Table of Contents

As we enter the second half of 2025, the AI wave remains strong. Although regional conflicts show signs of cooling, tensions have not fully dissipated. The U.S. tariff policies continue to stir global unease, while China’s economy, even with policy support, still struggles to regain momentum—highlighting the fragility of the global economy. For domestic industries, the situation remains precarious, and credit risks are inevitably on the rise.

On Aug 8, 2025, based on international developments, TEJ’s TCRI credit rating and industry research team has selected 4 critical industries to spotlight in 2025 H2 TCRI Online Webinar, outlining both risks and opportunities. TEJ’s Corporate Credit Risk solutions cover all listed firms and beyond, evaluating the creditworthiness of individual companies to support investment and lending decisions.

👉 Further Reading: Access TCRI to evaluate Taiwan corporate credit risk with data-driven precision.

Taiwan’s machinery tool industry is currently facing multiple challenges, including:

As global competition intensifies, the operating pressure on Taiwanese manufacturers grows steadily. Most machine tool firms in Taiwan are SMEs, burdened with long equipment payback cycles and high sensitivity to exchange rate fluctuations. In recent years, NT dollar appreciation has squeezed export margins, reduced competitiveness, and led to significant FX losses, heightening operational risks.

Characteristics of SMEs and Taiwan’s Machine Tool Industry Development

| Category | Small & Medium Enterprises (SMEs) | Large Enterprises | Note |

|---|---|---|---|

| Definition | Paid-in capital < NT$100 million, or fewer than 200 regular employees | Not applicable (non-SME definition) | Most Taiwan firms are SMEs with relatively higher proportions. Their limited scale restricts production lines and weakens bargaining power in exports. |

| Number of Companies | About 1,935 firms (95%) | About 100 firms (5%) | |

| Average Gross Margin | 20% | 30% | Manufacturing cycles are relatively long, leading to inventory pressure and higher operational risks from account receivables (typical payment terms exceed 150 days). |

| Average Net Profit Margin | 8–10% | 8–10% | |

| 2024 Production Value | US $121 billion | US $101 billion | High equipment costs and long payback periods intensify repayment pressure. Example: A CNC lathe can cost several million to tens of millions of NT dollars, significantly increasing the operational risks of SMEs. |

| 2024 Export Value | US$91 billion | US$131 billion |

(Table 1: Key reasons why the machine tool industry is highly sensitive to exchange rates)

Meanwhile, China—backed by government policies—has already become the world’s largest machine tool exporter as of 2024, leveraging low prices and subsidies to squeeze other exporters. Taiwan’s exports to China have steadily declined as China’s self-sufficiency rate rises, while exports to the U.S. are increasingly challenged by Korean competitors benefiting from favorable trade tariffs.

Taiwan firms still focus on mid- to low-end products, with critical technologies such as CNC controllers heavily dependent on industry leaders like Japan’s FANUC and Germany’s Siemens. This technological gap restricts Taiwan’s ability to move up the value chain and expand globally. Without breakthroughs in high-end R&D and clearer international positioning, the sector faces growing challenges.

👉 Further Reading: From Business Cycle Indicators to Asset Rotation: A Quantitative Strategy to Avoid Bear Markets

With cross-border travel in the Asia-Pacific region rebounding strongly, Taiwan’s aviation industry has seen steady post-pandemic recovery in passenger traffic. Benefiting from “revenge travel,” passenger ticket prices surged, and by 2024 the passenger revenue of Taiwan’s national carriers had already surpassed pre-pandemic levels. However, as the travel boom began to subside, ticket prices gradually retreated from their peak, causing passenger revenue growth to slow and even slightly decline.

On the cargo side, strong demand from AI-related product exports and cross-border e-commerce supported double-digit growth in both cargo volume and revenue for Taiwan’s national carriers in 2025H1. Nevertheless, with U.S. tariff policies becoming more defined, coupled with rising trade barriers and declining ocean freight rates, cargo demand in 2025H2 may face short-term fluctuations, leading to significant volatility. Overall, while the air transport market continues its recovery, future movements in ticket prices and broader market dynamics must be closely monitored, as uncertainty remains high

Another concern lies in the incomplete recovery of the aerospace supply chain. During the pandemic, the supply chain was heavily disrupted, and shortages of skilled labor and key parts continue to delay new aircraft deliveries. Now, additional tariff policies risk pushing manufacturing costs higher and further exacerbating delivery delays. With new aircraft supply constrained, Taiwan’s carriers have been forced to extend the service lives of existing fleets or lease additional planes, raising operational pressures.

At the same time, Taiwan’s carriers are adjusting their market strategy in response to shifting geopolitics. With Hong Kong’s traditional hub role diminishing, Taiwanese airlines are actively expanding North American routes to capture transit demand. Meanwhile, the rapidly growing ASEAN aviation market presents another growth opportunity, though the prevalence of low-cost carriers in the region also intensifies price competition.

Fleet Extension and Leasing: Operating Costs Will Continue to Rise

| Airline | Average Fleet Age | ≤ 5 years | 5–10 years | 10–15 years | ≥ 15 years | % of Fleet Over 10 Years | Note |

|---|---|---|---|---|---|---|---|

| China Airlines (2610) | 9.4 years | 23 | 29 | 10 | 20 | 37% | 🟨 China Airlines, EVA Air Heavier fleet replacement pressure, costs more likely to be impacted by the burden of aging aircraft. |

| EVA Air (2618) | 8.8 years | 12 | 49 | 13 | 11 | 28% | |

| Tigerair Taiwan (6757) | 6.6 years | 5 | 8 | 1 | – | 7% | 🟨 Tigerair Taiwan, STARLUX Airlines With delivery delays of new aircraft, their ability to expand routes and adjust operations will be restricted. |

| STARLUX Airlines (2646) | 2.4 years | 24 | 2 | – | – | 0% |

(Table 2: New aircraft delivery delays force carriers to extend or lease fleets, adding to operational pressure)

The rapid rise of AI applications is accelerating the fragmentation of the IC design industry, where the speed of transformation has become the key determinant of competitiveness. The 4 major cloud service providers (Amazon, Microsoft, Google, and Meta) are not only continuing large-scale purchases of NVIDIA chips but are also heavily investing in in-house AI chip development. They are collaborating with Taiwan companies such as Alchip, Global Unichip, MediaTek, and Andes Technology to drive the expansion of the Application-Specific Integrated Circuit (ASIC) market.

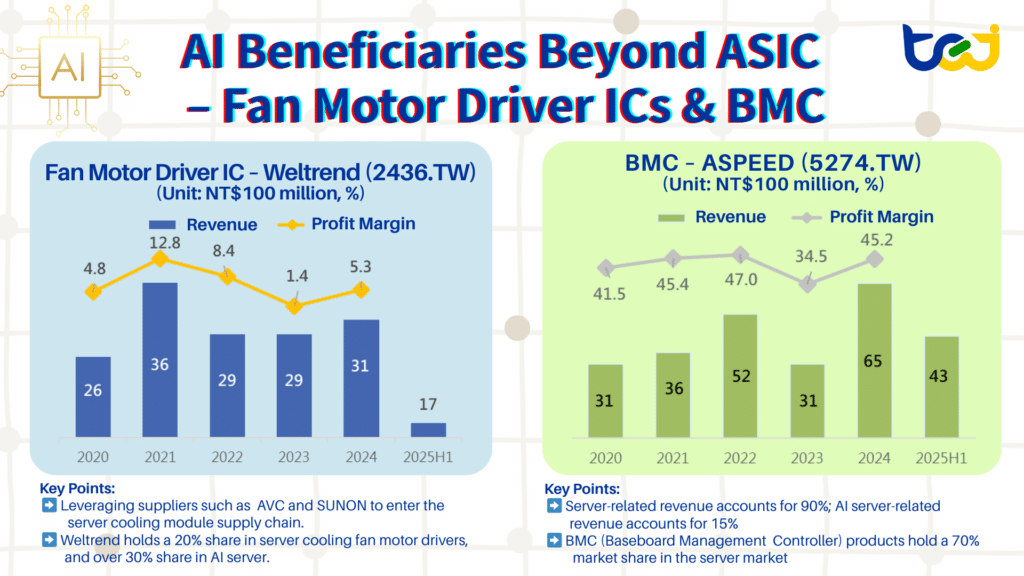

The growth rate of ASICs has already surpassed that of GPUs, further fueling demand for server-related components such as BMCs and fan motor driver ICs. Taiwan suppliers like Aspeed and Weltrend, with their high market share in servers and AI servers, continue to gain growth momentum. Against the backdrop of sustained high capital expenditures in AI, companies with layouts tied to AI and data centers will remain key beneficiaries.

(Figure 3: Beyond ASICs, AI-driven growth has boosted demand for fan motor driver ICs and BMCs)

(Source: TEJ Financial data)

By contrast, non-AI application markets such as PCs, automotive, and smartphones face growth pressures. PC demand has been influenced by the end of Windows 10 support and tariff factors, leading to front-loaded shipments in the first half of the year, but the risk of demand reversal looms in the second half. The auto market’s recovery has been sluggish, exacerbated by intense price competition. Meanwhile, the smartphone market’s long-term growth is slowing, with the second-hand phone segment growing faster than new sales—forcing companies like MediaTek to diversify into non-smartphone sectors to mitigate risk.

Overall, servers and AI applications remain the core growth engines of the industry. Companies that have successfully pivoted into AI-related businesses now hold a clear competitive advantage, while those unable to transform risk being marginalized in the future.

👉 Further Reading: AI Boom Benefits Taiwan: Can Taiwanese IC Design Firms Sustain Their Competitive Edge Amid China’s Semiconductor Autonomy?

Natural disasters and geopolitical events have highlighted the importance of communication resilience. Low Earth Orbit (LEO) satellites, which can maintain connectivity even when terrestrial infrastructure is damaged, have become a critical technology for many countries seeking to strengthen communication security. The U.S., Canada, Japan, the U.K., Australia, and India are all promoting relevant policies and technological development. In Taiwan, Chunghwa Telecom has introduced OneWeb services to reduce the risks of undersea cable disruptions and natural disasters.

Currently, SpaceX dominates the LEO satellite market, but challengers such as OneWeb and Amazon’s Project Kuiper are catching up quickly. As launch frequency and satellite numbers increase, demand is rising for satellite manufacturing, ground infrastructure, and component supply. The supply chain is still largely dominated by U.S. and European players, while Taiwanese firms are participating mainly as component and equipment suppliers.

Looking ahead, Amazon Kuiper and Telesat Lightspeed are expected to intensify competition. New technologies such as high–low orbit integration and direct-to-cell (DTC) satellite connections will further reshape the competitive landscape. Meanwhile, U.S. tariff policies, the EU’s autonomous launch programs, and Taiwan’s space center plans to launch domestically developed LEO satellites (targeted for 2027–2028) may all impact the industry structure.

TEJ (Taiwan Economic Journal) has long been a leader in financial databases and risk management solutions. Through TCRI Credit Risk Rating Index, we assist over 90% of Taiwan’s financial institutions and corporations in objectively evaluating the credit risk of their counterparties.

As a trusted data provider, TEJ also offers comprehensive market databases to support quantitative investment strategies. Among them, the TCRI Watchdog (WD) Database provides real-time tracking of major events affecting Taiwan’s listed companies—ranging from industry developments to critical corporate actions—making it an indispensable resource for event-driven and alternative data analysis.

With its scoring system (from -3 to +3) measuring the impact of industry events on credit conditions, the Watchdog empowers users to:

👉 Enhance your Taiwan strategies with data-driven insights – discover how the TCRI Watchdog Database helps institutional investors capture event-driven opportunities and strengthen quantitative investment models.

💥 Strengthen Your Taiwan Quant Strategies with TCRI Watchdog