Table of Contents

In the previous article, it was mentioned that Easy Visible (600093) was changed from traditional trading to supply chain gold business by the actual controller Tian Hui Leng in 2014, and the actual controllers changed three times in the past seven years. They faced with the situation of late submission of financial reports, substantial loss of assets and hollowing out of assets. During the investigation by the competent authority, this article first used public information to speculate on the company’s fraudulent practices and the role of the three actual controllers.

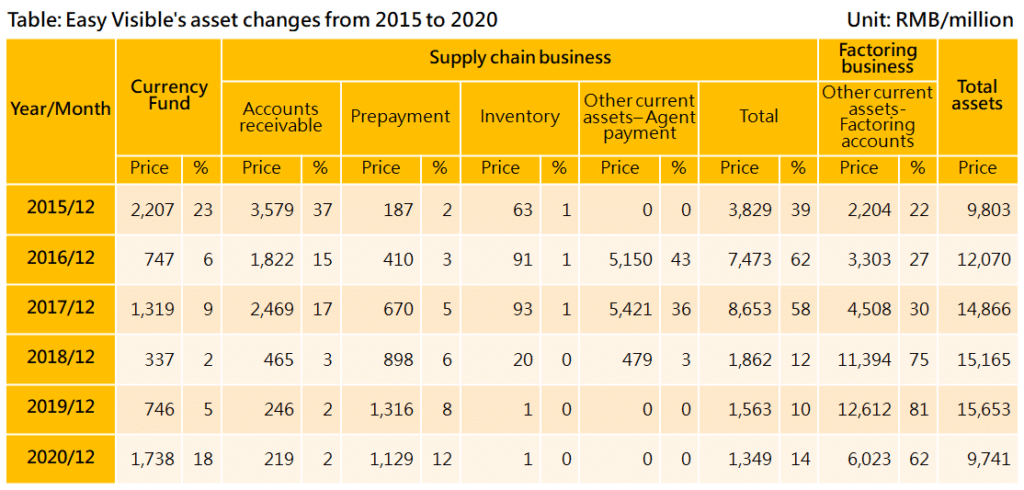

we introduced the company background, supply chain and factoring business operation model of Easy Visible. After analysis, we found that (refer to Table 1):

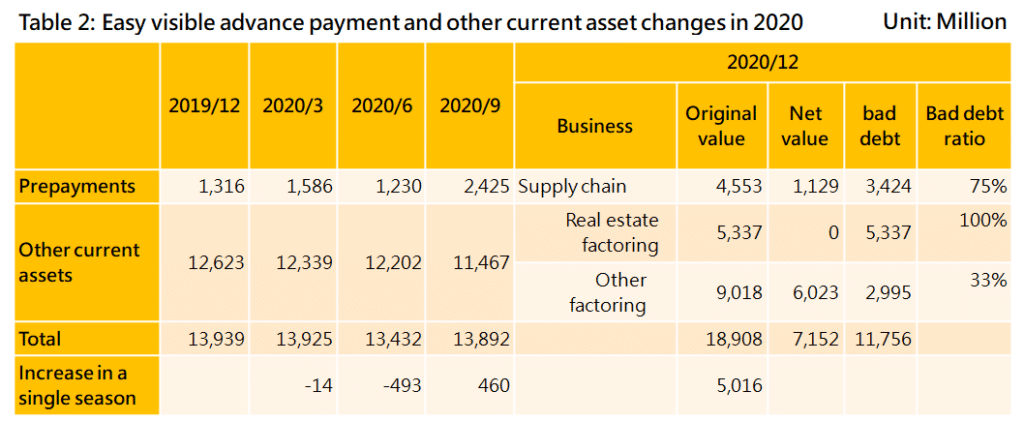

As shown in Table 2, these two largest assets remain at about 14 billion before 2020Q3, but they increase by 5 billion in the single quarter of 2020Q4 to 18.9 billion. In the end, they suffer a loss of 11.76 billion due to default problems. These include 75% of prepayments (3.42 billion) paid to supply chain suppliers, all real estate factoring accounts (5.34 billion) and 33% of other factoring accounts (3.0 billion).

In 2018, the Shanghai Stock Exchange began to pay attention to Easy Visible. At the beginning of the year, Easy Visible kept up with the blockchain boom, and the stock price limit up for five consecutive days. On January 18, 2018, the exchange asked the company to explain the reason for the abnormal change of stock price. On May 10, 2018, the Shanghai Stock Exchange sent another letter asking about the 2017 annual report. After two interrogations, the company’s stock price fell sharply in that year. The major shareholder Jiutian Holding Group entrusted 19% of the voting rights to Yunnan Agricultural Technology Company on October 7, 2018. Therefore, Jiutian Holding Group’s voting rights were reduced from 38.11% to 19.11%. This allowed Central Yunnan Industrial Development Group, the second largest shareholder, to become the controlling shareholder with the highest voting ratio of 29.4%. The actual controller becomes the Yunnan Management Committee. In hindsight, this may be a deliberate arrangement, speculating that its purpose is to retain the management rights in the hands of the major shareholder Central Yunnan Industrial Development Group, which has a good relationship with the company. Since its establishment, Central Yunnan Industrial Development Group began to have mutual transactions with Easy Visible. The purpose of these transactions is likely to “beautify” the financial status of Central Yunnan Industrial Development Group.

Central Yunnan Industrial Development Group helped Easy Visible achieve performance before becoming the controlling shareholder of Easy Visible in 2018. However, Central Yunnan Industrial Development Group has its own financial pressure and cannot continue to support Easy Visible in this way. Especially the situation of Easy Visible in 2019 was getting worse. On February 14, 2020, Easy Visible announced that the major shareholder Jiutian Holding Group and the controlling shareholder Central Yunnan Industrial Development Group intend to sell shares to Yunnan Industrial Investment Group. Yunnan Industrial Investment Group became the controlling shareholder and the actual controller due to the acquisition of 26% of the company’s shares. The actual controller will be switched to Yunnan SASAC.

Even if Yunnan SASAC becomes the largest shareholder, they still have not mitigated the market’s doubts about Easy Visible since 2019. Under the constant doubts from all parties, Easy Visible re-elect the board of directors and supervisors on August, 25, 2020, and Yunnan SASAC still officially take over the company.

What is the purpose of Yunnan SASAC’s takeover? In recent years, the development of science and technology in Yunnan Province has been slow. The main reason why Yunnan SASAC takes over the equity is that they want to rely on Easy Visible’s blockchain technology.

But is it true? Is it possible for Yunnan SASAC to take over a crisis without knowing it? Or is it going to rectify after knowing the situation? The follow-up development of this issue needs continuous attention.

Two of the three actual controllers of Easy Visible have more obvious intentions: Tian Hui Leng, a coal trader in Yunnan, bought a listed company at a low price in order to make a speculation on stocks, and changed ordinary trading into a popular supply chain finance business. In order to perform ostensibly well in its financial reports, Central Yunnan Industrial Development Group helped Easy Visible and assisted in financing. The real intention of Yunnan SASAC, which finally took over, remains to be seen.

It is common for Chinese listed companies to change their actual controllers. Usually, the new actual controller will reorganize assets to bring in new business. However, Easy Visible still maintains its original supply chain finance business. We doubt whether the new actual controller understands the company’s business. Also, after actual controllers were changed twice in 2018 and 2020 respectively, the senior executives of important subsidiaries are still Tian Hui Leng’s old team. Whether the new actual controller can control these subsidiaries is also a question. In addition, Tian Hui Leng’s brother resigned as the legal representative of Yunnan supply chain and Yunnan factoring in 2020Q1, which may reveal the message that Tian Hui Leng is going to leave in 2020.

For more complete research about credit risk of Chinese enterprises, please refer to TEJ CCRQM .