The formation of an investment strategy process includes data collecting, strategy initiating, Screening condition setting, backtesting, and eventually inputting the fund into the market to carry out a strategy.

We often have to face the following problems in the process:

How to swiftly test the historical performance to ensure the feasibility of investing strategy through the creation of investors’ mindsets? These stages take a great amount of time, statistical knowledge, programming ability, and so does data.

” TEJ Screening Backtesting system is backed up by complete TEJ database. The system also has a built-in statistics logic and testing program for the screening and backtesting section. Users can implement strategy initiation and performance backtesting in the same system, which would enhance the efficiency of investing strategy development by outputting more variety of graphs.”

Table of Contents

The survivorship bias in terms of backtesting work means that when performing a backtest, only considers the currently listed companies without including the samples of stocks issued by companies that are currentlly out of the list. If we miss those delisted stocks that existed in the backtesting work, the backtesting results will not reflect the true situation in the past, which makes the performance inaccurate. TEJ Database records all of the currently listed companies and the once listed ones. With the complete data, the backtesting could truly reflect the historical performance and offer accurate results.

【 Figure 1. The target in the database includes delisting companies】

TEJ renews the firm operating information and records all the market information in the after-hours daily. The ongoing research or initiating strategies can view its screening performance backtesting results by calculation.

1. No need for programming basics

It requires a great amount of data sample scraping, logic testing, and calculation to establish the screening condition, backtesting settings, and implementation process. In the past, users had to download information from the database and finish the backtesting through statistical software or self-written programs, which was not only quite a waste of time and human power but also increased the entrance threshold of investors doing backtesting. To solve this problem, TEJ includes the union method and ratings of strategy conditions. The backtesting weighting deployment and rebalance settings all conform to the requirements to basic screening performance backtesting, and the function saved the time for users to code themselves, which significantly decreased the threshold of strategic development.

2. Direct view of backtesting graph

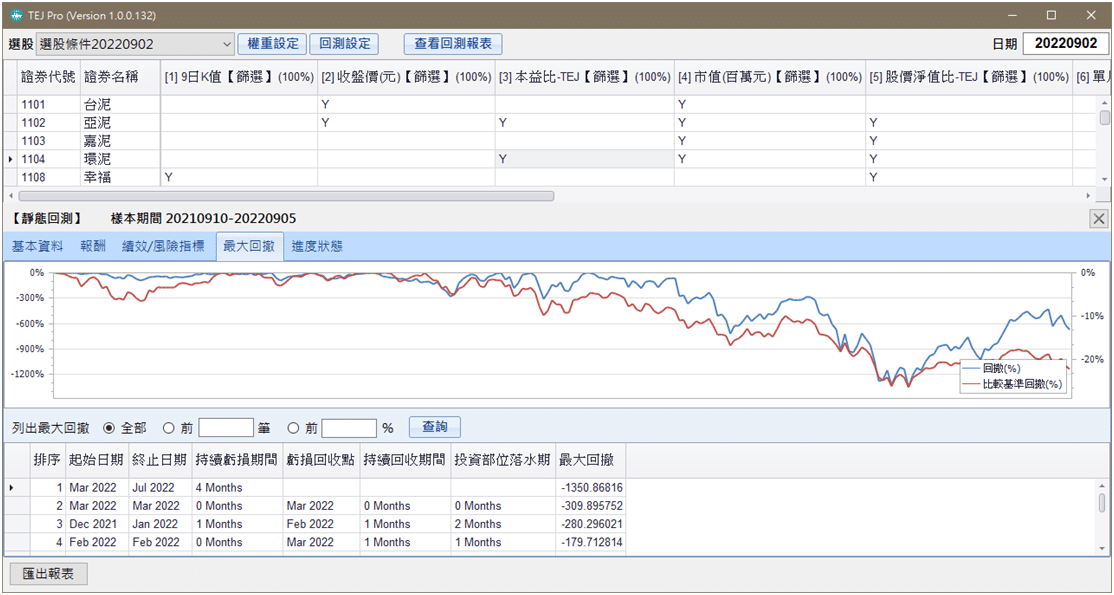

The backtesting results output by the system includes style analysis, the graph of returns, max retracement, etc. The necessary graphs to gain insight into strategy performance are viewable and could be exported to use in no time.

3. Strategy example sharings

The system has in-built frequently used strategies, provided for users as references to strategy initiating. TEJ also irregularly updates strategy examples on our websites to follow up on the market trend.

〔Highlight Functions of the Screening Performance Backtesting System〕

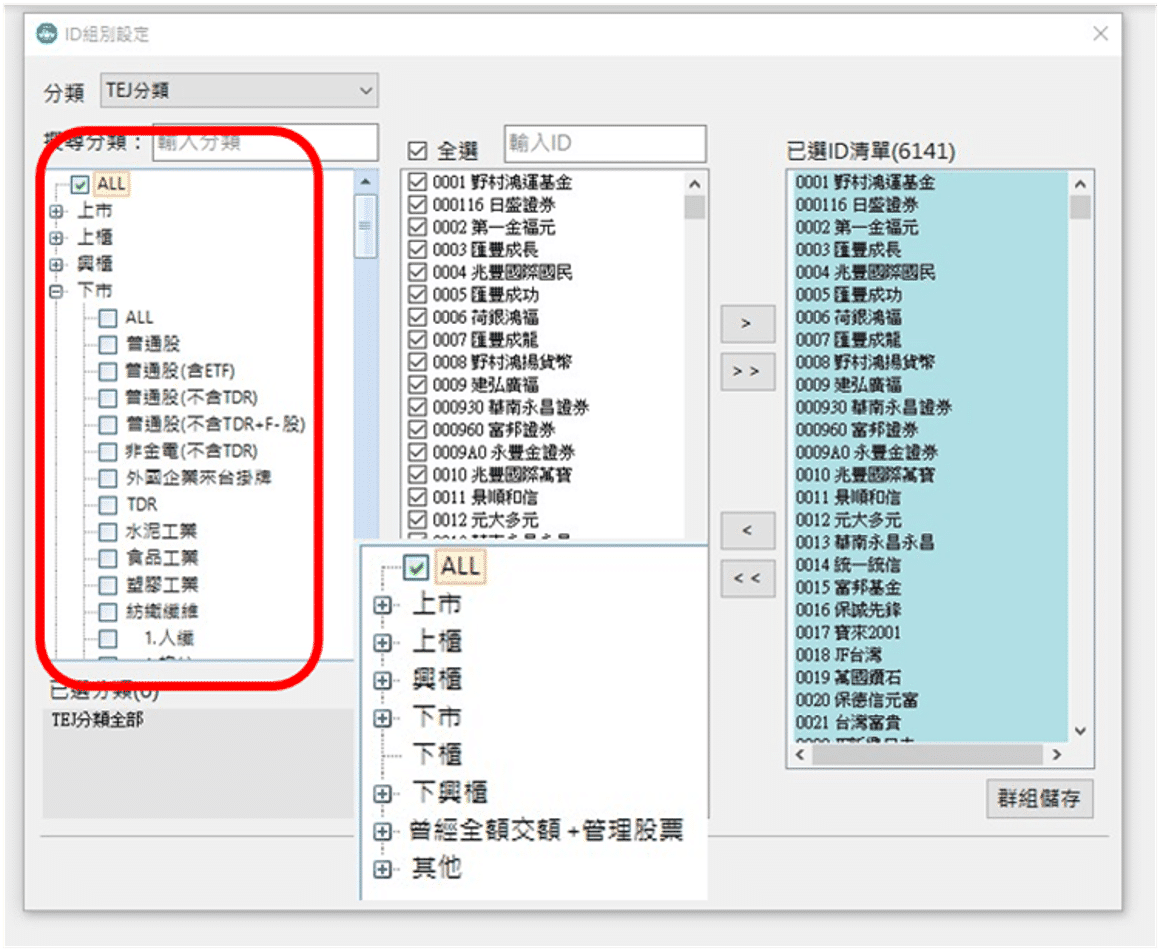

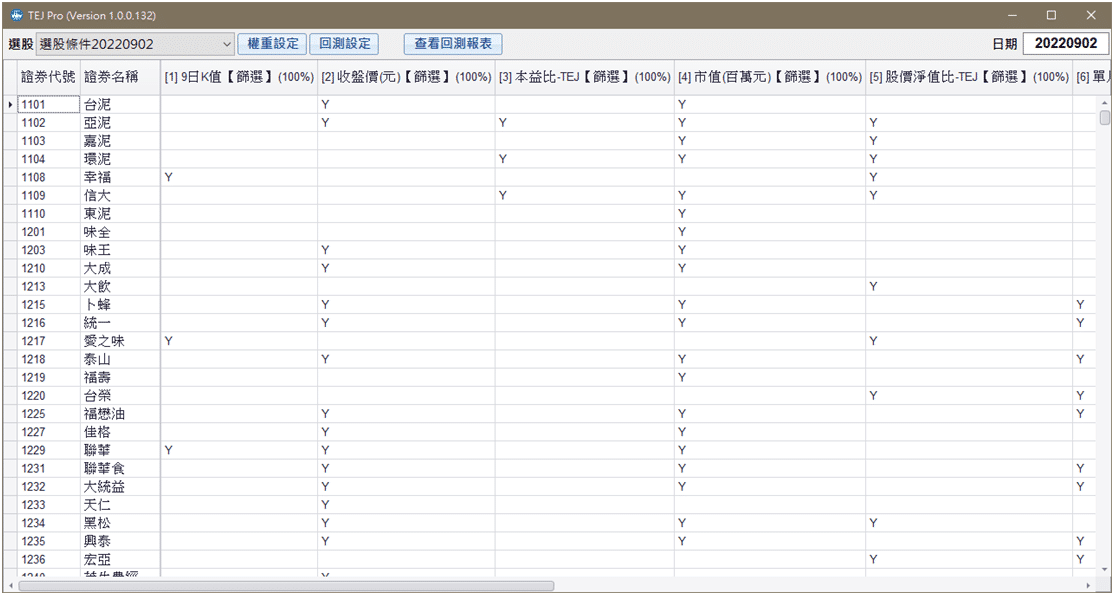

I. Screening pool preview

After the system established the screening requirement, it would immediately filter the stock list that meets the requirements and provides a preview. The preview function makes it easier to check the scores and weights of stocks that conform to the requirement, which is also convenient to check or revise.

【 Figure 2. Screening Condition Settings】

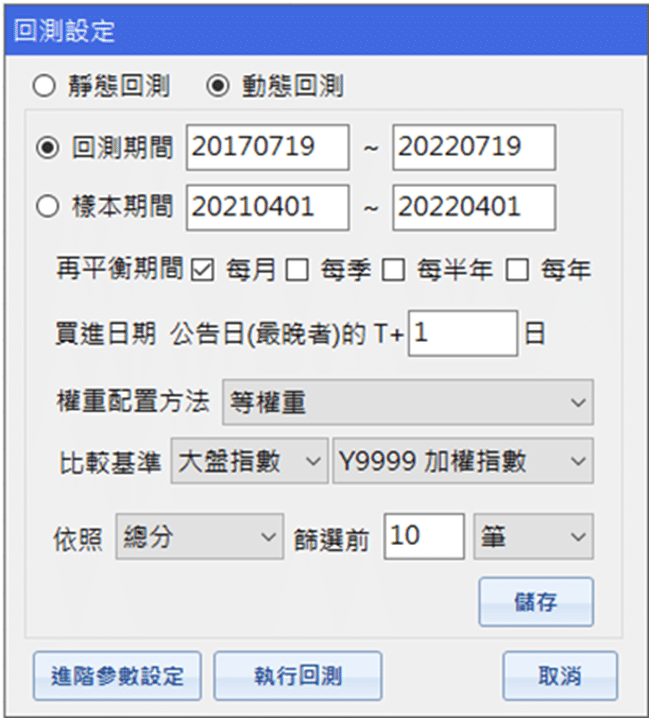

II. Backtesting parameters setting

The Backtesting settings provide:

(1) Static or dynamic backtesting

(2) Weight deployments

(3) Sample and backtesting periods (Make a small amount measurement of 2 years first, and implement a longer backtesting period after ensuring the previous substance)

【Figure 3. Backtesting Parameters Setting】

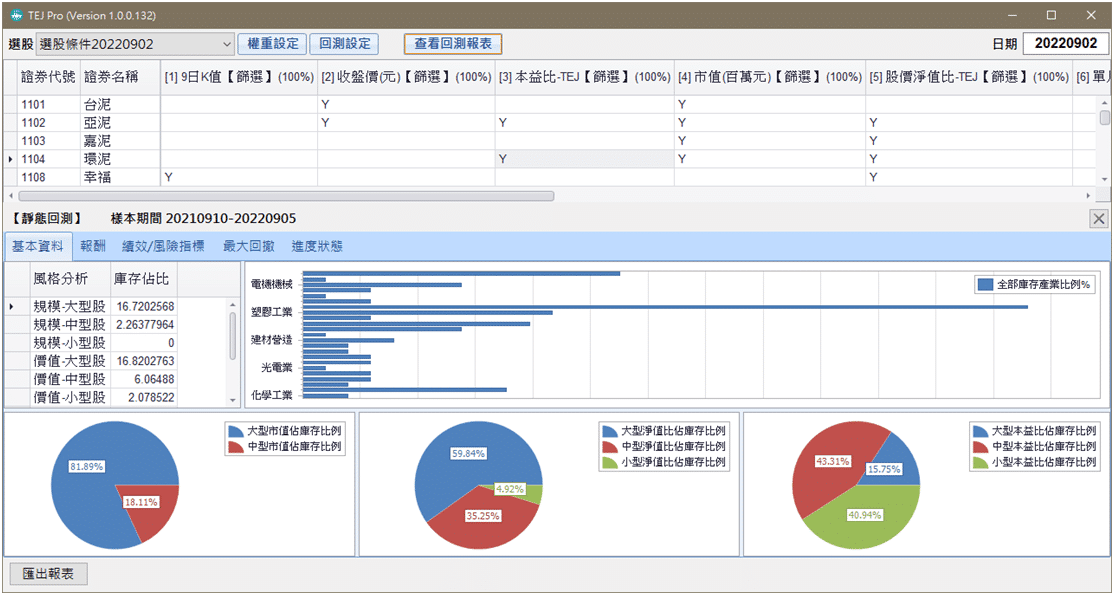

II. Report output

The report derived from the backtesting results should include style analysis, historical return graphs, performances/risk indexes, max retracements, etc. The graphs are arranged in horizontal order to make it easy to view the results of strategy performance, and eventually, export the report.

【Figure 4. Report output】

TEJ Screening and Performance Backtesting System is a newly-added function of the TEJ PRO system. It directly integrates various indexes like fundamentals/chips/technicals/financials in TEJ database. It also implements strategy initiating, performance backtesting, and graph illustrating in a single system dashboard, which enables you to view the various aspects of the strategic analysis.

TEJ’s most complete screening and backtesting tool give you spectacular efficiency for academic research. Just open TEJ PRO and try it yourself.