Table of Contents

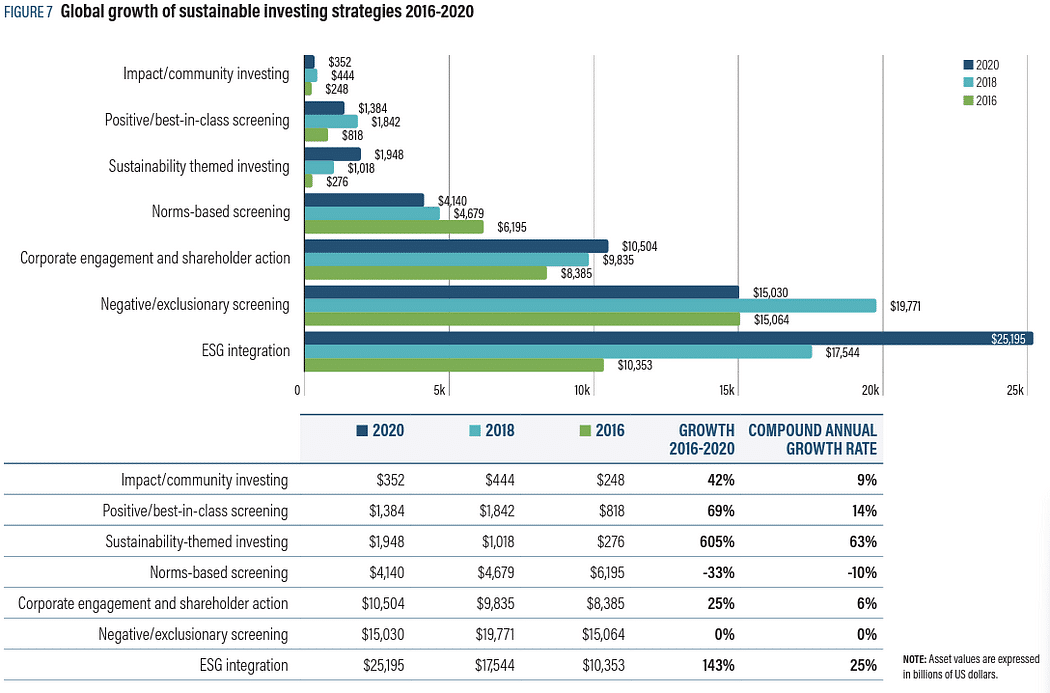

With the rapid global growth of ESG and sustainable development investments, the size of funds related to ESG has multiplied, currently totaling over $30 trillion in capital. As investors in ESG funds, our foremost concern lies in investment strategies and standards. According to the GSIA’s 2020 ESG Investing Report, the widely adopted approach among investment institutions is ESG integration. However, for the general public, the most fundamental strategy remains the most mature negative screening method.

Tracing its origins, the prototype of negative screening emerged in the 18th century. Religious groups first integrated their beliefs into investment decisions, avoiding companies involved in tobacco, alcohol, or gambling — steering clear of these “sin stocks.” Today, despite its decline, negative screening still stands as an unparalleled choice for constructing value-aligned investment portfolios. In this article, we will introduce screening methods in ESG investment strategies and delve into the techniques and performance of negative screening, helping you better understand the essence of ESG investing.

What is ESG Investment Screening? ESG investment screening is one of several methods when constructing portfolios under ESG (Environmental, Social, and Governance) issues. This approach involves including or excluding potential investment projects based on investor preferences, values, or ethical viewpoints. Investors can utilize a range of criteria to screen which companies, industries, or activities meet the criteria for a specific investment portfolio, or conversely, to filter out those that do not. These criteria may be established based on the investor’s preferences, values, and moral perspectives.

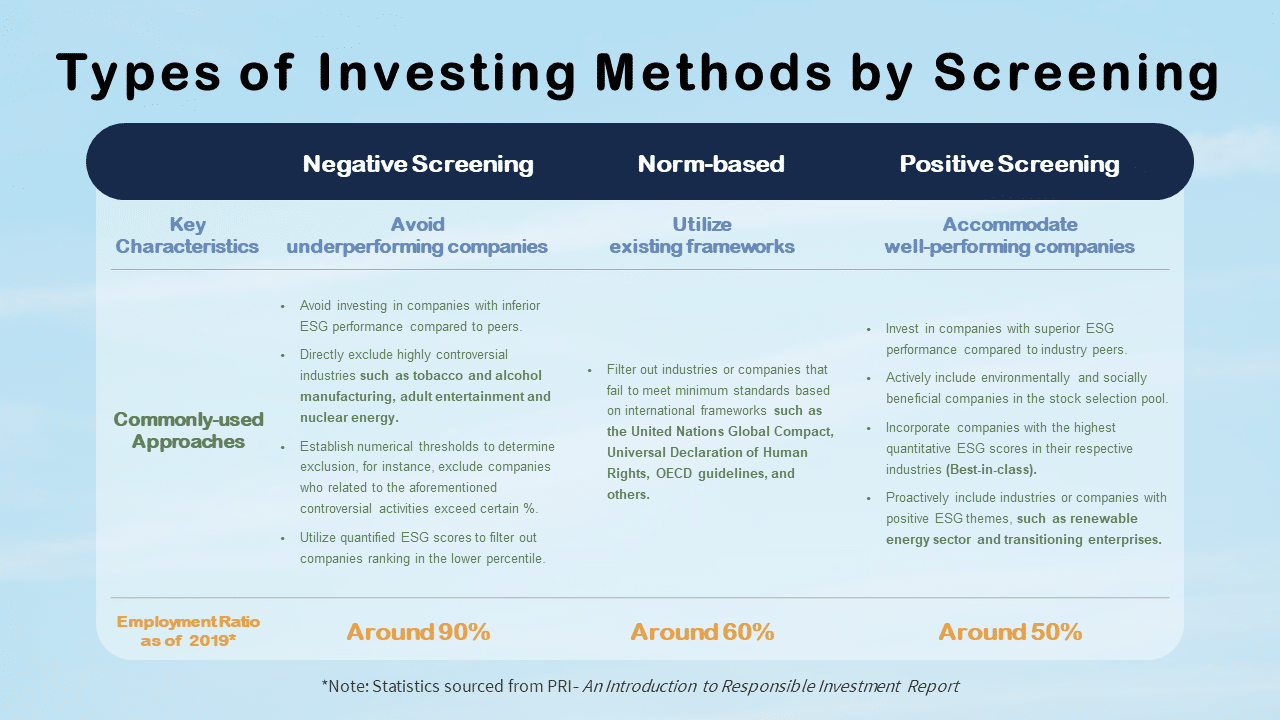

For example, you can exclude the largest greenhouse gas emitting companies through screening (Negative Screening), or select the lowest emitters (Positive Screening). Alternatively, you could employ investment screening based on standards set by organizations such as the OECD or the United Nations (Norm-based), ensuring companies adhere to their standards. A brief overview of various screening methods is depicted in the table below:

In the realm of responsible investment, utilizing screening to address ESG issues has evolved for long. Through screening, investors can better consider the crucial aspects of ESG, and select investment projects that align with their values. This simultaneously reflects a concern for sustainability and social responsibility, fostering a stronger alignment between investment and your sustainable beliefs.

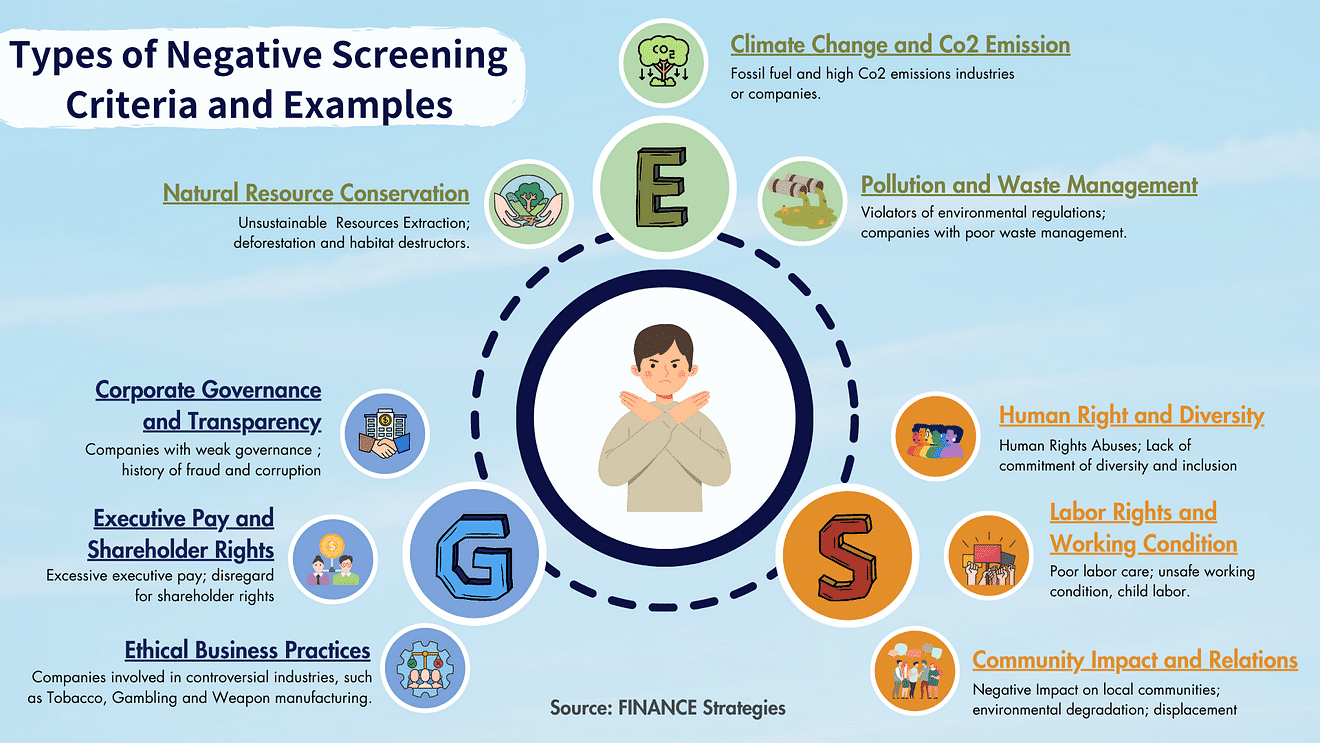

Among these three screening methods, negative screening is favored by many investment institutions due to its direct reflection of individual values. In practice, negative screening does not have an absolute definition. But generally speaking, if a company performs poorly in a particular issue, it is excluded; there is also the practice of filtering out entire industries based on specific issues, such as highly controversial industries (tobacco, alcohol, adult industry, etc.), or industries with high sensitivity to climate change.

As shown in the diagram below, the purpose of negative screening is to refine the selection of stocks for an investment portfolio. Typical factors sought during the screening process include high carbon emissions, poor labor relations, and governance issues, among others. Negative screening can also be used to avoid investing in industries considered highly regulated or with legal risks, such as fossil fuels or tobacco (subject to regional and cultural variations, not absolute). Finally, filtering out companies with lower ESG scores provided by third-party ESG rating agencies is also a feasible approach.

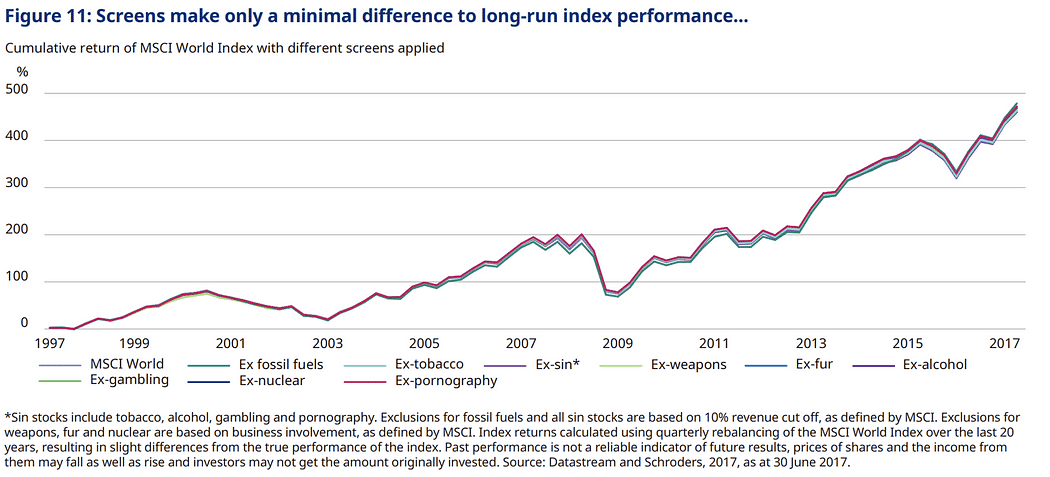

BUT, is negative screening possible to maintain or even enhance the relative returns while upholding responsible investment principles? This issue has significantly influenced the recent development of negative screening strategies. In the past, the main argument against negative screening was that exclusionary screening could potentially have a negative impact on an investment portfolio. For instance, if tobacco companies consistently outperformed the overall market, would investors employing a negative screening strategy underperform compared to those who included tobacco companies in their portfolios?

“If you limit the range of companies you can invest in, your investment performance will also be limited!”

In fact, a report from Swiss Credit’s highlighted that from 1900 to 2014, tobacco companies had an average annual performance that exceeded the overall markets in the United States and the United Kingdom by over 3%. Consequently, since the early 21st century, the California Public Employees’ Retirement System (CalPERS) and the Norwegian Government Pension Fund missed out on investment profits of approximately $1.94 billion and $3 billion from tobacco stocks, respectively. The argument was further supported by a report from the CFA Institute, which indicated that industries commonly regarded as controversial, such as alcohol, gambling, and tobacco, often exhibited better performance during bear markets, resulting in excess returns compared to the market. Additionally, these excluded companies might possess advantages in risk mitigation.

Both studies underlined that within the investment realm, constraining options often leads to constrained performance. Just like many actively managed funds trying hard to outperform the market, but they always cannot win the market in the long run. Similarly, in the ESG investing, these scenarios are not uncommon. However, does this imply that negative screening and performance cannot coexist? Not necessarily. We can explore this from the following two perspectives:

The objective of ESG investing encompasses not only seeking positive sustainability impacts but also generating economic returns. However, this goal can vary among different investors based on individual values, making it crucial to strike a balance between personal values and returns in ESG investing.

Among the methods, negative screening is a commonly employed approach that involves establishing specific exclusion criteria to align the investment portfolio with an investor’s values. This approach also encourages both investors and companies to place greater emphasis on sustainability issues, motivating companies with initially weaker ESG performance to improve and gain recognition within the capital markets. Although quantifying the impact of this approach might be challenging, its positive significance still cannot be overlooked.

Ultimately, on the journey to becoming ESG investors, negative screening serves as the initial step in realizing ESG objectives. It assists in constructing portfolios that mirror our values, subsequently influencing the ESG practices of companies. However, this is just the beginning. We should ponder a more fundamental question: “Do we aim to reduce support for harmful behaviors or collaborate with companies to promote positive ESG practices?” Amid the ever-expanding trend of ESG investing, our task is to take that first stride towards change. Only then will the aspiration of sustainable development draw closer, and our endeavors will assume a pivotal role in shaping companies’ future ESG practices.

Read More

Want to know more?

Interested in efficiently screening out investment targets that don’t align with ESG sustainability? Feel free to leave a comment, call, or mail us, accelerating your responsible investment process!

About us

⭐️ TEJ Website

⭐️ LinkedIn

✉️ E-mail: finasia@tej.com.tw

☎️ Phone: 02–87681088