Photo by Freepik

Table of Contents

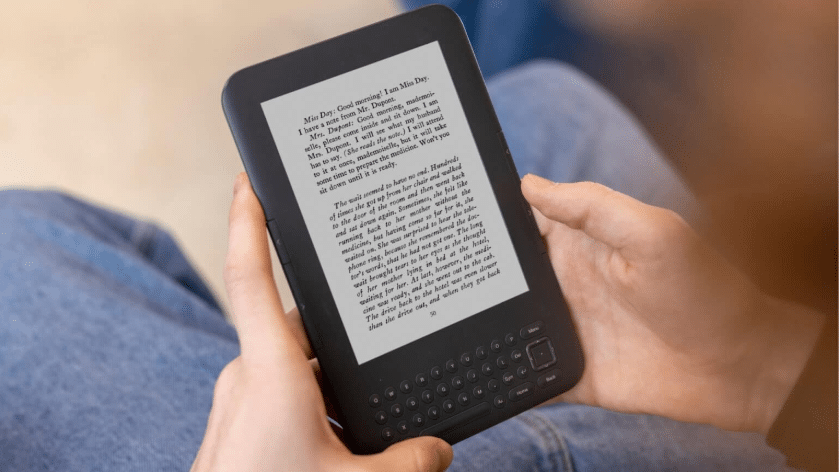

Since the outbreak of the pandemic, global business models have undergone significant transformations. Many companies and schools have adopted remote work and learning to comply with social distancing policies, leading to a surge in sales of electronic devices such as computers and tablets. However, as these devices primarily use LCD or OLED screens, prolonged use can cause eye fatigue, and their weight often increases due to the complexity of their functionalities.

As a result, the lightweight and eye-friendly features of e-paper, coupled with the growing focus on sustainability, have created new opportunities for its development. Beyond e-readers, the demand for electronic labels has seen exponential growth in recent years. This article will provide an in-depth look at the global status of e-paper and explore the development opportunities for Taiwanese manufacturers.

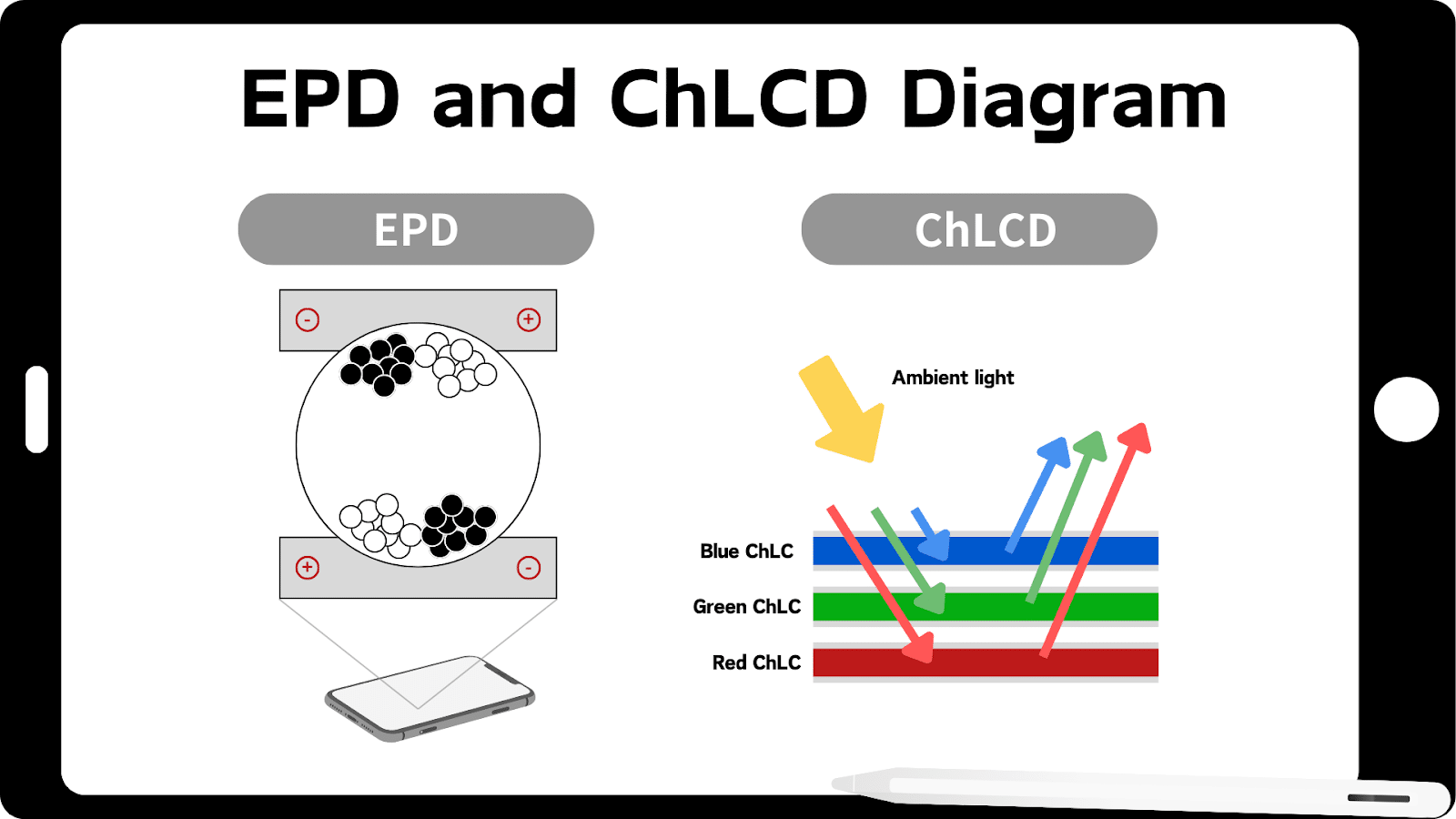

E-paper differs from conventional LCD and OLED (organic light-emitting diode) screens. Unlike these displays, e-paper mimics the appearance of traditional paper, relying on ambient light to illuminate its surface. This unique feature combines the advantages of digital displays and traditional paper, allowing for real-time content updates while providing a paper-like visual experience. Additionally, e-paper is more energy-efficient than tablets and offers eye-friendly and environmentally sustainable benefits. Current e-paper technology can be broadly categorized into two types: Electrophoretic Displays (EPD) and Cholesteric Liquid Crystal Displays (ChLCD) (as illustrated in Figure 1).

Figure 1, The diagram of EPD and ChLCD

Source: E ink Website, Guangzhou OED Website compiled by TEJ

The most critical technology for e-paper is the electronic ink film. According to the IPO prospectus of Qingyue Optoelectronics, as of 2022, only E Ink Corporation and Guangzhou OED Technologies have achieved mass production capabilities globally. E Ink Corporation dominates the market, accounting for over 90% of total production.

When comparing the same PPI (Pixels Per Inch), E Ink is the only company capable of producing color electronic ink films, offering significantly higher resolution than Guangzhou OED. This technological advantage places E Ink far ahead in both production capability and product quality (refer to Table 1).

Table 1, Comparison of E ink and Guangzhou OED

| Company | Film Type | Screen size | Resolution | PPI (Pixels Per Inch) |

Guangzhou OED | B/W | 1.54 | 200*200 | 184 |

| B/W | 2.13 | 122*250 | 131 | |

| B/W | 2.9 | 128*296 | 111 | |

| B/W | 7.5 | 480*800 | 124 | |

| B/W | 1.27 | 128*256 | 225 | |

E Ink | Colors | 2.36 | 168*296 | 144 |

| Colors | 2.9 | 128*296 | 111 | |

| B/W | 2.9 | 200*300 | 124 | |

| B/W | 2.9 | 128*296 | 111 | |

| B/W | 10.3 | 1404*1872 | 227 |

Source: E ink Website, Guangzhou OED Website compiled by TEJ

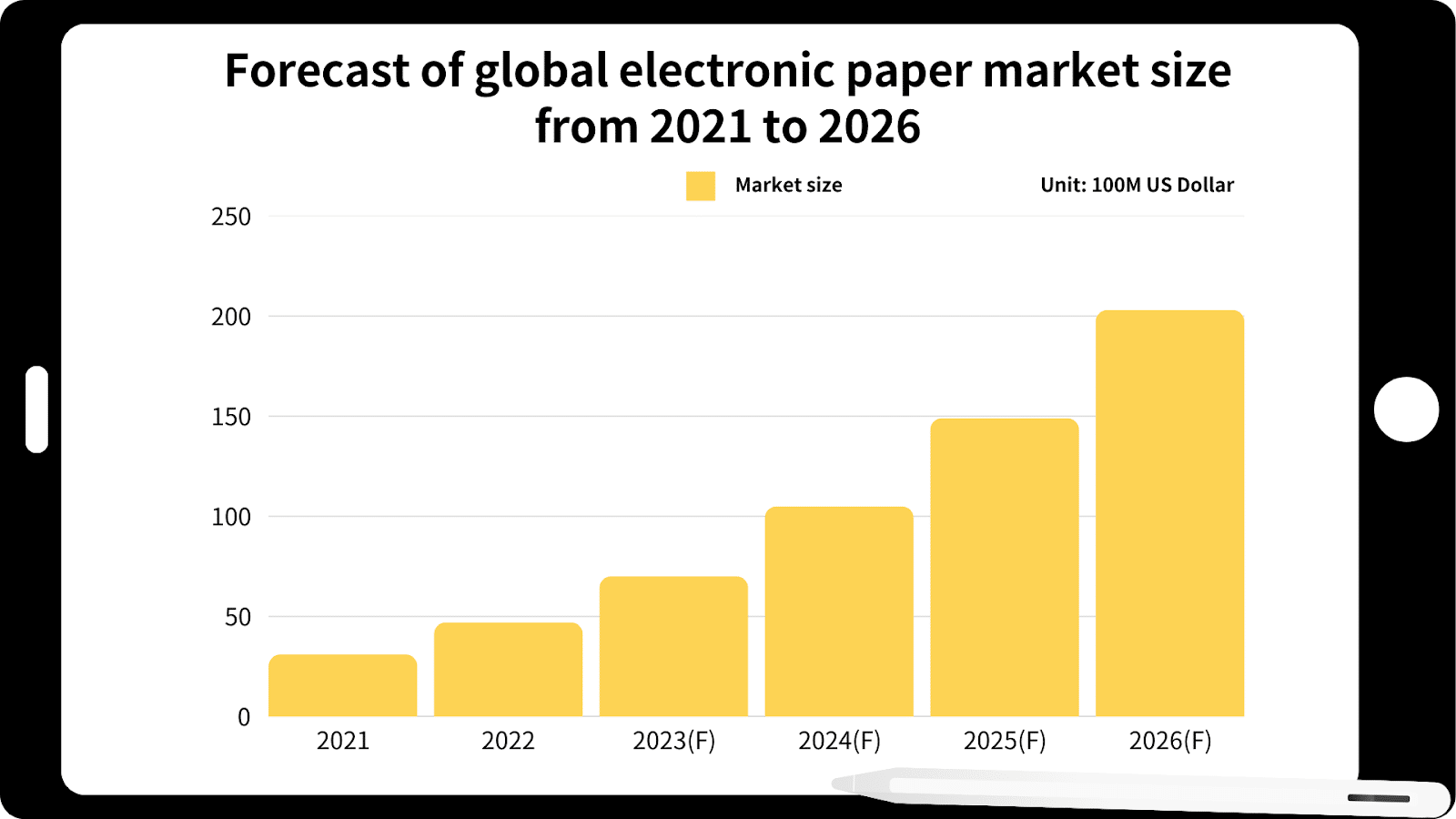

The increased demand for panel-based electronic products driven by remote work and learning during the pandemic, coupled with the rising emphasis on sustainability and ESG initiatives, has led to a significant rise in the need for e-paper devices such as e-readers and Electronic Shelf Labels (ESL). According to a report released by TrendForce in September 2022, the global e-paper market is expected to grow from $3.1 billion USD in 2021 to an estimated $20.3 billion USD in 2026 (see Figure 2).

Notably, SES-imagotag, the world’s largest ESL system integrator, announced in 2023 that it had secured an order from Walmart for 500 stores in the North American market, requiring a production capacity of 60 million ESL units. As of October 2023, Walmart operated 4,623 stores across the United States. If this partnership successfully rolls out ESLs across the initial 500 stores, the penetration rate is projected to reach 25% by 2025 and could potentially increase to 34% by 2027.

With the growing market demand and expanding applications, the development of e-paper technology is becoming increasingly promising.

Figure 2, Predicted size of global e-paper market from 2021 to 2026

Source: TrendForce compiled by TEJ

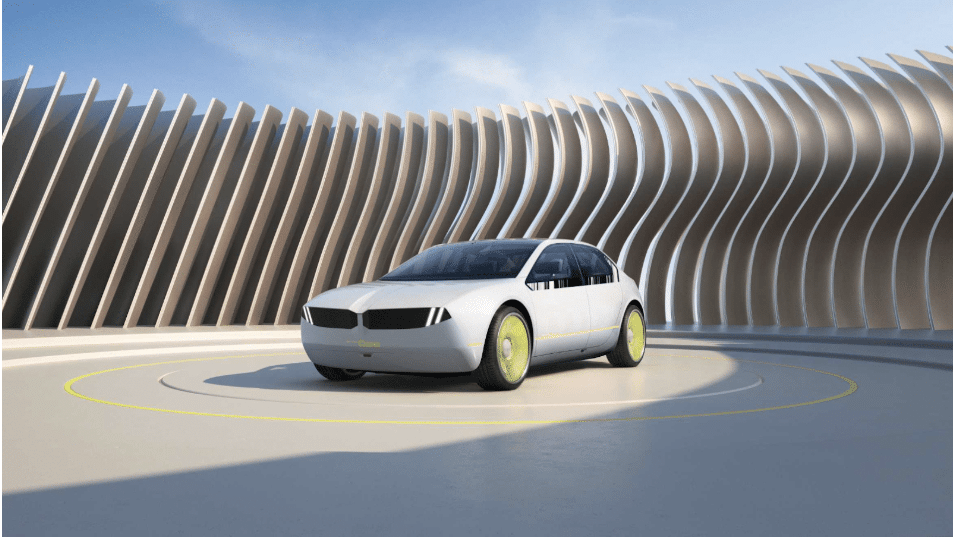

Beyond popular end products like e-readers and electronic labels, the e-ink films manufactured by E Ink Corporation have diverse applications across multiple industries. At the 2023 Touch Taiwan Smart Display Exhibition, E Ink introduced new color e-paper technologies, including E Ink Spectra 6 and E Ink Kaleido 3 Outdoor, and announced plans to develop large-scale color e-paper panels. Additionally, BMW has collaborated with E Ink to integrate E Ink Prism 3 technology, enabling dynamic car body color changes with over 32 options (see Figure 3).

This demonstrates that e-paper development is no longer confined to e-readers and electronic labels but is expanding into broader fields such as home appliances, advertising, and automotive technology. The future roadmap for e-paper is filled with exciting possibilities and innovations, making it a technology to watch.

Figure 3, BMW with E Ink Prism 3 technology

Source: BMW GROUP website

With a global e-paper market share exceeding 90%, E Ink has virtually monopolized the upstream e-paper supply chain, benefiting Taiwan’s driver IC manufacturers. Key players in Taiwan’s e-paper ecosystem include:

As the global leader in e-paper technology, E Ink Corporation has recognized the clear growth trajectory of ESL electronic labels and continues to announce expansion plans. These include the construction of the 7th production line at its Hsinchu plant and plans for an 8th production line to support the trend toward more colorful and larger e-paper applications.

Given the clear ESG trends and the shift in business models brought by the pandemic, the potential for e-paper development is vast. ESL penetration rates currently stand at around 20%, indicating significant room for growth. With over 90% of the global e-ink film production controlled by E Ink, it will be difficult for other manufacturers to catch up in the short term. As a Taiwanese company, E Ink’s continued innovation and market dominance would not only reinforce its global leadership but also bring substantial benefits to Taiwan’s e-paper supply chain, representing a significant advantage for related industries.

Explore the latest insights into Taiwan’s corporate landscape with the TEJ Watchdog Database. Our analysis of major events affecting Taiwan’s tech industry provides a clear and actionable perspective. Through a detailed evaluation of recent corporate news, we quantitatively assess the impact of these events on credit conditions, offering an event intensity rating from -3 to +3.

Stay informed about the dynamic changes in Taiwan’s technology sector, understand the factors influencing corporate credit risks, and make timely adjustments to your investment strategies. Visit the TEJ Watchdog Database today and gain the edge in navigating Taiwan’s evolving business environment.