In recent years, the efficiency of the Taiwan stock market has been substantially improved due to regulations of information disclosure and the gradual relaxation of daily price limits. Therefore, the relationship between the price momentum of the Taiwan stock market and the expected return is worthy of further exploration.

There are some past research on stock price momentum that may give us a glimpse into this area. Levy (1967) found that in the US stock market, the 26-week stock price deviation rate was positively correlated with the stock’s future return. In addition, Jegadeesh and Titman [1993] conducted research and found that there is a momentum effect in the U.S. stock market. The investment strategy of buying stocks with the best returns in the past 6-12 months and selling the stocks with the worst returns in the past 6-12 months at the same time can achieve both economically and statistically significant excess returns. Subsequent studies by many scholars have also found that the momentum effect is prevalent in the international stock market and different asset classes.

In order to explore the relationship between stock price momentum and expected stock return, academia and industry have also developed many indicators to measure stock price momentum. In addition to the momentum index calculated by using the past cumulative rate of return, the momentum oscillators also include volatility-adjusted stock cumulative return, the deviation between long and short moving averages, the cumulative value of CAPM residuals, etc. This article will use the momentum oscillators mentioned above to analyze and explore the relationship between stock price momentum and expected stock return in the Taiwan stock market.

Table of Contents

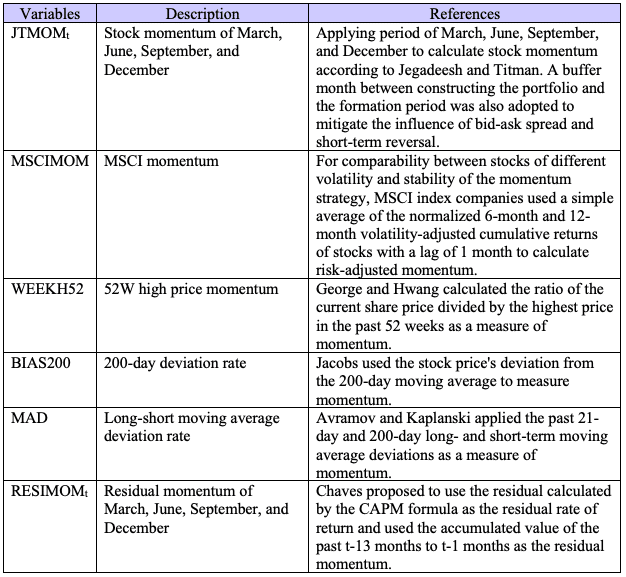

Our sample consists of stock prices of Taiwan’s Mid-Cap 100 Index constituent companies from January 2009 to December 2021, and the source is TEJ Data API. To avoid survivorship bias, the sample also includes companies that were constituents of the index at the time. In general, the stock price is prone to insufficient response to information in an inefficient market. Investors can use the performance of the past stock price as a momentum oscillator and use the investment strategy to generate profits. This article refers to the momentum oscillators proposed by past researchers to establish the table of variables for this analysis:

Table 2.1 Variables that measure stock price momentum

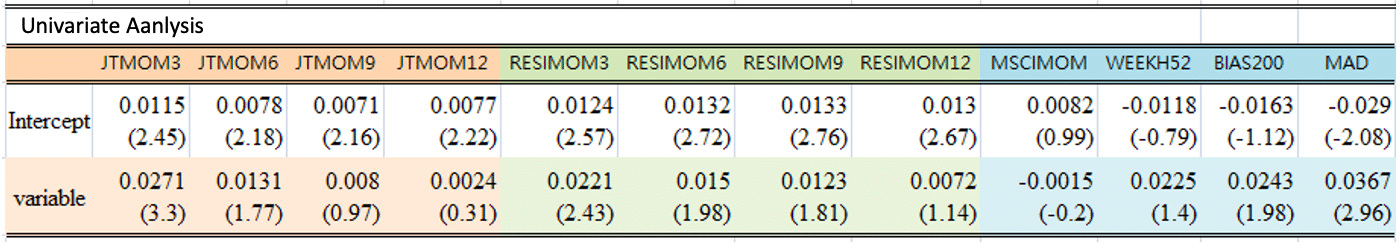

Univariate analysis was used to test the relationship between momentum variables, inclusive of JT Momentum (JTMOM), RESI Momentum (RESIMOM), and alternative momentum variables (MSCIMOM, WEEKH52, BIAS200, MAD), and the cross-sectional expected return on stocks. The analysis was conducted in exploring whether these variables could be used to predict the expected return as an effective factor.Overall, the cross-sectional regression analysis results demonstrated a positive relationship between the momentum variables and the expected stock return. Among JT Momentum, RESI Momentum, and alternative momentum variables, JTMOM3, RESIMOM3, and MAD were the most significant, indicating that they had the most predictive power for the expected return of the stock.

Table 3.1 Cross-sectional Regression Analysis Results

Time period: 2009/1-2021/12

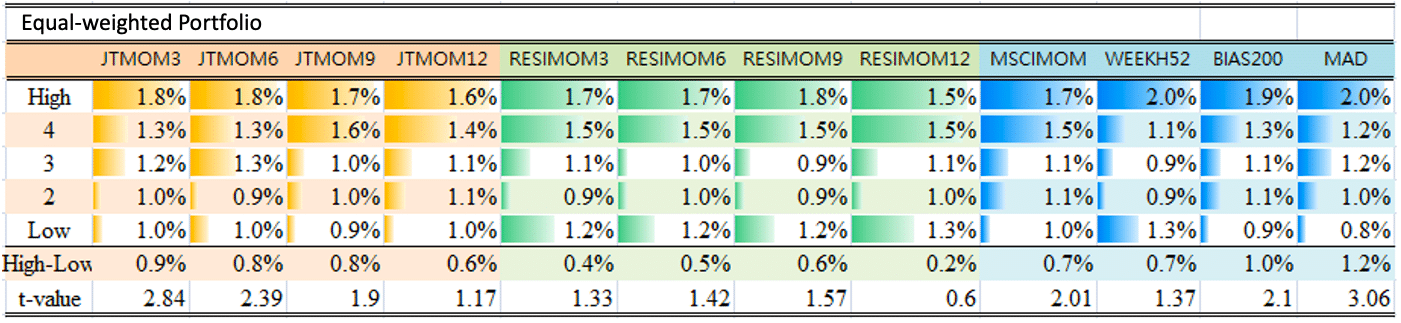

Next, we used portfolio analysis to examine the relationship between the momentum variables and the expected stock return. The analysis methodology was to calculate the momentum variable at the end of each month and use it to sort and group stocks. The portfolio was constructed on an equal-weighted or market capitalization-weighted basis and re-adjusted after holding for one month. Finally, we examined whether there was monotonicity between the average return rate and ranking of the portfolio and whether the average return of the long-short hedge portfolio (High-Low portfolio) was significantly different from 0 to determine whether the momentum variable has the power to predict the future return of the stock.

This method showed that momentum variables such as JTMOM3, JTMOM6, MSCIMOM, BIAS200, and MAD have better predictive ability for stock returns. In particular, the MAD variable with alternative momentum was the most statistically significant in predicting the future stock return rate.

Table 3.2 Analysis of Equal-weighted Portfolio

Time period: 2009/1-2021/12

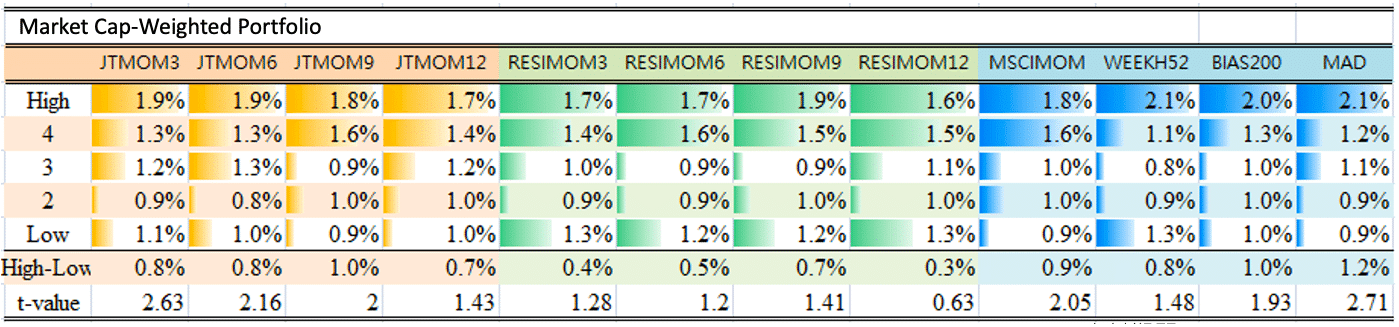

Table 3.3 shows the average monthly returns for portfolios weighted by market capitalization versus long-short hedged portfolios. There is little difference between the results of the market capitalization allocation and the equal-weight allocation. The market capitalization-weighted results showed that momentum variables such as JTMOM3, JTMOM6, JTMOM9, MSCIMOM, and MAD had better predictive power for stock returns. In particular, the MAD variable with alternative momentum was the most statistically significant.

Table 3.3 Analysis of Market Cap-Weighted Portfolio

Time period: 2009/1-2021/12

In the previous paragraphs, a cross-sectional regression and a univariate analysis of the portfolio were conducted on the momentum variables. The analysis results showed that the JT Momentum in the period of 3 and 6 months and the alternative momentum variables of MSCIMOM and MAD had the most economic and statistical significance in predicting the expected stock rate of return. However, univariate analysis does not consider the influence of its factors when testing variables. Therefore, to understand whether the explanatory power of the momentum variables for stock expected returns was endogenous or may be explained by other firm characteristic variables, we referred to Fama-Macbeth Regression for multivariate analysis.

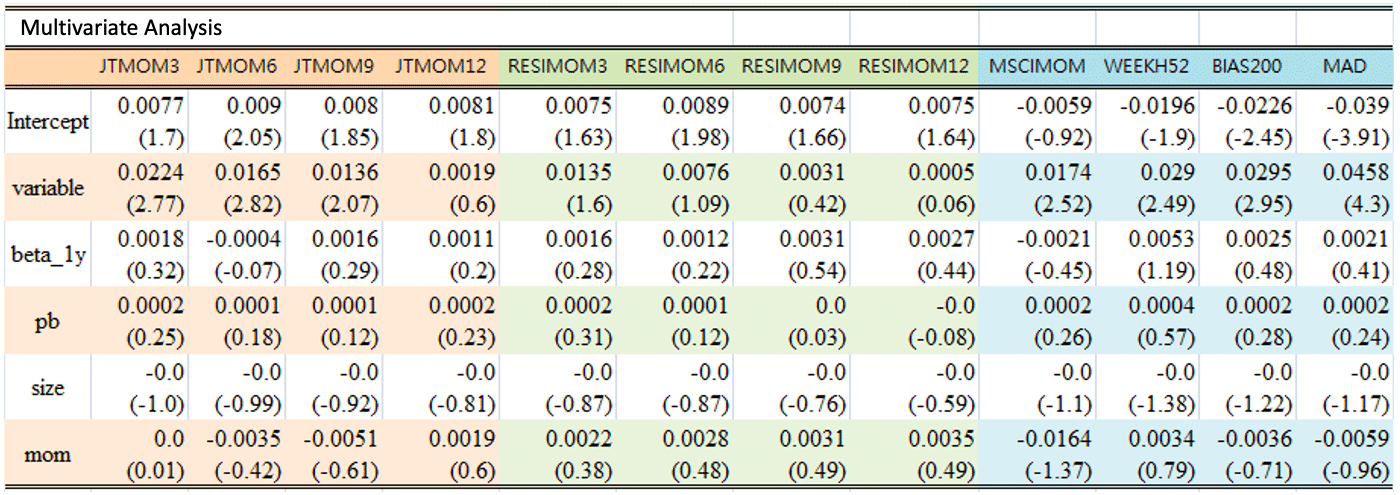

Fama-Macbeth regression applied the stock return rate in the next month to regress the momentum variables, and four other variables, including one-year beta (beta_1y), price-to-book ratio (pb), and market value (size), 12-month momentum (mom) were added. The regression model tested whether the explanatory power of the momentum variables to the expected stock return was still significant after controlling the four characteristic variables of a company.

Table 4.1 Fama-Macbeth Multivariate Regression Analysis

Time period: 2009/1-2021/12

Note: intercept: alpha intercept term; variable: momentum variable; beta_1y: one-year beta; pb: price-to-book ratio; size: market capitalization; mom: 12-month momentum

The results of multivariate analysis using Fama-Macbeth regression showed that after controlling the four company characteristic variables (one-year beta value, price-to-book value ratio, market capitalization, and 12-month momentum), the relationship between the momentum variables of JTMOM3 and MAD and the stock future expected return rate relationship was not affected. It represented that these two momentum variables had exclusive predictive power and explanatory power for stock expected return and were affected by scale. Besides, the significance of the momentum variable prediction of JTMOM6, JTMOM9, MSCIMOM, WEEKH52, and BIAS200 were improved. It is implied that if these momentum variables are applied to stocks with small market capitalization, the effect will be better.

This research applied Taiwan Mid-Cap 100 Index constituent stocks as samples to explore the relationship between share price momentum and cross-sectional expected return on stocks. TEJ also adopted academic and industry methods to construct different forms of momentum variables and built a cross-sectional regression model for univariate analysis. Finally, Fama-Macbeth regression was constructed for multivariate analysis, and we examined the performance of momentum portfolios under different economic environments.