Table of Contents

Burton G. Malkiel is the Chemical Bank Chairman’s Professor of Economics at Princeton University. He previously worked in the investment banking division of Smith Barney & Co. and has served as a director of several large investment institutions, including The Vanguard Group and The Prudential Insurance Company of America. He was also appointed as a member of the U.S. President’s Council of Economic Advisers. In both academic and investment circles, he is a highly respected and influential figure.

Burton G. Malkiel is best known for his book A Random Walk Down Wall Street (1973), which is still in print today and is regarded as one of the most influential classics on Wall Street. From a fundamental perspective, Malkiel is a proponent of the Random Walk Theory. He believes that although the Efficient Market Theory (EMT) has its flaws, it is largely correct, and that neither the traditional Firm Foundation Theory (such as value investing) nor the Castle-in-the-Air Theory (such as technical analysis) has real ability to predict the future. Truly successful fund managers are extremely rare and most results are largely due to luck. Therefore, he views investing as more of an art than a science. However, in A Random Walk Down Wall Street, he also proposes several investment principles for investors to follow when facing the market.

Malkiel believes that under the Firm Foundation Theory, stock prices are primarily determined by the following factors:

Therefore, he believes that there are three ways for investors to achieve investment success: (1) purchasing index funds, (2) finding outstanding fund managers to invest on their behalf, and (3) investing independently with careful and thoughtful analysis, and most of the time he tends to favor the first approach; however, if an investor truly wishes to participate actively in market movements, he offers the following operational guidelines.

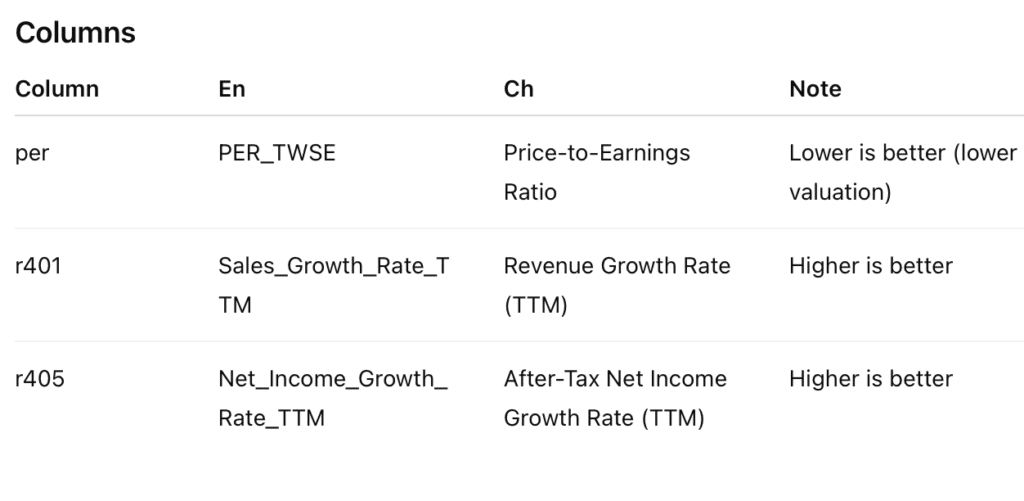

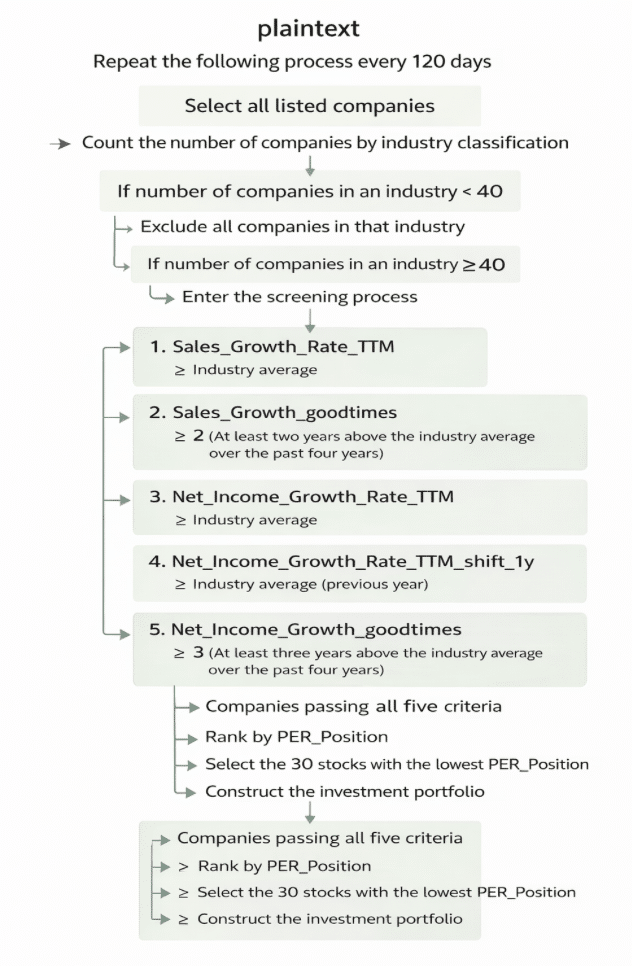

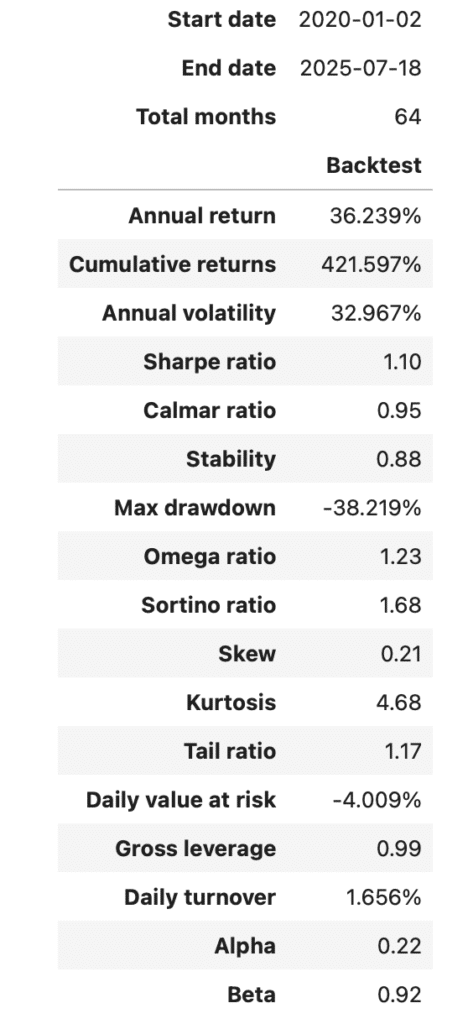

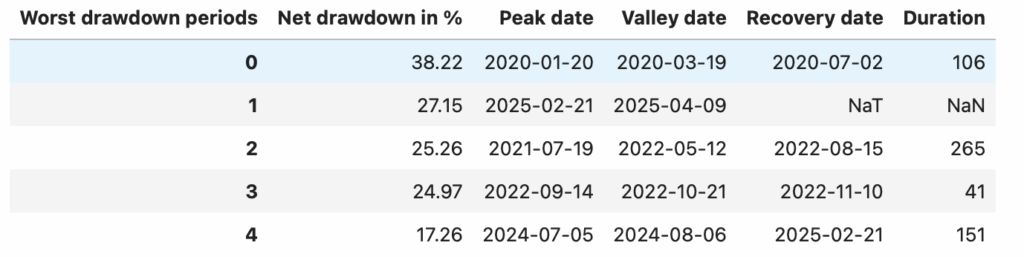

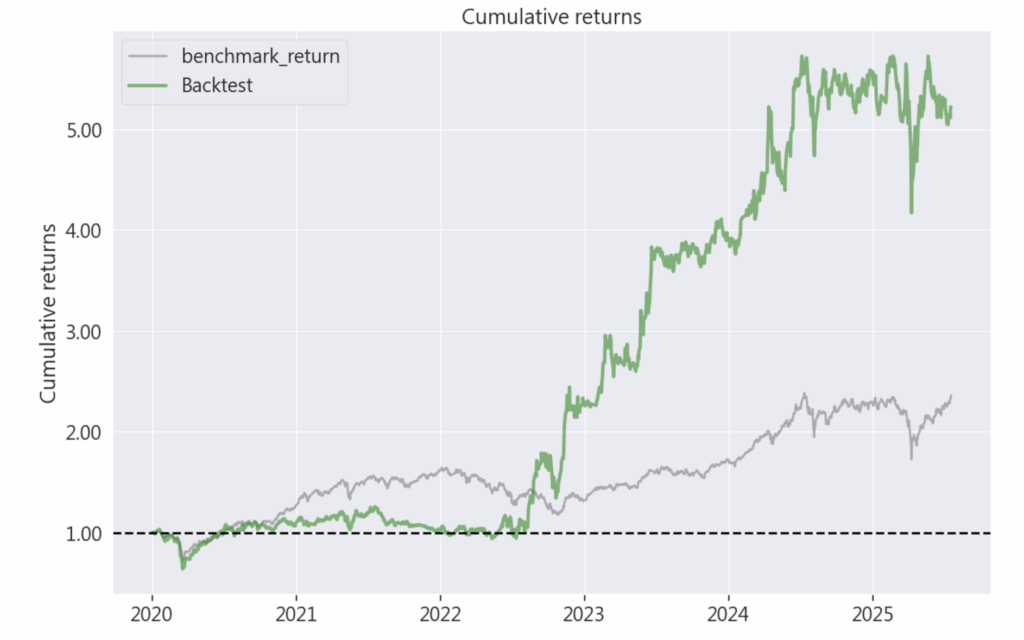

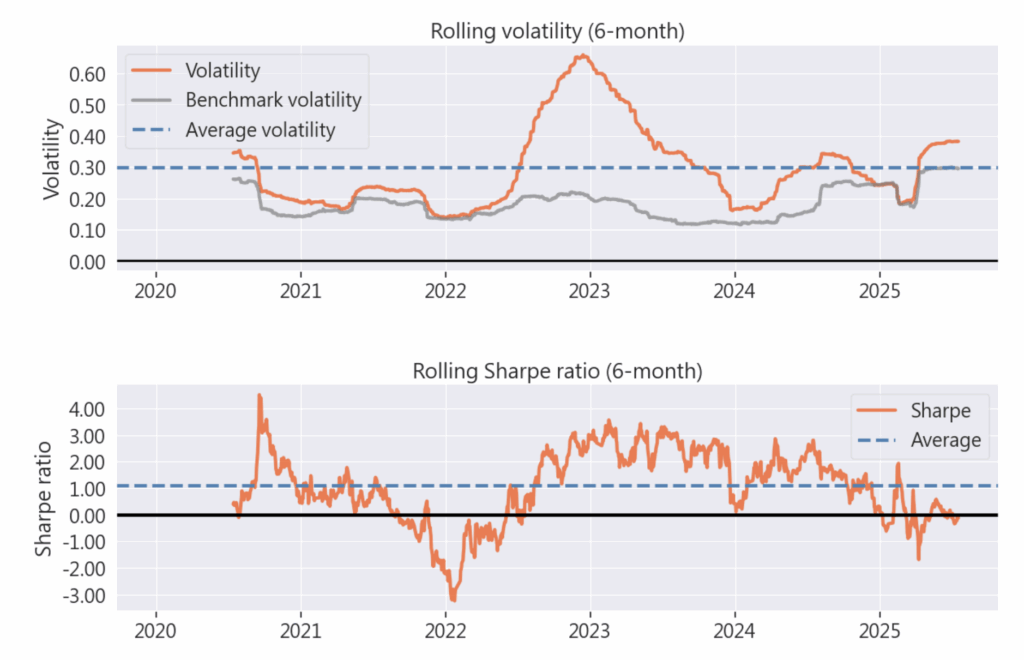

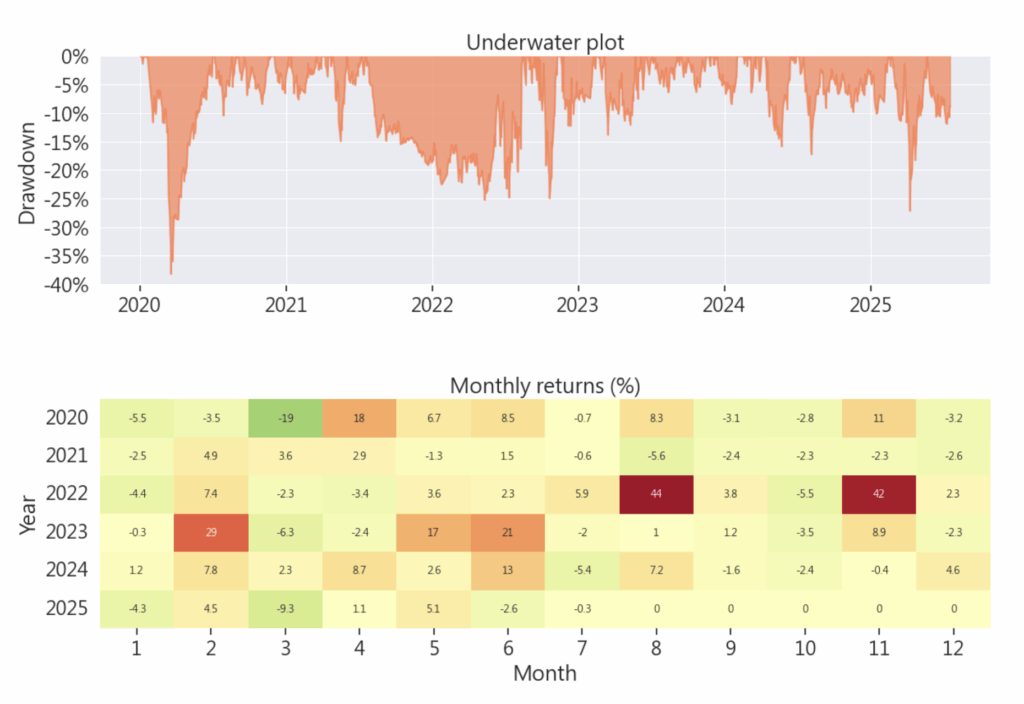

Based on Malkiel’s philosophy, we incorporate several adjustments tailored to the Taiwan stock market to construct the strategy. The parameters used are shown in the table below.

Although Malkiel believes that expected growth and dividend payments are important factors in determining stock prices, he does not consider so-called analyst market consensus to be sufficiently accurate and therefore does not encourage investors to incorporate it into their models.

To capture past and current revenue and earnings performance, we use the revenue growth rate and after-tax net profit growth rate over the past four years, measured relative to the industry average, to assess a company’s ability to sustain growth. Specifically, a company is considered to exhibit stable growth characteristics if, over the past four years, it has at least two years of revenue growth above the industry average and at least three years of net profit growth outperforming its peers.

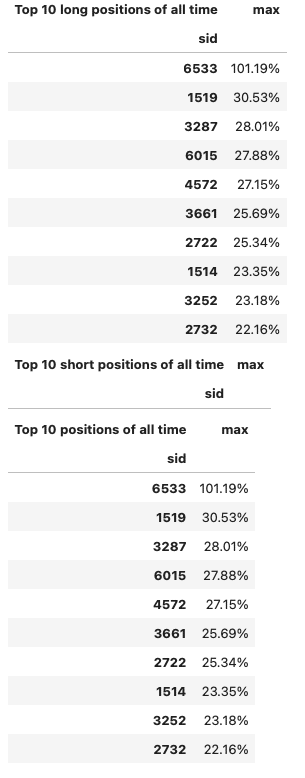

Finally, among the companies that meet the above criteria, we rank them by PER_Position (price-to-earnings ratio ranking position) from lowest to highest and select the 30 stocks with the lowest relative valuations to include in the investment portfolio. The portfolio is rebalanced every 120 days to maintain its fundamental advantages.

We welcome all investors to refer to this strategy. We will continue to share how to construct various indicators using the TEJ database, and backtest their performance.If you are interested in strategy backtesting, we invite you to explore the solutions offered by TQuant Lab, where high-quality data helps you build strategies tailored to your needs.Disclaimer:This analysis is for informational purposes only and does not constitute any form of financial product recommendation or investment advice.

[TQuant Lab Backtesting System] — Solving Your Quantitative Finance Challenges

TEJ Knowledge Finance Academy officially presents — “TQuantLab: Introduction to Quantitative Investing”.

This course integrates TEJ’s empirical data with practical quantitative methods, guiding you from the fundamentals to the core concepts of quantitative investment. Whether you are a finance professional, an investment researcher, or someone looking to enhance your analytical thinking, this course helps you build systemized research and evaluation skills—fast and effectively!

TQuantLab — Your gateway to effective quantitative investing.