Table of Contents

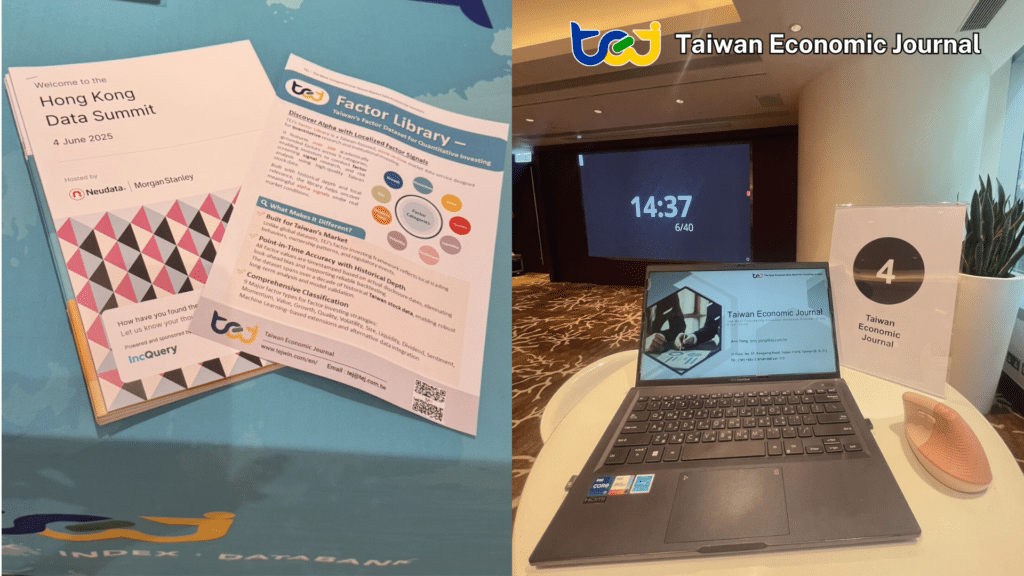

In June 2025, Taiwan Economic Journal (TEJ) was invited to participate in the Neudata Hong Kong Data Summit, joining hedge funds, data scientists, and vendors from around the world to explore how alternative data is driving alpha generation. Following our appearance at the London Summit earlier this year, TEJ continues to engage with global institutional investors—this time in Asia—by showcasing our deep and localized market datasets for Taiwan equities.

At this summit, TEJ spotlighted two of its most in-demand data solutions designed for institutional use:

📈 Factor Investing in Taiwan- Discover TEJ’s Local Alpha Signals

IAs investment strategies increasingly shift from intuition to evidence-based models, Factor Investing has become a cornerstone of quantitative research and multi-factor portfolio construction. TEJ’s Factor Library provides localized alpha signals engineered for Taiwan’s market, fully time-stamped to ensure historical accuracy and avoid data leakage in backtests.

Whether you’re building proprietary models, validating financial signals, or conducting thematic screening, TEJ’s factor datasets deliver actionable insights for research and execution.

TEJ offers a comprehensive suite of market data services to support alpha research, quant screening, risk analysis, and fundamental evaluation. Our coverage includes:

📈 Discover how TEJ’s localized datasets integrate into your internal workflows and dashboards.

Follow us on LinkedIn for updates on product enhancements, upcoming events, and insights from Taiwan’s financial markets: 🔗 TEJ LinkedIn