Table of Contents

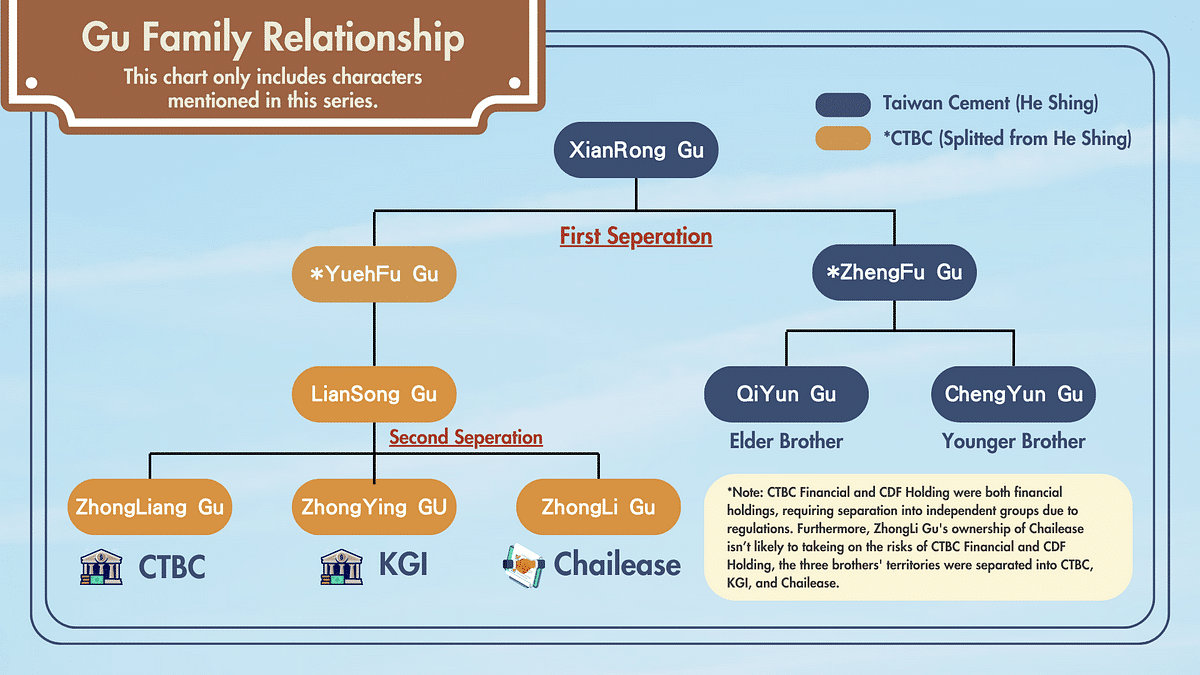

In the first story of the Gu Family separation series, we delved into the initial separations of Taiwan Cement and the CTBC Group. We provided insights into the subsequent development of the Taiwan Cement Group under the leadership of ChengYun Gu. It was highlighted that the separation of Taiwan Cement and the CTBC Group primarily occurred around May 2002 when CTBC Financial Holding was established. However, due to the majority of enterprises initially founded by the Gu family falling under the control of the group to be separated at the time of the split, TEJ traces the attribution point back to the establishment of the enterprise.

Unlike managing a traditional manufacturing industry, overseeing a vast financial landscape like the CTBC Group made Lien-Song Gu’s responsibilities far more intricate. As Lien-Song Gu entered his twilight years, he faced the phase of succession in leadership. However, Lien-Song Gu opted for a gradual approach instead of executing a complete divestment of the colossal CTBC Group. How did the Gu family’s three brothers expand their territories after the split? How did they continue to consolidate the Gu family’s dominant position in the financial sector? In this article, we will explore the second divestment of the Gu family and the subsequent development of the CTBC, KGI (CDF Holding as parent company), and Chailease groups. The timeline will narrate these three groups’ formation and development process, providing a comprehensive understanding of the Gu family’s jointly operated financial business landscape.

After the establishment of CTBC Financial in 2002, the CTBC Group began its operations centered around CTBC Financial. However, as LienSong Gu aged, he started consulting with his three sons about the prospect of separation. At this point, while CTBC had not officially split, it had already begun delineating its business territories. The eldest son, ZhongLiang Gu, acquired CTBC; the second son, ZhongYing Gu, obtained CDF Holding and Chinalife; and the third son, ZhongLi Gu, focused on managing Chailease.

In December 2008, ZhongYing Gu took control of CDF Holding. As both CTBC Financial and CDF Holding were financial holdings, and regulations required each financial holding to establish its group, they were split into independent groups. On the other hand, ZhongLi Gu’s ownership of the Chailease Group did not align with TEJ’s separation rules. However, since it was improbable for Chailease to assume the risks of both the financial businesses of CTBC Financial and CDF Holding, the territories of the three brothers were eventually separated into three independent groups: CTBC, KGI, and Chailease.

Among the three brothers, except for ZhongLiang Gu inheriting control of CTBC, the other two brothers needed to utilize resources originally belonging to CTBC to gain control. Therefore, the separation of the three brothers occurred at different times when each obtained control of their respective companies. This resulted in different timing for the split of each company. This article will only provide an explanation of the development process of CTBC and KGI from 2000 to 2010:

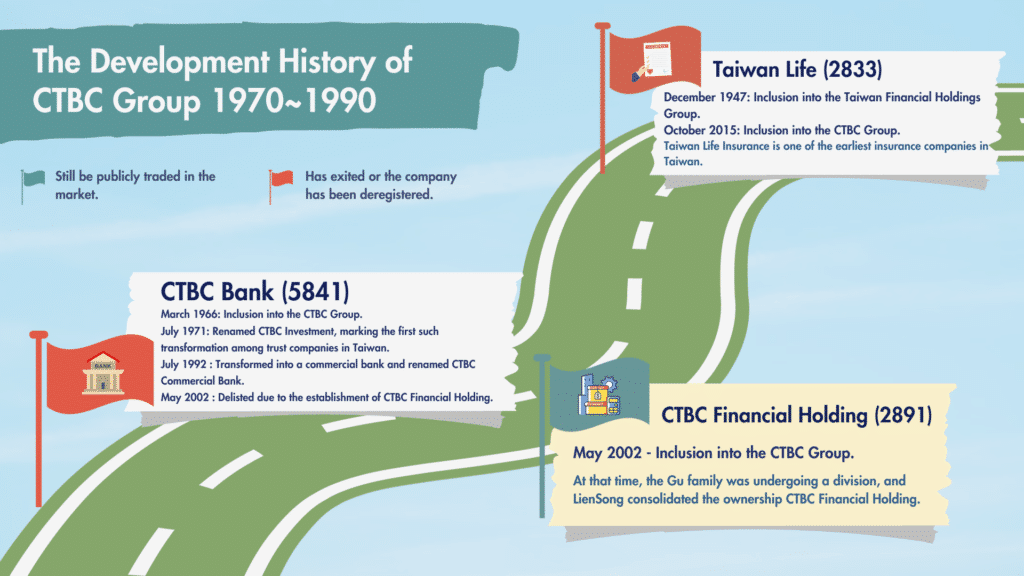

In 2001, as the government passed the Financial Holding Company Act, the Gu family was undergoing separation. LienSong Gu, involved in the financial sector, concentrated the equity of his affiliated companies and integrated various financial businesses. On May 17, 2002, CTBC Financial Holding Co., Ltd. was established and listed on the same day.

As of March 2002, according to TEJ, the CTBC Group held approximately 17% of the shares, securing 6 out of 7 board seats, with LienSong Gu as the chairman. Therefore, TEJ considers May 2002, the establishment date, as the point of inclusion into the CTBC Group.

China Trust Commercial Bank Co., Ltd. was initiated by ZhengFu Gu in March 1966. At its establishment, the company was named Chinese Securities and Investment Company, primarily engaged in underwriting securities, securities trading, and other investment businesses. In July 1971, it was reorganized into a trust and investment company, thus renamed China Trust Investment Company. In December 1991, it went public, becoming the first trust and investment company listed in Taiwan. In July 1992, it transformed into a commercial bank and was again renamed China Trust Commercial Bank Co., Ltd. In May 2002, it was delisted due to the establishment of CTBC Financial Holding.

As of TEJ’s earliest data in April 1996, the CTBC Group held approximately 15% of the shares, surpassing Taiwan Cement Group’s 8%, making it the largest shareholder. The CTBC Group secured 4 out of 8 board seats, with LienSong Gu as the chairman. Therefore, TEJ considers March 1966, the establishment date of Chinatrust Commercial Bank, as the point of inclusion into the CTBC Group.

Founded in December 1947 with investments from state-owned banks and public funds, Taiwan Life Insurance Co., Ltd. stands among the earliest insurance companies in Taiwan. 1998, it underwent privatization and became a publicly-traded entity in October 1997. However, it was delisted in October 2015 due to a merger, making it a 100% subsidiary of CTBC Financial Holding.

As of data from April 1997, the government, primarily through the Bank of Taiwan, held approximately 98% of Taiwan Life Insurance’s shares, occupying all seven board seats. Hence, TEJ marks December 1947, the establishment date of Taiwan Life Insurance, as its inclusion into the Taiwan Financial Holdings Group.

With relatively small capital before privatization, Taiwan Life Insurance attracted various stakeholders. In 1999, Long Bon joined forces with companies, securing over half of the ownership. Additionally, Long Bon engaged in extensive communications with TeCheng Chiu and the Ministry of Finance, ultimately gaining regulatory approval.

In August 1999, following the resignation of the chairman of the Bank of Taiwan, TeCheng Chiu temporarily assumed the position. In October 1999, a board election resulted in Long Bon holding approximately 25% of Taiwan Life Insurance’s shares and obtaining 4 out of 7 board seats, effectively gaining operational control. TEJ identifies August 1999, when the government relinquished the chairman position, as the inclusion point into the Long Bon Group.

In July 2013, CTBC Financial Holding was invited to assess a merger with Taiwan Life Insurance. The two parties agreed to merge Taiwan Life Insurance into CTBC Financial Holding through a 1-for-1.44 stock swap. However, amid a dispute over the management rights of Long Bon involving GoBo Group’s chairman, KuoRong Chu, the merger deal underwent changes. PingYu Chu, Long Bon’s founder, gave up the chairman position at Taiwan Life Insurance and became a resident director.

In March 2015, GoBo Life Insurance was taken over, leading Chu PingYu to approach CTBC Financial Holding again to discuss the merger. It was ultimately completed in October 2015 through a 1-for-1.6129 stock swap mechanism.

At this juncture, Taiwan Life Insurance became a 100% subsidiary of CTBC Financial Holding. TEJ designates the merger date in October 2015 as the inclusion point into the CTBC Group.

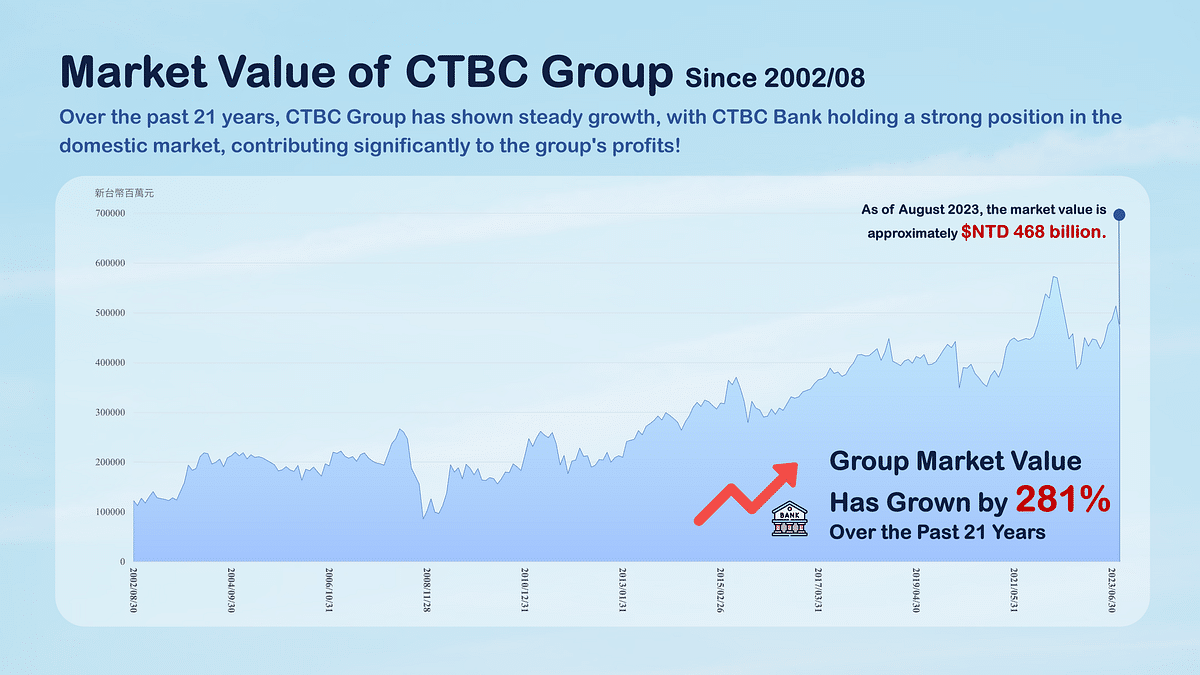

Read More: Long Bon Takes Control! Resolution of Taishan’s Long-standing Management Dispute

Looking back at the development of the CTBC Group, when facing the second division of the Gu family, LienSong Gu decided to pass on the operational control of the core company, CTBC Group, to his eldest son, ZhongLiang Gu. Despite ZhongLiang Gu stepping down from the management of CTBC Financial Holding in 2004, CTBC Group’s market value continued to grow significantly, with a growth rate of 281%. Although it cannot outperform the performance of Taiwan Cement Group mentioned earlier, for CTBC Group, the position of its financial businesses in the Taiwanese financial industry is the most significant achievement in over a decade. Among these, its Bank stands out, as its advertising slogan, “We are family,” remains deeply ingrained in the memories of the Taiwanese people.

Looking back to 1966, CTBC Group’s core enterprise, CTBC Bank, was established during a period of robust economic growth in Taiwan. The Gu family quickly transformed CTBC Bank into a well-known financial brand in Taiwan. In 2003, becoming Taiwan’s largest privately-owned bank, CTBC Bank continued to acquire other banks, expanding its operational scale. To this day, whether in terms of combined assets, profits, Tier 1 capital, customer numbers, and other indicators, CTBC Bank still ranks first among all banks in Taiwan, making it a crucial piece of the entire group’s puzzle. In the future, despite the downturn in the short term, Chinatrust Group is expected to continue solidifying its position as Taiwan’s leading financial institution.

Want to Learn More?

Check Out Our Comprehensive data on Corporate Governance!

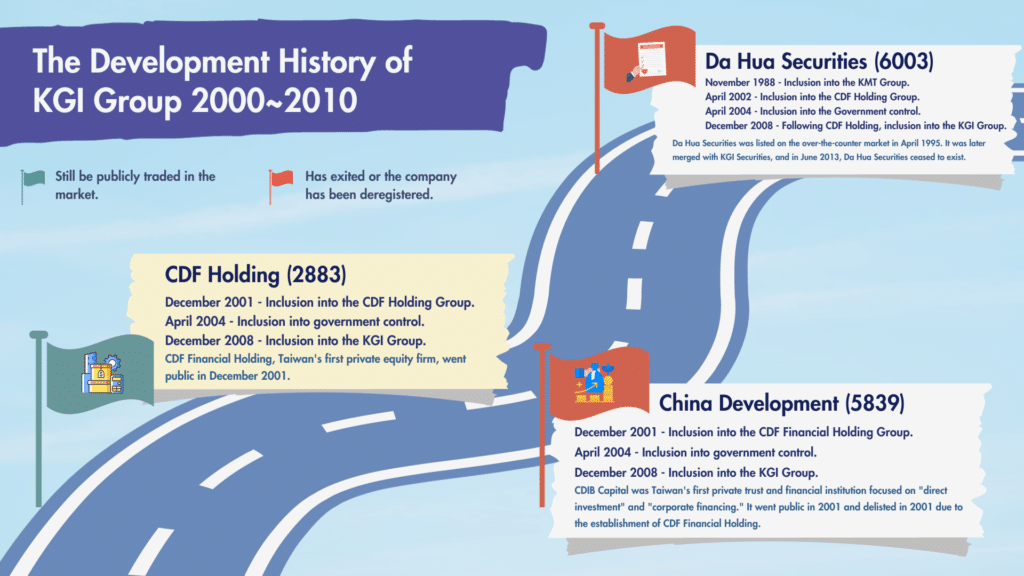

After covering the development journey of the CTBC Group, the next will delve into the development history of the KGI Group, which the second son, ZhongYing Gu, inherited.

In 1995, spurred by the Economic Stabilization Commission of the Executive Yuan and the World Bank, Chung Hua Development Trust & Investment Corporation was founded, becoming Taiwan’s first privately owned venture capital institution. 1999, it was restructured into Chung Hua Development Industrial Bank Co., Ltd. Then, in December 2001, following the enactment of the Financial Holding Company Act, Chung Hua Development Industrial Bank transformed into Chung Hua Development Financial Holding Co., Ltd. The company was listed on the stock exchange on the same day.

TEJ’s earliest data in September 2002 showed that the chairman was TaiYing Liu. With government-owned shares backing the operations team, they held 3 out of 19 board seats, maintaining control. Therefore, TEJ considers its establishment in December 2001 as the point of inclusion in the Development Financial Holding Group.

2003, TaiYing Liu was detained due to alleged involvement in a national security case, and MinHsun Chen took over as chairman. ZhongYing Gu saw potential in CDF Holding and, with the 1 billion provided by LienSong Gu and funds from his own CTBC Securities, China Life, and National Chiayi University, carried out a surprise attack. Within six months, they acquired approximately 6% of CDF Holding’s shares, collaborating with government-owned shares, and successfully secured control.

In April 2004, a board election was held. Public shares held around 6.8%, gaining all six seats out of 19. CTBC Group held approximately 5.3%, similarly securing six seats. MuChai Chen represented Mega International Commercial Bank as chairman. TEJ thus considers April 2004 as the point of inclusion under government control.

When collaborating with government-owned shares, ZhongYing Gu and the government negotiated for the chairman’s seat to go to the government while ZhongYing Gu held the general manager position. After the board election, Minister of Finance Lin Chuan laid out specific conditions. If CTBC’s ownership increased to 20%, the government shares would exit, allowing the Gu family to truly control CDF Holding, with the stipulation that they use their funds.

In December 2008, during a board election, the Gu family controlled approximately 16.3% of shares and secured 7 out of 11 board seats. The chairman was represented by MuChai Chen of KGI Securities. Due to the requirement for financial holdings to form distinct groups, TEJ considers the December 2008 board election as the point of inclusion into the KGI Group.

In the 1950s, as Taiwan’s economy grew, a need for a long-term capital source emerged for domestic enterprises. With the World Bank’s support, Chung Hua Development Trust & Investment Corporation was founded in May 1959, becoming Taiwan’s first privately-owned trust and financial institution focused on “direct investment” and “corporate financing.”

Within just three years, in 1962, Chung Hua Development Trust was already listed on the stock exchange. In August 1998, it transformed into a commercial bank and became Chung Hua Development Industrial Bank Co., Ltd. On December 28, 2001, CDIB Financial Holding Co., Ltd. was established, making Chung Hua Development Industrial Bank a 100% subsidiary.

Later, in May 2015, CDIB Capital shifted towards venture capital by transferring certain operations to KGI Bank. In March 2017, it rebranded as CDIB Capital Co., Ltd., focusing on venture capital, equity management, and private placement fundraising.

Chung Hua Development Trust initially had the government and KMT party-owned enterprises involved. As of May 1997, the government held around 9.6% of shares and secured 5 out of 20 board seats. KMT party-owned enterprises held 3.8% of shares but obtained eight board seats. TEJ recognizes May 1959 as the inclusion date into the KMT Group.

In December 2001, CDIB Capital became a 100% subsidiary of CDF Financial Holding. It later came under government control in April 2004 and became part of the KGI Group in December 2008.

In compliance with the “Securities Broker Establishment Standards” issued by the government in May 1988, the KMT promptly established Da Hua Securities Co., Ltd. in November 1988. Da Hua Securities became a 100% subsidiary of CDF Holding through a stock swap in November 2002, leading to its delisting. In June 2013, as part of CDF Financial Holding’s efforts to consolidate its securities businesses, Da Hua Securities merged with KGI Securities, effectively dissolving Da Hua Securities.

As of the earliest data available in August 1996, the KMT Group held around 34% of the shares, making it the largest shareholder, and secured 4 out of 11 board seats. It was chaired by HungAo Lee. TEJ recognizes November 1988 as the inclusion date into the KMT Group.

In 2000, the KMT lost political power and began handling party assets. According to data from April 2002, Chung Hua Development Industrial Bank acquired nearly 62% of Da Hua Securities’ shares in April 2002 and obtained two board seats out of 61. ChengHsiung Chiu represented Chung Hua Development Industrial Bank as chairman. Hence, TEJ considers April 2002 as the inclusion date into the CDF Holding Group.

In November 2002, Da Hua Securities became a 100% subsidiary of CDF Holding through a stock swap. As a subsidiary holding 100% of CDF Holding’s shares, it came under government control in April 2004. In December 2008, it followed CDIB Financial Holding into the KGI Group.

In the following article, we will continue to explore the attribution process of the KGI Group and the Chailease Group led by ZhongLi Gu, comparing the development scenarios of the three Gu brothers to see which group experienced the highest growth after the separation!

Related Article

Get Access to Our Ultimate Database!

If you have any questions about this article or want to obtain further access to the TEJ database, please feel free to leave a comment, call, or mail us.

TEJ, with nearly 20 years of experience in corporate governance recognition, provides a consistent and verifiable basis for identifying the ultimate controllers of groups. By incorporating the TCRI (Taiwan Corporate Credit Rating Index), which has nearly 30 years of company credit rating data, TEJ introduces a quantified model to unveil the credit risk levels of these groups.

Through TEJ GCRI Index, you can access information about the affiliation of each company to its respective group, inclusion and withdrawal dates, and reasons for such actions. Additionally, comprehensive annual financial data and group credit risk levels (GCRI) are available for each group. For more information, please refer to TEJ Credit Risk Solution!

About us

⭐️ TEJ Website

⭐️ LinkedIn

✉️ E-mail: tej@tej.com.tw

☎️ Phone:+886–2–87681088