Table of Contents

Calculation of the Foreign Institutional Investors Stock Holding Percentage

Calculation of the Investment Funds Stock Holding Percentage

✨Foreign Institutional Investors Stock Holding Percentage✨

The formula for foreign institutional investors stock holding percentage is as follows:

For individual stocks: Foreign institutional investors shareholding volume / Outstanding shares

For industries: Foreign-institutional-investors-held market value / Total market value outstanding

For listed companies, factors affecting foreign institutional investors shareholding include not only the net buy/sell volume of foreign investors in the centralized market but also non-centralized market trading factors that simultaneously affect foreign shareholding. Examples include: margin trading in the securities lending market, changes in the number of overseas depositary receipts, conversions of overseas convertible corporate bonds, changes in capital or shareholder meetings of listed companies, ex-rights declarations or ETF repurchases, changes in investors’ nationalities, and so on.

For over-the-counter (OTC) companies, factors affecting foreign shareholding include not only the net buy/sell volume of foreign investors in the OTC market but also non-market trading factors that simultaneously affect foreign shareholding. Examples include: margin trading in the securities lending market, changes in the number of overseas depositary receipts, conversions of overseas convertible corporate bonds, changes in capital or shareholder meetings of OTC companies, ex-rights declarations or ETF repurchases, changes in investors’ nationalities, and so on.

The following websites are for reference:

Listed Companies: https://www.twse.com.tw/zh/page/trading/fund/MI_QFIIS.html

Over-the-Counter Companies: https://mops.twse.com.tw/server-java/t13sa150_otc?step=0

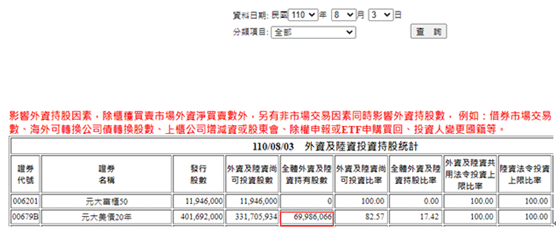

Using TSMC ( 2330 ) on August 3rd, 2021 as an example for a listed company, the total Foreign institutional investors shareholding volume can be found from the Taiwan Stock Exchange’s website with actual numbers, as shown in the image below:

Using Yuanta 20-year US Dollar Bond (00679B ) on August 3rd, 2021 as an example for an OTC target, the total foreign ownership can be found from the GreTai Securities Market with actual numbers, as shown in the image below ( The English version of this website is not available now ):

Now that you have the total foreign ownership, calculating the foreign ownership percentage becomes much easier. The next time you use the ownership percentage, you’ll have a clearer understanding of the factors affecting it, helping you avoid the frustration of discrepancies in your calculations.

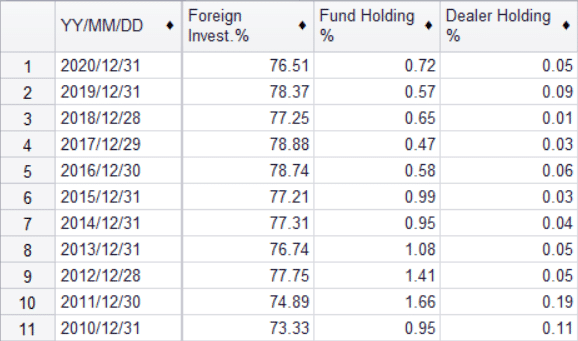

Furthermore, when the foreign ownership percentage of a stock is higher, it means that foreign investors have more influence on the price fluctuations of that stock. Taking TSMC ( 2330 ) as an example, the total foreign investment ratio has been consistently above 70% for the past decade. In theory, foreign investors have the most significant impact on TSMC’s stock price.

✨Investment Funds Stock Holding Percentage✨

In our last article, we mentioned that investment funds refer to domestic securities investment funds primarily aimed at offering funds for public purchase to aggregate all funds. They invest in the stock market through professional fund managers, while also charging investors commission fees and management fees. These fund managers also face some restrictions when operating, such as regulatory requirements that holdings must be over 70% and individual stock proportions cannot exceed 10% of their own fund’s net asset value. Therefore, the total shareholding ratio of investment funds for a particular stock is usually less than 15%. Hence, if investors notice that the shareholding ratio is approaching 15%, the time for the investment funds to sell is not far off, and the stock price may decline accordingly. Investors need to be extra cautious for those stocks.

How do we calculate the investment funds stock holding percentage? TEJ Pro provides the calculated results for users’ convenience. However, some users may have questions about the investment funds stock holding percentage calculated by TEJ. We will now provide a detailed explanation of the entire calculation process. We can see that the formula for investment funds stock holding percentage is as follows.

For individual stocks: ( Investment fund shareholding – Estimated ) / Outstanding shares

For industries: Investment fund market value / Total market value outstanding

What might raise questions here is the calculation of the investment fund shareholding. TEJ calculates investment fund shareholding based on information announced by the Securities Investment Trust & Consulting Association ( SITCA ) and makes adjustments accordingly.

Fund Investment Details – Quarter with Fund Asset Value Accounting for More Than 1%:

https://www.sitca.org.tw/ROC/Industry/IN2630.aspx?pid=IN22601_05

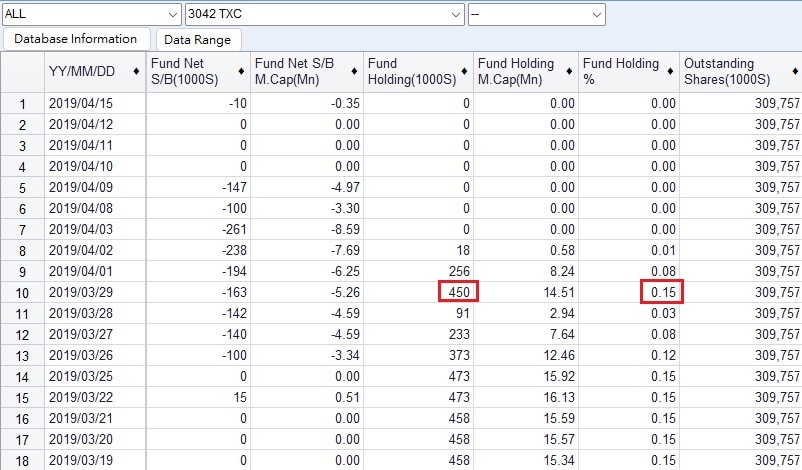

For TXC Corporation ( 3042 ), the most recent instance of a fund holding 3042 and accounting for over 1% of its net asset value was T3236Y Nomura Taiwan High Dividend Fund, as of March 2019. At that time, the Securities Investment Trust & Consulting Association ( SITCA ) disclosed a figure of 450. Therefore, TEJ calculates based on this value. However, by June 2019, when SITCA updated its figures, there were no longer any funds holding 3042 accounting for over 1% of their net asset value. Hence, the investment trust shareholding was adjusted to 0. Similarly, since there were no relevant figures disclosed by SITCA in September 2019, the basis for adjustment was also 0. TEJ calculates based on the buying and selling situation every day. Therefore, the investment fund ownership ratio for TXC Corporation (3042) on March 29, 2019, of 0.15 (450/309757) was calculated in this manner.

| Fund Name | Target Category | Target code | Target Name | Amount | Fund Asset Value Percentage |

| Nomura Taiwan High Dividend Fund | Listed Company | 3042 | TXC Corporation | 14,512,500 | 2.79 |

The net buy/sell, stock holding ratio, and turnover rate of the three major institutional investors are important indicators in chip analysis. When making investments, using this information as a basis allows us to better understand the market dynamics and potentially profit from stock trading. In this article, we introduced the calculation methods for foreign institutional investors and investment funds. In the next issue, we will delve into the calculation algorithms for dealers. We hope that every reader can gain a deeper understanding through our articles. If interested, our E-Journal also offers other related articles, which you can find in the link below.

Lastly, you can also follow us on IG: tej87681088, or visit the official website of TEJ Taiwan Economic News, where we provide rich content such as bi-weekly newsletters and TEJ API financial notes.

If you enjoyed this article, please show us your support and encouragement. If you have any questions, feel free to leave a comment below or send us an email, and we will get back to you as soon as possible. Thank you.

Subscribe to newsletter