In business, managers need a method to assess the value of every decision or project. Hence, valuation is developed to help stakeholders assess the worth of almost everything. It involves determining the fair market value of an asset, company, or investment opportunity. In this article, we will introduce the concept of valuation (DCF) and some common ways to perform valuation in business.

Table of Contents

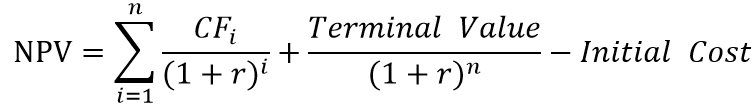

The idea of valuation is to add up all the cash flow generated and deduct all the cost needed to get the net value. However, when calculating costs, opportunity costs should also be considered. Opportunity cost refers to the potential benefits lost when choosing one investment over another. Additionally, once money is invested, its time value is lost, so future cash flows should be discounted at the risk-free rate.”. Net present value (NPV) is obtained by discounting each cash flow by risk free rate then adding them up together.

i = year, n = terminal year, CFi = Cash Flow in year i, r = Discount rate

To value a business project, we will have to estimate the cash flow generated from the project each year and the residual value of the project’s remainings after the project is over (after year n). Normally, the CD rate (Certificate of Deposit Rate) that matches the project’s duration is used as the discount rate, as it represents a risk-free short-term return rate. After acquiring NPV, managers should only choose projects with positive NPVs. When determining which project to invest in which project, NPV and the investing duration should be considered simultaneously. NPV only helps determine the earnings from the investment, while the length of the investing period is another crucial factor for avoiding cash flow problems.

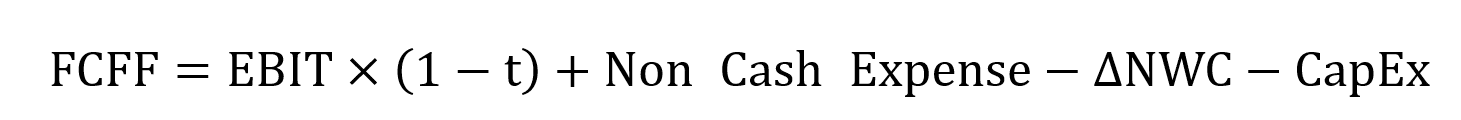

For stock investment, DCF calculates all the cash flow generated from the firm in the future, for the hope of finding the value per share of stock. DCF for stock valuation can be categorized into two types — FCFF valuation and FCFE valuation.

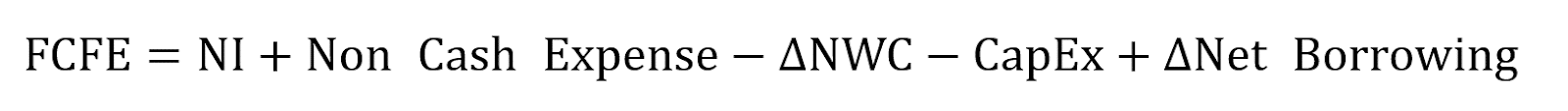

EBIT = Earnings Before Interests and Taxes (Can be found in Income Statement), t = Tax rate, Non Cash Expense = Amortization, Depreciation, etc., ΔNWC (Net Working Capital) = Change in Current assets – Change in Current liabilities, CapEx (Capital Expenditure) = Change in PP&E + Current Depreciation

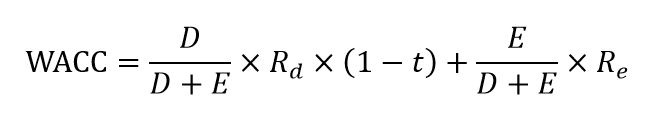

FCFF refers to the free cash flow received by the firm. Hence, the discount rate for FCFF should be based on the firm’s point of view. According to accounting standards, all of a company’s assets, which are used for generating FCFF, are bought through using either liability or equity — to be more specific, debt and share capital. Therefore, the opportunity cost of FCFF should be a combination of the cost of both debt and share capital.

WACC (weighted average Cost of capital) measures the weighted average cost of raising capital through debt and issuing shares, which are also known as cost of debt and cost of equity.

D (Debt) = Market value of Debt, E (Equity)= Market value of Share Capital, Rd = Cost of Debt, Re = Cost of Equity, t = Tax rate

Cost of debt is the borrowing rate of the company offered by lenders, and is affected by the company’s capital structure and industry prospective. Moreover, since debt financing provides tax shields, tax rates have to be deducted from cost of debt. On the other hand, cost of equity is normally obtained by using CAPM. Using the company’s history stock return to run regression with the market provides a point estimate of the required return of the company for investors.

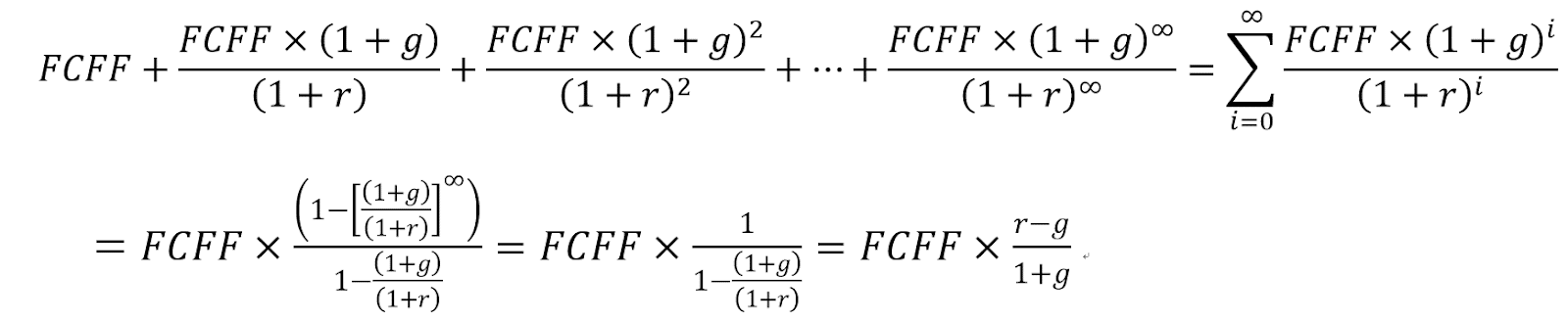

After acquiring WACC and FCFF for each year, we estimated a perpetual growth rate, usually denoted as g, for FCFF. For accuracy, analysts often estimate perpetual growth rate for every factor in calculating FCFF, to come up with a more reasonable estimate of perpetual growth rate for FCFF. The perpetual growth rate should always be smaller than the discount rate (WACC) of the company, or else the company would grow way much faster than it discounts, leading to a company value of almost infinity. (WACC > Perpetual Growth Rate)

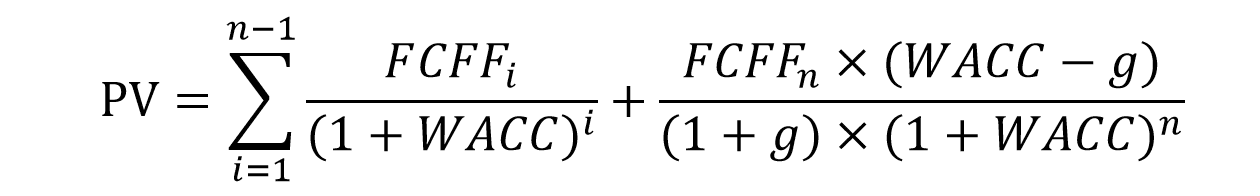

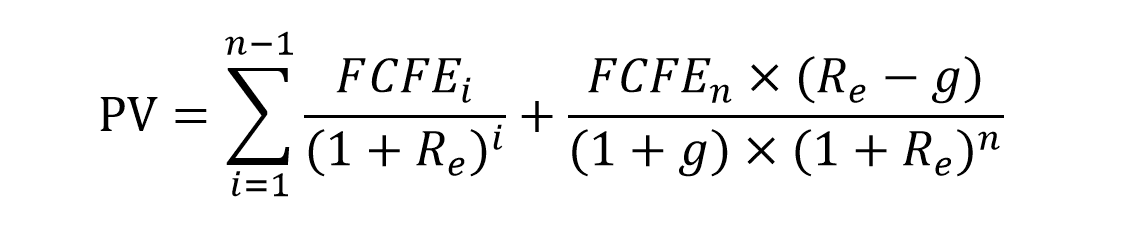

Hence, the full DCF valuation formula for FCFF is

PV = the present value of the company, n = the last year before the company starts to grow perpetually.

NI = Net Income, ΔNet Borrowing = Total borrowing of this year – Total borrowing of last year

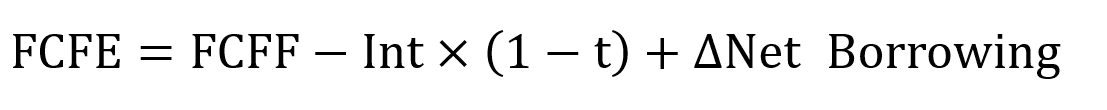

Hence, we can arrive at a solution that the relationship between FCFF and FCFE is

Int = Interest Expense

FCFE is the free cash flow to equity — to be more specific, the shareholders. Since FCFF is for both shareholders and creditors, interest expense is added back to FCFF, because it is also a part of FCFF used to pay back to creditors. However, FCFE is only for shareholders; thus, interest expense is deducted in FCFE, since creditors are paid first before shareholders. Furthermore, change in net borrowing is not included in FCFF since borrowings are still money lent from creditors, so it would still have to be repaid. However, because borrowing can be used to pay dividends to shareholders first, it is included in FCFE.

The discount rate for FCFE also differs from FCFF. Since FCFE is the free cash flow to shareholders only, the opportunity cost should also be the cost for shareholders only. Hence, the discount rate for FCFE is the cost of equity for shareholders acquired through CAPM.

After obtaining the Present Value of the company with FCFF or FCFE, we acquire the rational stock price by dividing PV with the company’s total shares outstanding instead of the total share issued. Since treasury stocks (stock repurchased) are also a part of the company’s equity, the free cash flow for treasury stock still flows back to the firm, and given back to the outstanding shareholders.

Valuation methods for Business M&A:

Mastering M&A Valuation: Key Strategies for Accurate Assessments – TEJ (tejwin.com)

Valuation provides insights into whether an asset is overvalued or undervalued. Investors use valuation techniques to make informed decisions about buying, selling, or holding investments. DCF serves as an instrument for performing fundamental analysis to reach a reasonable stock price of a company. However, since DCF heavily relies on future cash flow estimates, deep understanding and insights into the industry and business are essential for making accurate forecasts..

Accurate valuation is the key to successful M&A deals, guiding decisions, and mitigating risks. TEJ excels at providing precise valuation services, considering every transaction nuance, from synergies to intangible assets. Our detailed approach ensures decisions are well-informed, paving the way for successful transactions.

Learn more about TEJ Valuation Analytics Solution

Subscribe to newsletter