Table of Contents

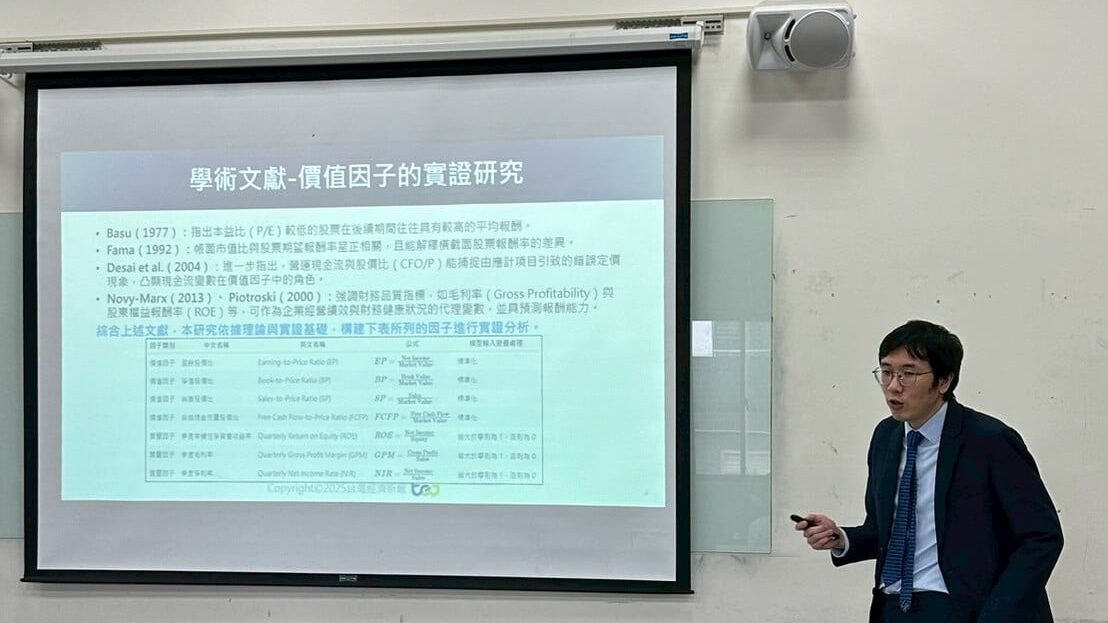

2025 International Conference of Taiwan Finance Association (TFA) is held at National Taiwan Normal University (NTNU) on June 6.This year’s annual conference adopts the theme “Artificial Intelligence and Finance,” exploring the applications of finance from multiple perspectives. TEJ was invited to deliver a practical seminar titled “Enhancing Factor Investing Strategy Performance Using Machine Learning,” sharing empirical research findings on the application of quantitative analysis methods in Taiwan’s stock market.

A key foundation of this research lies in the TEJ Quantitative Database, which offers comprehensive, point-in-time data specifically designed for backtesting and strategy development. This structure allows researchers to simulate investment decisions as they would have occurred historically, avoiding look-ahead bias and ensuring realistic evaluations.

Combining TEJ’s powerful quantitative database and、 factor library database and useful tools from TQuant Lab, the study found that GBDT-based value factors achieved strong and stable returns in Long Only strategies, with top quantile portfolios outperforming the market. Ridge models also performed well in Long & Short setups. The strategy showed solid investment potential, with controlled risk, efficient capital use, and reasonable turnover to manage costs.

Through active participation in academic events, TEJ continues to strengthen connections with scholars and research institutions. By sharing practical case studies and empirical research, we aim to build a bridge between academic insights and real-world financial applications, fostering deeper industry-academia collaboration in the field of quantitative investing.

Forecasting Dividend Rebound Probability with Ex-Dividend Event Studies

Factor Research – Idiosyncratic Volatility

Taiwan Market Data: TEJ Showcases Insights at Neudata London Summit 2025