Struggling to cut through the noise of endless investment advice? With so many strategies competing for your attention, it’s easy to feel overwhelmed or fall into guesswork. You might end up chasing returns, doubting your decisions, or wondering why your portfolio isn’t delivering. Here’s where factor-based investing comes in, as a proven, systematic approach grounded in real data.

This guide will walk you through everything you need to know, from its definition to the key factors and strategies commonly used. Whether you’re new to the concept or refining your approach, this article offers a clear and practical overview.

Table of Contents

So, what is factor-based investing? Factor investing is a quantitative strategy involving the selection of securities based on measurable characteristics (factors) that are historically linked to higher returns.

Unlike traditional stock picking, this approach uses data and research to guide investment choices, helping investors target specific sources of risk and reward across a portfolio.

The concept of factor investing traces back to the development of the Capital Asset Pricing Model (CAPM) in the 1960s. The CAPM, introduced by economists like William Sharpe and John Lintner, aimed to explain a security’s expected return based on its sensitivity to overall market risk, known as beta. According to the CAPM, market beta was the sole driver of returns, while any deviation was considered company-specific or “alpha.”

However, real-world data soon revealed that certain stock characteristics, such as company size or valuation, could consistently explain these differences in returns. This led to the rise of models like Stephen Ross’s Arbitrage Pricing Theory (APT) in 1976, which proposed that multiple economic factors influence asset prices, though it didn’t define which ones.

Later in 1992, Eugene Fama and Kenneth French advanced the field with their Three-Factor Model, which better accounted for historical returns, laying the groundwork for modern factor investing. Over time, additional factors were identified, giving rise to today’s data-driven factor investment strategies.

Factor investing is often described as a middle ground between passive and active investing.

Passive strategies aim to replicate market performance by tracking broad indexes with minimal trading. On the other hand, active investing involves frequent stock selection and timing decisions to outperform the market.

Like passive investing, factor investing is typically rules-based, transparent, and cost-efficient, using predefined criteria to construct portfolios. It also shares traits with active investing by selectively targeting factors to seek excess returns and manage risk more strategically. This approach offers a systematic way to pursue alpha while maintaining the efficiency of a passive structure.

Different factors respond uniquely to changing market conditions, so combining them helps improve diversification to reduce reliance on a single return source, even within equity portfolios.

By targeting characteristics linked to strong historical performance, factor investing can also help manage downside risk and increase the chance of consistent returns. Ultimately, factor-based strategies offer a structured, data-informed way to strengthen portfolio performance across various market cycles.

You can also dive deeper into this through TEJ’s factors research guides here:

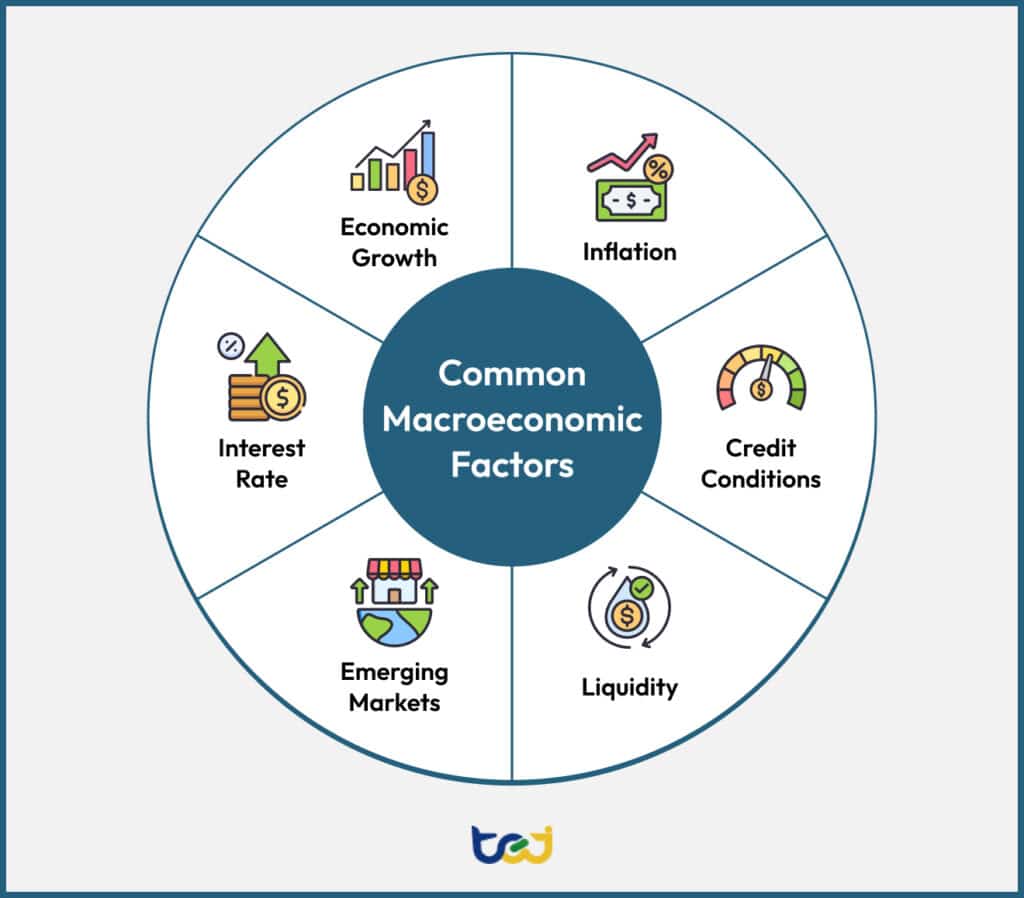

There are 2 main categories of investment factors, including macroeconomic factors and style factors. Let’s look at these categories and their examples below.

Macroeconomic factors represent broad, systemic risks and opportunities that influence returns across entire asset classes, not just individual securities. They are tied to the overall health and direction of the global economy. Examples include:

Economic growth reflects the overall health of the economy. Strong growth generally boosts corporate earnings and stock prices, while a slowdown can lead to reduced profits and market declines.

Inflation measures the rate at which prices for goods and services rise. Higher inflation erodes purchasing power and can pressure corporate margins, impacting equity and bond markets. Low and stable inflation tends to support market growth.

Interest rate changes influence borrowing costs for companies and consumers. Higher rates can slow growth and pressure stock prices, while lower rates typically boost market activity.

Credit conditions gauge the availability and cost of borrowing in the market. Tight credit can increase default risks and reduce corporate expansion, while easier credit can support growth.

Exposure to emerging markets introduces higher growth potential but comes with political, currency, and sovereign risks, which can cause volatility in portfolios.

Liquidity measures how easily assets can be bought or sold without affecting prices. Low liquidity can magnify volatility and make it harder for investors to exit positions during market stress. In contrast, highly liquid markets allow for more stable portfolio management.

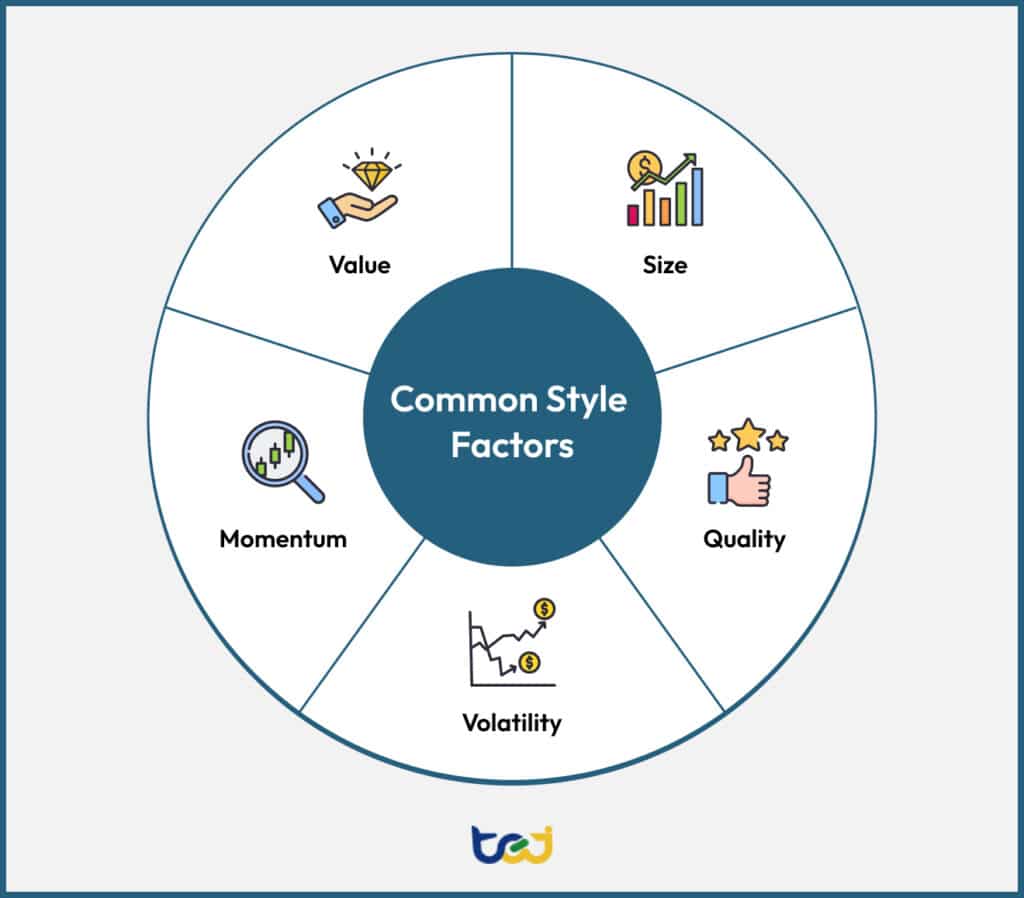

Style factors explain the sources of risk and return within asset classes by focusing on measurable company-level characteristics. They allow investors to systematically tilt their portfolios towards companies exhibiting these traits. Examples include:

Value factors focus on buying securities that appear undervalued relative to their fundamentals, using metrics like price-to-earnings (P/E) or price-to-book (P/B) ratios. Historically, undervalued companies have delivered stronger long-term returns as their market price gradually reaches their true value.

The size factor reflects a company’s market capitalization. Small-cap stocks (those from companies with relatively smaller market capitalization) often outperform large-cap stocks over time because they may have higher growth potential.

Under the idea that trends can persist in the short term, momentum is measured over three- to twelve-month periods, helping investors target stocks with strong recent performance and vice versa.

Quality factors identify financially sound companies with strong balance sheets, stable earnings, and high returns on equity or assets. These companies often perform well in volatile markets.

Volatility factors focus on price stability. Low-volatility stocks, which experience fewer price swings, have historically provided better risk-adjusted returns than their high-volatility counterparts.

Nevertheless, identifying effective factors can be challenging due to inconsistent definitions, data limitations, and the “factor zoo” phenomenon, where many proposed factors lack true predictive power. Hence, disciplined methodologies and reliable databases, such as TEJ’s factor library, become essential to avoid bias and errors in investment decisions. It covers nine factor categories, including dividend yield, value, and growth, enabling efficient factor investing.

Investors can implement factor investing in several ways depending on their risk tolerance, time horizon, and portfolio objectives. The three most common approaches are single-factor, factor-timing, and multifactor strategies, so let’s delve deeper into them:

A single-factor strategy involves constructing a portfolio that focuses on exposure to just one specific factor at a time, such as value, momentum, or low volatility.

With this approach, investors can capture the long-term risk premium associated with that particular factor. It is also relatively straightforward to understand and implement, often incurring lower transaction costs than more complex strategies.

Still, the performance of single-factor investments can be highly cyclical, with potential underperformance lasting years. This makes them better suited for investors with patience and strong conviction over a long-term horizon.

Factor timing attempts to rotate among factors based on expected market conditions, seeking to capture each factor’s outperformance at the right time, while letting go of those that are expected to lag.

While a well-executed timing strategy could theoretically deliver exceptional returns, the approach requires highly accurate predictions and involves significant turnover costs. Missing just a few key periods of factor outperformance can severely hurt results, making this strategy very difficult for most investors.

A multifactor strategy combines exposure to several distinct factors simultaneously within a single portfolio, leveraging the often-low correlations between them.

This diversification helps reduce reliance on any single factor, smoothing returns and mitigating periods of underperformance. In turn, multifactor strategies generally offer a better balance of risk and return compared to single-factor or timing approaches.

However, multifactor strategies can be more complex to construct and manage than single-factor portfolios. This is why investors have to rely on sophisticated analysis and robust data to determine the optimal weighting and rebalancing frequency for multiple factors.

TEJ stands as a trusted financial data provider known for delivering accurate, research-ready solutions to support advanced investment strategies.

Engineered for factor investments, our Factor Library is a fully point-in-time database covering over 100 factors across nine major categories: Momentum, Dividend Yield, Value, Growth, Quality, Liquidity, Volatility, Size, and Sentiment. Built on academic foundations and localized for Taiwan’s market, it helps investors streamline research and improve backtesting reliability for enhanced portfolio construction.

Explore the TEJ’s Factor Library today and discover how it integrates seamlessly with our Quantitative Investment Database for even greater insight and performance.