Table of Contents

In quantitative investment research, financial data is the cornerstone of strategy development and validation. Every factor or model design must be built on reliable and complete financial data. If the data itself contains flaws or omissions, even the most sophisticated strategies may fail in the real market. Therefore, establishing a financial database that can faithfully restore the true historical picture is crucial for quantitative researchers.

TEJ Point-in-Time Audited Financial Database designed specifically for quantitative strategy research, provides Point-in-Time (PIT) data as the foundation for backtesting.

In many research scenarios, traditional databases or self-collected data yield impressive results in backtesting, yet the performance in real markets frequently falls short of expectations. This gap does not stem from flaws in strategy logic, but rather from two fatal issues hidden in the raw data: look-ahead bias and survivorship bias.

These two pain points are the most easily overlooked in quantitative research and strategy backtesting, yet they are precisely the key factors that determine whether a strategy can truly work in the market.

The foundation of a reliable strategy: Point-in-Time

To build a strategy that truly reflects reality and withstands the test of the market, its foundation must be established on a data structure that can “reproduce the information available at the historical moment.” This is the core spirit of Point-in-Time (PIT).

TEJ, with 30 years of data processing experience, has specially developed the Financial Database for Investment -TEJ PIT Audited Financial Database designed for rigorous quantitative research and institutional-level backtesting.

The core of TEJ PIT Audited Financial Database is a rigorous Point-in-Time (PIT) data framework. Our data source is based on the public information disclosed via the Market Observation Post System (MOPS). However, since official data are overwritten once corrections are made, such data cannot be directly used for backtesting.

The value of TEJ lies in the subsequent two core processes, ensuring that your research can faithfully reconstruct the complete historical landscape.

For researchers, attempting to manually reconstruct history from MOPS is an extremely difficult task. Two major challenges arise:

The PIT framework of TEJ systematically resolves these issues and guarantees the most accurate historical snapshot:

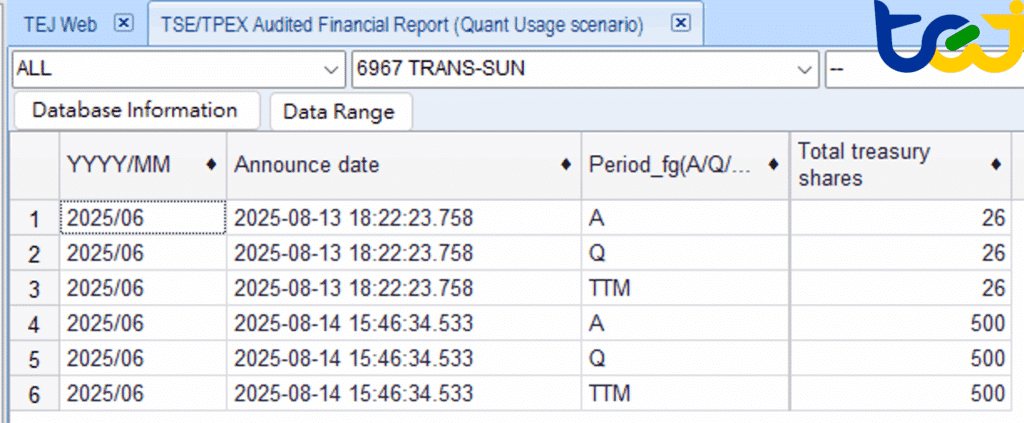

The company mistakenly reported the number of “total treasury shares “. On August 14, 2025 , it issued a correction via MOPS “Material Information,” revising the figure from 25,637 shares to 500,000 shares.

In TEJ PIT Audited Financial Database, we retained both versions with their respective timestamps.

This precise treatment ensures that no backtest uses future information and that strategies reflect the reality known to the market at the time.

Figure 1:Correction notice for TRANS-SUN (6967.TW)’s Q2 2025 financial report

Figure 2:TEJ database retains complete versions of TRANS-SUN (6967.TW) ‘s financial data for Q2 2025, both before and after auditor certification.

More importantly, this correction was not fully disclosed in the English version or other electronic filings, since the original financial PDF itself contained no error. This highlights the fragmentation and inconsistency of official information sources, making it easy for researchers to miss such critical changes. TEJ’s systematic collection process is designed to resolve such gaps.

📌 You may intetesting: TEJ Factor Library-100+ factors built for Taiwan market

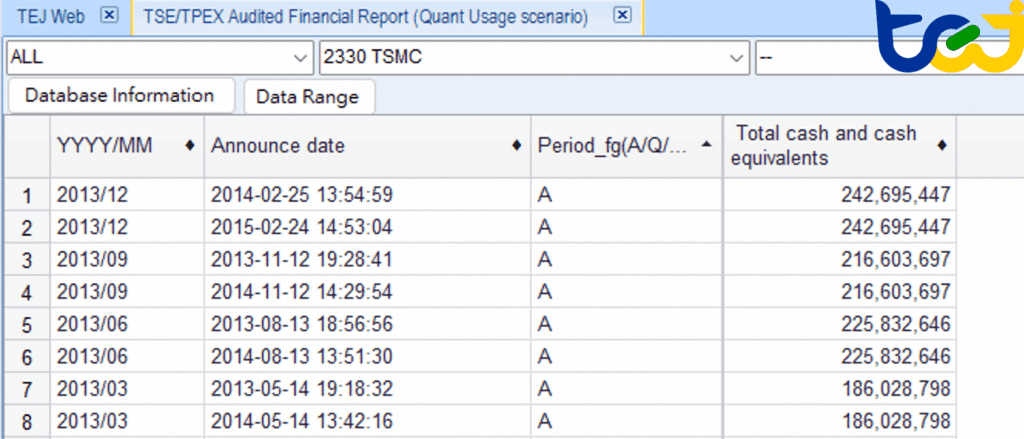

TEJ’s handling of announcement dates balances historical completeness with maximum precision. Since 2013 (based on the cover date of reports), announcement times are recorded down to hours, minutes, and seconds. This granularity even allows backtesting accuracy to extend to intraday price reactions.

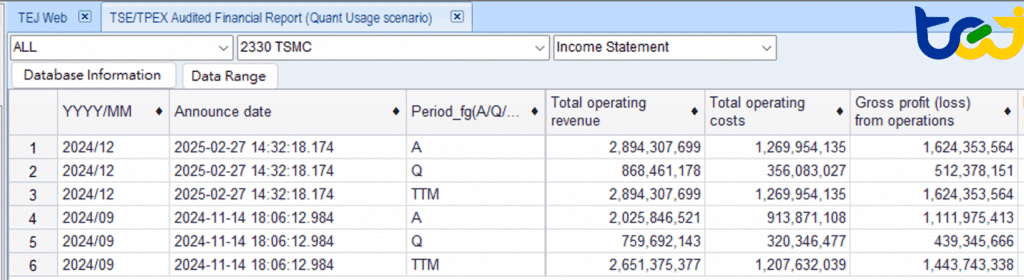

Figure 3:TSMC (2330) financial report release dates in TEJ database, 2013

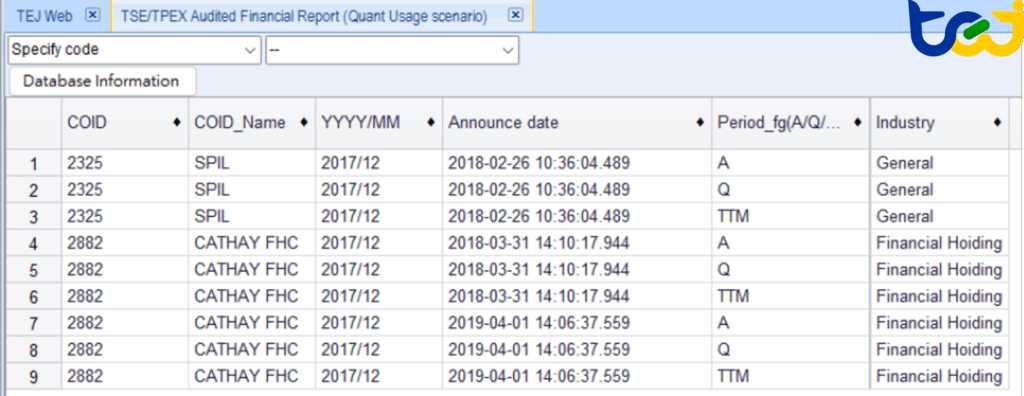

A real market includes successful firms, delisted companies, and industries with very different models. If the sample is incomplete, strategy returns will be distorted. TEJ PIT Audited Financial Database secures sample integrity from two angles:

This design ensures the strategy universe always matches the actual market at any point in history. It provides a complete, unbiased, and efficient foundation for market averages and cross-industry factor tests.

Example: Both Siliconware Precision (2325, delisted in 2018) and Cathay Financial Holdings (2882, still listed) are fully preserved in the database.

Figure 4:TEJ PIT Audited Financial Database provides complete listed, delisted, financial and non-financial firms

TEJ PIT Audited Financial Database not only ensures unbiased backtesting but also provides value-added features that turn raw statements into ready-to-use research materials, enabling focus on strategy development instead of data preprocessing.

Quantitative research relies not only on raw financial items but also on numerous ratios derived from them. Researchers often need to extract multiple fields and calculate them manually, a process that is tedious and prone to error when handling different reporting periods.

To address this, TEJ PIT Audited Financial Database builds on standardized accounting items from MOPS and pre-computes more than 300 commonly used ratios and indicators, covering:

Most importantly, all derived indicators adopt the Point-in-Time methodology, ensuring calculations across periods are also free from look-ahead bias.

Taiwan adopted IFRS for all listed companies in 2013, creating a discontinuity in long-term data. For researchers needing 15–20 years of history, reconciling GAAP with IFRS manually is both complex and time-consuming.

TEJ resolves this by adjusting all pre-2012 GAAP reports into IFRS-equivalent formats. This enables seamless long-term analysis across accounting regimes, ensuring strategy validity is not distorted by changes in reporting standards.

MOPS does not directly provide Q4 standalone data or Trailing Twelve Months (TTM) values. TEJ fills these gaps by offering three reporting frequencies, clearly marked as A / Q / TTM:

These flexible timeframes empower more robust factor design for both value and growth strategies.

Figure 5:TEJ database provides complete annual, quarterly, and trailing twelve-month (TTM) data

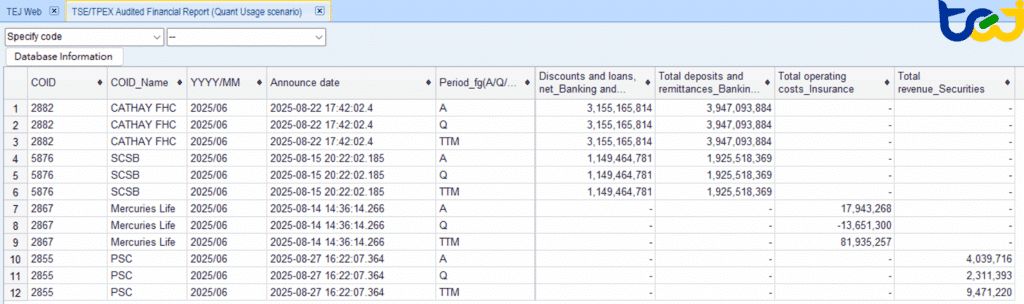

Different industries operate with distinct models and key indicators, and generic items are insufficient to evaluate financial firms. To address this, TEJ PIT Audited Financial Database includes sector-specific accounts for banks, insurers, holding companies, and securities firms. This allows factors to be built closer to industry fundamentals, expanding both the depth and scope of analysis.

Figure 6:Examples of accounting categories specific to the financial industry

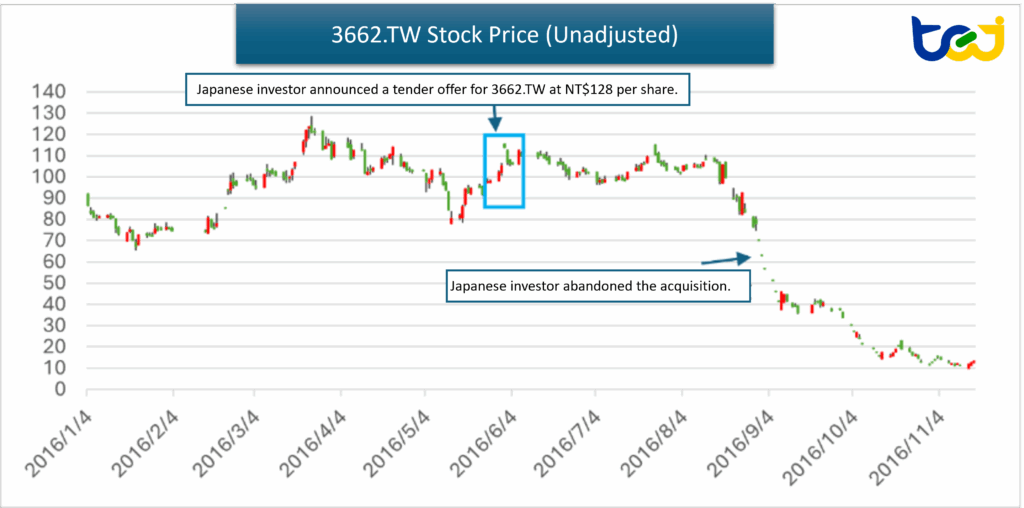

The well-known case of XPEC Entertainment (3662.TW) was not only a failed merger but also a litmus test for the rigor of backtesting data.

In 2016, the market was driven into frenzy after Japanese investor “Bai Chi Gan Tou Digital Entertainment” announced a high-premium tender offer for XPEC. This dream quickly collapsed when the acquirer defaulted at the end of August, leading to a stock price crash and severe investor losses.

Figure7:Stock price XPEC (3662.TW) of and timeline of events

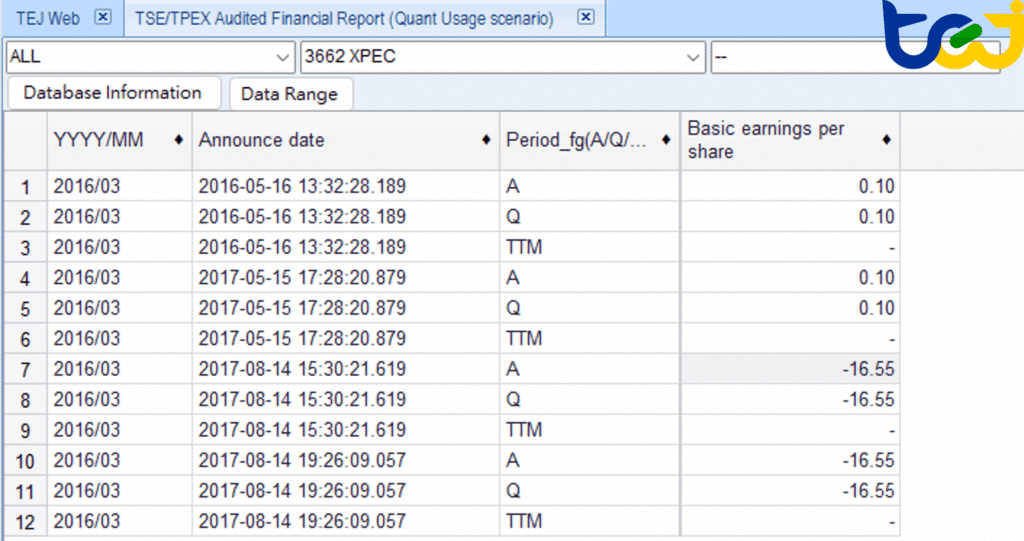

More critical issues emerged afterward. On May 16, 2016, XPEC originally reported Q1 EPS as positive (0.1). Yet, after the fraud was exposed, the company retroactively announced on August 14, 2017, that the true Q1 EPS was -16.55, a massive loss.

Figure 8:Multiple historical versions of XPEC (3662.TW) ‘s EPS data for Q1 2016

This case highlights two very different backtesting outcomes:

This example demonstrates the core value of Point-in-Time: fair and credible backtesting based solely on information available to the market at each historical moment.

The success of quantitative research starts with the quality of data. Even a seemingly minor flaw can invalidate an otherwise sound strategy. TEJ PIT Audited Financial Database directly addresses the most critical challenges with three key strengths:

Through these advantages, TEJ delivers not just data but a complete, verifiable solution that accelerates research and strategy deployment. With the right tools, researchers can move beyond data traps and focus on strategy design and factor discovery. TEJ PIT Audited Financial Database stands as the most reliable cornerstone for building sustainable alpha in today’s highly competitive markets.

💡Contact us to request a custom Quantitative database demo