Table of Contents

In the previous article, we traced the expansion of the KGI Group during the period from 2000 to 2010. This article will continue to explore the development of the KGI Group since 2011 and also introduce a unique group corporation within the Gu family — the Chailease Group. In contrast to the financial businesses of the CTBC and KGI Groups, Chailease operates in the leasing industry. What makes its development distinctive? In this article, we will delve into the origins and growth of the Chailease Group.

Finally, we will compare the domains of the Gu family, specifically Taiwan Cement Corporation and the three Gu brothers. We will examine their achievements after venturing into different territories. This comparison will help shed light on which family member has achieved the most remarkable success in this competitive journey of the Gu family. By delving into this comprehensive comparison, you can learn more about the performance of Gu family members in various conglomerates and further understand the significance of the Gu family’s footprint in Taiwan’s industry today!

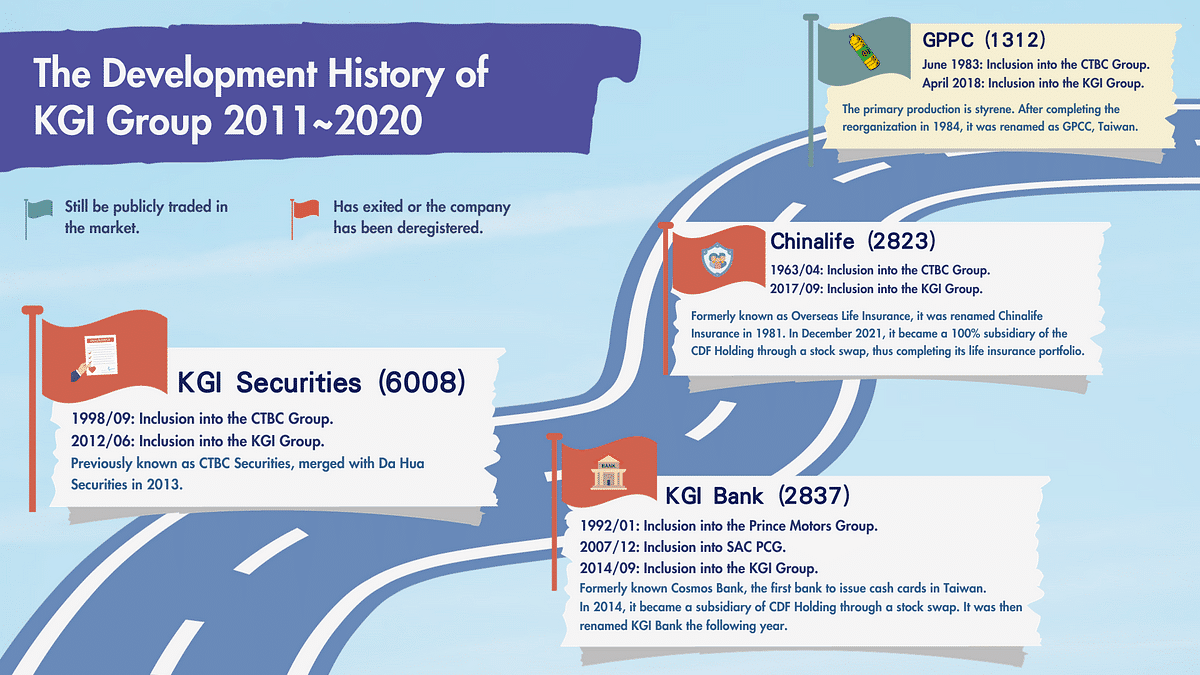

In May 1988, the government established the “Securities Broker Establishment Standards,” officially regulating the standards for setting up securities firms. Under the umbrella of CTBC, the Gu family established CTBC Securities Corporation in September 1988. In April 1993, it went public on the OTC market but became a 100% subsidiary of KGI Financial Holding through a stock swap in January 2013, thus delisting.

In 1997, CTBC Securities started to enter the Hong Kong market through its overseas investment companies. To avoid a name conflict with China CITIC Securities in Hong Kong, they began using the name KGI Securities in Hong Kong. They adopted the same name in their subsidiaries in Thailand and South Korea. In 2003, CTBC Securities renamed itself China Trust Securities Corporation, and to differentiate itself from the new entity, it began using KGI Securities in Taiwan. In 2008, CTBC Securities officially changed its name to KGI Securities to enter the Chinese market.

Based on data available as of June 1996, the Gu family held approximately 65.5% of the shares and secured 2 out of 5 board seats. HeYong Yan served as the chairman of ZhongCheng Development Investment. As mentioned earlier, when enterprises founded by the Gu family are split, the point of inclusion is typically traced back to the establishment of the enterprise. Therefore, we consider September 1988 when CTBC Securities was included in the CTBC Financial Group.

In 2004, shortly after taking over as the Chairman of KGI Financial Holding, ZhongYing Gu expressed his intention to acquire KGI Securities. However, he was accused of self-dealing, as he also served as the General Manager of KGI Securities at the time, which led to him discontinuing the acquisition. In June 2012, as part of the integration of CTBC and KGI Securities businesses, CDF Holding acquired 80% of KGI Securities using a combination of cash and shares, setting a record as the highest acquisition amount in the history of the securities industry, amounting to NT$54.6 billion. In June 2013, KGI Securities further merged with Dahua Securities, leading to the dissolution of Dahua Securities in June 2013.

As the acquisition of 80% of KGI Securities by CDF Holding was completed in June 2012, we consider this point as the inclusion of KGI Securities in the KGI Financial Group.

In 1987, the political landscape changed in Taiwan, and in response to market-opening demands, the government revised the Banking Act in 1989, establishing new privately-owned banks. In 1990, Prince Motor’s founder, ShengFa Hsu, formed Cosmos Bank. The company obtained an operating license in January 1992. It was listed on the OTC market in August 1995 and transitioned to the stock exchange in June 1998.

Based on data available as of March 1998, the Prince Motor Group held approximately 26% of the shares and secured 10 of 15 board seats. ShengFa Hsu served as the Chairman. Therefore, we consider January 1992 when Cosmos Bank was included in the Prince Motor Group.

In 1999, Cosmos Bank introduced the cash card service to Taiwan, issuing the country’s first cash card. However, the “Double Card Storm” occurred as other banks aggressively lowered the application thresholds for credit cards and cash cards to boost cardholder numbers. This led to a rapid deterioration of the quality of loan portfolios due to a surge in delinquent accounts, and Cosmos Bank was adversely affected. In January 2006, Cosmos Bank came under the management supervision of the Financial Supervisory Commission (FSC) due to insufficient net assets, and ShengFa Hsu withdrew from the bank’s operations.

To improve its capital structure, in June 2005, Cosmos Bank conducted a private placement to raise capital. In January 2006, it signed a share subscription contract with GE Capital Taiwan Holdings Corporation (GECT). GECT subscribed to about 197 million new shares of Cosmos Bank, with a total value of approximately NT$2.76 billion, acquiring approximately 10% of Cosmos Bank’s equity. Concurrently, Cosmos Bank tailoredly issued NT$6.25 billion of convertible corporate bonds for GECT. To share the risks, GECT introduced S.A.C. PEI Asia Investments Holdings II S.à r.l. (SAC). SAC required the financial institutions, including CDF Holding and ShinKong Financial Holdings, to convert their Cosmos Bank debt holdings of about NT$13.25 billion into approximately 11.5% of Cosmos Bank’s equity. As CDF Holding and ShinKong Financial Holdings faced significant losses with the debt conversion, they initially resisted. Eventually, after mediation and pressure from the FSC, they reluctantly accepted the terms.

In December 2007, during a change of board members, GE Capital took a 51% stake but did not secure operational control. They gained two board seats, while foreign investor SAC PCG obtained four board seats, including the chairman, William Xia. Using the number of board seats as the primary criterion, we consider December 2007 as the point when SAC PCG was included.

In 2014, CDF Holding planned to transform the China Development Industrial Bank into a pure venture capital company. However, to facilitate this transformation, they needed to separate China Development Industrial Bank’s corporate finance and financial market business to other banks. To accomplish this, CDF Holding targeted Cosmos Bank in September 2014. In January 2015, CDF Holding, with a cash offer of NT$13.4 per share and 0.2 new shares, acquired 100% of Cosmos Bank’s equity, totaling approximately NT$23 billion. It became a 100% subsidiary of CDF Holding and subsequently delisted. In January 2015, Cosmos Bank was renamed KGI Commercial Bank. In May 2015, CDF Holdings transferred the corporate finance and financial market business of China Development Industrial Bank to KGI Commercial Bank.

As the acquisition of 100% of KGI Commercial Bank by CDF Holding was completed in September 2014, we consider this point as the inclusion of KGI Commercial Bank in the KGI Financial Group.

In April 1963, Overseas Life Insurance Co., Ltd. was initiated by overseas Chinese in the Philippines. In September 1974, it underwent a reorganization, with China Trust Investment Co. becoming involved in its operations. At that time, ZhengFu Gu took on Chairman, and LienSong Gu assumed the position of General Manager. The company was renamed Chinalife Insurance Co., Ltd. in 1981. It went public in February 1995 and became a 100% subsidiary of CDF Holding through a stock-swap in December 2021, subsequently delisting from the stock exchange.

Based on data available as of April 1998, the Gu family held approximately 53% of the shares and secured all 5 board seats. ZhengFu Gu served as the Chairman. Due to the considerable passage of time, it was impossible to access data from the time of the initial establishment. Therefore, TEJ regards the inclusion of Chinalife Insurance in the Gu family as dating back to its establishment in April 1963. Since, in the case of the Taiwan Cement and CTBC splits, the inclusion point is typically traced back to the time of the enterprise’s founding, TEJ uses April 1963 as the point of inclusion in the CTBC Group.

After the first family division, without a life insurance business within KGI Group, ZhongYing Gu led the charge to acquire Chinalife Insurance Co., Ltd. As a result, in September 2017, CDF Holding conducted a public tender offer to receive approximately 25% of Chinalife Insurance’s shares. In December 2021, CDF Holding successfully acquired all of the shares of Chinalife Insurance Co., Ltd., making it a 100% subsidiary of CDF Holding.

During the supplementary board election in October 2017, KGI Group held approximately 35% of the shares of Chinalife Insurance Co., Ltd., securing 3 out of the six board seats. MingYang Wang was appointed Chairman, representing CDF Holding. Due to the considerable passage of time, accessing data from the initial establishment was impossible. Therefore, TEJ uses the point in September 2017, when the share acquisition was completed, as the inclusion point for Chinalife into the KGI Group. Subsequently, in April 2023, the board of Chinalife approved a change of its name to “KGI Life Insurance Co., Ltd.”

Read More: CTBC (2891. TW) & CDF Holding (2883. TW): The Gu Brothers Expanding Respective Business!

GPPC was initially founded as Da De Chang Petrochemical Company by BoYing Zhang in September 1973, with a primary focus on the production of styrene. In 1982, due to the impact of the second oil crisis, the company applied for corporate reorganization. This process was completed in 1984, and the company was renamed GPPC. During the restructuring, the Gu family assumed control, with LienSong Gu serving as the chairman. GPPC was subsequently listed on the stock exchange in December 1988.

Based on data available from TEJ as of September 1997, the Gu family held approximately 34% of the company’s shares, making them the largest shareholders. They also occupied four out of seven seats on the board of directors. At that time, ChungTai Wu served as chairman, representing ZhongGuan Investment. Although there is no available data regarding the period before the corporate reorganization, in June 1983, China Trust Investment Co., Ltd. began serving as the company’s reorganization manager. As a result, TEJ uses June 1983 as the reference point to include GPPC as part of the CTBC Group.

One of the board members of GPPC is a company called Jing Guan Investment, registered in the British Virgin Islands as “Prime Bridge International Limited.” It is unclear who the ultimate beneficial owner of Jing Guan Investment is, but JinLong Zhen serves as its chairman. JinLong Zhen is closely associated with ZhongYing Gu, having been promoted by ZhongYing Gu during his time at KGI Securities. It is reasonable to assume that ZhongYing Gu controls Jing Guan Investment. In December 2008, ZhongYing Gu was in the KGI Group, which led to Jing Guan Investment being included in the KGI Group. While the market commonly associates GPPC with ZhongYing Gu, it’s important to note that he holds only 12% of the company’s shares and occupies just one seat on the board of directors.

In April 2018, ChungTai Wu stepped down as chairman, and PinZheng Yang, representing Jing Guan Investment, assumed the position of chairman. The KGI Group acquired operational control of GPPC. TEJ uses April 2018 as the reference point to include GPPC in the KGI Group.

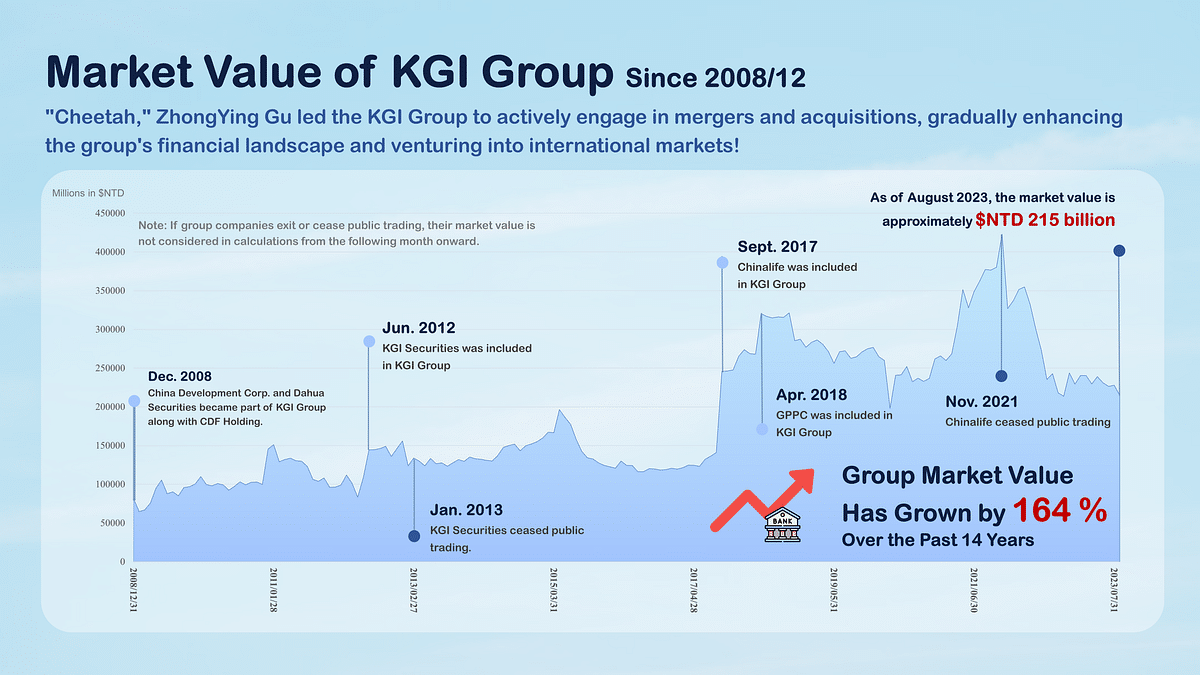

Under the leadership of ZhongYing Gu, the KGI Group, while not as large as his older brother ZhongLiang Gu’s CTBC Group, has achieved remarkable market cap growth of 164% in recent years. Looking back at the group’s history of mergers and acquisitions, in 2001, ZhingYing Gu successfully acquired a company with total assets exceeding a billion dollars with an investment of approximately 10 billion NTD, earning him the nickname “Cheetah.” Subsequently, CDF Holdings transformed from an industrial bank into a commercial bank, successfully merging with Cosmos Bank to the current KGI Bank. Finally, the group completed its financial puzzle by entering the life insurance sector and taking control of GPPC, Taiwan, a significant player in the petroleum industry.

ZhongYing Gu’s fast, fierce, and precise decision-making style, coupled with a global perspective, has enabled the KGI Group to experience substantial growth in market cap and has led CDF Holding to expand its international presence. Despite encountering hostile takeovers and legal issues throughout this journey, KGI’s history of mergers and acquisitions has only strengthened its competitiveness in the financial sector, firmly establishing the Gu family’s position in the industry.

Looking forward, KGI Group remains unpredictable. ZhongYing Gu has consistently proven to be a dynamic and unpredictable figure. Nevertheless, KGI Group will not stop here and will continue to expand its footprint!

Want to Learn More?

Check Out Our Comprehensive data on Corporate Governance!

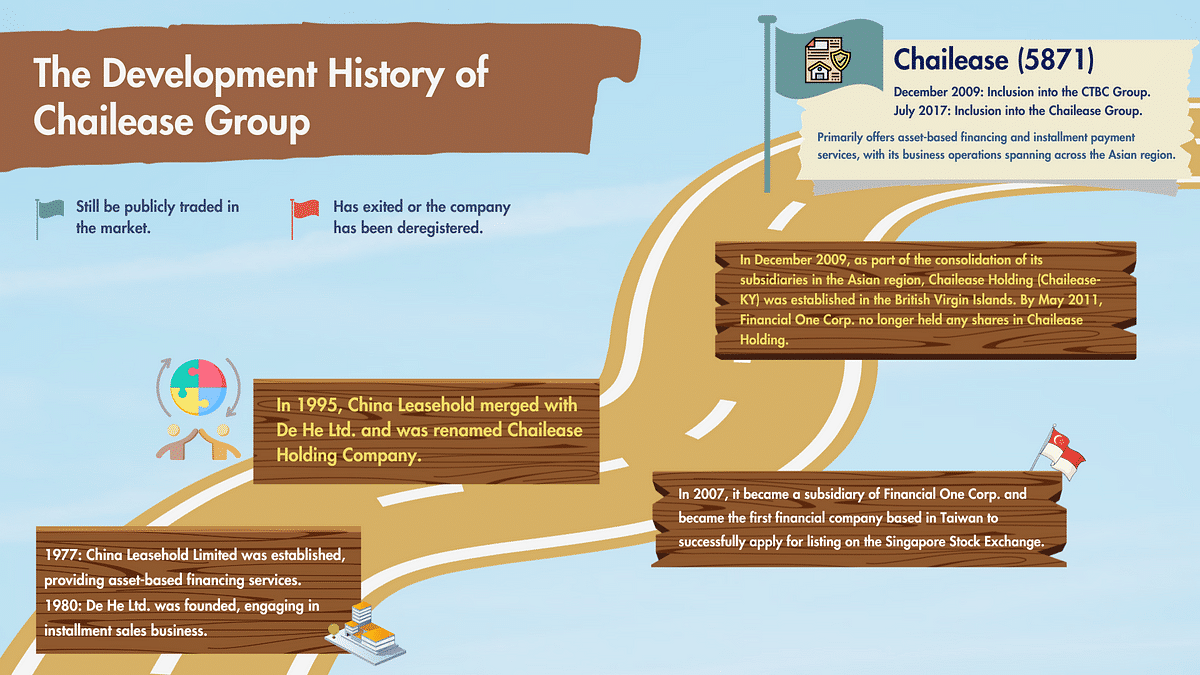

After discussing the development of the CTBC and KGI groups, let’s look at the Chailease Group led by the third brother of the Gu family, ZhongLi Gu. Within the Gu family’s financial landscape, Chailease operates in the leasing industry, primarily focusing on assisting small and medium-sized enterprises in overcoming financing challenges. Interestingly, this complements his brothers’ businessesin the CTBC and KGI groups. So, how did the Chailease Group rise to prominence?

In 1977, China Leasing Corporation was established in Taiwan, providing asset-based financing services. In 1980, De He., Ltd. was founded, specializing in installment sales. To enhance competitiveness with significant multinational leasing and financial companies from abroad, China Leasing merged with De He. Ltd. in 1995, establishing Chailease Holdings Co., Ltd.

In 2007, Chailease Holdings Co., Ltd. became a subsidiary of Financial One Corp. after a 100% equity conversion. Financial One Corp. successfully listed on the Singapore Stock Exchange in July 2007, becoming the first financial company based in Taiwan.

In December 2009, Chailease Holdings Limited was established in the Cayman Islands to consolidate subsidiary companies across the Asian region. In April 2011, Financial One Corp. was delisted from the Singapore Stock Exchange and repurchased its shares from shareholders in May of the same year, using Chailease Holdings’ equity as consideration. Financial One Corp. no longer held any shares in Chailease Holdings.

According to data from TEJ as early as May 2011, the CTBC Group held approximately 5.7% of the shares. Although the majority of this 5.7% shareholding was held by ZhongLi Gu himself, the presence of LienSong Gu at that time meant that some risk was still associated with the group. Therefore, Chailease Holdings is considered to have been integrated into the CTBC Group in December 2009 when it was established.

However, the risk associated with LienSong Gu was alleviated when he passed away in December 2012. Only in July 2017, during re-election, that ZhongLi Gu was appointed director by a private investment company. At this time, ZhongLi Gu’s Chailease Group held about 7.7% of the shares and gained control over all six board seats, with FengLung Chen as the chairman.

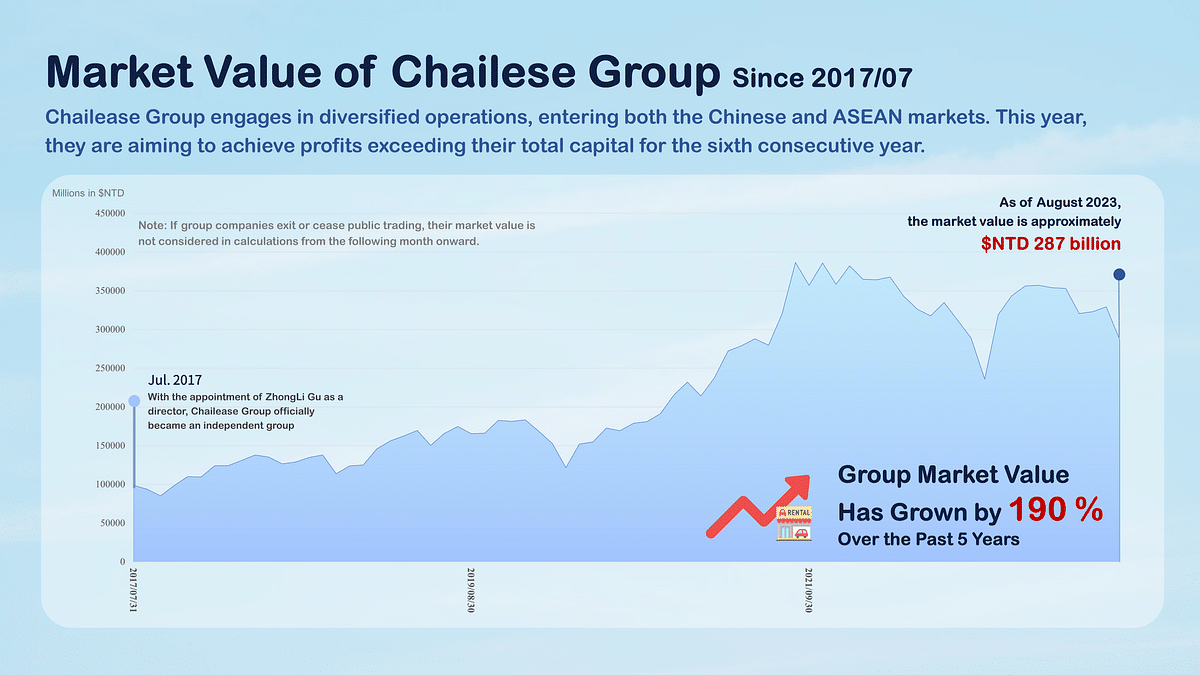

Compared to his brothers’ CTBC Group and KGI Group, Chailease Group operates in a more diversified range of sectors. In addition to asset leasing, it is involved in consumer finance, solar power plants, insurance brokerage, and more. These have all contributed to the diversified growth of Chailease Group. In recent years, Chailease Holdings has actively expanded into the ASEAN market, enlarging its investments and leasing business. ZhongLi Gu, with his extensive network and proactive joint venture strategies, has successfully led the company into diverse needs, rapidly establishing local businesses. Over the past five years, Chailease Holdings has achieved an impressive 190% growth in market value. This is the most outstanding growth of the three brothers’ respective groups during the same period.

When reviewing the history of Chailease Group, it becomes evident that the company does not expand its group members as actively as the other two financial groups. Instead, it relies on Chailease Holdings to elevate the group’s market value, creating a powerful kingdom in cross-border leasing. In recent years, in the backdrop of the global pandemic, Chailease Holdings has achieved consistent profits surpassing its capital for five consecutive years, demonstrating its resilience in challenging times. Looking ahead, even though it was affected by economic headwinds in China in 2023, Chailease is expected to continue achieving profits exceeding its capital this year, maintaining its dominant position in the leasing industry under the name of the Gu family. It may even surpass other financial enterprises in terms of market value.

From the example of the Gu family’s separation, it can be observed that due to significant losses incurred by QiYun Gu, LienSong Gu explicitly expressed his unwillingness to bear the losses. Consequently, ZhengFu Gu, acting as an elder, negotiated the division of the Gu family’s business empire, resulting in the formation of two separate groups: Taiwan Cement Group and CTBC Group, marking the first separation of the Gu family. This first separation aligns with TEJ’s hypothesis regarding the family transformation process, as the Gu family, not wanting to sever ties within the family completely, opted for a negotiated separation to prevent the depletion of family resources in internal conflicts. While family members were not as cooperative as before, they achieved commendable results in developing their respective business territories.

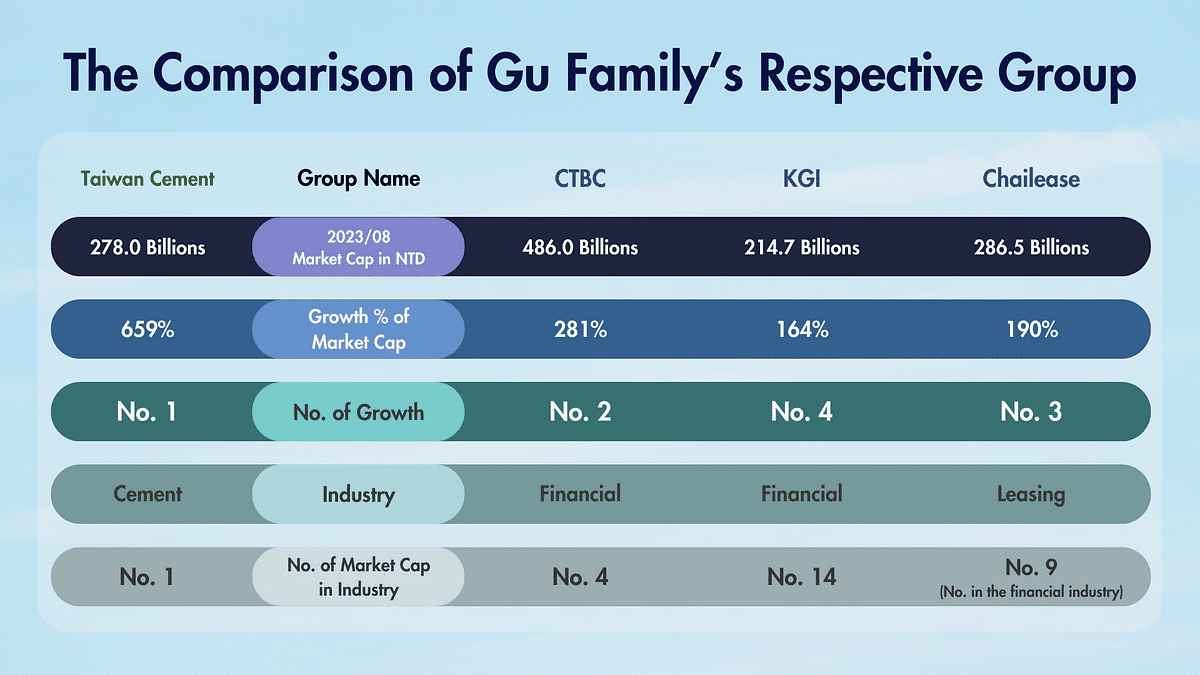

According to the table provided, after the first separation of the Gu family into the CTBC and Taiwan Cement Groups, the Taiwan Cement Group saw a remarkable 659% increase in market value. In comparison, the CTBC Group experienced a growth rate of 281%. Both groups underwent significant growth over these 21 years in terms of market value growth, with Taiwan Cement’s growth rate being more than twice that of CTBC. Looking at these growth rates, the Taiwan Cement Group, inherited by ZhenFu Gu, ChengYun Gu, and QiYun Gu, successfully realized two objectives: expanding internationally and transitioning from the traditional cement industry. This success ensured that Taiwan Cement was not left behind by the times.

Subsequently, after LienSong Gu experienced the first separation of the family, he recognized the importance of settling the family assets during his lifetime to avoid family property disputes. Therefore, after consulting his three sons, he divided the business territories and initiated the second separation. According to TEJ’s rules for family transformations and splitting of family groups, this second separation process was similar to the first separation in that it did not involve any family members turning against each other. Instead, it was directly orchestrated by the elder, LienSong Gu, who delineated the territories.

However, upon closer examination of the divided business territories, the ownership of the companies was still controlled by investment companies under LienSong Gu’s name, ensuring that he retained substantial control. For instance, GPID and Beacon Hill Co., Ltd. controlled the shareholdings and chairman positions of Chailease. Similarly, investment companies like ZhongGuan Investment, Laibu Investment, and HeWei Investment controlled the shareholdings and chairman positions of the companies managed by ZhongYing Gu. Ultimately, these investment companies were owned by the Yen family or LienSong Gu. Therefore, the second division of the business territories before LienSong Gu’s passing resulted in a situation where control was not relinquished. Yet, operational control had shifted (with the sons serving as general managers of their respective businesses). If assessed based on shareholding and control positions, TEJ couldn’t justify a formal group split. However, as ZhongYing Gu acquired the Development Bank, it legally required a separate division into another group. On the other hand, considering the risks associated with each group, Chailease Group was unlikely to assume the risks of both CTBC and CDF Holdings. Therefore, the decision was made to split the three brothers into three independent groups.

The second split, the separation of CTBC Group, allowed each of the three brothers to have business territories that could develop independently. As indicated by the growth rates in the table, the other two groups — KGI Group, with a growth rate of 164%, and Chailease Group, with a growth rate of 190% — demonstrated significant growth. Although the periods and the complexity of each group’s businesses were not entirely comparable, the industry rankings in the table also indicate that CTBC and KGI Group held a prominent position in the Taiwanese financial sector. Furthermore, if we consider Chailease part of the financial industry, its market value ranks ninth (surpassing KGI Group). While the market value growth of these three groups may not be as impressive as that of Taiwan Cement Group, the Gu family’s status in the financial sector remains prominent, and their future development is still worth observing.

In conclusion, family groups may only divide business territories after undergoing family transformation. However, the decision to split into separate groups depends on the determination of shareholding and control positions and whether family members will support each other and share risks. If they do, the groups should be considered part of the same entity. If not, and if they meet the conditions for separation, the groups can be formally split.

Want to know more?

TEJ, with nearly 20 years of experience in corporate governance recognition, provides a consistent and verifiable basis for identifying the ultimate controllers of groups. By incorporating the TCRI (Taiwan Corporate Credit Rating Index), which has nearly 30 years of company credit rating data, TEJ introduces a quantified model to unveil the credit risk levels of these groups.

Through TEJ GCRI Index, you can access information about the affiliation of each company to its respective group, inclusion and withdrawal dates, and reasons for such actions. Additionally, comprehensive annual financial data and group credit risk levels (GCRI) are available for each group. For more information, please refer to TEJ Credit Risk Solution!

If you have any questions about this article or want to obtain further access to the TEJ database, please feel free to leave a comment, call, or mail us.

About us

⭐️ TEJ Website

⭐️ LinkedIn

✉️ E-mail: tej@tej.com.tw

☎️ Phone: +886-2-87681088