Table of Contents

In the previous article, we delved into the undisclosed financial reporting issues at Chung Fu, providing readers with a basic understanding of the company. At its core, this event stems from an internal struggle for control, a common battle between the company’s management and market factions. In fact, the ownership dispute at Chung Fu had its origins several years ago. Back then, the company’s management failed to actively utilize its assets and pursue growth, prompting the market faction to embark on a reform mission at Chung Fu. They successfully gained control of the company through a shareholder vote in 2022.

Unfortunately, despite the market’s high hopes for the company’s prospects, Chung Fu’s operations failed to show any signs of improvement. The new management became embroiled in a power struggle with the former chairman, diverting their focus away from running the company. This even led to a suspension of trading due to delayed financial report filings. With the change in ownership, the back-and-forth battles between the two sides only added to the confusion. As various narratives emerged, the truth became increasingly elusive. What were the underlying causes of the internal issues at Chung Fu? This article will provide a detailed account of the ownership dispute at Chung Fu, the clashes between the company and market factions, and ultimately, the implications of the Chung Fu crisis on us as investors.

In 2020, a surprising surge in ChungFu’s stock prices captured the market’s imagination, with 2022 seeing repeated upper Limit breaks. How did this long-standing company with an average monthly revenue of just 1 million NT Dollars transform into a market sensation so quickly? What’s fueling the stock surge, given no apparent turnaround in operations?

The market’s fascination with Chung Fu primarily stems from its valuable land assets, notably a 21,000-square-meter plot in Zhongli, Taoyuan, and an office building in Zhonghe, New Taipei City. These holdings are highly prized, with the Zhongli plot alone estimated at 3 to 4 billion NT Dollars. This has turned Chung Fu into a coveted asset stock, attracting investors and market attention. Before the current ownership dispute, 2020 saw concerns over weak corporate governance, leading to a board election contest between the company and market factions.

A year later, the battle for control resurfaced, shining a spotlight not only on Chung Fu’s land assets but also symbolizing new players entering the scene. The market’s expectation of asset revitalization under fresh management has been revived.

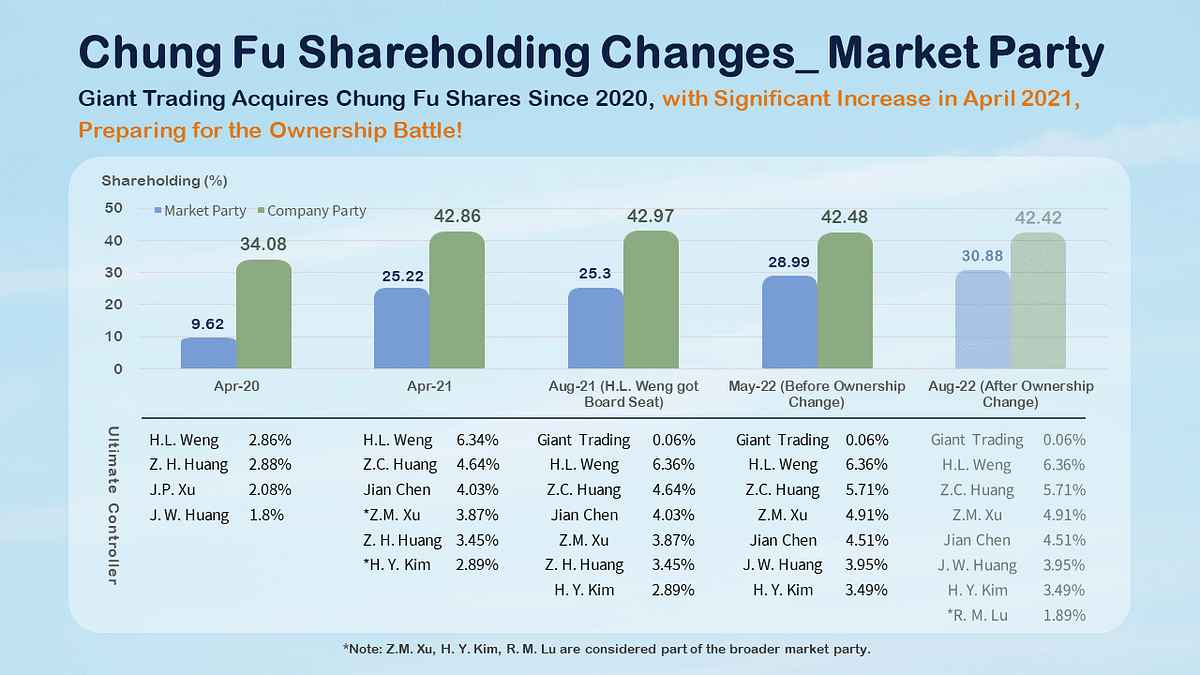

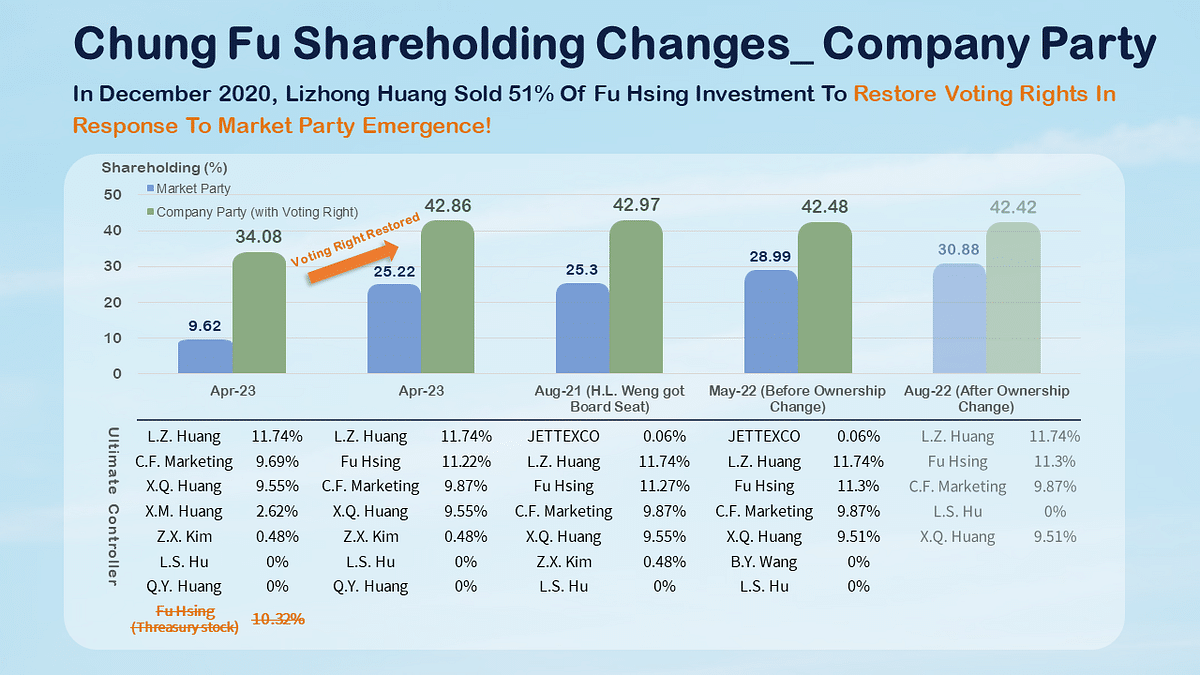

According to TEJ Group’s Credit Risk Observer statistics, starting from April 2020, the market party, led by Giant Trading, began acquiring shares of Chung Fu. Initially, individuals like HongLin Weng, ZhiHong Huang, and JiaWen Huang (spouse of Chen Jian) were involved. Next year, current Chairman Jian Chen, ZhuMei Xu, and ZhenChang Huang, among others, also began purchasing Chung Fu shares in the market. This indicates that the market party has been gearing up for the ownership battle.

From the chart above, we can see that Giant Trading and the broader market faction collectively held only 9.62% of shares in 2020. However, in 2021, they significantly increased their holdings to 25.22%. In August of the same year, they successfully secured a board seat for Giant Trading’s representative, HongLin Weng. Before the change in ownership, the market faction and the broader market faction held a combined 28.99% of shares, gradually closing in on the company faction’s 42.48% ownership. If the majority of the remaining shareholders support the new reformist group, winning control of the company is indeed a possibility.

Furthermore, of note is the intriguing connection to a suspected insider trading incident involving HappyTuk (7584) in March 2023. Chung Fu’s market faction members, Jian Chen and ZhuMei Xu, along with independent directors HongLin Weng and RongZhi Gao, are linked to HappyTuk. The controversy surrounding the new management is not unique, and upon closer examination, the market party’s acquisition of Chung Fu’s share may be related to realizing the value of Chung Fu’s land assets.

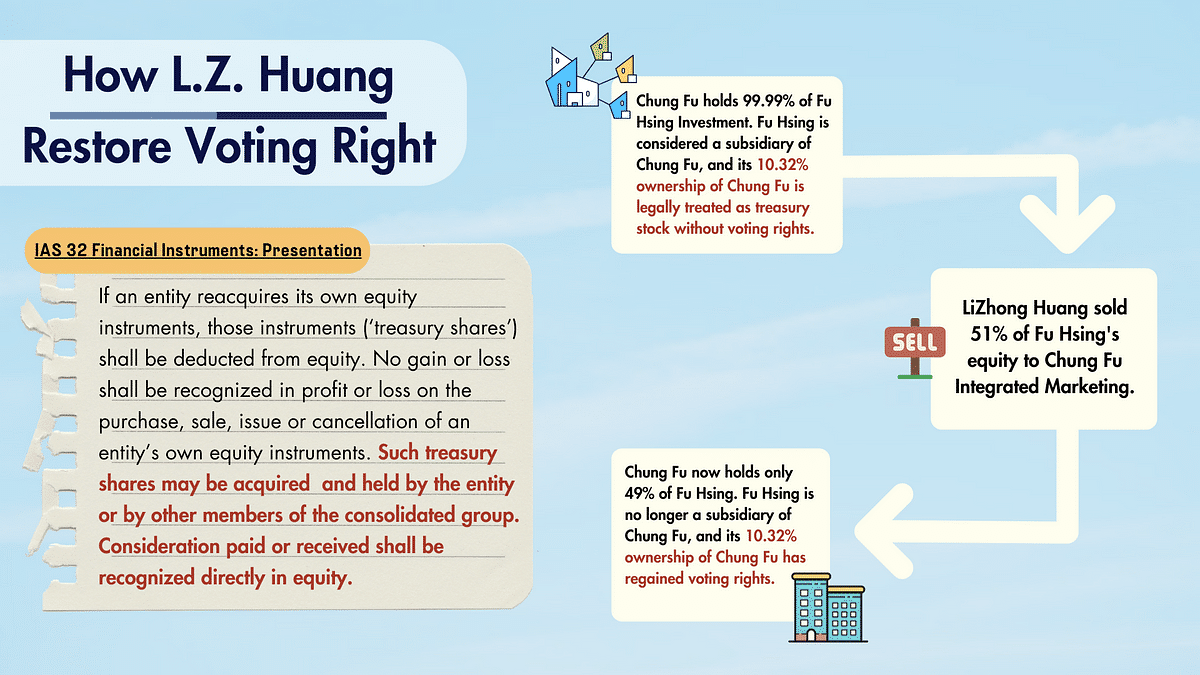

Faced with the market faction’s strategic moves, Chairman Huang Lizhong, representing the company faction, did not remain passive. On December 16, 2020, he transferred the 51% ownership of Fu Hsing Investment, a subsidiary of Chung Fu, to his private company, Chung Fu Integrated Marketing. The question arises: both Fu Hsing Investment and Chung Fu Integrated Marketing are controlled by members of the company faction. So why did he shift ownership from his left hand to his right hand?

The above question can be answered through the cross-shareholding between Chung Fu and Fu Hsing Investment. According to TEJ Group’s Credit Risk Observer, Chung Fu holds 99.99% of Fu Hsing’s shares, which is over 51%, making Fu Hsing a subsidiary of Chung Fu. How does this affect the company faction? It has a significant impact. Under IFRS accounting rules, when a subsidiary holds shares of its parent company, those shares are treated as treasury stock. Therefore, Fu Hsing’s 10.32% ownership of Chung Fu was considered treasury stock, and treasury stock does not have voting rights.

From LiZhong Huang’s perspective, countering the market faction’s preparations became paramount. He wisely sold Fu Hsing Investment’s 51% ownership to Chung Fu Integrated Marketing at 7.03 NT Dollars per share, severing the subsidiary relationship and granting voting rights. Subsequently, he acquired more Chung Fu shares through Fu Hsing, amassing an 11.3% stake in the company.

LiZhong Huang’s actions may appear reasonable and legal. However, the issue lies in the fact that he sold his ownership on December 11, 2020, but didn’t disclose this significant information until February of the following year. Additionally, the price of 7.03 NT Dollars per share has raised doubts among the market faction, who suspect questionable valuation standards and the possibility of undervaluing assets.

Want to Learn More?

Check Out Our Comprehensive data on Corporate Governance!