Table of Contents

In Part 1 – Factor Research: The SIR Short-Selling Factor, we examined the fundamental nature of the Short Interest Ratio (SIR) and clarified how it reflects short-selling sentiment within Taiwan’s equity market. Our empirical findings confirmed that institutional SBL shorting consistently embeds meaningful negative information—particularly among mid- and large-cap stocks, where SIR demonstrates strong and significant predictive power. These insights provide a solid foundation for strategy development, but they also raise a more practical question: Can SIR enhance portfolio performance when applied within real-world investment strategies?

In Part 2, we shift from factor interpretation to factor application. Specifically, we explore how SIR can be combined with the 52-week high momentum factor, and whether this integration can strengthen momentum-based strategies in the Taiwan market. Incorporating realistic elements—such as transaction costs, position constraints, and slippage—our backtests evaluate the true feasibility and robustness of SIR-enhanced strategies. Through these results, we assess whether SIR can remain a reliable indicator even under the complexities of real market conditions.

➡️ TEJ Joins the Neudata NY Data Summit!

To ensure objectivity and comparability across all strategies, the backtests in this study are conducted under a unified set of assumptions and market conditions.

A key consideration in this study is that we do not construct a standalone “low-SIR long-only” strategy. As highlighted earlier, a substantial portion of the market—approximately 25% of all observations—consists of stocks with SIR = 0. A pure low-SIR strategy would therefore select almost the entire zero-SIR universe, resulting in an overly broad and undifferentiated selection pool. Instead, SIR is used in a more targeted manner:

Given that 52-week high momentum (MOM52WH) is a widely recognized and empirically strong factor, we design three strategies that allow us to compare:

These strategies are rebalanced monthly, and each selects the top 50 stocks based on the specified ranking methodology.

Table 1 summarizes the three strategies evaluated in this study. Each strategy follows a monthly rebalancing schedule and applies equal weighting across its 50 selected constituents.

Table 1. factor strategy definition

| Strategy Name | strategy | Stock Selection Criteria |

| mom | Single-factor strategy | Selects the 50 stocks with the highest MOM52WH values, representing a pure momentum effect. |

| mom_mask_sir_zero | Sequential filtering strategy | (1) Filtering:Excludes all stocks with SIR > 0. (2) Ranking:Among the remaining “zero-SIR” stocks, selects the 50 with the highest MOM52WH values. |

| mom_sir | Composite integrated strategy | (1) Integration: Combines the momentum factor (MOM52WH) with the SIR factor (with SIR ranked in reverse order). (2) Ranking: Selects the 50 stocks with the highest composite scores, targeting stocks with high momentum and low short-selling pressure. |

This section provides a detailed comparison of the three strategies introduced earlier. We begin with the pure momentum strategy (mom) as the baseline, and then examine how the two SIR-enhanced strategies—mom_sir and mom_mask_sir_zero—differ in both return and risk dimensions.

Table2: Backtesting Performance Comparison of Strategies

| mom | mom_sir | mom_mask_sir_zero | benchmark | |

|---|---|---|---|---|

| Annual return | 12.70% | 16.41% | 21.69% | 13.61% |

| Cumulative returns | 329.20% | 536.36% | 993.30% | 373.38% |

| Annual volatility | 12.62% | 9.51% | 11.06% | 16.21% |

| Sharpe ratio | 1.011 | 1.646 | 1.832 | 0.869 |

| Max drawdown | -21.96% | -18.88% | -20.71% | -28.55% |

| Sortino ratio | 1.366 | 2.259 | 2.549 | 1.212 |

| Alpha | 0.060 | 0.113 | 0.158 | |

| Beta | 0.490 | 0.350 | 0.395 |

Data period: Jan 2013 – Jul 2025; Benchmark: TAIEX Total Return Index

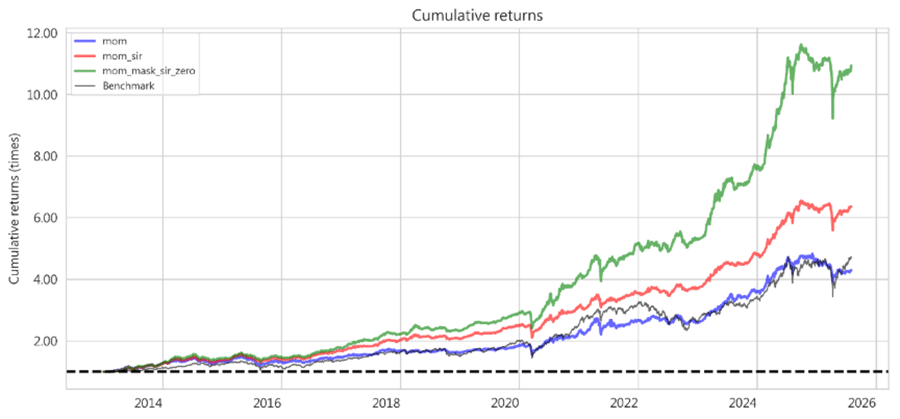

Figure 1: Cumulative Returns of Strategies

Data period: Jan 2013 – Jul 2025; Benchmark: TAIEX Total Return Index

The results lead to several clear conclusions:

First, although the pure momentum strategy exhibits long-term effectiveness, its annualized return of 12.70% slightly underperforms the market benchmark (13.61%) and comes with relatively higher volatility and drawdowns.

In contrast, the two SIR-enhanced strategies demonstrate substantial improvements across both performance and risk metrics. This finding strongly supports the core premise of our study: using SIR to avoid stocks under institutional short-selling pressure can significantly improve the robustness of momentum strategies.

By integrating SIR—either as a filter or as part of a composite score—the strategies deliver higher returns, lower volatility, and meaningfully better risk-adjusted performance.

This study demonstrates that incorporating the Short Interest Ratio (SIR)—a sentiment factor derived from institutional SBL short-selling activity—can meaningfully enhance momentum-based strategies in Taiwan market. While a pure momentum approach remains broadly effective, its performance is constrained by higher volatility and exposure to stocks under negative institutional sentiment.

The backtesting results show that both SIR-enhanced strategies outperform the baseline momentum strategy across all key dimensions, including annualized returns, volatility reduction, drawdown control, and overall risk-adjusted performance. Notably, simply filtering out stocks with SIR greater than zero already leads to a substantial improvement in strategy robustness. Meanwhile, the integrated factor approach, which combines momentum and SIR into a unified composite score, further strengthens the consistency of excess returns.

These findings reaffirm a central insight of this research:

institutional short-selling pressure contains actionable negative information, and systematically avoiding such stocks is an effective way to improve portfolio quality.

In short, SIR is not only informative at the factor-analysis level but also highly practical when applied to real-world investment strategies. Its ability to refine stock selection, mitigate downside risks, and enhance performance makes it a compelling addition to Taiwan-focused quantitative models.

The Short Interest Ratio (SIR) is only one part of the broader landscape of factor research, and the factor structure of Taiwan’s equity market is far more diverse than any single indicator can capture. Built upon decades of complete historical data for all listed companies in Taiwan, the TEJ Factor Libreary provides an extensive multi-category factor system—including sentiment factors, risk factors, momentum factors, value factors, quality factors, and more. Each factor is constructed with transparent methodologies, long lookback horizons, and research-grade consistency, making it directly applicable for quantitative analysis.

For researchers and investors alike, high-quality and standardized factor data are essential not only for testing market hypotheses but also for building strategies, conducting backtests, and designing multi-factor asset allocation models. Whether you aim to explore how different factors behave in Taiwan’s market or plan to integrate multi-factor frameworks into your own investment process, the TEJ Factor Library offers a reliable and analytically rich starting point.

By developing a deeper understanding of these factors and applying them judiciously, investors can form more structured and resilient investment decisions—continuously uncovering dependable market signals in an environment that is constantly evolving.

➡️ See what’s inside TEJ’s Factor Library and explore the signals driving performance.