Table of Contents

本策略基於追蹤市場中所謂「聰明錢」的流向,即三大法人(外資、投信、自營商)的動向。策略假設,當三大法人對市場未來方向有一致且強烈的看法時,跟隨其方向進行交易的勝率較高。

本研究以台灣指數期貨(台指期, TX)作為唯一的交易標的,並使用每日的最高價、最低價、收盤價資料(用於計算 ATR 波動率),以及三大法人的未平倉數據(用於產生交易訊號)。由於策略中的波動濾網需要一段時間的歷史數據進行(warm-up),其中最長的計算週期為 vol_window(252天),為了確保回測開始時有足夠穩定的歷史數據,實際回測期間定為 2016年1月1日 至 2025年10月1日,以確保所有交易訊號的嚴謹性與有效性。

三大法人未平倉淨口數:

ATR(Average True Range):

如果 net_oi 為正,則做多;如果為負,則做空。倉位大小由 round(net_oi / 1000) 決定。例如:今天未平倉量10000,則下單10口,明天未平倉量11000,在下一口。

當滿足以下任一條件時,策略會平倉出場:

這種進出場門檻的不同設計被稱為 Hysteresis(磁滯/緩衝區),目的是為了防止策略在信號臨界點附近因小波動而頻繁進出,增加交易的穩定性。

期貨合約到期日的前一天,zipline 會自動將即將到期的合約平倉,策略邏輯會在下一個月份的主力合約上建立新倉位,以確保交易的連續性。(如需提前轉倉仍需寫 roll_futures)

import os

os.environ['TEJAPI_KEY'] = 'YOUR_KEY'

os.environ['TEJAPI_BASE'] = 'http://tejapi.tejwin.com'

os.environ['ticker'] = 'IR0001'

os.environ['future'] = 'TX'

os.environ['mdate'] = '20100101 20250920'

!zipline ingest -b tquant_futureimport pandas as pd

import numpy as np

import talib

import pyfolio as pf

from zipline import run_algorithm

from zipline.api import(

continuous_future,

order_target,

get_datetime,

schedule_function,

date_rules,

time_rules,

record,

set_commission,

set_slippage,

symbol,

set_benchmark,

get_open_orders,

)

from zipline.finance import commission, slippage

from zipline.TQresearch.futures_smart_money_positions import institution_future_data

from zipline.assets import Futuredef initialize(context):

context.tx_future = continuous_future('TX', offset = 0, roll = 'calendar', adjustment = None)

context.benchmark_asset = symbol('IR0001')

set_commission(futures = commission.PerContract(cost = 200, exchange_fee = 0))

set_slippage(futures = slippage.FixedSlippage(spread = 10))

set_benchmark(symbol('IR0001'))

# 門檻

context.signal_threshold = 5000

context.exit_threshold = 1000

# 波動濾網參數

context.atr_window = 12

context.vol_window = 252

context.vol_quantile = 0.9

# 下載法人數據

start_date = '2010-01-01'

end_date = '2025-10-15'

print('正在下載三大法人未平倉數據...')

all_inst_data = institution_future_data.get_futures_institutions_data(root_symbol = ['TX'], st = start_date)

if not all_inst_data.empty:

df = all_inst_data.set_index('mdate')

df['calculated_net_oi'] = df['oi_con_ls_net_dealers'] + df['oi_con_ls_net_finis'] + df['oi_con_ls_net_funds']

context.major_inst_oi = df[['calculated_net_oi']]

else:

context.major_inst_oi = pd.DataFrame()

print("警告:未下載到任何三大法人數據")

schedule_function(rebalance, date_rule = date_rules.every_day(), time_rule = time_rules.market_open())def rebalance(context, data):

current_dt = get_datetime().tz_localize(None)

try:

# 抓三大法人資料

df = context.major_inst_oi

if df is None or df.empty:

return

try:

session_dt = pd.Timestamp(data.current_session).tz_localize(None).normalize()

except Exception:

session_dt = current_dt.normalize()

idx_ts = pd.to_datetime(df.index)

try:

idx_ts = idx_ts.tz_convert(None)

except Exception:

idx_ts = idx_ts.tz_localize(None)

idx_norm = idx_ts.normalize()

# 取出小於現在時間的資料

mask = idx_norm < session_dt

if not mask.any():

return

last_idx = df.index[mask][-1]

signal_row = df.loc[[last_idx]]

net_oi = signal_row["calculated_net_oi"].iloc[0]

if pd.isna(net_oi):

return

# ATR 波動濾網

history = data.history(

context.tx_future,

["high", "low", "close"],

context.vol_window + context.atr_window + 2,

"1d"

)

atr_series = talib.ATR(

history['high'],

history['low'],

history['close'],

timeperiod = context.atr_window

)

valid_atr = atr_series.dropna()

is_vol_high = False

current_atr = np.nan

vol_threshold = np.nan

if len(atr_series) >= context.vol_window + 1:

current_atr = atr_series.iloc[-1]

past_atrs = atr_series.iloc[-(context.vol_window + 1): -1]

vol_threshold = past_atrs.quantile(context.vol_quantile)

is_vol_high = current_atr > vol_threshold

# 當前交易合約與現有口數

current_contract = data.current(context.tx_future, "contract")

if current_contract is None:

return

pos = context.portfolio.positions.get(current_contract)

current_qty = int(pos.amount) if pos else 0

raw_target = int(round(net_oi / 1000))

final_target = current_qty

# 實現交易邏輯

if is_vol_high:

final_target = 0

else:

if abs(net_oi) < context.exit_threshold:

final_target = 0

elif abs(net_oi) > context.signal_threshold:

final_target = raw_target

open_orders = get_open_orders()

if current_contract not in open_orders:

if final_target != current_qty:

order_target(current_contract, final_target)

print(

f"{current_dt.date()} 調整口數 {current_qty} 到 {final_target}"

f"net_oi = {net_oi}, ATR = {current_atr:.2f}, high_vol = {is_vol_high}"

)

record(

target_pos = final_target,

net_oi = net_oi,

atr = current_atr,

vol_threshold = vol_threshold,

is_vol_high = int(is_vol_high)

)

except Exception as e:

print(f"Error in rebalance on {current_dt}: {e}")def analyze(context, results):

returns, positions, transactions = pf.utils.extract_rets_pos_txn_from_zipline(results)

benchmark_rets = results.benchmark_return

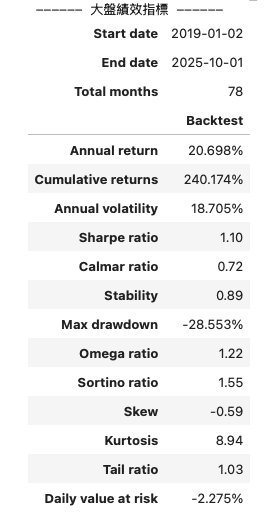

print("------ 大盤績效指標 ------")

pf.show_perf_stats(benchmark_rets)

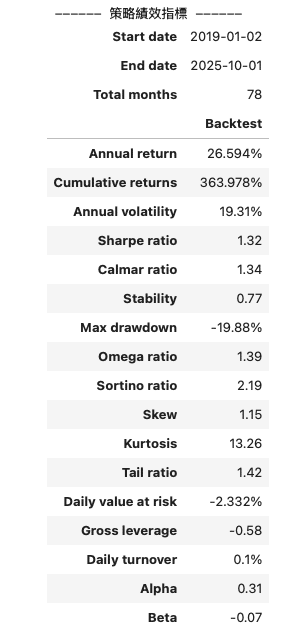

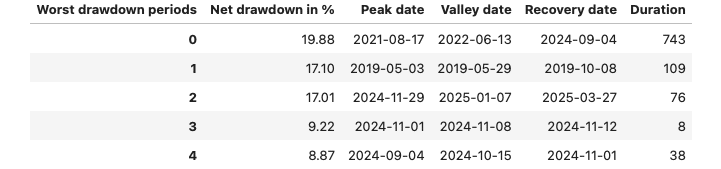

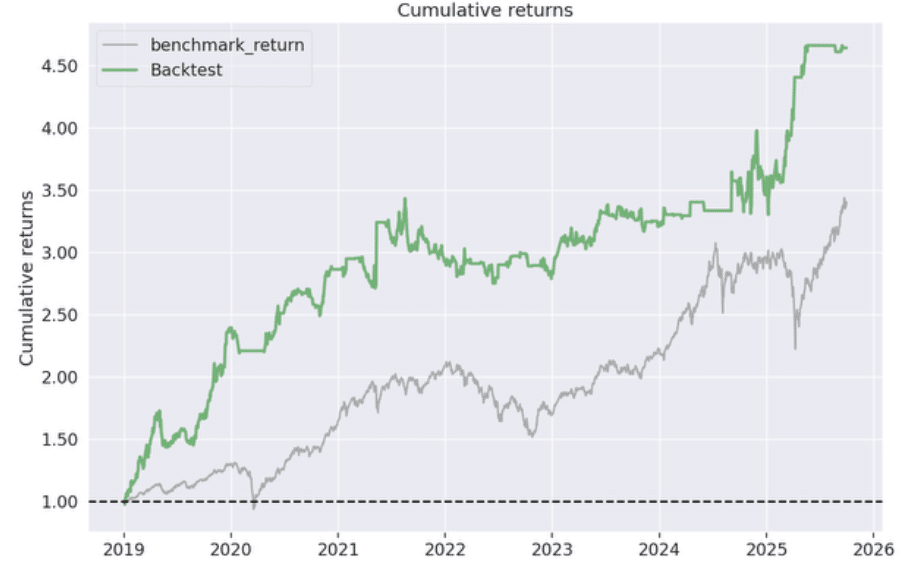

print("------ 策略績效指標 ------")

pf.create_returns_tear_sheet(

returns = returns,

positions = positions,

transactions = transactions,

benchmark_rets = benchmark_rets

)

if __name__ == '__main__':

start_date = pd.Timestamp('2019-01-01', tz = 'utc')

end_date = pd.Timestamp('2025-10-1', tz = 'utc')

result = run_algorithm(

start = start_date,

end = end_date,

initialize = initialize,

capital_base = 10000000,

analyze = analyze,

data_frequency = 'daily',

bundle = 'tquant_future'

)

歡迎投資朋友參考,之後也會持續介紹使用 TEJ 資料庫來建構各式指標,並回測指標績效,所以歡迎對各種交易回測有興趣的讀者,選購 TQuant Lab 的相關方案,用高品質的資料庫,建構出適合自己的交易策略。

溫馨提醒,本次分析僅供參考,不代表任何商品或投資上的建議。

TEJ 知識金融學院正式上線—《TQuantLab 量化投資入門》課程強勢推出!

這門課程結合 TEJ 實證資料與專業量化方法,帶你從零開始掌握量化投資的核心概念,

協助金融從業人員、投資研究人員以及想強化投資邏輯的你,快速建立系統化分析能力!