Table of Contents

In recent years, investing in ETFs has become a global trend among investors. With the global ETF market exceeding $12 trillion, it is evident that ETFs have become a significant aspect of the market. Notably, Taiwan’s ETF market growth outpaces the broader market under the AI boom, which became the third largest in Asia by the second quarter of 2023 and demonstrated impressive growth in both speed and scale.

When tracking ETFs, investors need more than just basic information about the ETFs themselves. They also need to understand the market and the underlying assets of the ETFs. Each ETF has a mechanism for rebalancing their portfolios, with varying frequencies and schedules for these changes. In this information-rich market, investors require accurate data and statistics. TEJ ETF database provides comprehensive information on major ETFs in the Taiwan market, assisting investors in selecting profitable investment targets amidst the constantly evolving and diverse range of ETFs.

TEJ ETF database provides the latest market and capital flow data information on a daily basis, allowing investors to keep themselves updated with the market performance and information of ETFs. In addition to providing well-organized ETF data, TEJ also exclusively includes daily ETF holdings information, helping investors to promptly grasp ETF rebalancing news and adjust portfolio allocations in a timely manner. Furthermore, daily ETF physical subscription and redemption information assists investors in understanding potential ETF arbitrage strategies of major institutional investors.

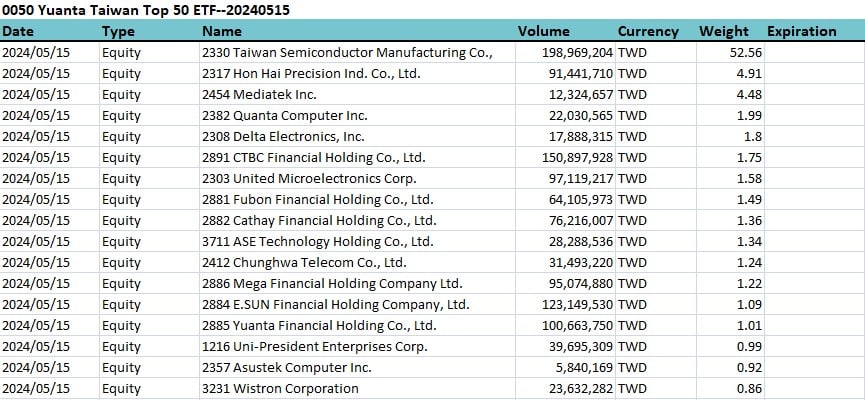

We update ETF holdings information daily, allowing investors to stay informed about changes in the constituent stocks of each ETF. By accessing this daily data, investors can track the timing and frequency of ETF rebalancing. This enables investors to not only obtain constituent stock information timely but also to gain insights into industry trends, effectively managing our investment portfolios.

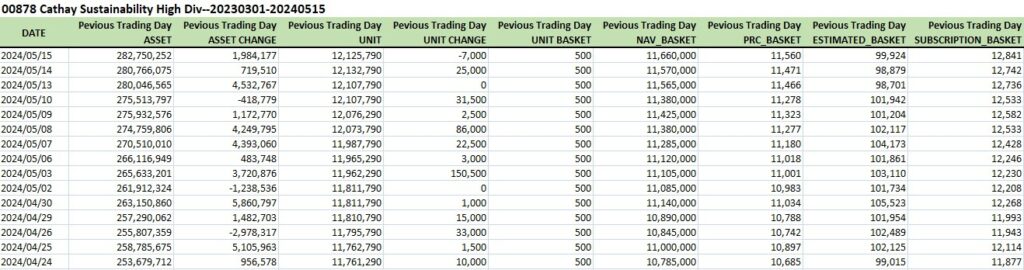

TEJ collects daily primary market subscription and redemption information of the ETFs of Taiwan’s domestic investment institutions. Since ETFs, once listed, have two trading channels—primary and secondary markets—arbitrage opportunities arise when the net asset value (NAV) and market price differ between these two markets. Through this database, investors can also understand the daily primary market activities of authorized participants, helping to align secondary market prices more closely with their true value.

Learn More About the High-Quality ETF Database by TEJ!

ETF Profile: Fundamental information of all Taiwan-listed ETFs, covering various categories such as equity ETFs, futures ETFs, and bond ETFs.

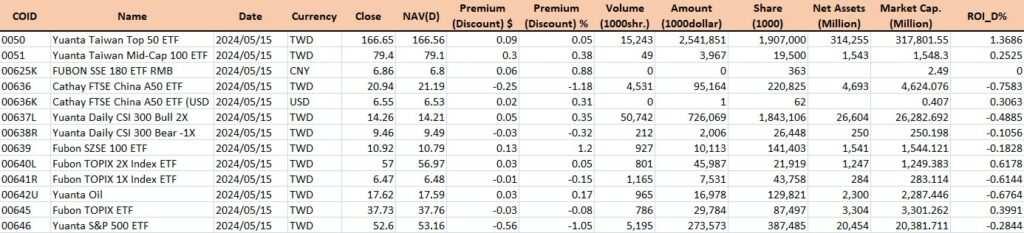

ETF Price: Daily market trading information, including market price, net asset value (NAV), premium/discount, and rate of return.

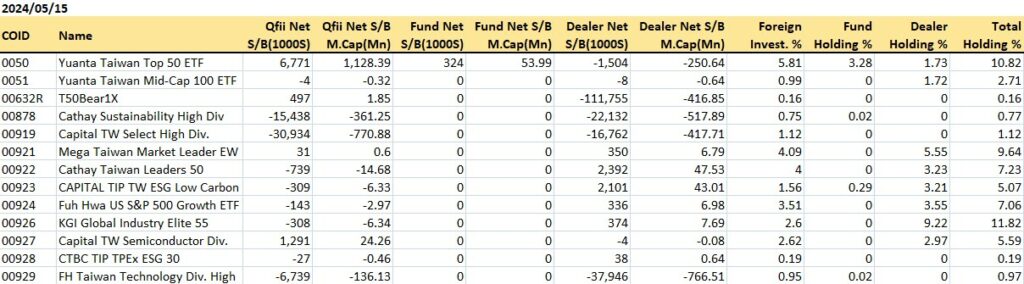

Buy/Sell of Three Institutional Investors: Provides daily investment information for institutional investors, Qfii, Dealers, and Investors, on each Taiwan-listed ETF, including trading volume and amount, etc.

TEJ ETF Database compiles fundamental, market, and holding data for Taiwan-listed ETFs, providing comprehensive investment information to help you stay on top of market trends and make informed investment decisions. Consult and use the TEJ ETF database now to accelerate your investment analysis, seize market opportunities, and achieve higher investment returns!