Table of Contents

Odd lot trading refers to the practice of buying and selling smaller quantities of stock that do not constitute a standard trading unit (commonly 1,000 shares in Taiwan). This mechanism lowers the financial barrier to entry, enabling investors with limited capital to participate in the stock market by purchasing shares incrementally. It provides a pathway for individuals to gradually build their portfolios while offering greater flexibility in diversifying investment risks. Moreover, odd lot trading allows small amounts of capital to be actively invested, enhancing the potential for returns compared to traditional savings. At the same time, it bolsters market liquidity, catering to the broader need for capital flow within the financial system.

Same as regular stock trading, investors can execute transactions using order placement platforms provided by major brokerage firms in Taiwan.

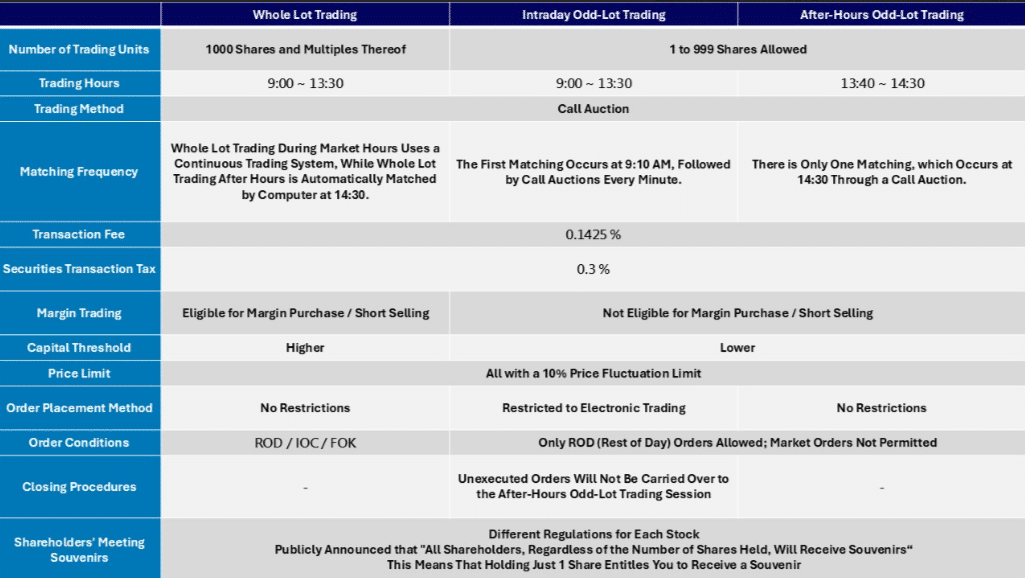

Based on the timing of transactions, odd-lot trading is divided into intraday and after-hours trading:

In terms of order of execution, whether during intraday or after-hours trading, “price priority” is the key rule. However, when prices are the same, intraday trading is determined by time—whoever’s order is placed first wins. In contrast, after-hours trading is different; the order of transactions is randomly chosen by a computer, giving everyone a fair chance without having to race against the clock.

Transaction fees are a critical but often overlooked aspect of odd-lot stock trading that can subtly reduce profits if not carefully considered. In Taiwan’s stock market, the fee structure for odd-lot trading is largely similar to that of standard lot trading. Investors are required to pay a 0.1425% transaction fee and a 0.3% securities transaction tax. However, due to the smaller transaction amounts typically involved in odd-lot trades, most brokerage firms impose a minimum transaction fee of NT$20 per trade.

Here is an easy formula to remember:

For transactions below NT$14,036 (since 20 ÷ 0.1425% = 14,035.09), the minimum fee of NT$20 applies. For investors who frequently trade smaller amounts, such as NT$5,000 or NT$10,000, it may be worthwhile to consider brokerages offering lower fees tailored for regular small-scale investments.

Figure 1. Comparison Chart of Odd-Lot Trading

In the early days, odd lot trading was restricted to after market hours. However, on October 26, 2020, the securities market introduced odd-lot trading during market hours, marking a significant event that revitalized the investment landscape. This change not only lowered the investment threshold but also made the market more active and flexible. It reduced the time required for trade matching, facilitated more immediate market information disclosure, and enabled investors to seize opportunities with greater speed and precision. TEJ summarized the impact of this changes in three key points:

Curious about the information Block Trade uses for their portfolios?

Click below to discover the secrets from TEJ!

On top of offering more liquidity to stock markets, the data of odd-lot trades may give investors helpful information on the retail investors’ feelings about a specific stock. According to the odd-lot theory, a historical method of technical analysis, small investors (odd-lot traders) are the least informed participants in the market, and their actions are interpreted as contrarian investment indicators. However, research has shown that its effectiveness was already questionable in the 1960s and 1970s, and by the 1990s, it was gradually abandoned as mutual funds became popular.

In contrast, Taiwan’s stock market, established in 1961, is relatively young compared to markets in Europe, the United States, and Japan. Taiwan’s odd-lot trading system has also gradually relaxed since 2005, evolving from allowing after-hours trading to introducing intraday trading in 2020 and further shortening the matching interval in 2022 to improve market efficiency and liquidity.

Although the odd-lot theory has lost relevance in Western markets, it still holds research value in Taiwan. Some studies have found that the growth in odd-lot trading volume is increasingly correlated with the TAIEX index, suggesting that the activity in Taiwan’s odd-lot market demonstrates its growing influence.

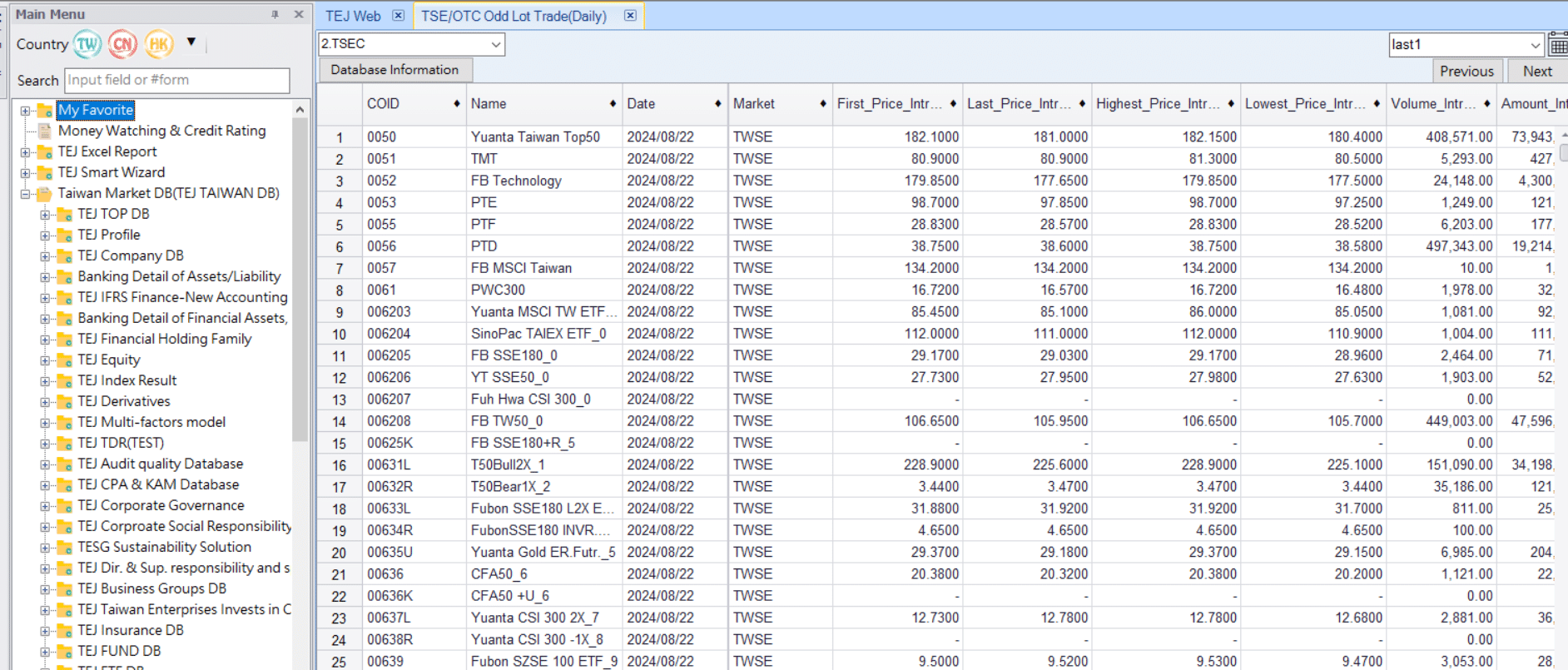

Whether you’re interested in investing in odd-lot stocks or seeking detailed information to refine your investment strategy, TEJ provides a professional database to support your needs.. TEJ’s odd-lot trading data offers the stock prices and volumes of individual stocks during both market hours and after-market trading, updated daily to ensure your strategy research receives the most current information.

Figure 2. TEJ PRO Odd Lot Trading Database

Odd lot trading offers excellent convenience and flexibility, especially for investors with limited funds who want to participate in stock markets. This new trading method has introduced more investment options, such as fixed and variable amounts, allowing investors to purchase a set number of shares with smaller amounts of capital. Following the improvement of liquidity, the data of odd-lot trades may reflect extra information on the retail investors’ feelings, making it possible to be considered an element of strategy-making.

In addition to odd lot trading data, TEJ also offers high-quality market data for strategy backtesting to optimize your investment approaches. This includes stock price data adjusted for dividends, chip analysis with daily institutional buy-sell data, as well as margin trading information, all of which provide a comprehensive view of market conditions at specific points in time, enabling accurate backtesting of investment strategies.

TEJ’s extensive data sets are designed to enhance your analysis and strategy development. Beyond basic stock prices, they include various financial metrics, company risk attributes, and even broker trading information. By partnering with TEJ, you gain access to valuable insights that empower data-driven investment decisions. Leverage our market data solutions today to elevate your financial strategies.

Subscribe to newsletter