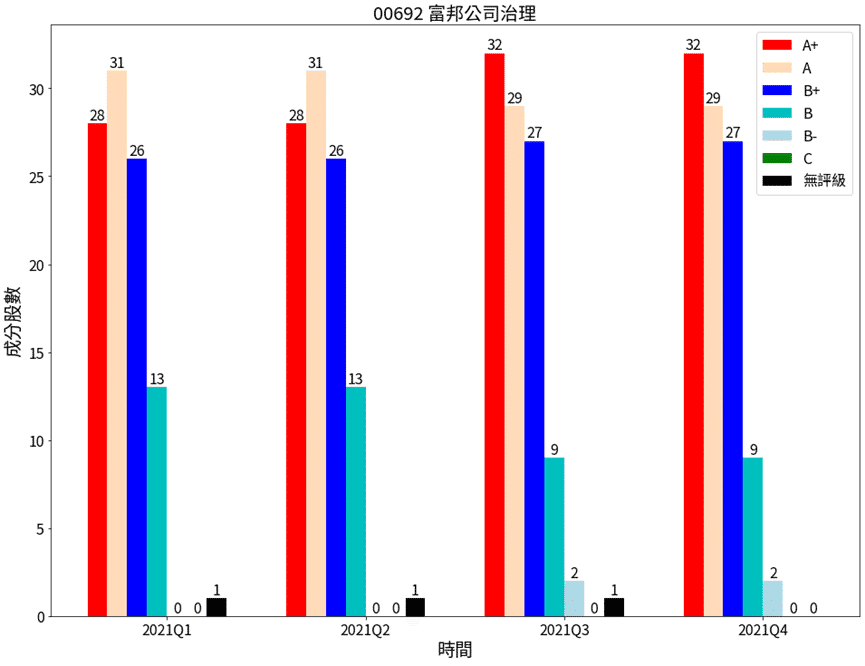

Fubon Corporate Governance ETF (00692)

This ETF tracks the “Taiwan Stock Exchange Corporate Governance 100 Index” and uses a market capitalization-weighted approach. It prioritizes companies in the top 20% of corporate governance evaluation results, focusing on the corporate governance aspect of ESG. It then includes financial screening criteria (such as one-year after-tax net profit and revenue growth rate).

From the chart, it is evident that the TESG ratings for 2021 highly overlap with the constituents selected based on the top 20% corporate governance evaluation. In other words, the quantitative TESG model’s ratings align closely with the results derived from expert assessments of governance indicators.

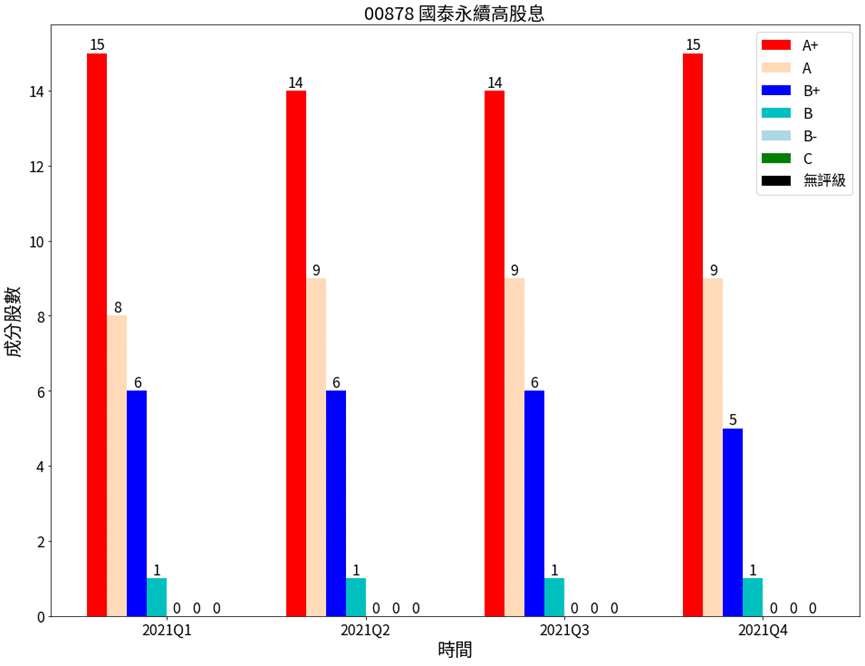

Cathay Sustainable High Dividend ETF (00878)

This ETF tracks the “MSCI Taiwan ESG Sustainable High Dividend 30 Index.” It prioritizes the screening of stocks with MSCI ESG ratings of BB or higher and MSCI ESG controversy scores of 3 or higher. Weight allocation is based on adjusted dividend yield. It combines the characteristics of sustainable development and high dividend yield.

From the chart, it can be seen that the stocks rated B or higher by TESG exhibit a high degree of similarity to those rated BB or higher by the MSCI rating mechanism.

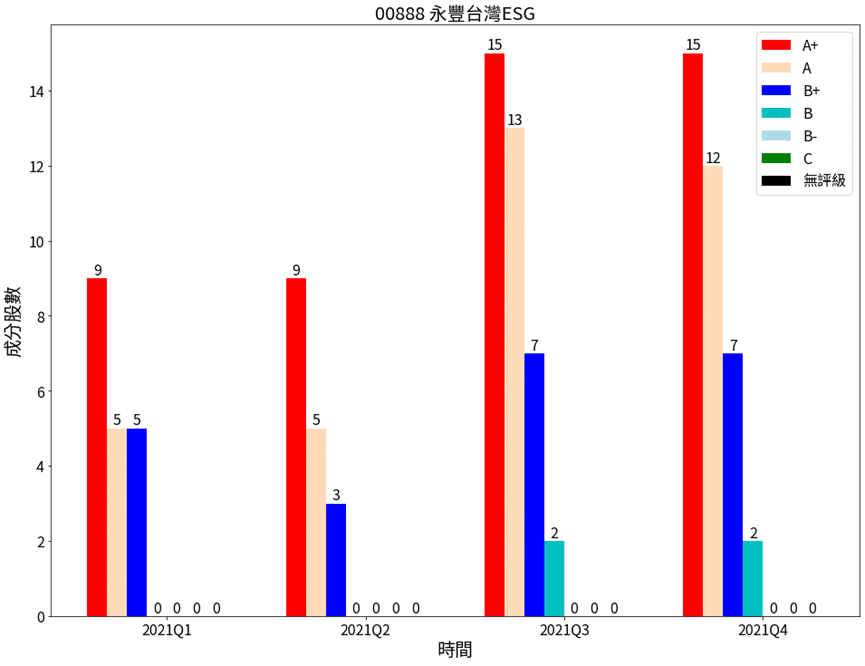

Yuanta Taiwan ESG ETF (00888)

This ETF tracks the “FTSE Taiwan ESG High Quality Index” and uses FTSE ESG ratings and the trailing 12-month dividend yield as screening criteria. It is similar to 00878 in pursuing stocks with high ESG ratings and good dividend yields. However, the difference lies in 00888’s additional 20% weighting for stocks with high ESG scores. Therefore, 00888 places relatively greater emphasis on ESG performance compared to 00878.

It can be observed that as of last September, due to the semi-annual component stock adjustments, the number of component stocks increased significantly from 17 stocks to 37 stocks. This year, it has even increased to 56 stocks. The additional stocks typically have ratings of A+ and A in TESG, indicating a strong alignment between high ESG-rated stocks assessed by FTSE ESG evaluations and the results calculated by TESG.

This article provides a brief introduction to several popular ESG ETFs in Taiwan, including the established 00692, as well as the recent popular 00878 and 00888 high-dividend ESG ETFs. It also explains in detail the ESG rating mechanism used by TESG, a local ESG rating model in Taiwan. It highlights the differences between TESG and well-known international index providers in terms of stock selection. From the three charts presented above, it’s evident that TESG’s fully quantified model yields results highly similar to MSCI and FTSE Russell, providing domestic readers with a precise, traditional Chinese-language ESG database.

In the next part, we will use Python to practically apply the TESG database, combining it with some simple financial indicators to construct a customized investment portfolio.

Lastly, it’s important to reiterate that the assets mentioned in this article are for illustrative purposes only and do not constitute recommendations or advice regarding any financial products. If readers are interested in topics such as strategy development, performance testing, empirical research, etc., they are welcome to explore the solutions available in theTEJ E Shop, which provide comprehensive databases and tools for various analyses and assessments.