In today’s globalized economy, real-time and reliable financial information is vital for businesses, policymakers, and academic researchers. TEJ (Taiwan Economic Journal), with our excellent data quality and professional standards, has long been highly regarded in the field of financial databases in Taiwan. Moreover, scholars have published over a hundred research papers using TEJ data in international journals, highlighting the database’s significance and influence in academic citations.

Table of Contents

TEJ Taiwan Economic Journal provides a comprehensive financial database, including financial, operational, and market information for Taiwan and Asian financial markets. It covers topics such as credit risk, corporate governance, audit quality, conglomerates, corporate social responsibility, and ESG research. The professional data quality of TEJ database is derived from rigorous data collection, cleaning, and verification processes. Therefore, this high-quality data serves as a reliable information source for many academic citations in Accounting, Finance, and Management.

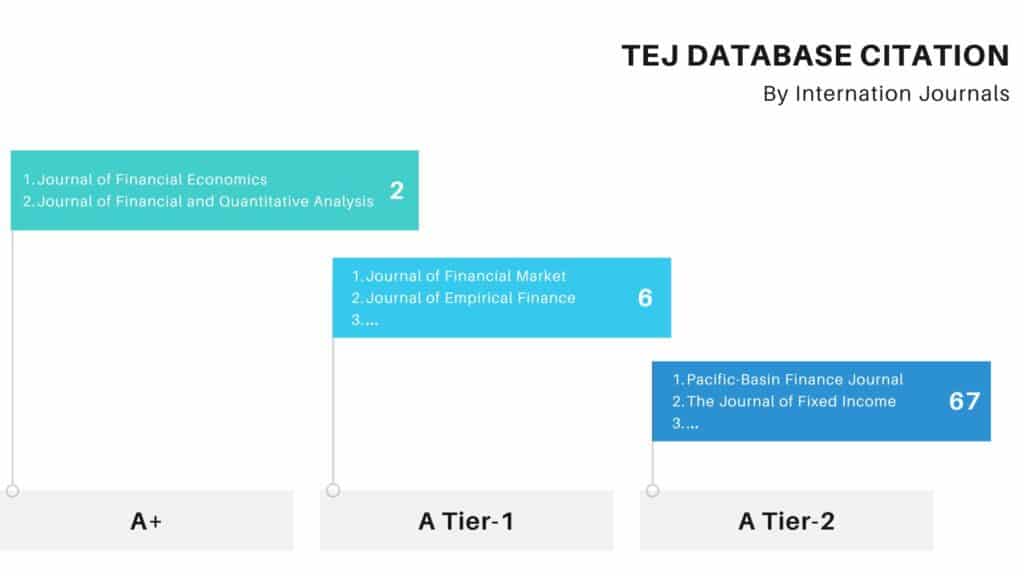

TEJ database is commonly cited in international journals, serving as the first choice for researchers in Finance and Economy. From 2012 to 2022, of all the international journals that received an A + to A Tier-2 grading, a total of 75 thesis/dissertation cited TEJ data, with 2 A+ articles, 6 ATier-1 articles, and 67 A Tier-2 articles.

What’s more, the two international journals with an A+ grading that cited TEJ are respectively 《Journal of Financial Economics》(JFE)and 《Journal of Financial and Quantitative Analysis》(JFQA). For more information on TEJ database citation, please refer to the table below,

These 75 international journal articles that cited TEJ’s financial database covered topics from securities markets, corporate governance, corporate operations, conglomerates, and other research areas. Among these, corporate governance serves as a precursor to current ESG issues. Scholars refer to TEJ’s corporate governance database, particularly for in-depth research on topics such as ultimate controllers, insider shareholding, and equity control.

Research on securities markets is extensive, including interactions between stock prices and various factors, performance of derivative financial products, and decision-making by institutional investors and the public. These topics remain popular in academic research, whether in Taiwan or other Asian markets.

Other topics regarding corporate investment decisions, monthly revenue information, mergers and acquisitions, and treasury stock policies have also been subjects of research published in international journals over the years.

The success of TEJ is not only evident in its prominent position within Taiwanese academic research but also in its significant influence on international journal studies. With comprehensive financial data coverage for the Chinese market, TEJ provides both depth and breadth, meeting the quality requirements of international journals and academic papers. Additionally, TEJ research team possesses professional expertise to discuss the meaning and sources of data and assist scholars in resolving any doubts during usage or analysis.

Aligning with global economic development and trending international research topics, TEJ provides you with professional and valuable financial database. Together, we shall advance toward the summit of international journal research!