Table of Contents

移動平均線(Moving Average, MA)的思想源於 20 世紀初的 道氏理論(Dow Theory)。道氏理論強調市場具有趨勢性,且趨勢可透過價格本身來觀察,但早期價格資料波動劇烈,缺乏平滑工具。分析者因此開始利用一段期間的平均價格來減少隨機雜訊,這便是移動平均線的濫觴。 隨著統計學與電腦運算的進步,移動平均線逐漸成為量化交易最基礎的技術指標之一。從簡單移動平均(SMA)、指數移動平均(EMA),到更複雜的變體如雙指數移動平均(DEMA)、Hull MA 等,均線的改良目的皆在於解決傳統均線的「延遲性」問題,使其更快速或更平滑地反映價格趨勢。

在應用層面,均線策略廣泛存在於不同市場:

其中,最具代表性的莫過於「黃金交叉(Golden Cross)」與「死亡交叉(Death Cross)」。當短期均線上穿長期均線,往往被視為多頭趨勢啟動;反之則意味空頭來臨。然而,單純依賴交叉訊號在震盪市容易產生假突破,因此實務上常搭配多層停損、風控濾網與期貨換月處理,以提高策略的可行性與穩健性。

本策略即在黃金交叉框架下,結合移動停損與濾網動態管控風險,並應用連續合約處理期貨換月,使回測與實盤保持一致性。

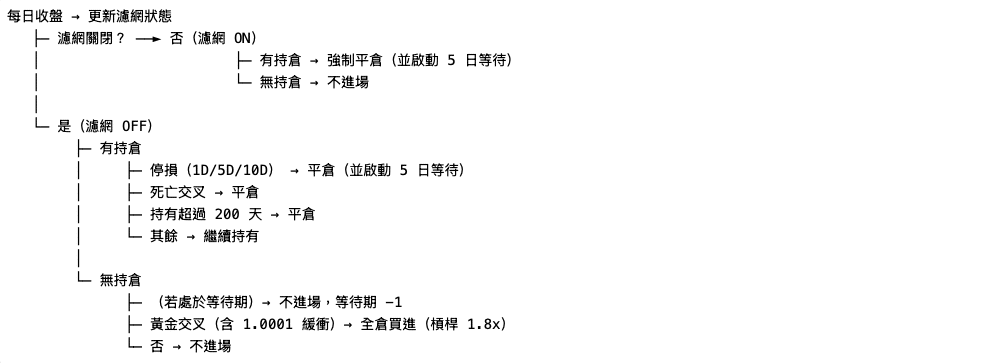

(MA3[-2] < MA10[-2]) and (MA3[-1] > MA10[-1] * 1.0001)return_1d < −5%return_5d < −10%return_10d < −15%(MA3[-2] > MA10[-2]) and (MA3[-1] < MA10[-1]) → 平倉

#%% Setup

ticker1 = 'IR0001 IX0001'

ticker2 = 'MTX MSCI NYF'

# 環境變數

import os

import sys

# import time # 未使用

import yaml

''' ------------------- 不使用 config.yaml 管理 API KEY 的使用者可以忽略以下程式碼 -------------------'''

notebook_dir = os.path.dirname(os.path.abspath(__file__)) if '__file__' in globals() else os.getcwd()

yaml_path = os.path.join(notebook_dir, '..', 'config.yaml')

yaml_path = os.path.abspath(os.path.join(notebook_dir, '..', 'config.yaml'))

with open(yaml_path, 'r') as tejapi_settings: config = yaml.safe_load(tejapi_settings)

''' ------------------- 不使用 config.yaml 管理 API KEY 的使用者可以忽略以上程式碼 -------------------'''

# --------------------------------------------------------------------------------------------------

os.environ['TEJAPI_BASE'] = config['TEJAPI_BASE'] # = "https://api.tej.com.tw"

os.environ['TEJAPI_KEY'] = config['TEJAPI_KEY'] # = "YOUR_API_KEY"

# --------------------------------------------------------------------------------------------------

os.environ['ticker'] = ticker1

os.environ['future'] = ticker2

os.environ['mdate'] = '20180101 20251002'

!zipline ingest -b tquant_future

# 數據分析套件

import warnings

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from logbook import Logger, StderrHandler, INFO

# tquant 相關套件

# import tejapi

# import TejToolAPI

import zipline

import pyfolio as pf

from zipline.utils.calendar_utils import get_calendar

from zipline.utils.events import date_rules, time_rules

from zipline.finance.commission import (

PerContract

)

from zipline.finance.slippage import (

FixedSlippage

)

from zipline import run_algorithm

from zipline.api import (

record,

schedule_function,

set_slippage,

set_commission,

order_value,

set_benchmark,

symbol,

get_datetime,

date_rules,

time_rules,

continuous_future

)

from pyfolio.utils import extract_rets_pos_txn_from_zipline

# logbook 設定

warnings.filterwarnings('ignore')

print(sys.executable)

print(sys.version)

print(sys.prefix)

log_handler = StderrHandler(

format_string = (

'[{record.time:%Y-%m-%d %H:%M:%S.%f}]: ' +

'{record.level_name}: {record.func_name}: {record.message}'

),

level=INFO

)

log_handler.push_application()

log = Logger('Algorithm')

#%% Strategy 1.3

# 目前最讚的版本的修改版 + 濾網天數限制

'''========================================================================================='''

# 策略參數

#---------------------------------------------------------------------------------------------

'''

未觸發濾網時 MA3 & MA10 黃金交叉 => 買進(全倉,槓桿 1.8倍),濾網開啟 or 死亡交叉 or 觸發停損條件 or 超過持有天數 => 平倉

'''

# 均線參數

SHORT_MA = 3

LONG_MA = 10

# 停損參數

MAX_HOLD_DAYS = 200

STOPLOSS_1D = 5

STOPLOSS_5D = 10

STOPLOSS_10D = 15

# 濾網參數

FILLTER_ON_ACCDAY = 2

FILLTER_OF_ACCDAY = 3

FILLTER_ON_TRIGGER = -5

FILLTER_OF_TRIGGER = 5

FILLTER_AUTO_OFF_DAYS = 200 # 濾網開啟後自動關閉天數

# 槓桿參數

LEVERAGE = 1.8

MAX_LEVERAGE = LEVERAGE + 0.05

# 其他

MTX_CONTRACT_MULTIPLIER = 50 # 小台乘數(請依你行情系統設定)

CAPITAL_BASE = 1e6

START_DT = pd.Timestamp('2020-01-02', tz='utc')

END_DT = pd.Timestamp('2025-09-26', tz='utc')

print(f'最大槓桿:{MAX_LEVERAGE} 倍')

print("[Trading log---------------]: ----------------------------- | signal ----- |action|Original posi| Note")

#---------------------------------------------------------------------------------------------

def initialize(context):

set_benchmark(symbol('IR0001'))

set_commission(

futures=PerContract(

cost = {'MTX': 15},

exchange_fee = 0

)

)

set_slippage(

futures=FixedSlippage(spread=1.0))

# set_max_leverage(MAX_LEVERAGE)

context.asset = continuous_future('MTX', offset=0, roll='calendar', adjustment='add')

context.universe = [context.asset]

context.in_position = False

context.hold_days = 0

context.wait_after_stoploss = 0

context.filter_triggered = 0 # 添加濾網狀態變數

context.filter_days = 0 # 濾網開啟天數計數器

schedule_function(ma_strategy, date_rules.every_day(), time_rules.market_close())

def ma_strategy(context, data):

# 獲取足夠的歷史資料

hist = data.history(context.asset, ['close'], bar_count=max(LONG_MA+2, 15), frequency='1d')

close = hist['close']

# 獲取基準指標歷史資料

benchmark_hist = data.history(symbol('IR0001'), ['close'], bar_count=7, frequency='1d')

benchmark_close = benchmark_hist['close']

# 計算策略累計報酬

return_1d = (close.iloc[-1] - close.iloc[-2]) / close.iloc[-2] * 100

return_5d = (close.iloc[-1] - close.iloc[-6]) / close.iloc[-6] * 100

return_10d = (close.iloc[-1] - close.iloc[-11]) / close.iloc[-11] * 100

# 計算指數累計報酬

benchmark_return_on = (benchmark_close.iloc[-1] - benchmark_close.iloc[-(FILLTER_ON_ACCDAY+1)]) / benchmark_close.iloc[-(FILLTER_ON_ACCDAY+1)] * 100

benchmark_return_of = (benchmark_close.iloc[-1] - benchmark_close.iloc[-(FILLTER_OF_ACCDAY+1)]) / benchmark_close.iloc[-(FILLTER_OF_ACCDAY+1)] * 100

# 計算均線

short_ma = close.rolling(window=SHORT_MA).mean()

long_ma = close.rolling(window=LONG_MA).mean()

# 判斷是否有持倉

contract = data.current(context.asset, 'contract')

open_positions = context.portfolio.positions

in_position = contract in open_positions and open_positions[contract].amount != 0

value = context.portfolio.portfolio_value

# 計算黃金交叉訊號

# golden_cross = (short_ma.iloc[-2] < long_ma.iloc[-2]) and (short_ma.iloc[-1] > long_ma.iloc[-1])

golden_cross = (short_ma.iloc[-2] < long_ma.iloc[-2]) and (short_ma.iloc[-1] > long_ma.iloc[-1] * 1.0001)

# 計算死亡交叉訊號

death_cross = (short_ma.iloc[-2] > long_ma.iloc[-2]) and (short_ma.iloc[-1] < long_ma.iloc[-1])

# 計算停損訊號

stop_loss_flag = (return_1d < -STOPLOSS_1D) or (return_5d < -STOPLOSS_5D) or (return_10d < -STOPLOSS_10D)

# 計算濾網訊號

if context.filter_triggered == 0:

if benchmark_return_on <= FILLTER_ON_TRIGGER:

context.filter_triggered = 1

context.filter_days = 0 # 重置濾網天數計數器

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Filter ON | Benchmark {FILLTER_ON_ACCDAY}d return: {benchmark_return_on:.2f}%')

else: # context.filter_triggered == 1

context.filter_days += 1 # 濾網天數計數器增加

# 檢查濾網自動關閉條件:天數達到上限

if context.filter_days >= FILLTER_AUTO_OFF_DAYS:

context.filter_triggered = 0

context.filter_days = 0

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Filter OFF | Auto off after {FILLTER_AUTO_OFF_DAYS} days')

# 檢查濾網關閉條件:市場反彈

elif benchmark_return_of >= FILLTER_OF_TRIGGER:

context.filter_triggered = 0

context.filter_days = 0

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Filter OFF | Benchmark {FILLTER_OF_ACCDAY}d return: {benchmark_return_of:.2f}%')

# 計算進出場訊號

# 濾網未觸發時,依策略進出場

if context.filter_triggered == 0:

# 有部位 => 判斷出場時機

if in_position:

context.hold_days += 1

# 移動停損

if stop_loss_flag:

order_value(contract, 0)

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | STOP_LOSS | sell | position: {open_positions[contract].amount if contract in open_positions else 0} | Hold Days: {context.hold_days}')

context.hold_days = 0

context.wait_after_stoploss = 5

# 死亡交叉

elif death_cross:

order_value(contract, 0)

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Death Cross | sell | position: {open_positions[contract].amount if contract in open_positions else 0} | Hold Days: {context.hold_days}')

context.hold_days = 0

# 超過持有天數限制

elif context.hold_days >= MAX_HOLD_DAYS:

order_value(contract, 0)

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Max Hold | sell | position: {open_positions[contract].amount if contract in open_positions else 0} | Hold Days: {context.hold_days}')

context.hold_days = 0

# 無部位 => 判斷進場時機

else:

context.hold_days = 0

if context.wait_after_stoploss > 0:

context.wait_after_stoploss -= 1

elif golden_cross:

order_value(contract, value * LEVERAGE)

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Golden Cross | buy | position: {open_positions[contract].amount if contract in open_positions else 0} | Amount: {value * LEVERAGE}')

context.hold_days = 0

# 濾網觸發時,無條件直接平倉

else: # context.filter_triggered == 1

if in_position:

context.hold_days += 1

order_value(contract, 0)

#----------------------------------|--------------|

log.info(f'{get_datetime().date()} | Filter Close | sell | position: {open_positions[contract].amount if contract in open_positions else 0} | Hold Days: {context.hold_days} | Filter Days: {context.filter_days}')

context.hold_days = 0

context.wait_after_stoploss = 5

record(close=data.current(context.asset, 'price'))

record(position=open_positions[contract].amount if contract in open_positions else 0)

record(filter_status=context.filter_triggered) # 記錄濾網狀態

def analyze(context=None, results=None):

close = results['close']

ma3 = close.rolling(window=3).mean()

ma10 = close.rolling(window=10).mean()

position = results['position']

filter_status = results.get('filter_status', pd.Series(0, index=results.index)) # 濾網狀態

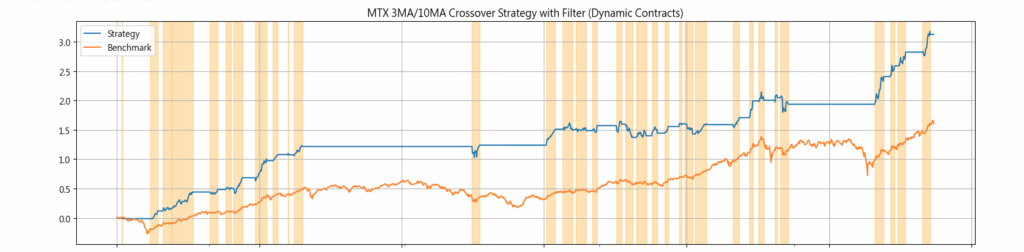

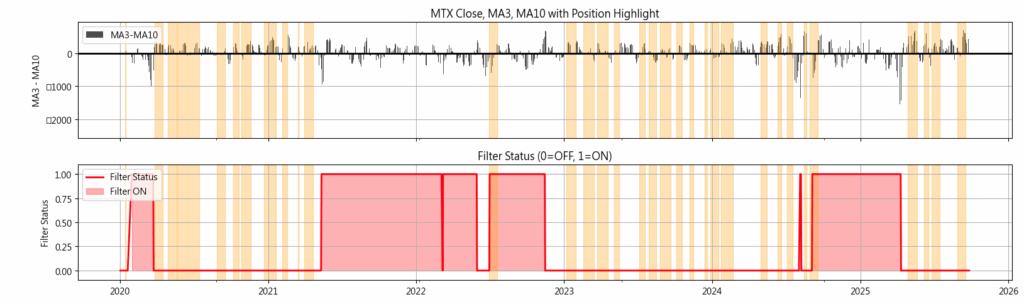

fig, (ax1, ax2, ax3) = plt.subplots(

3, 1,

figsize=(16, 9),

sharex=True,

gridspec_kw={'height_ratios': [4, 2, 2]}

)

# 上方:策略與基準績效

results.algorithm_period_return.plot(label='Strategy', ax=ax1)

results.benchmark_period_return.plot(label='Benchmark', ax=ax1)

ax1.set_title('MTX 3MA/10MA Crossover Strategy with Filter (Dynamic Contracts)')

ax1.legend(loc="upper left")

ax1.grid(True)

# 中間:收盤價、均線與持倉區塊

# ax2.plot(close.index, close, label='MTX Close')

ma_diff = ma3 - ma10

ax2.set_title('MTX Close, MA3, MA10 with Position Highlight')

ax2.bar(ma_diff.index, ma_diff, width=0.8, alpha=0.7, label='MA3-MA10',

color=['black' if x > 0 else 'black' for x in ma_diff])

ax2.axhline(y=0, color='black', linewidth=2, linestyle='-')

ax2.set_ylabel('MA3 - MA10')

ax2.legend(loc="upper left")

ax2.grid(True)

# ax2.plot(ma3.index, ma3, label='MA3')

# ax2.plot(ma10.index, ma10, label='MA10')

# 下方:濾網狀態

ax3.plot(filter_status.index, filter_status, label='Filter Status', color='red', linewidth=2)

ax3.fill_between(filter_status.index, 0, filter_status, alpha=0.3, color='red',

where=(filter_status > 0), label='Filter ON')

ax3.set_ylim(-0.1, 1.1)

ax3.set_ylabel('Filter Status')

ax3.set_title('Filter Status (0=OFF, 1=ON)')

ax3.legend(loc="upper left")

ax3.grid(True)

# 添加持倉區塊到所有圖表

in_position = (position > 0)

start = None

for i in range(len(in_position)):

if in_position.iloc[i] and start is None:

start = i

elif not in_position.iloc[i] and start is not None:

ax1.axvspan(close.index[start], close.index[i-1], color='orange', alpha=0.3)

ax2.axvspan(close.index[start], close.index[i-1], color='orange', alpha=0.3)

ax3.axvspan(close.index[start], close.index[i-1], color='orange', alpha=0.3)

start = None

if start is not None:

ax1.axvspan(close.index[start], close.index[-1], color='orange', alpha=0.3)

ax2.axvspan(close.index[start], close.index[-1], color='orange', alpha=0.3)

ax3.axvspan(close.index[start], close.index[-1], color='orange', alpha=0.3)

plt.tight_layout()

plt.show()

results = run_algorithm(

start = START_DT,

end = END_DT,

initialize = initialize,

capital_base = CAPITAL_BASE,

analyze = analyze,

data_frequency = 'daily',

bundle = 'tquant_future',

trading_calendar = get_calendar('TEJ'),

)

#%% pyfolio

'''========================================================================================='''

plt.rcParams['font.sans-serif'] = ['Arial', 'Noto Sans CJK TC', 'SimHei']

plt.rcParams['axes.unicode_minus'] = False

try:

returns, positions, transactions = extract_rets_pos_txn_from_zipline(results)

# print('returns:', returns.head())

# print('positions:', positions.head())

# print('transactions:', transactions.head())

except Exception as e:

print('extract_rets_pos_txn_from_zipline error:', e)

returns = results.get('algorithm_period_return', None)

positions = None

transactions = None

if returns is not None:

print('returns (fallback):', returns.head())

benchmark_rets = getattr(results, 'benchmark_return', None)

if benchmark_rets is None and hasattr(results, 'benchmark_period_return'):

benchmark_rets = results.benchmark_period_return

if benchmark_rets is not None:

print('benchmark_rets:', benchmark_rets.head())

else:

print('No benchmark returns found!')

if returns is not None:

pf.tears.create_full_tear_sheet(

returns=returns,

positions=positions,

transactions=transactions,

benchmark_rets=benchmark_rets

)

else:

print('No returns data for pyfolio.')

#%% Summary

'''========================================================================================='''

summary_strategy = pf.timeseries.perf_stats(returns, factor_returns=benchmark_rets)

summary_benchmark = pf.timeseries.perf_stats(benchmark_rets)

summary = pd.concat([summary_strategy, summary_benchmark], axis=1)

summary.columns = ['Strategy', 'Benchmark']

summary = summary.round(4)

summary

benchmark_rets: 2020-01-02 00:00:00+00:00 0.008614

2020-01-03 00:00:00+00:00 0.000823

2020-01-06 00:00:00+00:00 -0.012970

2020-01-07 00:00:00+00:00 -0.006110

2020-01-08 00:00:00+00:00 -0.005322

Name: benchmark_return, dtype: float64

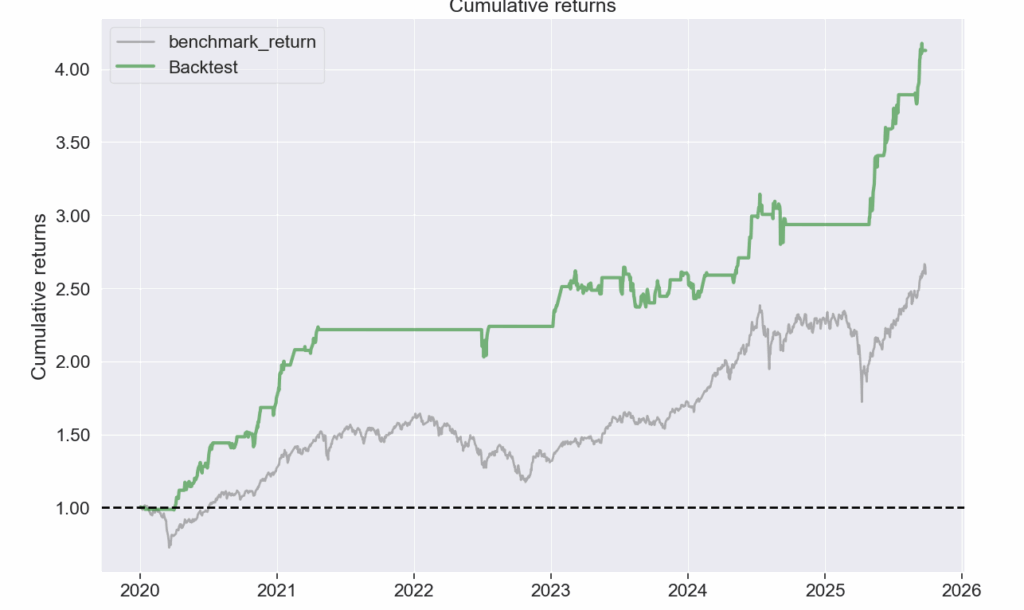

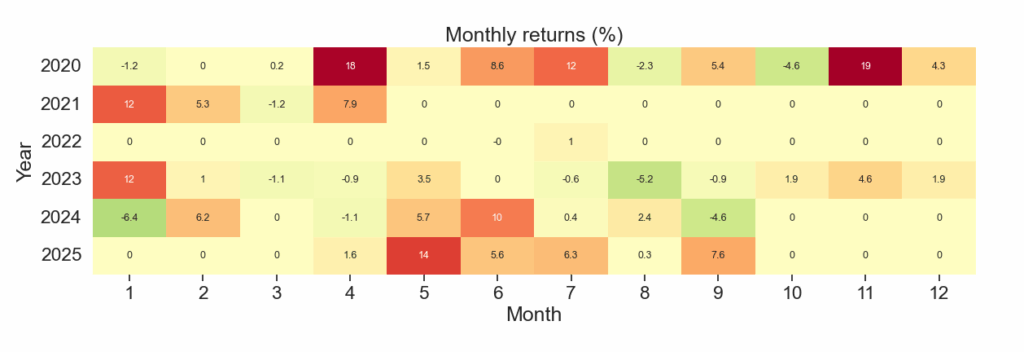

| Start date | 2020-01-02 | |

|---|---|---|

| End date | 2025-09-26 | |

| Total months | 66 | |

| Backtest | ||

| Annual return | 29.162% | |

| Cumulative returns | 312.722% | |

| Annual volatility | 13.704% | |

| Sharpe ratio | 1.94 | |

| Calmar ratio | 2.67 | |

| Stability | 0.81 | |

| Max drawdown | -10.902% | |

| Omega ratio | 1.88 | |

| Sortino ratio | 3.28 | |

| Skew | 0.54 | |

| Kurtosis | 13.65 | |

| Tail ratio | 1.96 | |

| Daily value at risk | -1.621% | |

| Gross leverage | 0.61 | |

| Daily turnover | 0.156% | |

| Alpha | 0.24 | |

| Beta | 0.28 | |

| Worst drawdown periods | Net drawdown in % | Peak date | Valley date | Recovery date | Duration |

|---|---|---|---|---|---|

| 0 | 10.90 | 2024-07-11 | 2024-09-04 | 2025-05-09 | 198 |

| 1 | 10.30 | 2023-07-14 | 2023-08-25 | 2024-05-13 | 201 |

| 2 | 9.16 | 2021-04-20 | 2022-07-06 | 2022-07-20 | 309 |

| 3 | 6.69 | 2020-10-12 | 2020-10-30 | 2020-11-06 | 20 |

| 4 | 6.09 | 2023-03-07 | 2023-07-10 | 2023-07-14 | 88 |

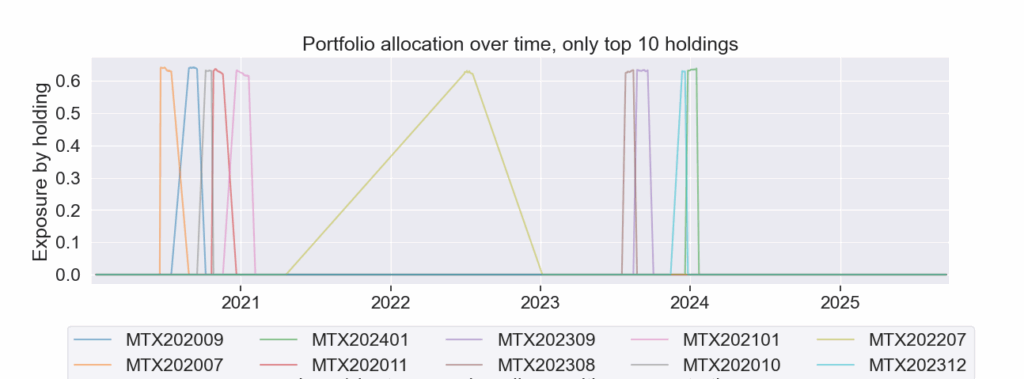

| Top 10 long positions of all time | max |

|---|---|

| sid | |

| MTX202009 | 64.14% |

| MTX202007 | 64.14% |

| MTX202401 | 63.85% |

| MTX202011 | 63.68% |

| MTX202309 | 63.38% |

| MTX202308 | 63.30% |

| MTX202101 | 63.26% |

| MTX202010 | 63.23% |

| MTX202207 | 63.08% |

| MTX202312 | 63.05% |

| Top 10 short positions of all time | max |

|---|---|

| sid |

| Top 10 positions of all time | max |

|---|---|

| sid | |

| MTX202009 | 64.14% |

| MTX202007 | 64.14% |

| MTX202401 | 63.85% |

| MTX202011 | 63.68% |

| MTX202309 | 63.38% |

| MTX202308 | 63.30% |

| MTX202101 | 63.26% |

| MTX202010 | 63.23% |

| MTX202207 | 63.08% |

| MTX202312 | 63.05% |

| Strategy | Benchmark | |

|---|---|---|

| Annual return | 0.2916 | 0.1881 |

| Cumulative returns | 3.1272 | 1.5977 |

| Annual volatility | 0.1370 | 0.1978 |

| Sharpe ratio | 1.9365 | 0.9707 |

| Calmar ratio | 2.6749 | 0.6587 |

| Stability | 0.8124 | 0.8224 |

| Max drawdown | -0.1090 | -0.2855 |

| Omega ratio | 1.8757 | 1.1919 |

| Sortino ratio | 3.2789 | 1.3591 |

| Skew | 0.5411 | -0.5698 |

| Kurtosis | 13.6454 | 8.1531 |

| Tail ratio | 1.9604 | 1.0142 |

| Daily value at risk | -0.0162 | -0.0242 |

| Alpha | 0.2355 | NaN |

| Beta | 0.2803 | NaN |

本策略以 MA3/MA10 黃金交叉為核心,加入 1.0001 緩衝減少假突破,搭配「急跌濾網」(基準 2 日跌幅≦−5% 即強平+5 日冷卻)、三段式停損與時間停損,在順勢時能放大趨勢、遇劇烈下跌能優先保本;採連續合約處理換月,提升回測與實盤一致性。優點是訊號簡潔、風控層次明確、1.8× 槓桿配合嚴格停損可穩定風險報酬;限制在於均線遲滯與盤整期易被鞭打、濾網門檻與參數對績效敏感。建議後續進行走時序與敏感度測試(MA 期間、緩衝值、濾網阈值),引入波動分層或 ADX 篩選只在趨勢期啟動,並納入成本滑價評估以強化實務可行性。

溫馨提醒,本次分析僅供參考,不代表任何商品或投資上建議。