Table of Contents

In 2021, China’s three listed companies of SSE and SZCE did not send out 2020 financial reports at the end of April. Steyr Motors GmbH (000760) and Northcom Group (002359) were already in financial crisis and they were delisted on July 23rd. These two companies did not focus on the capital market. It is not surprising that they do not submit financial reports. However, Easy Visible (600093), the first blockchain-related stock, was unable to deliver financial reports, which shocked the entire market.

Easy Visible’s shares stop trading since May 6, 2021. The exchange requires that the financial report be sent before July 6th, otherwise they will issue a *ST delisting risk warning. Although the company rushed to deliver its financial report on July 6th, the assets were reduced by nearly 12 billion, a substantial loss of 11.5 billion. The net value also turns from positive to negative, and past profits figure are questioned.

In 2014, Tian Hui Leng, the actual controller at the time, took Easy Visible to develop the supply chain finance business. Until 2020, the actual controller has been changed twice within seven years. Such frequent changes are rare among listed companies.

Before we start to figure out the company’s controller change, late submission of financial reports, suspected hollowing out and other issues. let’s first understand the company’s background and business model:

Easy Visible is engaged in the supply chain business of bulk commodities including coal, coke, steel, aluminum, copper, tin, etc. They provide information, capital, logistics and other services for enterprises in the supply chain. In 2016, Easy Visible and IBM jointly developed the “Easy Visible Block Application System”. They used blockchain technology to improve operational efficiency, reducing supply chain management and factoring business risks while reducing management and other operating costs. The company’s supply chain management business is mainly concentrated in holding subsidiary Yunnan supply chain, and wholly-owned subsidiary Guizhou supply chain.

There are three main business models of Easy Visible’s supply chain management, namely, pre-settlement model, pre-receipt model and agent payment model. The scenarios of the three business models are as follows:

Downstream customers usually settle by cash on delivery, and the settlement cycle is usually 3-6 months. The operating situation of steel and coal production enterprises fluctuates greatly. The long settlement cycle puts a lot of pressure on the funds of steel and coal suppliers. Easy Visible’s pre-settlement business provides financial support for the supply and demand of bulk commodities.

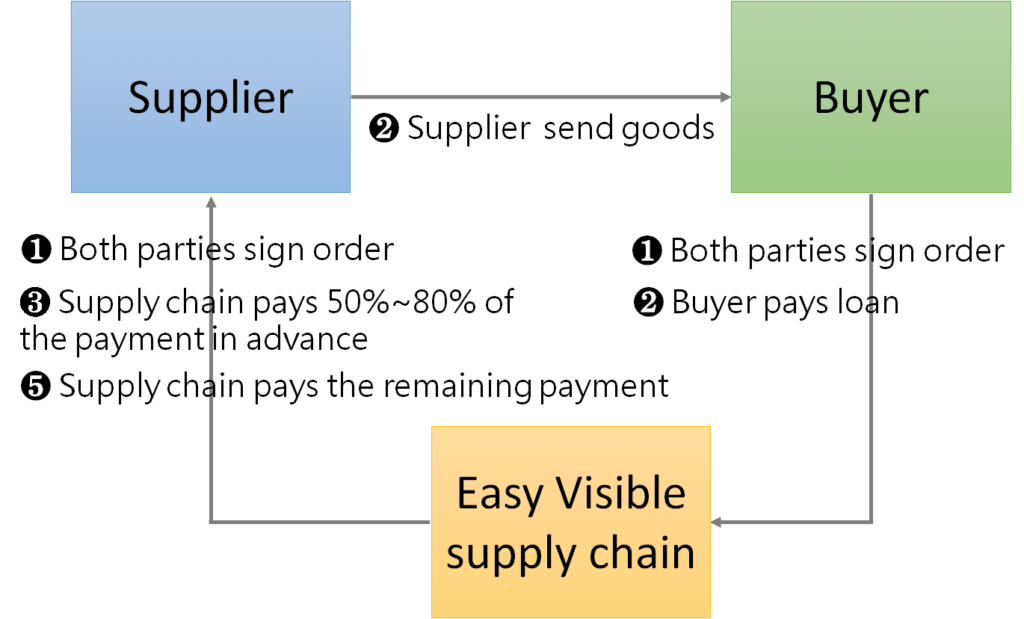

The company signs purchase and sales agreements with suppliers and customers (buyers), but the company does not undertake logistics and transportation functions. Instead, suppliers directly deliver goods to customers, and upstream and downstream companies directly connect. After receiving the arrival information provided by the customer, the company provides funds to the customer in advance, and pays the supplier according to a certain percentage of the transaction amount (usually 50%-80%). After the customer pays the purchase price to the company, the company and the supplier settle the payment. Since the company paid a large proportion of funds to suppliers in advance as the deposit, it reduced the financial pressure on upstream suppliers. Upstream suppliers give the company a certain discount on the sales price of the goods, and Easy Visible thus obtains a certain degree of trade balance.

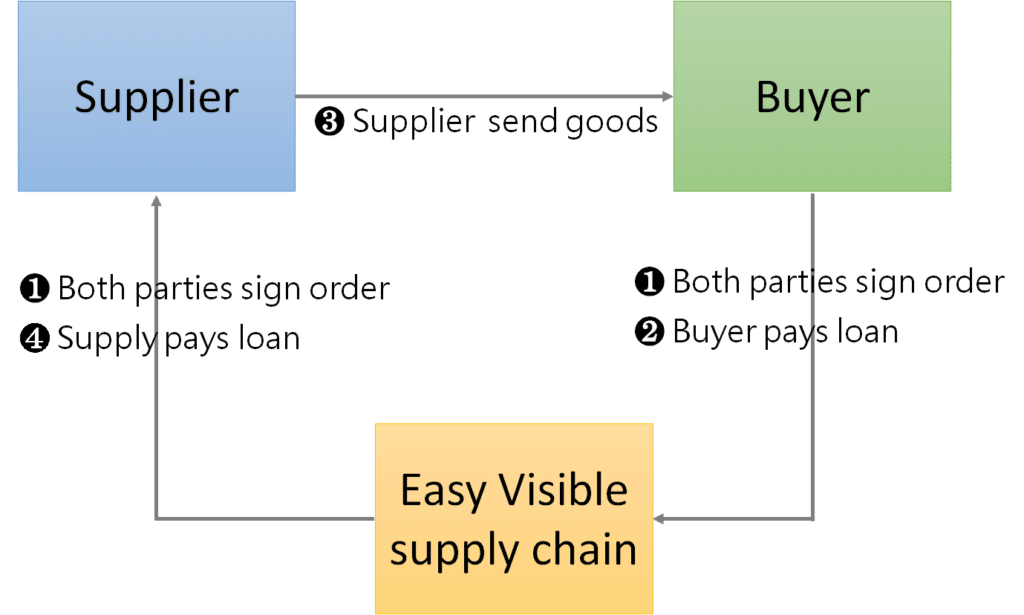

First mode: When the supplier is not a large enterprise and the bargaining power is low, after the buyer pays the goods in advance, the supplier first delivers the goods to the buyer, and the Easy Visible supply chain then pays the goods to the supplier.

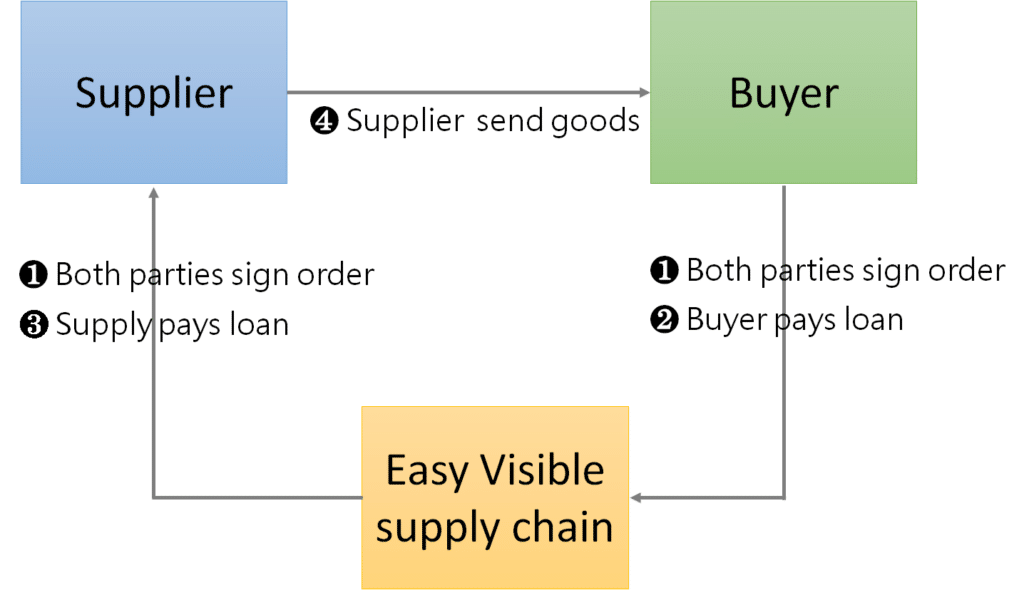

Second mode: When the supplier is a large enterprise with high bargaining power, after the buyer pays the goods in advance, the Easy Visible supply chain first pays the goods to the supplier, and the supplier then ships the goods to the buyer.

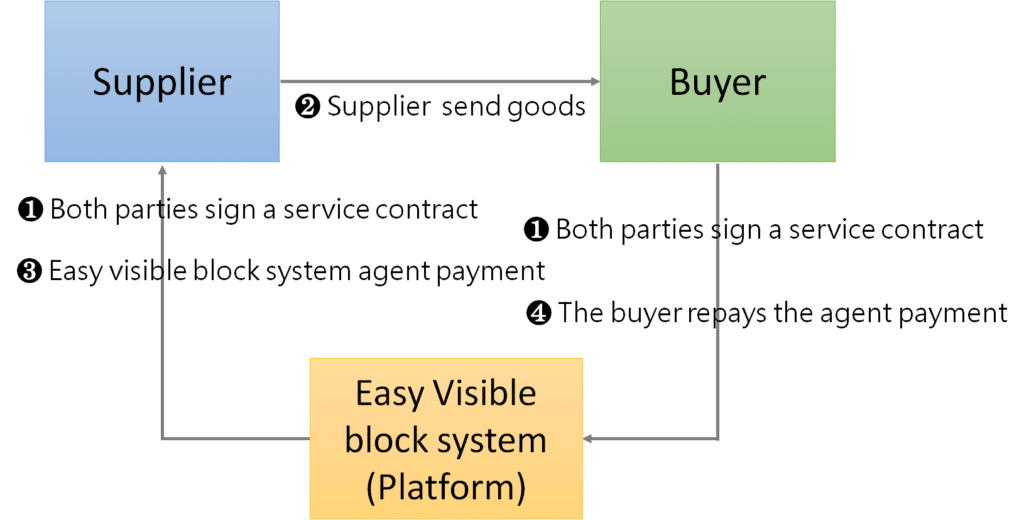

The company’s “Easy Visible block” trading system is connected to the business systems of suppliers and buyers to obtain transaction information of both parties, which serves as an important basis for supply chain and fund settlement services. After the buyer receives the goods, the buyer issues a payment instruction through the trading platform. After the transactions on the Easy Visible system are successfully finished and confirmed, the buyer pays the upstream supplier.

The difference between the company’s agency payment business and the traditional trade-based supply chain business is that in the agency payment business, the company does not directly participate in trade, but emphasizes the collaboration with the core enterprise. The core enterprise needs to fully disclose its transaction information to the company. The agency payment business funds are accounted as “Other Current Assets” in the balance sheet. The agency payment business income comes from the company’s collection of service fees from the service recipient.

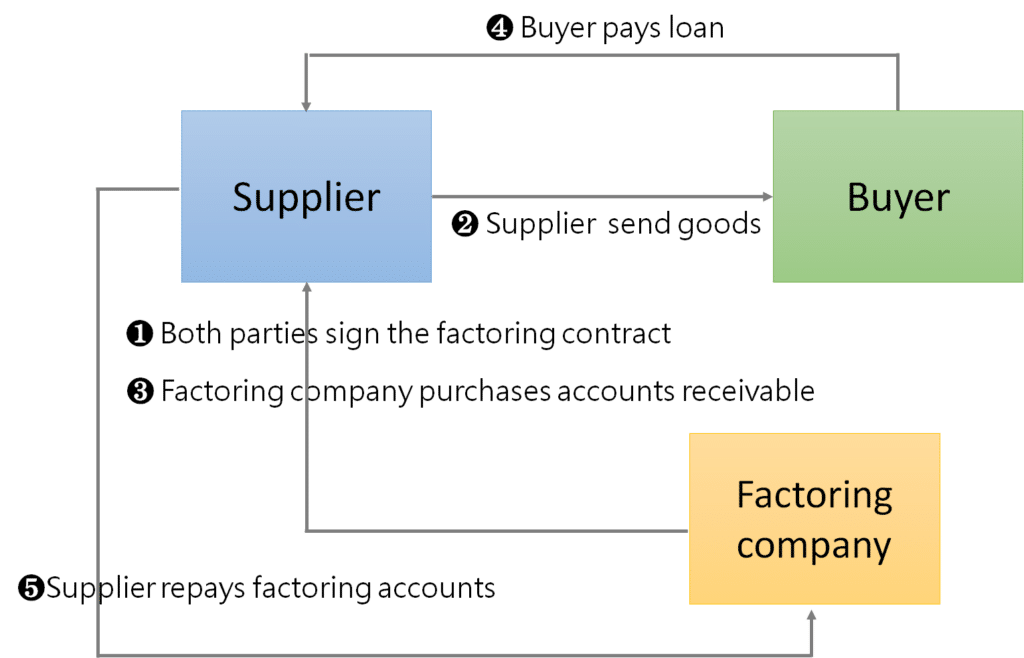

In addition to supply chain finance, Easy Visible’s factoring business is that after the factoring company buying the factoring account, they earn interest income and management fee income during the period when the customer pledges the accounts receivable, and the customer will be charged when it is due.

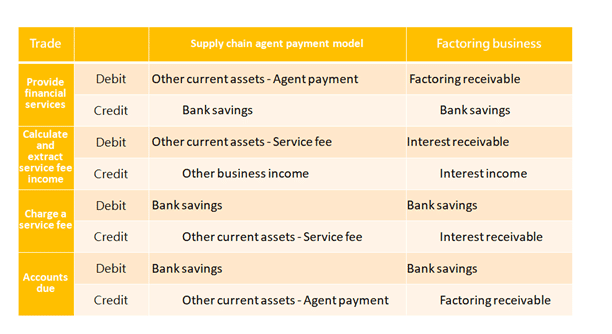

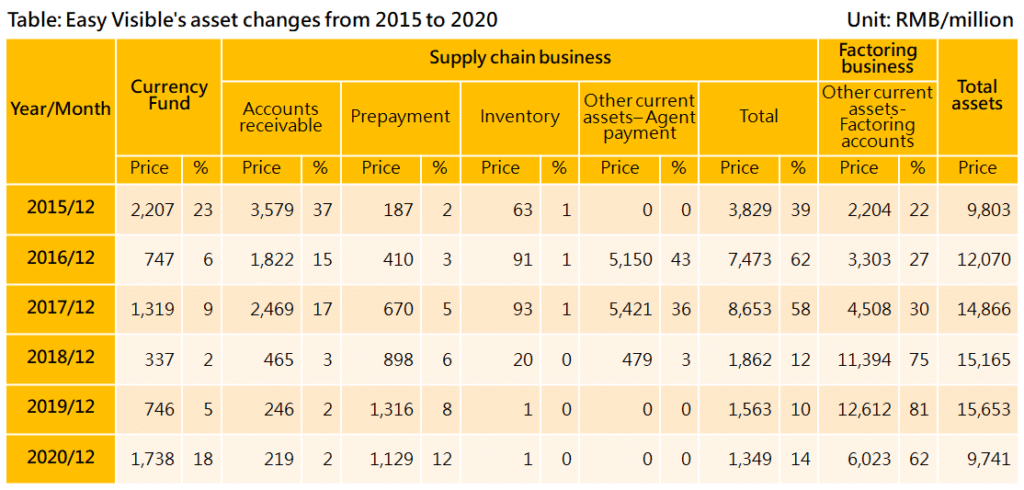

The accounting entries of the supply chain agency payment model and factoring model are shown in the following table. In 2018, there was a major turning point in the transaction model. The supply chain department’s agency payment model was adjusted to a factoring business model, which resulted in a significant decrease in the agency payment amount and a significant increase in the amount of factoring receivables from 2018.

The accounting entries are as follows:

The above-mentioned trading model makes Easy Visible’s asset composition have the following characteristics:

In 2014, Tian Hui Leng, the substantial controller, converted the company from traditional trade to supply chain finance business, and he made the company become China’s first blockchain-related stock. However, actual controllers of Easy Visible have been changed for up to 3 times over the past 7 years, and the company faced the problems of late payment in the financial reports, substantial losses of assets and being hollowed out. After we understand the company’s business model in this issue, we will share with readers the three actual controller changes and Tian Hui Leng’s operations in the next issue.

For more complete research about credit risk of Chinese enterprises, please refer to TEJ CCRQM.