Table of Contents

Since the pandemic outbreak, the panel industry has experienced the long-awaited boom of the past decade. However, with the waning of the pandemic and the gradual decline of the WFH economy in 2022, coupled with global inflation and a series of unforeseen events, the panel industry is facing a rapid freeze. With demand plummeting, companies entering destocking phases, and increasing financial pressures, Taiwanese panel manufacturers are witnessing a significant decline in revenue and profits.

As of the third quarter of 2023, major consumer markets have not fully recovered, and the downward trend in panel prices has only slightly stabilized. Prices of panels for various applications have not shown a steady upward trend. In the absence of panel demand, what is the price trend for multiple applications? On the other hand, how are Taiwan’s leading panel manufacturers coping with the economic headwinds maintaining their financial condition in good shape? In this article, we will summarize the price trends of panels since the pandemic and explore the recent changes in the panel industry, along with the progress of Taiwanese manufacturers’ proactive transformation plans and their effectiveness in response strategies.

Looking back at 2022, the waning effect of the WFH economy coupled with high inflation has led to a significant decline in demand for end-products and a substantial increase in inventory. The results have been disappointing despite major brands and e-commerce platforms offering discounts and subsidies during promotional events like 618, Double 11, Double 12, and Black Friday. According to TEJ statistics, the overall shipments of end-products showed a comprehensive decline in 2022. Due to the fading effect of the stay-at-home economy, NB (Notebook) and Chromebook suffered the most significant impacts, with shipment YoY declines of -24% and -55%, respectively. Other applications such as TV, Monitor, and Tablet also exhibited declines ranging from 4% to 9%.

Entering the first half of 2023, although inflation is gradually cooling down, major consumer markets in Europe, the United States, and China still face a challenging economic environment with sluggish demand. In the traditional peak season of the first half, the performance of consumer spending during China’s 618 shopping festival did not meet external expectations. In other regions, major brands are considering the uncertain economic conditions of 2023, with consumer sentiment not fully recovering. Despite ongoing inventory improvements, major brands remain relatively conservative in their stocking attitudes compared to the past few years.

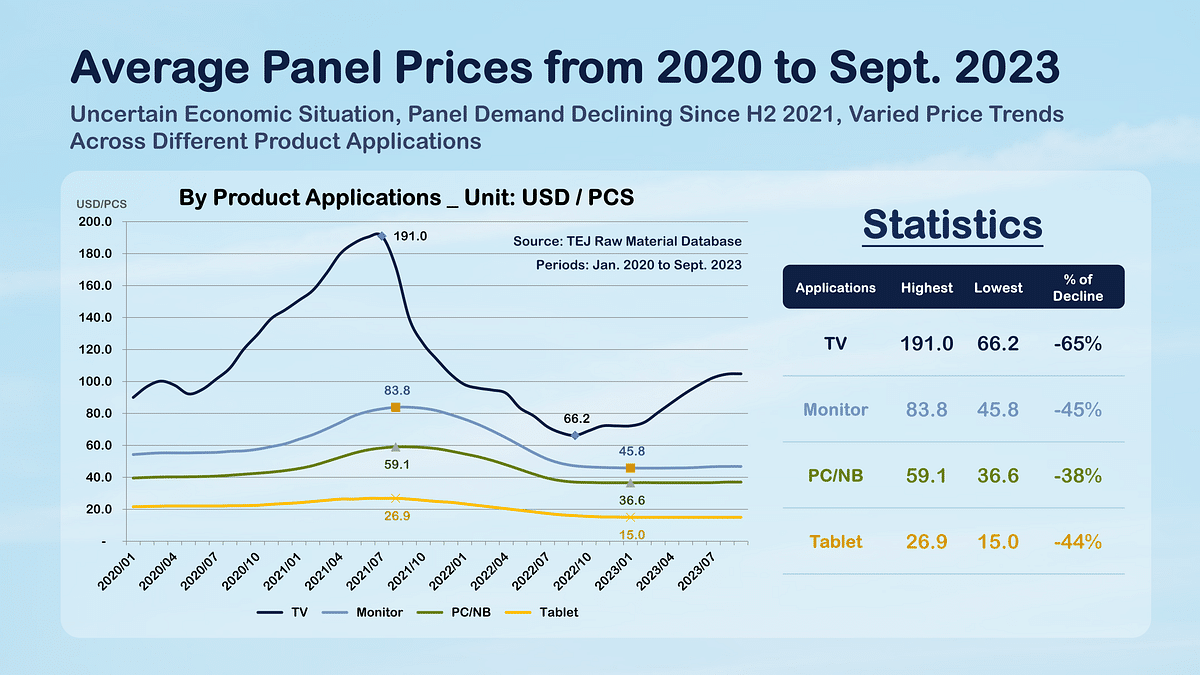

In terms of average panel prices (as shown in the chart above), the average price of TV panels rapidly declined from a peak of $191/PCS in July 2021 to a low of $66.2/PCS in September 2022, marking a 65% decrease. However, due to the earlier entry of TV panels into a correction phase, they experienced an early rebound. As of September 2023, the average price of TV panels has reached $104.8/PCS, showing a growth of 57% compared to the low point in September 2022. However, this recent increase in TV panel prices is mainly attributed to (1) short-term inventory replenishment by brand manufacturers, (2) strategic hoarding driven by urgent orders and price hike expectations, and (3) continued control of production capacity utilization by panel manufacturers.

Nevertheless, the decline in demand for TV panels in the third quarter has led to a halt in the upward trend of prices, and if demand continues to weaken in the fourth quarter, prices may face the risk of loosening. Currently, panel manufacturers are still implementing strict control over capacity utilization to maintain price stability.

For Monitor and PC/NB panels, the average prices dropped by 45% and 38%, respectively, from their peaks in September 2021 ($83.8/PCS for Monitor and $59.1/PCS for PC/NB) to their lows ($45.8/PCS for Monitor and $36.6/PCS for PC/NB). The price trends are similar to TV panels but with a lag in the starting and rebound points by one to two months. The current average prices for September 2023 are $46.8/PCS for Monitor and $37.0/PCS for PC/NB, showing a slight growth of 2% and 1%, respectively, compared to the lows. The price increase is mainly due to brand manufacturers increasing their inventory in Q2 and Q3. However, with less-than-ideal demand in Q3 and panel quotations stabilizing rather than rising, if demand remains weak in the future, panel prices may experience a decline.

The price of Tablet panels also experienced a decline, dropping by 44% from the peak of $26.9/PCS in June 2021 to the low point of $15.0/PCS. However, unlike TV, Monitor, and PC/NB panels, Tablet panels have not shown a significant rebound trend. The main reason is speculated to be that major tablet manufacturers with high market shares did not release new products in the first half of 2023. Additionally, with ongoing inflation and squeezed consumer purchases, these factors are expected to extend the product usage lifecycle, delaying the purchase of new devices. Looking ahead to the second half of the year, manufacturers are expected to release new tablet models, which may drive tablet shipments. However, considering the ongoing uncertainty in the overall economic situation, the general decline in panel prices is expected to continue.

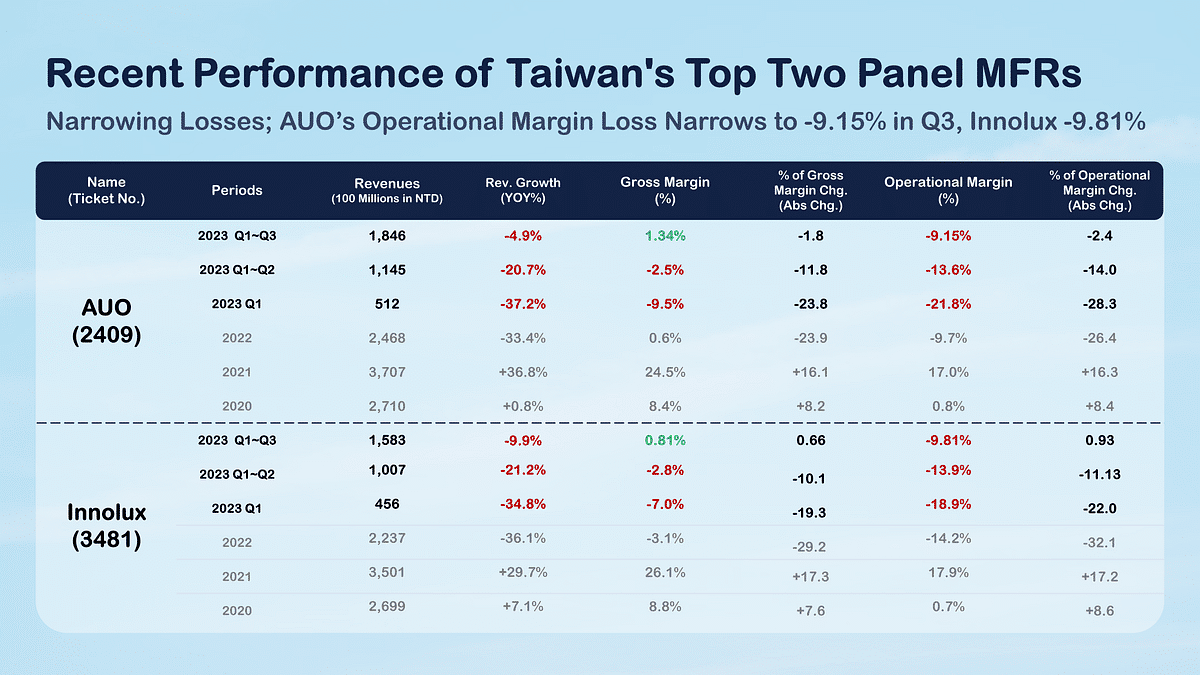

In 2022, the waning effects of the WFH economy and factors such as high inflation impacted end demand, leading to a significant downturn in the panel industry. Both AUO and Innolux, experiencing a revenue decline of -33.4% and -36.1%, respectively, saw their operating margins from profits to losses, reaching -9.7% and -14.2%.

Moving into the first quarter of 2023, with persistently high inflation and a higher base period, revenue declines remained substantial at -37.2% and -34.8% for AUO and Innolux, respectively. Operating margins continued to decline, reaching -21.8% and -18.9%. However, as the destocking of panel terminals approached its end, average prices for various applications, including TV, Monitor, and PC/NB panels, showed an upward trend. The combination of a low base period and the recovery of panel prices has noticeably alleviated the decline in revenue and profitability for panel manufacturers.

In the first nine months of 2023, AUO’s accumulated revenue improved from a Q1 decline of -37.2% to -4.9%, and its operating margin reduced from -21.8% in Q1 to -13.6% in H1. Similarly, Innolux’s accumulated revenue improved from a Q1 decline of -34.8% to -9.9%, and its operating margin reduced from -19.3% in Q1 to -10.1% in H1. Despite the ongoing challenges, the operational performance of these Taiwanese panel manufacturers has shown signs of stabilization and improvement.

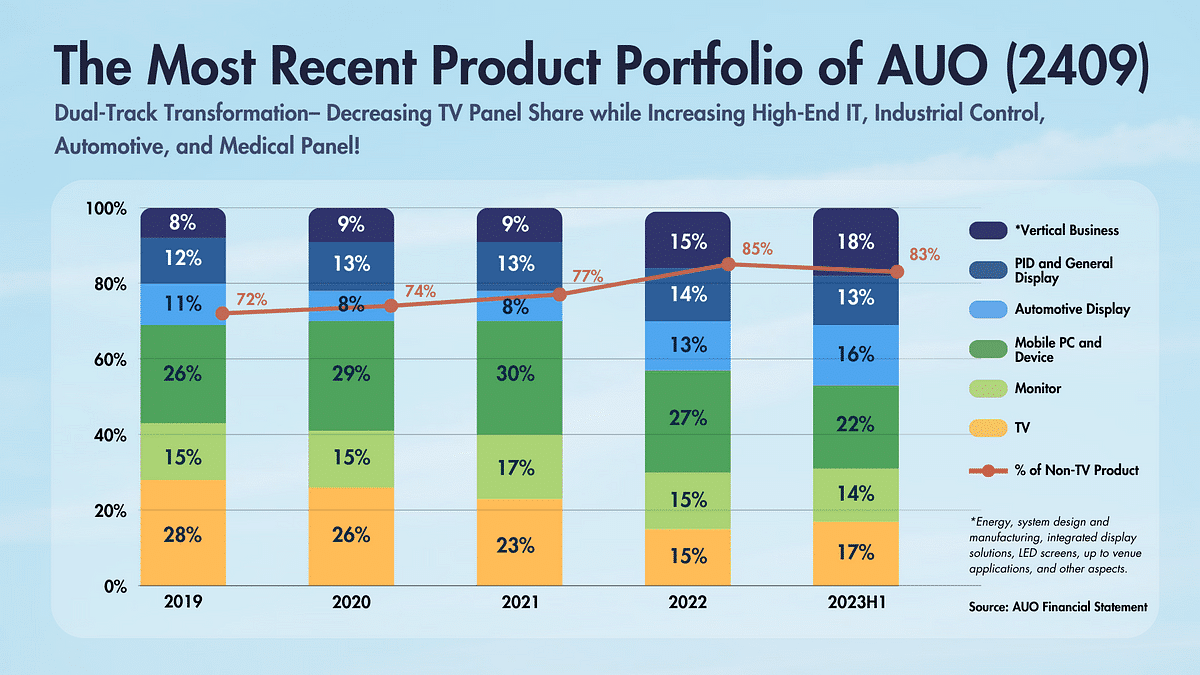

Beginning with AUO, the company maintains a dual-axis transformation strategy, consistently reducing the proportion of TV panel shipments while simultaneously increasing shipments of (1. )high-end IT, (2. )industrial control, (3. )automotive, and (4. )medical panels. Additionally, AUO is actively expanding into the energy sector, particularly solar power plants and the field of field economics. As of 2023 H1, the proportion of TV panel shipments has decreased from 34% in 2019 to 17%. There is also significant growth in automotive displays and vertical integration businesses, rising from 11% and 8% in 2019 to 16% and 18%, respectively. The proportion of volatile segments, including TV, NB/PC, Tablet, and smartphones, has decreased from 69% in 2019 to 53%. Moreover, AUO announced the acquisition of 100% equity in BHTC. BHTC specializes in automotive human-machine interfaces (HMI), automotive air conditioning control systems, and electronic control components. The acquisition is expected to not only continue expanding into the field economics and strengthen the competitiveness of display solutions but also rapidly acquire BHTC’s global customer resources to expand revenue proportions in the automotive panel and vertical integration sectors.

Although facing significant revenue decline and even losses due to the current downturn in the panel industry, Taiwanese manufacturers have not actively expanded production like their Chinese and Korean counterparts, thereby avoiding the burden of substantial CAPEX and R&D expenses. According to the latest financial data for Q2 2023, the dependency on borrowing has only increased to 68%, significantly lower than the previous peak of 138%. The financial situation remains favorable, with a substantial cash reserve of 90.7 billion NTD.

Read More: After a decade, Has the Joint Task Force of BenQ-AUO Group Increased Revenue and Profits?

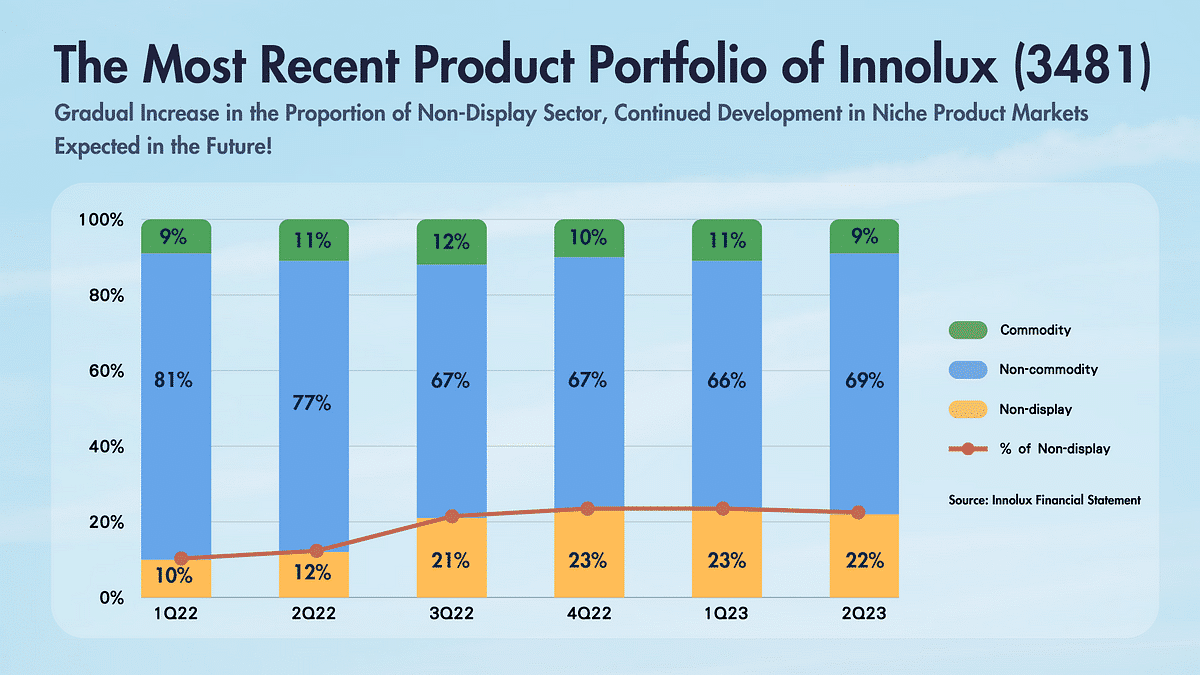

Continuing with Innolux, the company has implemented a dual-track transformation strategy similar to AU Optronics, dividing its operations into two major segments: Display (Commodity and Non-commodity) and Non-display.

The operational strategies for each category are outlined as follows:

FOPLP is a collaborative development with the Industrial Technology Research Institute in 2019. It involves renovating 3.5-generation facilities into semiconductor packaging plants to produce the wiring layers (RDL) required for advanced semiconductor packaging. Mass production is expected to commence in the latter half of 2023, with several customers currently undergoing verification processes. Additionally, the company expresses its commitment to continue developing niche product markets, aiming to mitigate the impact of economic cycles through diversified initiatives. As of the latest earnings call data, the revenue proportion from the Non-display sector has reached 23% in 2023 H1, growing by 12 percentage points compared to the same period last year, which was 11%.

Although Innolux has experienced a significant decline in revenue and profitability during this downturn in the panel industry, it is noteworthy that the company does not bear the burden of CAPEX and R&D for facilities in China or Korea. The current financial situation remains robust, with a dependency on borrowing of only 29% and a substantial cash reserve of 106.4 billion NTD.

Looking ahead to the first half of 2024, most panel prices across various applications have shifted from an upward trend to stabilization. This indicates weak demand. If the overall economy does not show a clear recovery, the panel industry’s prospects may not see improvement.

Taiwan’s two major panel manufacturers’ operational strategies are heading toward a dual-track transformation. Having experienced several cycles of the LCD, both companies have established robust financial structures and are proactively expanding into non-panel industries. Consequently, despite the current economic downturn, their operational funds remain relatively healthy.

In conclusion, as we await a potential recovery in the panel industry in 2024, manufacturers seeking to break free from the cyclical nature of the panel industry must venture into niche areas and other non-panel industries. The subsequent changes in these two manufacturers’ business strategies and product portfolios will impact their long-term competitiveness and operational capabilities. We can keep monitoring the developments and plans of both companies in non-panel industries to stay abreast of the latest trends in the panel industry.

Read More:

About us

⭐️ TEJ Website

⭐️ LinkedIn

✉️ E-mail: finasia@tej.com.tw

☎️ Phone: 02–87681088

Subscribe to newsletter