Table of Contents

As Bobby Axelrod, the main character in the drama “Billions”, said “ short selling is just like leukocyte in the capital market. They specialize in swallowing bad companies, which can increase the efficiency of the capital market.”

Margin Transactions and Securities Lending are institutional arrangements that vitalize the securities market, providing investors with more diverse ways to participate. When investors have insufficient funds and are bullish on the future market, they can use “margin purchase” to purchase securities from a securities firm; on the other hand, when investors do not have any securities and are bearish on the future market, they can use “short sale” or “borrowing” to sell securities through securities financing to achieve the purpose of selling securities.

Short selling is not without its benefits. According to past studies, short selling traders are usually “informed traders” who are capable of identifying overestimated stocks. By shorting overvalued stocks, the prices of these stocks can be brought back to the fundamentals, thus increasing market efficiency and serving the function of price discovery. Some literature indicates that “SBL Short Sale” and “Margin Short Sale” may have different influences on stock return due to the difference of traders. Therefore, we discuss the expected return predictability of the FTSE TWSE Taiwan Mid-Cap 100 index’s constituent between two short selling ways through the research process of factor-based investing, then choose the best factor of short selling.

In Taiwan, there are two kinds of short selling ways, which are “Margin Short Sale” and “SBL Short Sale”. Most of the traders of “SBL Short Sale” are institutional investors, like foreign investors, investment trusts, and dealers. Unlike SBL Short Sale, traders of “Margin Short Sale” are mostly individuals (retail investors) and general legal persons (general corporations) due to the regulations.

◎ Margin Short Sale: When investor does not have any securities and are bearish on the future market, tehy can apply for securities financing from a securities dealer or a securities firm by preparing a certain amount of margin. Investors only need to return the securities within a certain period of time in the future to achieve the purpose of selling.

◎ SBL Short Sale: The lender receives a fee for borrowing securities, temporarily transfers the marketable securities to the borrower, and receives collateral. The borrower will return the securities within a certain period in the future.

However, having a deal of SBL does not mean short-selling, it can be used for repayment, contract fulfillment, hedging, arbitrage and other purposes. Therefore, we only provide some empirical evidence of the “SBL Short Sale” to reflect the actual short-selling volume of investors.

In this article, we take the constituents of FTSE TWSE Taiwan Mid-Cap 100 index as samples. The data were taken from TEJ, and the period is from January 2013 to September 2021. Also, we treat the data properly to avoid survivorship bias and Look-ahead bias.

Referring to Lee et al.(2017), we organize short-selling variables into table 1 below. Considering the amount of “Margin Short Sale” and “SBL Short Sale” will affect the volume and market value of a stock, adjusting the volume and market value or taking growth rate as a short-selling variable is necessary. For detailed variable treatment, see table 1 below.

| Code | Variable | Calculation |

|---|---|---|

| sbls_v | Ratio of SBL Short Sales amount to Trade amount(%) | (SBL Short Sales amount of the month/Trade amount of the month)×100% |

| shorts_v | Ratio of Margin Short Sales amount to Trade amount(%) | (Short selling amount of the month/Trade amount of the month)×100% |

| sbls_g | Growth rate of SBL Short Sales(%) | ((SBL Short Sales amount of current month/SBL Short Sales amount of previous month)-1)×100% |

| shorts_g | Growth rate of Margin Short Sales(%) | ((Margin Short Sales amount of current month/Margin Short Sales amount of previous month)-1)×100% |

| sbls_mv | Ratio of SBL Short sells balance to Market Value(%) | (SBL sells balance of the month/Market Value of the month)×100% |

| shorts_mv | Ratio of Margin Short sells balance to Market Value(%) | (Margin Short sells balance of the month/Market Value of the month)×100% |

Want to Obtain Comprehensive Stock Data of Short Selling?

Click the Link and Exlpore More About Market Data!

Next, we organize all the descriptive statistics into table 2 below. As you can see, all the short-selling variables are positive skewness, which represents that there are stocks short sold in high volume. We can also discover that “SBL Short Sale” takes more shares than “Margin Short Sale” in short selling. We presume the reason is that institutional investors short sell mainly through “SBL Short Sale”.

| sbls_v | shorts_v | sbls_g | shorts_g | sbls_mv | shorts_mv | |

| Mean | 3.235 | 1.122 | 164.858 | 114.831 | 1.446 | 0.127 |

| Std | 3.149 | 1.433 | 2374.384 | 645.715 | 1.652 | 0.265 |

| Min | 0 | 0 | -100 | -100 | 0 | 0 |

| 25% | 0.92 | 0.179 | -50.485 | -53.146 | 0.329 | 0.004 |

| 50% | 2.246 | 0.601 | 0.439 | -8.667 | 0.793 | 0.022 |

| 75% | 4.531 | 1.506 | 102.657 | 81.183 | 1.88 | 0.111 |

| Max | 20.491 | 14.95 | 199062.3 | 22924.66 | 9.357 | 2.869 |

To understand if the short selling variables are effective factors, we take cross-sectional regression analysis and portfolio analysis as the research methodology.

In cross-sectional regression, we have a regression of the return rate of the next month(t) on the return rate of the current month(t+1). In table 3, among all the variables, we can see that only sbls_v has statistical significance. There is a negative relation between sbls_v and the expected return of the stock, which is predictive of the expected return on the cross-section of stocks. The others variables are statistically insignificant.

| sbls_v | shorts_v | sbls_g | shorts_g | sbls_mv | shorts_mv | |

| Cross-sectional Regression Coefficient Mean | -0.139 | 0.071 | 0 | 0 | -0.096 | 0.156 |

| t-value | -3.262*** | 0.334 | 0.478 | 0.376 | -1.077 | 0.158 |

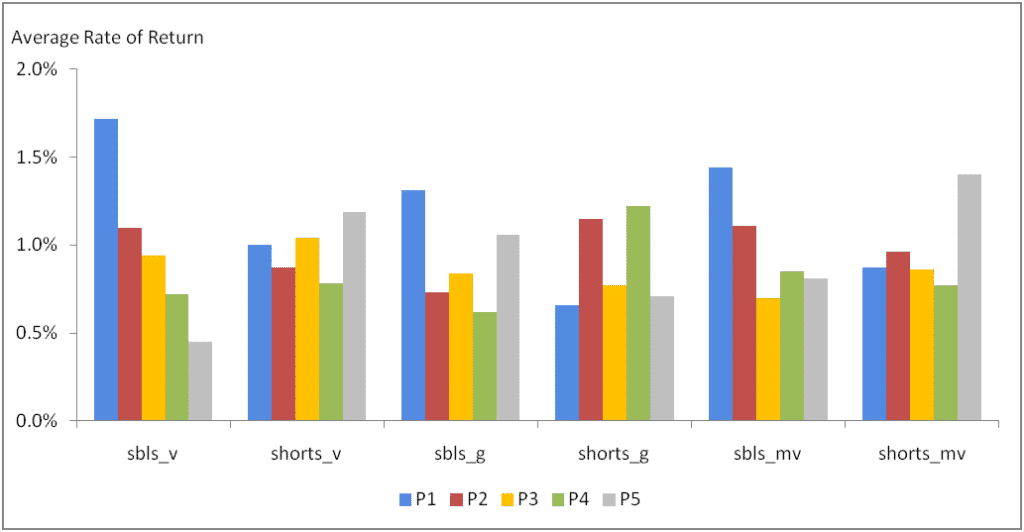

As for portfolio analysis, we sort the variables by size and separate them into 5 equal-weighted portfolios, and according to the number of short selling from low to high, namely as P1, P2, P3, P4, and P5. Next, we hold it for one month and calculated the average return rate, then changed the stocks among the portfolios to see if it is monotonicity and has predictability between short selling variables and expected return. Figure 1 shows sbls_v has the best predictability, which is consistent with the result of cross-sectional regression analysis.

We further calculated the annualized return and compared it with the market’s performance. We found that the performance of the investment factor constructed with SBL Short Sale is better than that of the investment factor constructed with Margin Short Sale. In addition, using sbls_v as the stock selection factor and choosing the investment group with the lowest shorting volume (P1) can obtain an annualized return that exceeds the market, which is the best investment strategy found in this study.

Through the analysis of cross-section regression and portfolio analysis, we can have a conclusion that Ratio of SBL Short Sales amount to Trade amount (sbls_v) has a significant negative relation with the expected return, and sbls_v indeed has predictability to the expected return of the future.

In addition, the empirical result is inconsistent between the variables of “SBL Short Sale” and “Margin Short Sale”. The possible reason is that the trader of “lending securities” are mostly institutional investors who have preferable to the constituents of FTSE TWSE Taiwan Mid-Cap 100 index. While institutional investors are generally regarded as “informed traders”, the difference between traders of “SBL Short Sale” and “Margin Short Sale” could have different predictability of variables to expected return.

Taiwan stock market data, TEJ collect it all.

Taiwan Economical Journal (TEJ) has long-term cooperation with internationally renowned data providers, providing high-quality financial data for five financial markets in Asia. Our data includes all listed companies on stock markets in Taiwan, China, Hong Kong, Japan, Korea, etc. With TEJ’s assistance, you can access relevant information about major stock markets in Asia, such as securities market, enterprise operations, financials, sustainability data, etc., providing investors with timely and high-quality content!

Subscribe to newsletter