As developed nations like the U.S., Japan, or Germany navigate persistent inflation, high interest rates, and shifting geopolitical dynamics, investors are turning their attention to emerging markets. These fast-growing economies are forecasted to contribute around 65% of the world’s GDP by 2035 as they are fueled by an expanding middle class, rapid technological adoption, and significant infrastructure development.

To help you understand this dynamic asset class, we’ll break down what emerging markets are, the benefits and challenges of investing in them, as well as methods to approach this investment strategically.

Table of Contents

Emerging markets are countries experiencing rapid economic growth and industrialization, typically transitioning from low-income, less-developed economies toward higher-income, modernized ones. Common criteria used to classify emerging markets include increasing GDP, expanding industrial output, improving infrastructure, and rising standards of living.

These economies can be tracked through benchmarks such as the MSCI Emerging Markets Index, which consists of 24 countries, including India, Brazil, Vietnam, Mexico, South Africa, and more.

Among these nations, Taiwan is often considered an emerging market with one of the highest potentials. It benefits from a resilient, export-driven economy, particularly in semiconductor manufacturing, where it plays a central role in the global tech supply chain through companies like Taiwan Semiconductor Manufacturing Company Limited (TSMC). TSMC is ranked 1st by the MSCI Emerging Market Index among the top 10 constituents in 2025 with a $957.46 billion USD float-adjusted market capitalization.

Taiwan is also experiencing growth thanks to AI innovation, energy-efficient technologies, and high-end hardware production. This makes Taiwan an attractive investment destination within emerging market portfolios.

No, they are not the same. Emerging market investing focuses on stocks or assets in developing countries, while forex trading involves exchanging one currency for another to profit from rate changes.

Are emerging markets a good investment? Many believe so, given their growth, diversification, and valuation potential.

Emerging markets often expand at much faster rates than developed economies. Research by S&P Global shows that emerging economies are projected to grow around 4.1% per year through 2035, compared to just 1.6% for advanced economies.

This economic expansion often translates into greater potential for corporate earnings growth and, consequently, higher equity returns. For example, the iShares MSCI Emerging Markets ETF (EEM), tracking the MSCI Emerging Markets Index, saw a total return of nearly 193% over 20 years (~5.5% annualized) and ~18% year-to-date in 2024-2025.

This is reflected in MSCI’s July 2025 performance report as well, which shows that the Emerging Markets Index has delivered an annualized return of 8.07% since 2000, outpacing the 6.83% return of the MSCI ACWI and the 6.95% of the MSCI World Index over the same period. Notably, Taiwan’s TSMC holds the largest index weight at 10.74%, underscoring how these companies play a critical role in driving long-term growth and investor returns.

Studies published in the International Journal of Economics and Financial Issues show equity markets in developing economies have lower correlations with U.S. and other developed market equities. This means their performance isn’t always tied to the same economic cycles or market movements.

Thus, allocating capital to emerging markets enhances portfolio diversification, helping investors reduce overall risk and volatility for smoother returns, as emerging markets may follow a different trajectory during downturns in developed markets.

Emerging market stocks frequently trade at more attractive valuations than those in developed markets. For instance, the MSCI Emerging Markets Index’s Price-to-Earnings ratio (P/E, the ratio of a company’s stock/share price to their earnings per share) and Price-to-Book ratio (P/B, the ratio of a company’s current market price to the book value) ratio are lower than those seen in the MSCI World Index, representing developed markets.

While this valuation discount reflects factors like higher perceived risks, it can also present compelling opportunities for investors seeking undervalued assets with strong growth prospects, especially given that these markets are often less efficiently priced or less covered by analysts.

While emerging markets offer high growth potential, they also come with unique risks. Here are key challenges investors should consider and ways to mitigate them:

Emerging market currencies can fluctuate sharply against major currencies like the U.S. dollar. For instance, the Argentinian peso has experienced significant depreciation in recent years, sparking rampant inflation and capital flight. Such devaluation can erode returns or amplify losses, even if the underlying asset performs well in local terms. In addition, some markets may lack liquidity, making it harder to buy or sell assets efficiently.

To manage such currency and liquidity risks, investors can adopt a long-term horizon and diversify across various emerging economies, instead of focusing exposure to one.

Emerging markets often experience larger price swings than developed ones. Limited financial disclosures, inconsistent data standards, and lower analyst coverage can further increase uncertainty.

Still, researching individual markets and using country-specific risk assessments can help investors make informed decisions. Notably, Taiwan’s equity market enforces investment regulations and financial reporting standards (such as monthly revenue reports and quarterly financials), offering greater transparency and investor protection.

On top of that, solutions like TEJ’s Financial Data provide a unique access to Taiwan’s comprehensive financial disclosures, serving as a reliable data backbone for informed decision-making in the market.

Policy shifts, unstable governments, or conflict can severely disrupt markets. These changes can affect everything from interest rates to trade policies, hurting company earnings. For example, Russia’s 2022 invasion of Ukraine led to sanctions and exclusion from global financial systems, causing many foreign investors to write down or exit positions entirely.

Once again, this highlights how diversification across multiple countries and sectors is important to reduce the impact of political instability in any one region.

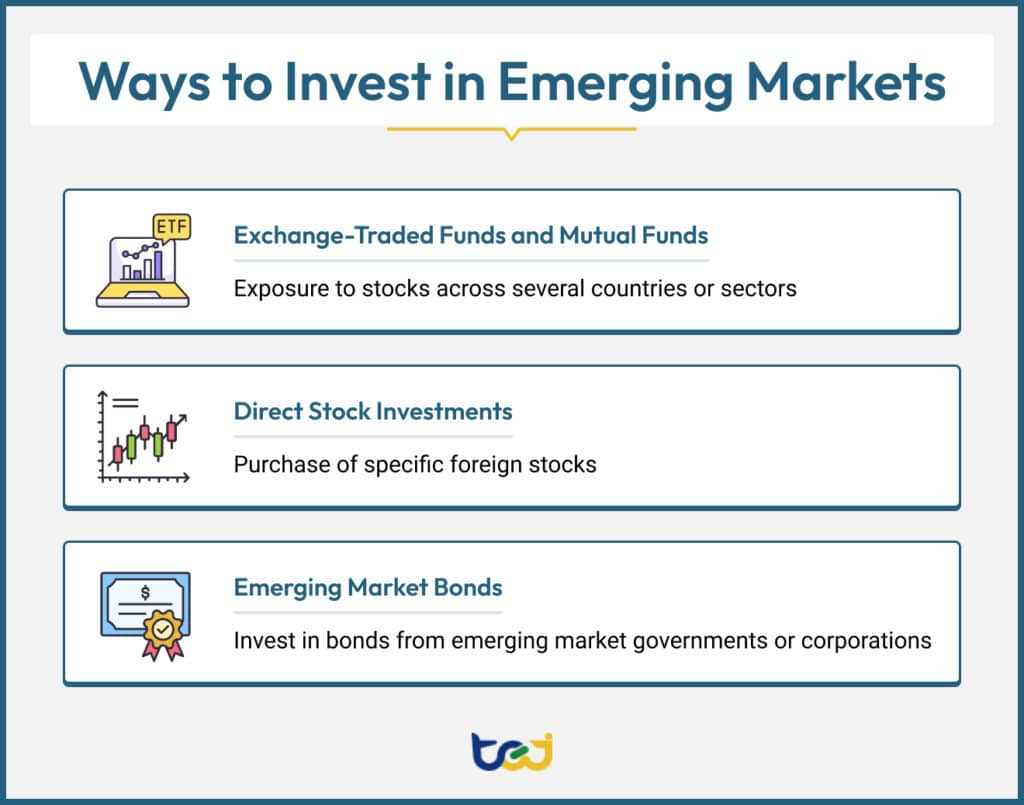

There are several ways to gain exposure to emerging markets. Below are three common strategies investors can consider:

Exchange-traded funds (ETFs) and mutual funds are popular entry points for investing in emerging markets. These funds typically track a broad index, like the MSCI Emerging Markets Index, and hold a diversified portfolio of stocks across several countries or sectors.

This strategy helps reduce the risk associated with investing in a single company or country. Investors can choose between broad-based funds or more targeted options, such as funds focused on small-cap stocks, specific regions, or themes like dividend-paying companies.

What’s more, ETFs and mutual funds offer cost efficiency, easy trading, and transparency, but it’s still crucial to research the fund’s holdings, fees, and country-specific risks before investing.

For hands-on investors who want to focus on specific companies, direct stock purchases in emerging markets are another option. For U.S. investors, many foreign stocks, including high-profile ones like Taiwan Semiconductor Manufacturing Company Limited (TSMC), are available through American Depositary Receipts (ADRs), making them accessible without needing to open an international brokerage account.

While direct stock investments offer the potential for higher returns from successful individual picks, they also come with greater volatility and limited diversification compared to broad funds, so investors should do due diligence to understand each company and the local market dynamics thoroughly.

Investing in bonds from emerging market governments or corporations offers a way to earn fixed income while gaining exposure to these economies. Some investors access these through dedicated funds, like the Vanguard Emerging Markets Bond Fund (VEMBX), which offers built-in diversification.

These bonds typically offer higher yields than those from developed countries but also carry higher risks, such as currency fluctuations, inflation, and credit instability. As with stocks, it’s wise to use a broker with international expertise and to evaluate a bond’s credit rating and currency exposure before investing.

There’s no universal rule for how much of your portfolio should be allocated to emerging market investments. In practice, diversified portfolios often allocate between 5% and 10% to emerging markets.

Nevertheless, your ideal allocation should be based on personal factors, such as your risk tolerance, investment horizon, and the overall diversification of your existing portfolio. Some investors begin with a modest 2% allocation and gradually increase exposure as they become more comfortable. It’s also important to review your allocation periodically and rebalance as needed to ensure it aligns with your evolving financial goals and market conditions.

For those interested in specific markets like Taiwan, tools such as TEJ’s Taiwan Corporate Credit Risk Index and Watchdog can help assess company-level risk and stay updated on key developments that may impact investment decisions.

Comprehensive data is crucial when investing in emerging markets, where volatility and information gaps can pose added risks. As a trusted financial data provider, TEJ offers reliable, high-quality data solutions to help investors assess opportunities, manage risks, and make confident, data-driven decisions.

Through our Quantitative Investment Database, investors gain access to a wide array of financial and economic metrics, from company fundamentals and risk attributes to broker trading activities. These datasets support robust model-building, accurate backtesting, and timely decision-making, unlocking the full potential of your emerging market investments. Explore these solutions today!