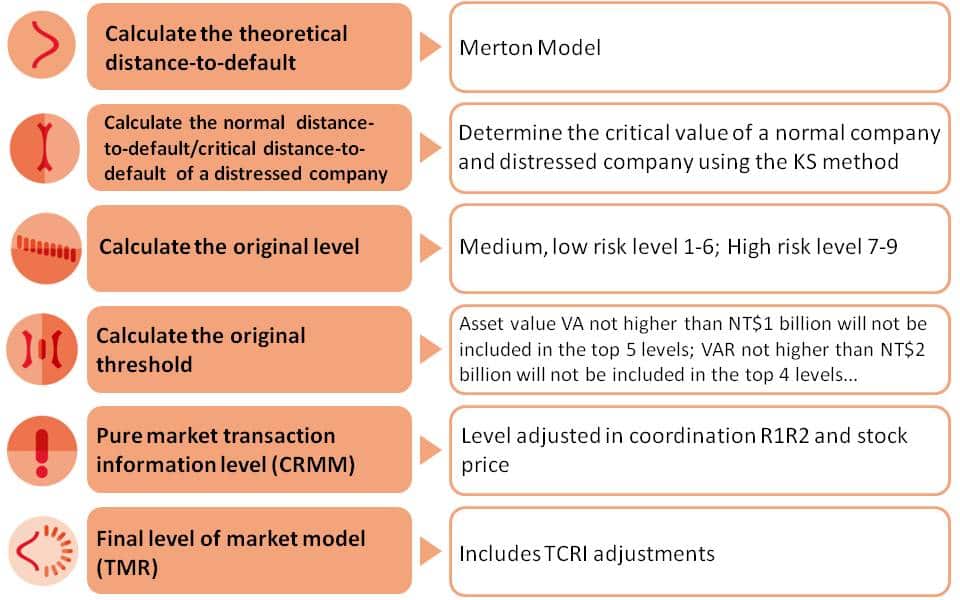

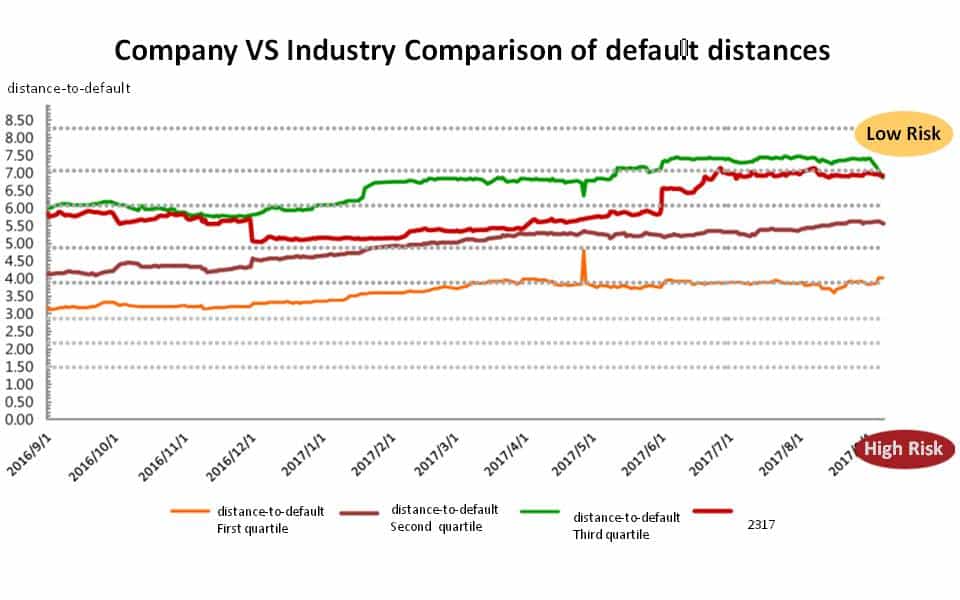

Adopting the concept of Real Options of Merton Model (1974) → Uses daily stock prices to predict a company’s credit risk. After the calibration by TEJ for Taiwan’s market, the predictive ability of CRMM significantly improves and is suitable for Taiwan’s booming stock market and underdeveloped bond market. It is combined with TEJ’s financial database and is tailored for daily risk monitoring.

Table of Contents

The shorter the final level of the TMR model, the stronger the ability to correctly identify high-risk companies. In addition, using the CRMM model, regardless of the level of indicators in the short, medium, and long-term, the predictive discriminatory ability is much higher than that of the well-known foreign structural model by about 13%.

Monitoring CRMM information on affiliated enterprises of a group and the latest changes in credit risk of each group.

| Major Alerts | CRMM Information (DD, TCRITM, TMR, Rating Adjustments), Market Trading Information, Significant Transaction Alerts, Risk Levels |

| Stock Price Alerts | Capital Flow Information, Unusual Activity Alerts | |

| Financial Alerts | Growth, Safety, Operational Efficiency Information, and Severe Deterioration Alerts | |

| Board of Directors and Supervisors Alerts | Changes and Deterioration in Directors’ and Supervisors’ Shareholding and Pledging |