Table of Contents

Over the past decades, quantitative investing has evolved from academic theory into a core pillar of modern investment management. Foundational models such as CAPM, APT, and the Fama-French multifactor framework have shaped how investors identify and quantify systematic return drivers—known as factors. These factors have since been embedded into institutional workflows, powering everything from alpha generation to portfolio construction and risk management.

However, the proliferation of factors—often inconsistently defined or statistically fragile—has given rise to what researchers call the “factor zoo.” This phenomenon underscores the urgent need for structured, high-quality data and disciplined implementation frameworks.

TEJ’s Factor Library was created in response to these challenges. It offers a robust, point-in-time (PIT) database featuring more than 100 academically grounded and locally adapted factors across 9 core categories. Built for practical deployment in the Taiwan stock market, the library empowers investors to accelerate research, build repeatable quantitative strategies, and generate more reliable alpha signals through transparent and consistent data.

Yet even with a well-structured foundation, factor investing remains a complex discipline—especially when moving from theory to execution.

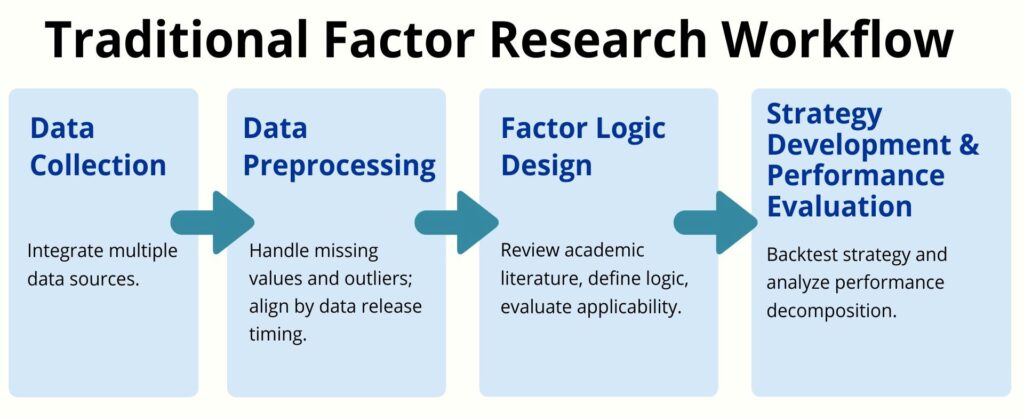

The factor investing process—from data collection to strategy construction—is complex and resource-intensive (see Figure 1). Analysts must source data from multiple providers or crawlers, deal with inconsistent formats, and often face the lack of a point-in-time (PIT) structure—introducing risks like look-ahead bias.

Figure1:Traditional Factor Research Workflow

Preprocessing involves missing value handling, outlier detection, and aligning data by release timing—all technically demanding tasks. Designing factor logic requires extensive literature review, adapting definitions for local markets, and ensuring statistical validity. These challenges consume significant time and resources and introduce errors that can hinder research and replication.

A well-structured factor database that incorporates PIT processing, academic rigor, and transparent methodology can greatly streamline the process and help investors focus on strategy innovation.

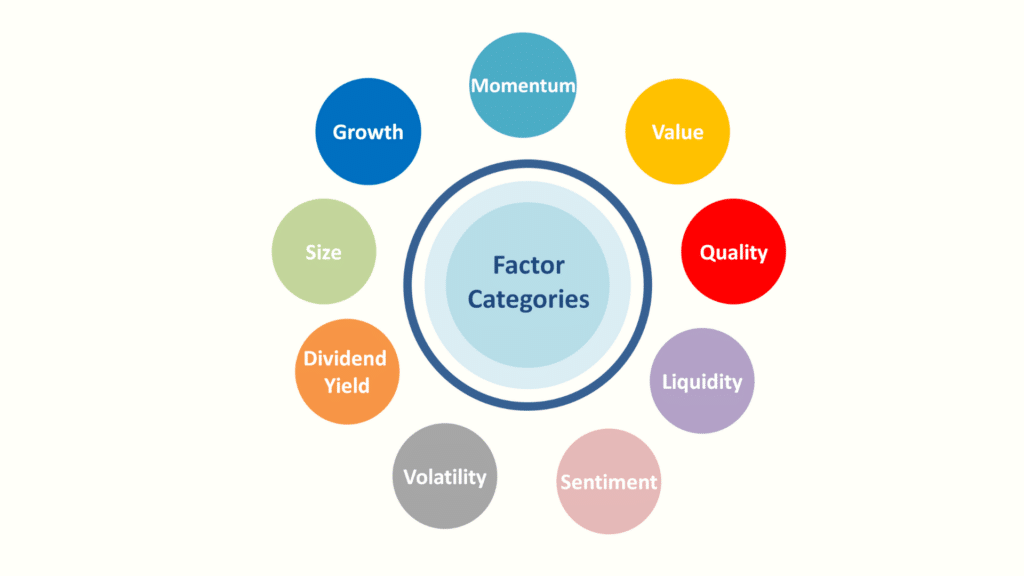

TEJ’s Factor Library is a structured, point-in-time database designed to explain asset risks and returns through factor characteristics. It currently covers nine major factor categories: Momentum, Dividend Yield, Value, Growth, Quality, Liquidity, Volatility, Size, and Sentiment. All data are processed with complete PIT alignment and traceability to eliminate forward-looking bias.

Figure 2:TEJ Factor Library -9 Factor Categories

| Category | Description |

|---|---|

| Momentum | Reflects the continuation of a company’s stock price and fundamental performance. Includes two subcategories: Price Momentum and Fundamental Momentum. |

| Dividend Yield | Reflects a company’s dividend policy. |

| Value | Reflects market valuation of the company. Includes two subcategories: Book-to-Price and Earnings Yield. |

| Growth | Reflects a company’s earnings growth potential. |

| Quality | Reflects the fundamental characteristics of a company. Includes subcategories such as Profitability, Earnings Quality, Investment Quality, Earnings Variability, and Solvency. |

| Liquidity | Reflects the activeness of stock trading. |

| Volatility | Reflects the uncertainty in stock prices or returns. Includes two subcategories: Beta and Residual Volatility. |

| Size | Reflects the market capitalization of a company. |

| Sentiment | Reflects investor perception and market sentiment toward a stock. Includes subcategories such as Fund Flow, Holdings, News-based Information, and Behavioral Factors. |

The value of the Factor Library extends beyond data provision—it enables diverse applications across the investment lifecycle. Depending on the strategy, investors can deploy single or multiple factors for stock selection, risk assessment, and model construction.

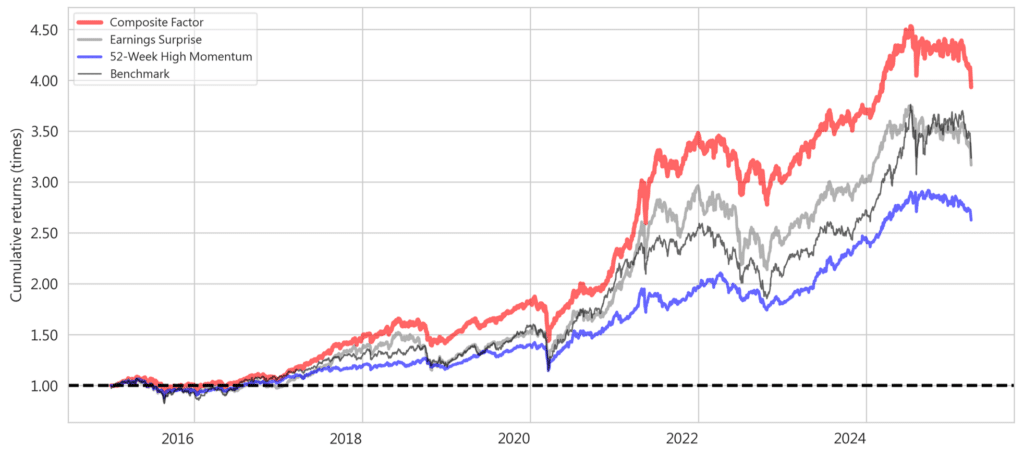

Figure 3: Cumulative Return of a Factor Strategy – highlighting how factor data supports performance backtesting to discover alpha-generating strategies.

In today’s market environment—characterized by an explosion of factors and widening information gaps—researchers often find themselves bogged down by labor-intensive processes such as data preparation, validation, and ongoing maintenance. These challenges make it difficult to focus on strategic optimization and backtesting. The TEJ Factor Library was explicitly designed to solve these pain points. Its data service emphasizes academic rigor, practical relevance, and completeness in update frequency, data structure, and usability. It also serves as a high-quality market data service that facilitates advanced quantitative data analysis.

| Factor Code | mom52wh |

| Factor Name | Momentum Factor (52-Week High) |

| English Name | 52-Week High Momentum (MOM52WH) |

| Category | Momentum |

| Subcategory | Price Momentum |

| Expected Direction | Positive |

| Reference | George, T.J., & Hwang, C. (2004). The 52-Week High and Momentum Investing. Journal of Finance, 59(5), 2145–2176. |

| Calculation Method | Adjusted closing price of the day divided by the highest adjusted price over the past 252 trading days. |

TEJ’s Factor Library empowers investment teams with high-quality, standardized, and traceable factor data, bridging the gap from data acquisition to live strategy execution. It’s not just a research tool, but a strategic asset—enabling alpha discovery, model backtesting, and risk management.

By combining academic insights with local market practices, and supporting over 100 factors across nine categories with PIT structure and daily updates, TEJ provides the robust infrastructure required to navigate the expanding world of factor investing. In an era of market uncertainty and data explosion, only those with access to verifiable and flexible factor systems can stay ahead in the quant investing landscape.

TEJ’s commitment to innovation, accuracy, and usability positions the Factor Library as an indispensable resource for investors aiming to transform data into performance.