Table of Contents

In order to grow the business, the current business operators are bolder than in the past, and the financial leverage is generally higher. With the development of technology, the life cycle of products has been shortened, price fluctuations and the frequent entry and exit of competitors have increased business risks. In addition, the development of the financial commodity market is booming, and the degree of participation by corporate operators has increased greatly. Therefore, in addition to financial operating information as a reference for corporate credit risk performance, changes in corporate management are also regarded as one of the clues to the future trend of corporate credit risk.

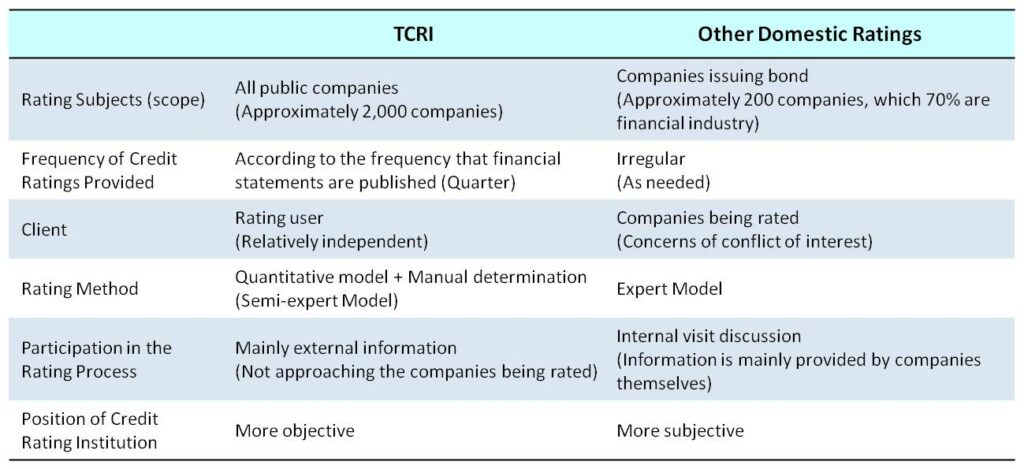

Based on the market’s emphasis on corporate credit risk assessment, TEJ’s industrial research team developed the “TCRI Taiwan Corporate Credit Risk Index” (hereinafter referred to as TCRI) in 1991, which is an open, transparent and highly differentiated credit rating system based on a quantitative model and supplemented by professional manual interpretation. TCRI is widely recognized by most financial institutions for its high differentiation ability, stability of volatility, and comparability with large international credit rating agencies. Currently, the TCRI has become an important reference index for over 90% of Taiwan’s banking industry to measure credit risk in investment and lending.

We adopt proactive ratings to keep an eye on the latest corporate developments and adjust credit risk ratings

Recognized as the most representative credit risk index by domestic academic and research institutions.

The effectiveness of TCRI™ rating results is periodically validated.

TCRI is a semi-expert model to evaluate Public Companies. The methodology is transparent, and discriminatory, financial industry take this rating as a reference for investment and credit granting.

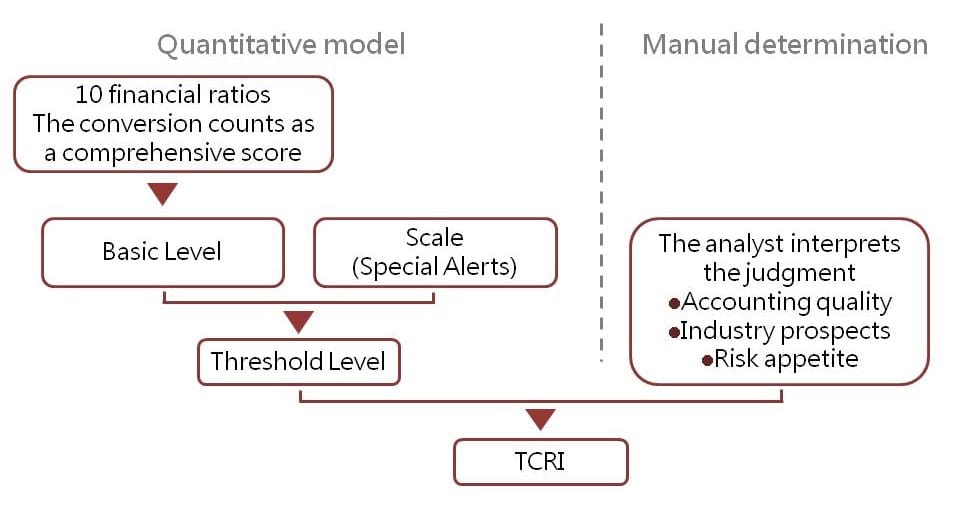

The semi-expert model is mainly used based on a quantitative model and supported by manual determination. It is divided into three steps.

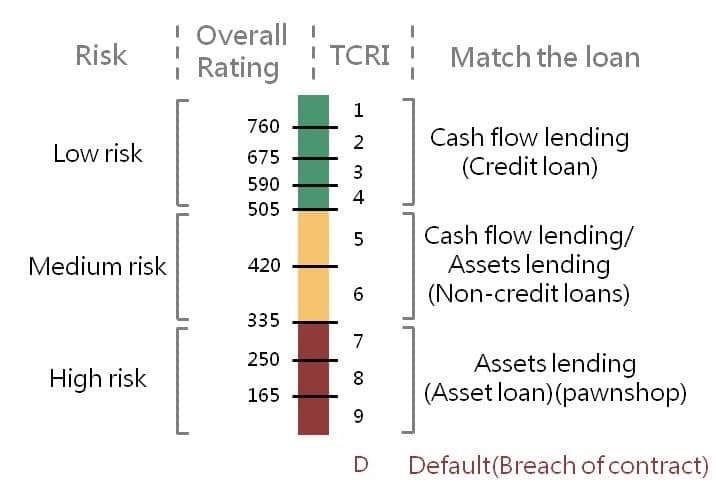

The rating is divided into 1-9 levels, with low risk (1-4), medium risk (5-6), and high risk (7-9), and when the company is in default, it is labeled as D (Default).

Manual determination mainly includes the following three aspects:

| A: Accounting Information | I :Industry Prospective | M :Management Risk |

|---|---|---|

| Verify the reasonableness of accounting estimates (accounting analysis and quality of financial statements; financial analysis). | Consider the macroeconomic environment and industry trends, including the company’s competitive position in the industry. | Evaluate changes in management, shareholding structure, investment strategy, and risk preferences. |

Start Managing Your Corporate Credit Risk of Investment and Lending Today!

TCRI uses a quantitative model to generate basic and threshold levels, and then makes limited corrections through manual interpretation. Due to the inclusion of manual interpretation in the rating process, the TCRI focuses on four points: accounting quality (A), industry outlook (I), operator risk appetite (M), and financial pressure (F).

Overall ROC of the TCRI™ in the past 10 years was 88%-97% and an average of 93%, which surpasses the standard of 70% in the Corporate Credit Rating Model Technical Manual.

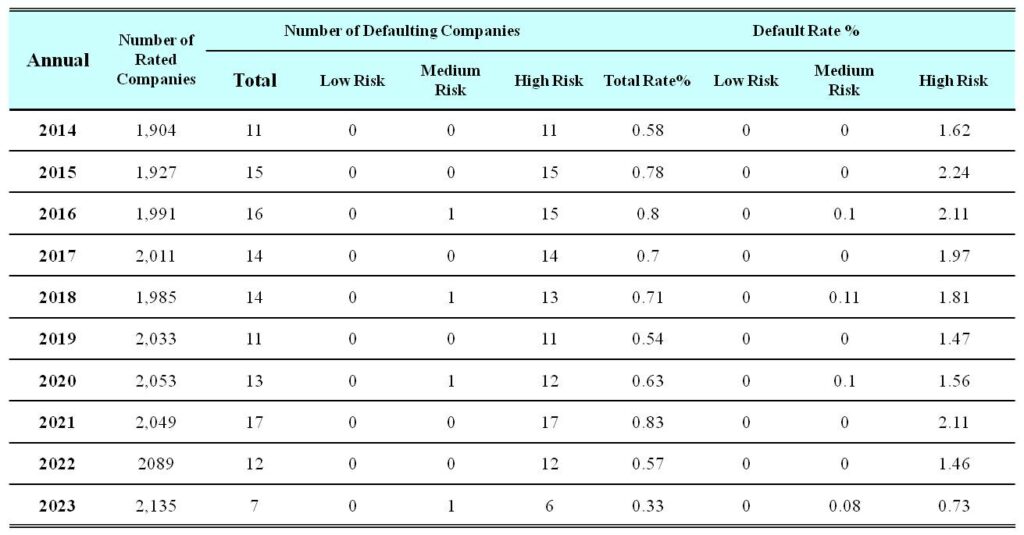

The number of companies that default and default rate meet expectations. With a lower level (i.e., higher risk), the number of companies that default and the default rate increase.

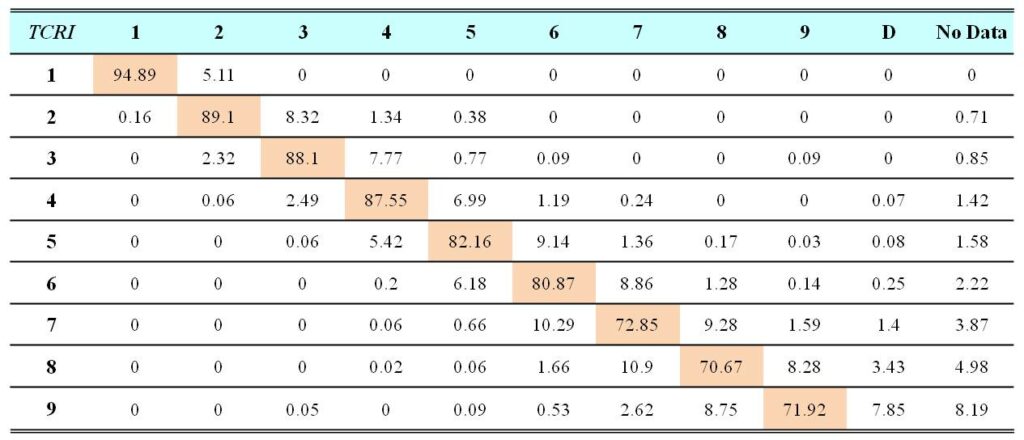

On average 70%-80% of levels are maintained for 1 year, which is near the standards of S&P and Moody’s. Also, the relatively high fluctuation of high-risk levels meets expectations.

TCRI’s risk categories are consistent with those of external benchmarks. TCRI’s credit ratings are based on a quantitative model and manually assisted by a semi-expert process. The ratings are based on a combination of publicly available information (operating data, financial statements, etc.) of the companies evaluated, making the ratings more objective and independent.

TCRI’s Corporate Credit Risk Index are based on a quantitative model coupled with a semi-expert program. According to the public information of the enterprise (financial accounting quality, industry outlook, risk appetite of the operators…), we conduct a comprehensive credit risk assessment. With the independent, fair and verifiable evaluation method, it is generally trusted by the financial industry in Taiwan for investment and credit extension.

Subscribe to newsletter