Table of Contents

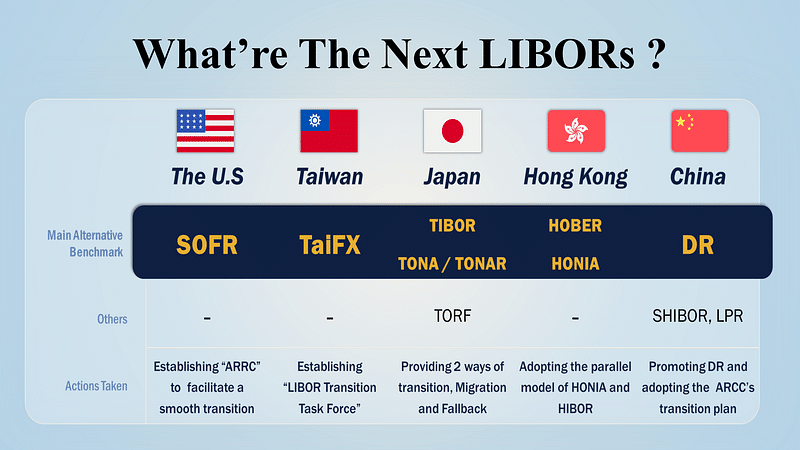

As of now, various alternative benchmarks have been proposed in response to the exit of LIBOR. The most widely used SOFR, TONA introduced by Japan, SONIA by the bank of England, and LPR and DR by China. However, how to apply them to outstanding financial instruments remains a question for the authorities concerned.

This article will introduce the Alternative Reference Rates Committee (ARRC) and outline the alternative rate benchmarks proposed or adopted by Taiwan, Japan, Hong Kong, and China; the details are also elaborated on in each section.

The ARRC is a collaborative effort between the Federal Reserve Board (FRB) and the Federal Reserve Bank of New York (FRBNY), intending to facilitate a smooth transition from LIBOR to alternative benchmarks. Among these alternative benchmarks, the most recommended one by ARCC is the Secured Overnight Financing Rate (SOFR); still, various transition methods have been proposed for different countries and institutions as references.

To minimize the impact of LIBOR’s phaseout on Taiwan’s financial market, the Central Bank and Financial Supervisory Commission (FSC) issued a public guide in February 2020. The guide urges financial institutions to seek alternative benchmarks, modify relevant contracts, and establish hedging strategies. At the same time, the Bankers Association was requested to establish a “LIBOR Transition Project Task Force” to assist in the successful transition.

Nonetheless, transitioning from LIBOR to alternative rates involves many issues. In response, several banks and securities firms have set up LIBOR transition project teams and established special sections on their websites for investors. For example, Mega Bank has integrated its Corporate Banking Division as a channel to handle relevant work.

Besides the alternative benchmarks recommended by ARRC, Taiwan already has the TaiFX available for USD lending. Equipped with its clause, when TaiFX is higher than LIBOR by 35–40 bps, an additional interest rate will be applied to the excess portion, allowing customers to absorb the difference themselves. Because of this, TaiFX was suggested by both Mega Bank and First Bank to apply to the USD lending market within Taiwan.

The Japanese yen is one of the five currencies in which LIBOR is computed, so the Japanese market has been discussing a replacement for LIBOR since 2015.

Alternative Rate Benchmark

1. TIBOR (Tokyo InterBank Offered Rate)

TIBOR is an interest rate calculated based on quotes for interbank lending. There are two types of TIBOR: “Japanese Yen TIBOR (DTIBOR),” published by The National Association of Bankers in 1995, and “Euroyen TIBOR (ZTIBOR),” published by NABJ in 1998, representing onshore and offshore markets in Japan, respectively.

In 2014, the Japan Bankers Association Tokyo (JBATA) took over the calculation and publication of TIBOR. The measure remained the same, but the newly published rates were called “JBA TIBOR.” JBATA calculates five different quotes for each of the five terms provided by banks at 11 a.m. every day, then publishes DTIBOR and ZTIBOR on its website.

2. TONA (Tokyo Overnight Average Rate)

TONA or TONAR, launched by the Bank of Japan in 2016, is a backward-looking interest rate used as a benchmark for measuring the cost of Japanese yen in the overnight interbank lending market. As TIBOR still holds a significant position in the Japanese financial market, the JBA adopts a parallel model to ensure consistency between TONA and TIBOR.

3. TORF (Tokyo Term Risk-Free Rate)

TORF generates its interest rate through transaction data rather than bank quotes. It is a forward-looking rate built on top of TONA. Because the reference and calculation periods of TORF are the same, the influence on the financial market during the transition from LIBOR to TORF is relatively tiny compared to other alternative rates.

The regulatory for TORF is QUICK Corp, a Japanese financial information provider, which has been responsible for calculating and publishing TORF rates daily.

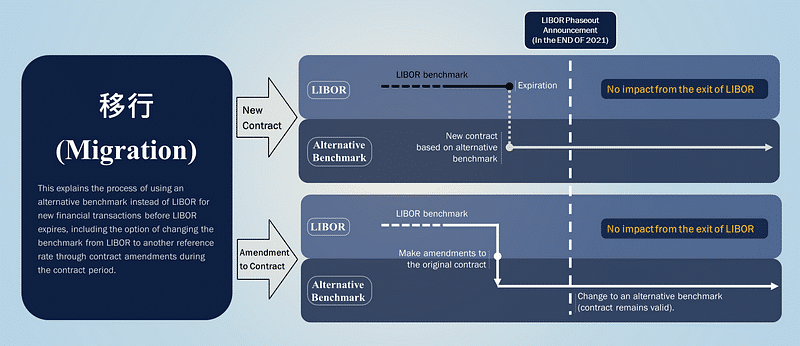

There are two ways to transition interest rate benchmarks, namely “移行” and “フォールバック,” differing in the timing of the rate benchmark transition.

1. 移行 (Migration)

Migration will be left to the contracting parties to decide whether to enter into a new agreement or make amendments to the original contract. The figure shows that the timing for renegotiation or modification can be determined flexibly under the mutual agreement.

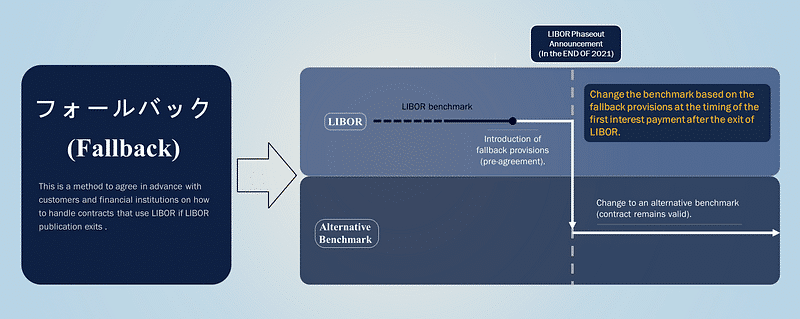

2. フォールバック (Fallback)

Fallback refers to no adjustment to the original agreement. Still, it is supplemented with a provision to adopt an alternative interest rate benchmark after the cessation of the LIBOR on December 31, 2021.

Alternative Rate Benchmark

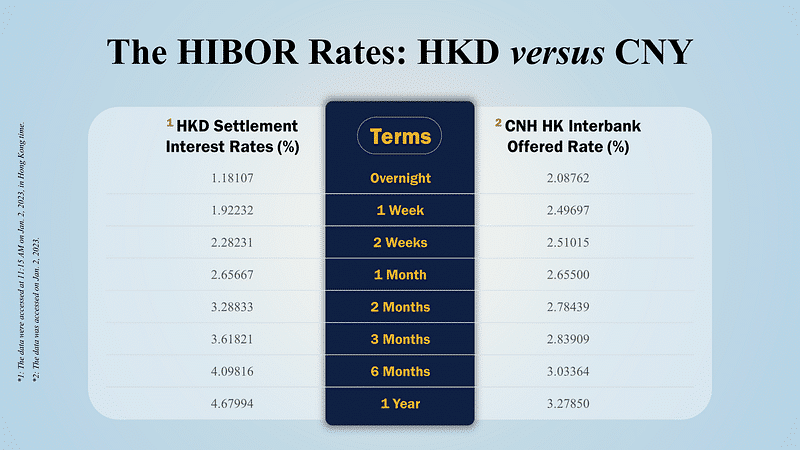

1. HIBOR Hong Kong Interbank Offered Rate)

HIBOR is the Hong Kong interbank lending rate, which comes in three versions: the Hong Kong dollar, the US dollar, and the Chinese yuan. The HKD and USD HIBOR are calculated and published by the Hong Kong Association of Banks, while the CNY HIBOR data is released by the Hong Kong Treasury Markets Association.

Quotes of HIBOR are provided by 20 designated banks daily for calculating the interest rate subsequently. In addition, HIBOR has multiple terms like LIBOR.

2. HONIA (HKD Overnight Index Average)

HONIA is a risk-free overnight and fully transaction-based interest rate benchmark similar to SOFR. The Hong Kong Monetary Authority (HKMA) encourages market participants to introduce more products based on HONIA to support the expansion of the HONIA. However, using actual transaction data for calculation makes it impossible for investors to predict future rates, which prevents HONIA from entirely replacing HIBOR.

Quotes of HIBOR are provided by 20 designated banks daily for calculating the interest rate subsequently. In addition, HIBOR has multiple terms like LIBOR.

When and How Interest Rates Benchmarks Transition

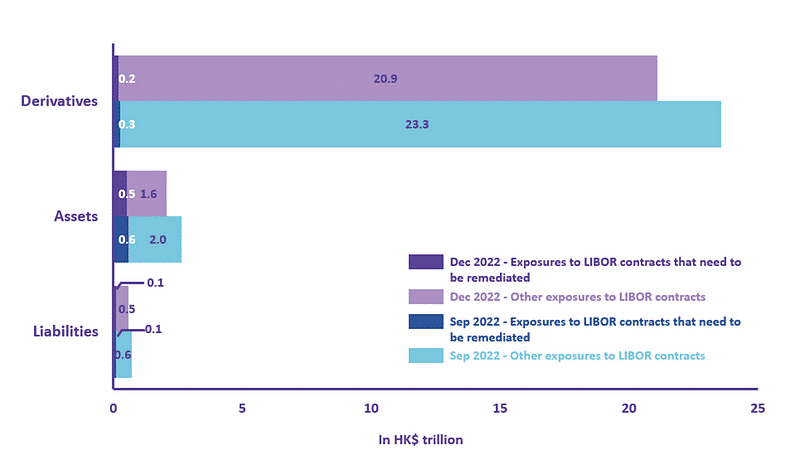

According to the HKMA, the number of LIBOR contracts that need to be revised decreased by over 90% from the peak in 2020. Overall, the transition from LIBOR to alternative benchmarks is progressing smoothly.

However, former Vice president of the HKMA, Eddie Yue, pointed out that Hong Kong would adopt a parallel model of HONIA and HIBOR because they still have confidence in the pricing mechanism of HIBOR, and the cancellation of HIBOR would come with high costs.

On August 31, 2020, the People’s Bank of China stated that the DR would be the top choice as an alternative benchmark for LIBOR, as it can reflect the most accurate financial market conditions.

Alternative Rate Benchmark

1. SHIBOR (Shanghai Interbank Offered Rate)

SHIBOR is an unsecured, single-rate interest rate quoted by primary dealers or other higher-rated banks. After removing the highest and lowest quotes, calculating the average, and obtaining the interest rate for that period, the rate is announced by the Shanghai Interbank Offered Rate Center.

Like LIBOR, SHIBOR provides eight different periods (O/N, 1W, 2W, 1M, 3M, 6M, 9M, 1Y), and both are forward-looking rates based on bank quotes rather than actual transaction rates. Although SHIBOR has the same subjective flaws as LIBOR, its position is still crucial as many financial products are priced using SHIBOR.

2. LPR (Loan Prime Rate)

LPR is also one of the leading alternative rate benchmarks in China. LPR refers to the loan interest rate financial institutions offer their prime customers. It is quoted by 18 reporting banks based on the market operations rate plus a basis point and calculated by the National Interbank Funding Center to provide two types of tenors, one year and five years.

3. DR (Depository-Institutions Repo Rate)

In 2020, the People’s Bank of China (PBOC) released the White Paper indicating that DR will be selected as the primary alternative benchmark and cultivated as the benchmark for actual RMB transactions. To promote the development of DR and enable its broader application in the financial market, PBOC has implemented five measurements:

When and How Interest Rates Benchmarks Transition

There isn’t a clear timeline for the transition of LIBOR-denominated financial products. As for how to transition from LIBOR to other interest rate benchmarks, the PBOC has adopted the transition plan provided by the ARRC.

Under this plan, the institution and investors will negotiate the time and measures to incorporate the conversion mechanism into the original issuance conditions of financial products. Furthermore, the ARRC-recommended benchmark rate will be given priority by PBOC. As for future issuances of financial products, LIBOR-denominated products with embedded alternative rate transition may be used, or alternative rates may be used directly, depending on the mutual agreement of both parties.

According to the Financial Stability Board (FSB), the transition of USD LIBOR to SOFR has made significant progress. Meanwhile, the FSB encourages market participants to complete the last mile of the LIBOR by improving overnight risk-free rates (RFRs) and establishing a reliable and liquid environment.

As countries have accelerated the transition to new benchmarks. TEJ reminds you to actively review your investment portfolios for involvement with relevant interest rate benchmarks in case of asset loss.

Subscribe to newsletter