An Introduction to National Stabilization Fund and its hot stocks’ performances

Table of Contents

Difficulty: ★☆☆☆☆

In 2022, under the unstable background caused by the Ukrainian-Russian War and high inflation, rising prices suppressed consumers’ purchasing power, which made a great influence on companies’ profits. As a result of this, people were concerned about a global recession. The US Federal Reserve raised the interest rate against high inflation, but it led to the withdrawal of funds from bond and stock markets. This was the end of the Quantitative Easing policy published two years ago. The US Nasdaq and Philadelphia Semiconductor Indexes both made a correction of over 30%, Taiwan Weighted Index also fell from 18619pts to 13950pts, equivalent to 25%. After a mass crash of 390pts on July 12th, the Ministry of Finance officially authorized National Stabilization Fund to enter the market for stable market reasons. This was the 8th time of National Stabilization Fund entrance, and also was the first action after the index went above 10000pts.

Competent Authority: Executive Yuan

Purpose of establishment: Article 1 of the Regulations on the Establishment and Management of the National Financial Stability Fund: To maintain the stability of the capital market and other financial markets and ensure national stability in response to major domestic and foreign events.

Funding source:

1. With the shares of public enterprises held by the government as the guarantee, loans from financial institutions with a maximum loan amount of NT$200billion.

2. Borrow the funds available for securities investment but not yet invested in the postal savings fund, postal life insurance accumulation fund, labor insurance fund, labor retirement fund, and civil servants’ retirement pension fund; the maximum amount is NT$300 billion.

Total cap: NT$500 billion

Trader: A committee consists of eleven to thirteen members, one of whom is a chairman, who is concurrently served by the vice president of Executive Yuan. Other members are the chairman of the labor committee of the hospital and the minister of the Ministry of Civil Affairs are concurrently appointed by the competent authority, and are selected by the competent authorities from the scholars and experts recommended by the various parties of the Legislative Yuan.

The volume of the stock market declines drastically leading to many investors can’t sell their shares, the capital of the stock market outflows substantially, the Taiwan stock market fell significantly more than other Asian markets, and the mass crash of the stock market lead to the fear of other financial markets.

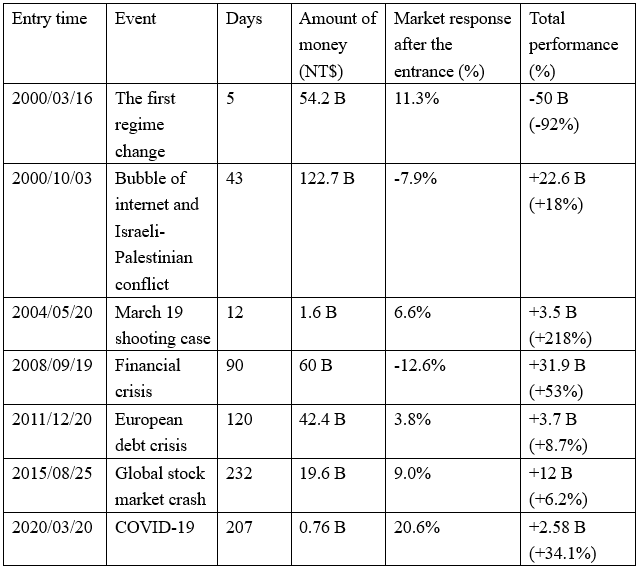

The objective of the National Stabilization Fund is to stabilize stock markets and other financial markets. From the above table, it is obvious that National Stabilization Fund usually can control the descending trend of the index. However, National Stabilization Fund failed in the below two situations: The Bubble of the internet and the Israeli-Palestinian conflict in 2000, and the global financial crisis in 2008. It shows that National Stabilization Fund was powerless when it faced global negative economical factors. Nevertheless, under the overall observation, National Stabilization Fund is an effective measure to stabilize the stock market, especially for uneconomical factors. It can normalize the stock market with a little money. For instance, unstable political circumstances after the March 19 shooting case, and the outbreak of Covid-19.

Observing the shareholding details of National Stabilization Fund for the past four times, we found the following ten stocks are all in the pocket list of National Stabilization Fund. We classify the following ten stocks by industry.

Financial stocks: 2880 Huanan Gold, 2886 Mega Gold

Technology stocks: 2308 Delta ELECTRONICS, 2330 TSMC, 2317 Hon Hai, 2382 Quanta

Production stocks: 1101 Taiwan Cement, 1301 Formosa Plastics, 1303 South Asia, 1326 Taiwan Chemical

Can we earn by investing Hot Pocket List?

It is often mentioned in the news that people can make money by following the National Stabilization Fund Hot List. Is this a real case?

We will discuss the profit of the above ten stocks during the entry period of the Fund in the past four times.

import tejapi

import pandas as pd

import numpy as nptejapi.ApiConfig.api_base="Your Key"

tejapi.ApiConfig.ignoretz = Trueplt.rcParams['font.sans-serif'] = ['Microsoft JhengHei']

plt.rcParams['axes.unicode_minus'] = False

Entry and exit details of major securities companies — stock type (AMTOP1)

Listed company adjusted stock price(daily)-ex-right and dividends adjustment(TWN/APRCD1)

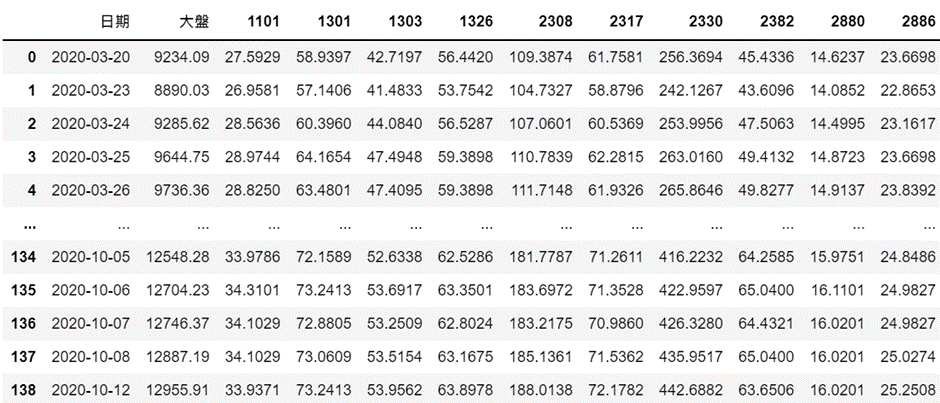

The data period is the period of the 7th National Security FundGet

Taiwan Weighted Return Index

#第七次國安基金進場

mdate = {'gte':'2020-03-20', 'lte':'2020-10-12'}

#八大行庫券商

bank = ["000102 合庫證券","000538 第一金證","000104 臺銀證券","2801 彰銀","2834 臺企銀","5857 土銀","000930 華南永昌證券","000700 兆豐證券"]

Obtain the stock price of National Stabilization Fund Fund’s hot pocket list.

#國安基金熱門標的

coid = ["1101","1301","1303","1326","2308","2317","2330","2382","2880","2886"]for i in range(0,len(coid)):

stock = tejapi.get('TWN/APRCD1',

coid = coid[i],

mdate = mdate,

paginate=True)

df1 = pd.DataFrame({"日期":stock["mdate"],str(coid[i]):stock["close_adj"]})

#以日期做合併

df = pd.merge(df,df1,left_on="日期",right_on="日期",how="outer")

df

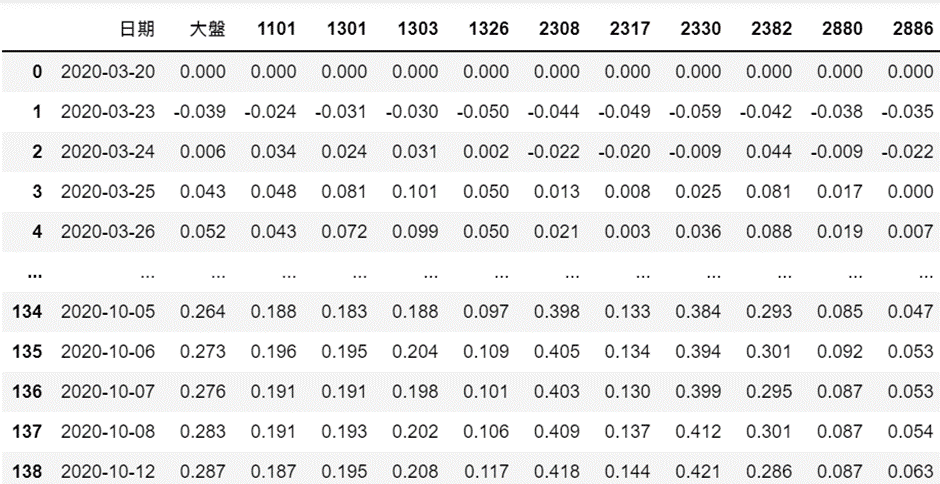

Individual stock performance calculation

Performance formula: (daily stock price — stock price of the Fund on the first day of market entry) / stock price of the Fund on the first day of market entry.

#算個別個股績效

#(每天股價-國安基金進場第一天股價)/國安基金進場第一天股價

df2 = (df.iloc[:, 1:] - df.iloc[0, 1:].values.squeeze()).div(df.iloc[:, 1:])

#四捨五入

df2 = df2.astype(float).round(3)

df_result = pd.DataFrame({"日期":df["日期"]})

df_result = pd.merge(df_result,df2,left_on=None,right_on=None,left_index=True,

right_index=True)

df_result

df = df_result

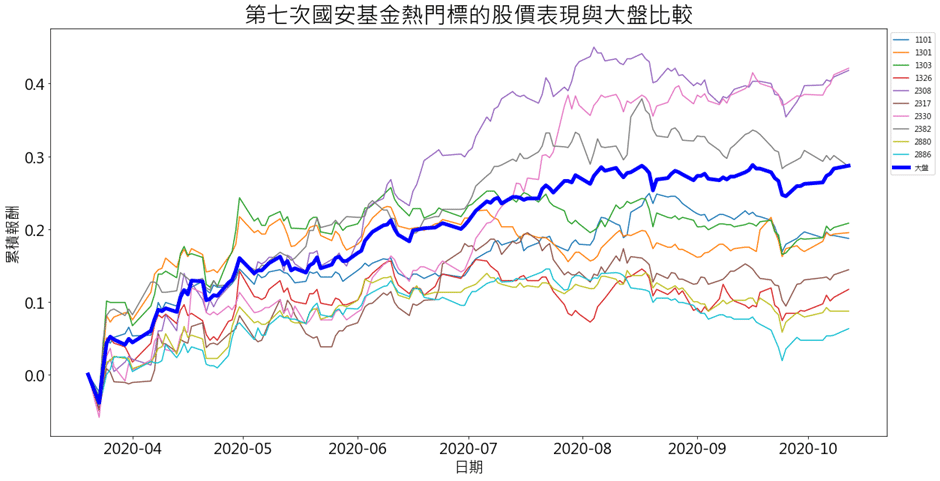

import matplotlib.pyplot as plt

df.set_index(pd.to_datetime(df["日期"], format="%Y-%m-%d"), inplace=True)

del(df["日期"])

plt.rcParams['font.sans-serif'] = ['Microsoft JhengHei']

plt.rcParams['axes.unicode_minus'] = False

#畫圖

fig, ax1 = plt.subplots(figsize=(20, 10))

plt.plot(df.index,df[coid],lw=1.5,label=coid)

plt.plot(df.index,df["大盤"],lw=5,label="大盤",color="blue")

plt.xlabel("日期",fontsize=20)

plt.ylabel("累積報酬",fontsize=20)

plt.xticks(fontsize=20)

plt.yticks(fontsize=20)

plt.title("第七次國安基金熱門標的股價表現與大盤比較",fontsize=30)

plt.legend(bbox_to_anchor=(1, 1.0))

plt.show()

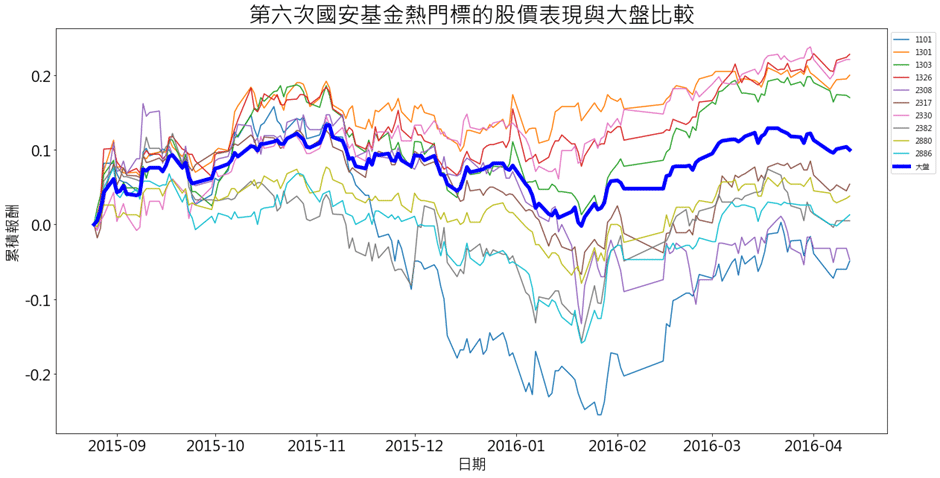

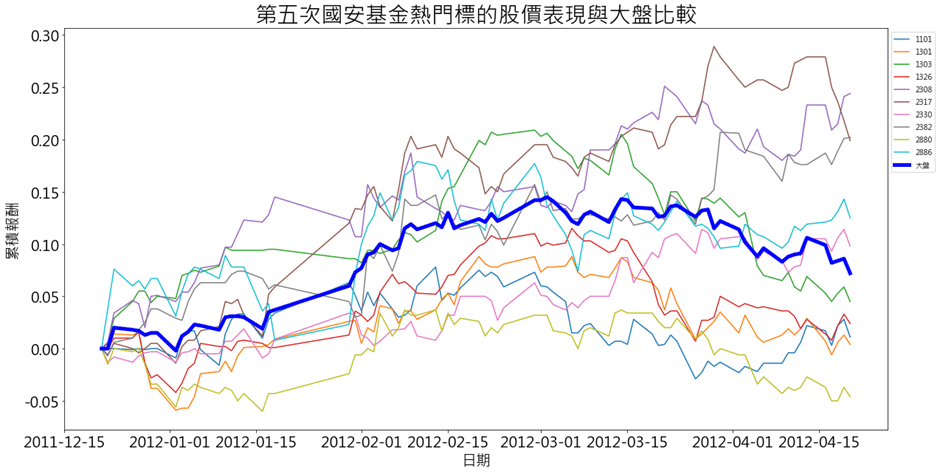

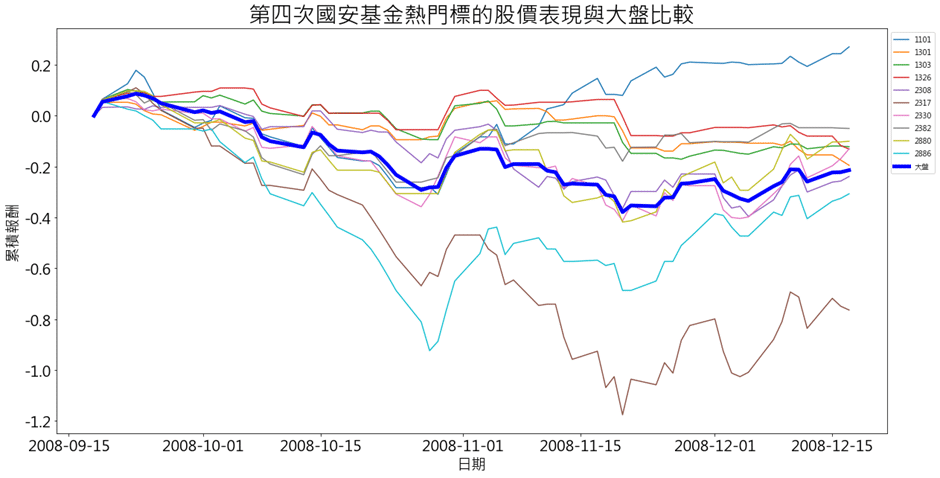

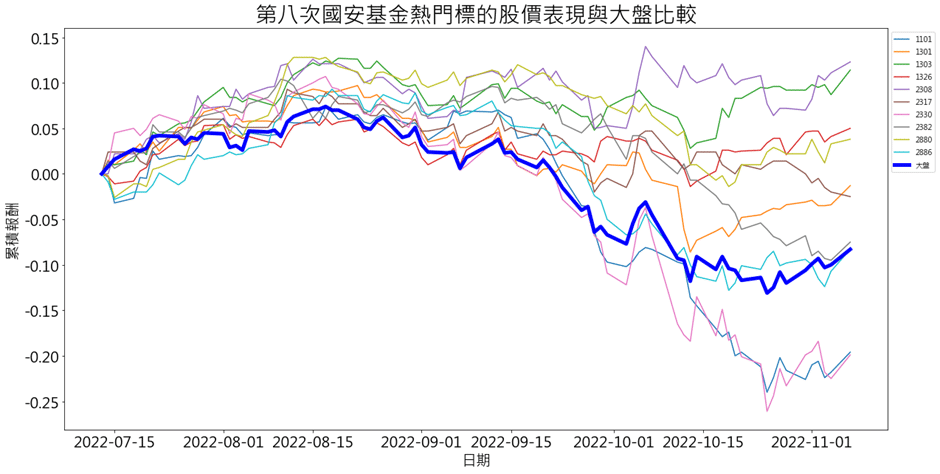

The results of the above four popular stocks entering the market found that the targets in the Fund list may not necessarily outperform the market during the market entry period. Only 2330’s cumulative returns during the four market entry periods all beat the market. Therefore, When Fund enters the market, we don’t need to screen according to the previous targets of the National Stabilization Fund. ETFs that passively track weighted indexes, such as: 0050, will be a more appropriate choice.

Since National Stabilization Fund’s entry and exit and shareholding details are strictly confidential, the public can only see the profit and loss and shareholding during the protection period in the National Stabilization Fund financial report issued by the Ministry of Finance after the Fund announced the end of the period. The only way to track the movement of the Fund during the market protection period is to take the action on the trading daily records of the eight major banks. However, since not only the Fund enters and exits from the eight major banks, but also ordinary large investors and retail investors, this undoubtedly greatly increases the difficulty of tracking.

The data period is the period of the seventh National Security Fund support

Taiwan Weighted Return Index

Obtain oversell data during the fund entry period from the eight major bank warehouses.

#第七次國安基金進場

mdate = {'gte':'2020-03-20', 'lte':'2020-10-12'}

#八大行庫券商

bank = ["000102 合庫證券","000538 第一金證","000104 臺銀證券","2801 彰銀","2834 臺企銀","5857 土銀","000930 華南永昌證券","000700 兆豐證券"]

#國安基金熱門標的

coid = ["1101","1301","1303","1326","2308","2317","2330","2382","2880","2886"]

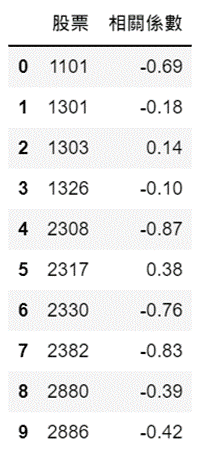

The correlation between the stock price performance of the National Stabilization Fund’s popular stocks and the total net transaction amount of the eight major securities firms.

cor = []

for i in coid:

#-------------------------------------------------------------------

#個股股價

market = tejapi.get('TWN/APRCD1',

coid = i,

mdate = mdate,

paginate=True)

#累積買賣超

df = pd.DataFrame({"日期":market["mdate"],"股價":market["close_d"]})

#-------------------------------------------------------------------

#個股券商買賣超

data = tejapi.get('TWN/AMTOP1',

coid = i,

mdate = mdate,

paginate=True)

#-------------------------------------------------------------------

for i in range(0,len(bank)):

#選出八大券商

broker = bank[i]

data1 = data[data["key3"] == broker]

bs_data = data1[["mdate","bs_m"]]

bs_data = bs_data.rename(columns={"mdate": '日期',"bs_m": str(broker)})

#算出八大券商期間累積買賣超

df = pd.merge(df,bs_data,left_on="日期",right_on="日期",how="outer")

df[str(broker)] = df[str(broker)].fillna(0)

bs_m_list = list(df[str(broker)])

agg = []

n = 0

for j in range(0,len(bs_m_list)):

n = n + bs_m_list[j] #每日淨買賣

agg = agg + [n] # #每日加總

df[str(broker)] = agg

#八大券商買賣總金額

df_total = pd.DataFrame({"股價":market["close_d"],

"八大淨買賣總和":df[bank].sum(axis=1)})

#標準化

from sklearn.preprocessing import StandardScaler

df_total[df_total.columns] = StandardScaler().fit_transform(df_total[df_total.columns])

#相關性

df_total_cor = round(df_total['股價'].corr(df_total["八大淨買賣總和"]),2)

cor = cor + [df_total_cor]

df_cor = pd.DataFrame({"股票":coid,"相關係數":cor})

df_cor

Present individual stock price performance and the accumulated transaction amount of the eight major brokerages in pictures.

#輸入個股代碼

coid = "2308"

#個股股價

market = tejapi.get('TWN/APRCD1',

coid = coid,

mdate = mdate,

paginate=True)

df = pd.DataFrame({"日期":market["mdate"],"股價":market["close_d"]})

#---------------------------------------------------------------------------

#個股券商買賣超

data = tejapi.get('TWN/AMTOP1',

coid = coid,

mdate = mdate,

paginate=True)

for i in range(0,len(bank)):

broker = bank[i]

data1 = data[data["key3"] == broker]

bs_data = data1[["mdate","bs_m"]]

bs_data = bs_data.rename(columns={"mdate": '日期',"bs_m": str(broker)})

#累積買賣超

df = pd.merge(df,bs_data,left_on="日期",right_on="日期",how="outer")

df[str(broker)] = df[str(broker)].fillna(0)

bs_m_list = list(df[str(broker)])

agg = []

n = 0

for j in range(0,len(bs_m_list)):

n = n + bs_m_list[j] #每日淨買賣

agg = agg + [n] # #每日更新

df[str(broker)] = agg

df["八大淨買賣總和"] = df[bank].sum(axis=1)

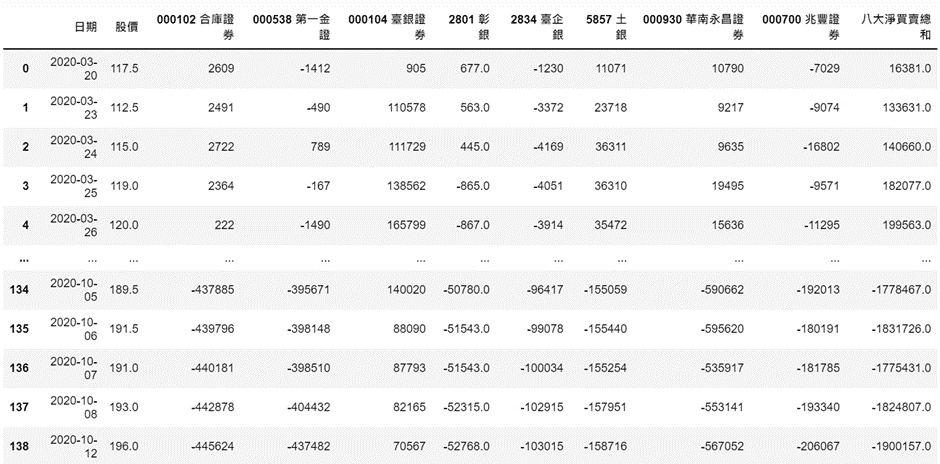

df

df.set_index(pd.to_datetime(df["日期"], format="%Y-%m-%d"), inplace=True)

del(df["日期"])

plt.rcParams['font.sans-serif'] = ['Microsoft JhengHei']

plt.rcParams['axes.unicode_minus'] = False

#畫雙軸圖

fig, ax1 = plt.subplots(figsize=(20, 10))

plt.plot(df.index,df[bank],lw=1.5,label=bank)

plt.plot(df.index,df["八大淨買賣總和"],lw=5,label="八大淨買賣總和")

plt.xlabel("日期",fontsize=20)

plt.ylabel("累積買賣超(元)",fontsize=20)

plt.xticks(fontsize=20)

plt.yticks(fontsize=20)

plt.title(str(coid)+" 國安基金期間八大券商累積買賣超關係圖",fontsize=30)

plt.legend(bbox_to_anchor=(-0.05, 1.0))

ax2 = ax1.twinx()

plt.plot(df.index,df["股價"],lw=5,label=str(coid)+"股價")

plt.ylabel("股價(元)",fontsize=20)

plt.yticks(fontsize=20)

plt.legend(bbox_to_anchor=(1, 1.0))

plt.show()

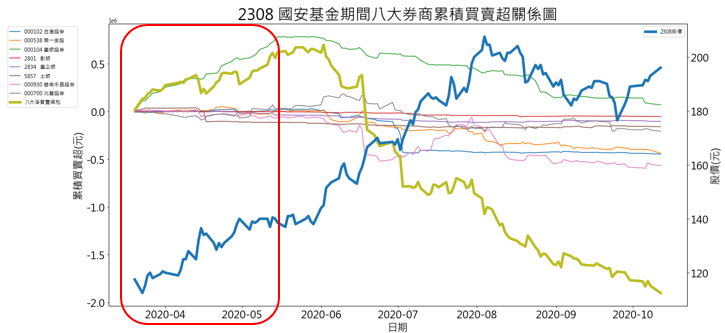

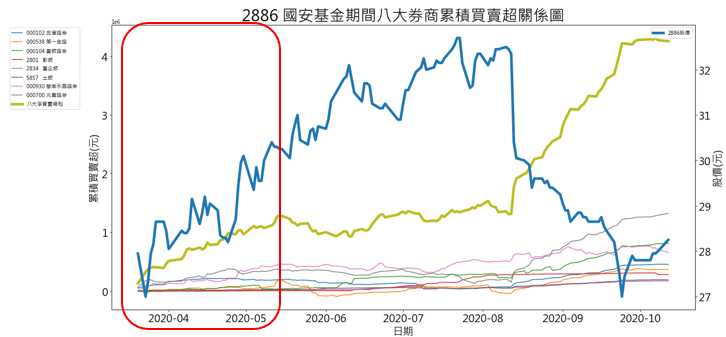

We selected three stocks from the three major industries of finance, technology, and convention for discussion, namely 2886 Mega International Commercial Bank, 2308 Delta Electronics, and 1303 Nan Ya Plastics Corporation. It is obvious that the total amount of transactions has increased during the period of March to May. With the effect of the National Stabilization Fund’s support, the Taiwan stock market has gradually stabilized. In the stage of rising stock prices of technology stocks at 2308 Delta Electronics, the eight major banks showed an oversell situation, and 2886 Mega International Commercial Bank, 1303 Nan Ya Plastics Corporation’s stock price performance was relatively modest during the period of support, and the eight major brokerages continued to overbuy.

It can be clearly seen from the above chart that the stock price is not directly proportional to the trading volume of the eight major banks, and even inversely proportional, but this is also in line with the purpose of the Fund, which aims to achieve market stability.

As a pair of invisible black hands in the Taiwan stock market, the National Stabilization Fund has a significant influence on stabilizing market sentiment and investor confidence. This article puts forward different views on some public opinions on the Fund incident

1. The stock price performance of the National Stabilization Fund’s popular stocks may not beat the broader market. Investing in the market index is a more appropriate choice.

2. The total net transaction amount of the eight major bank treasuries is not directly proportional to the stock price performance, but it can be inferred that the purpose of the National Stabilization Fund is to stabilize the market.

Although the National Stabilization Fund can often stabilize the market in the short term after the press release. However, the stock market had ever fallen continually because of the economic recession in the international environment. Investors should still carefully judge the current market situation and the overall economy. You should not enter the market blindly only by relying on the news of the National Stabilization Fund to enter the market.

Finally, we attach the 8th entry of the National Stabilization Fund, which is currently in progress. We also make a comparison chart of the performance of the above-mentioned popular stocks and the broader market for readers’ reference.

Last but not least, please note that “Stocks this article mentions are just for the discussion, please do not consider it to be any recommendations or suggestions for investment or products.” Hence, if you are interested in issues like Creating Trading Strategy , Performance Backtesting , Evidence-based research , welcome to purchase the plans offered in TEJ E Shop and use the well-complete database to find the potential event.