Table of Contents

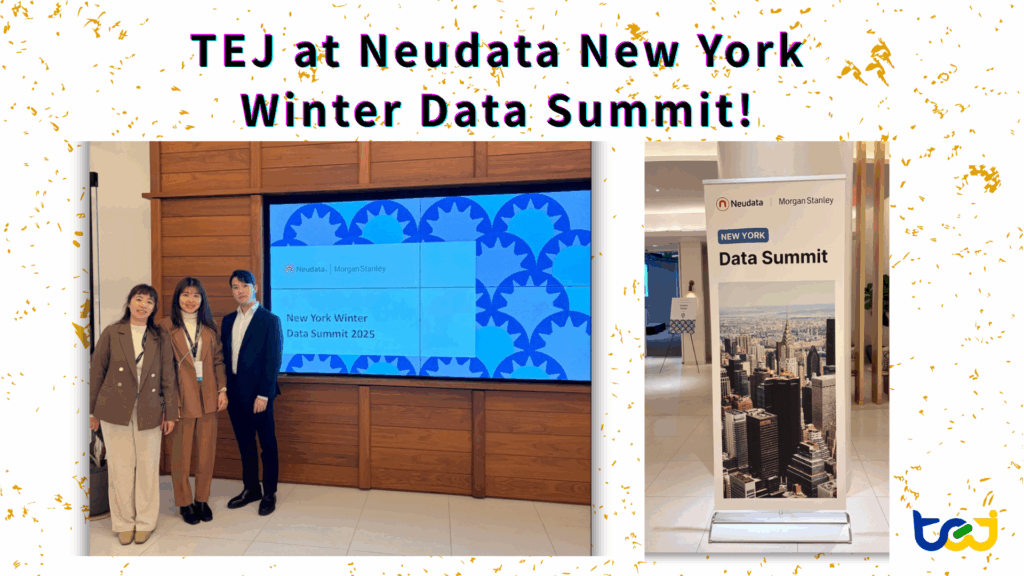

TEJ was pleased to participate in the Neudata New York Data Summit in December 2025, an event that brought together global leaders in quantitative research, alternative data innovation, and investment technology. Throughout the summit, our team engaged in discussions with portfolio managers, data scientists, and researchers who are actively seeking differentiated datasets to enhance their investment models and expand their coverage across the Asia-Pacific region.

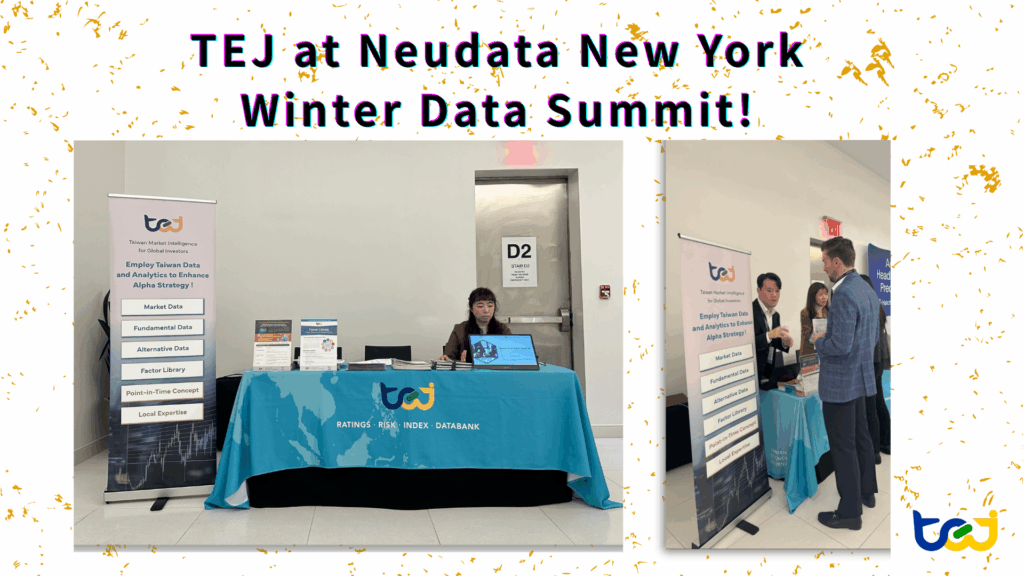

The summit provided an excellent platform for TEJ to highlight the depth and reliability of our Taiwan-focused data ecosystem. Visitors expressed strong interest in how TEJ’s long-history, structured, and transparent datasets can support model development across areas such as alpha research, quantitative strategies, and credit risk monitoring. The event also offered valuable insights into the evolving needs of global investors, helping us better understand how Taiwan market data can strengthen international investment workflows.

During the event, TEJ showcased several flagship data products designed to help global investors strengthen research capabilities and build robust systematic strategies. Key solutions presented include:

👉TEJ Point-in-Time Audited Financial Database – Rejecting “Peek-ahead” Backtesting

👉TCRI Watchdog : How Major Announcements Drive Stock Price Volatility

👉Factor Library – Taiwan’s Factor Dataset for Quantitative Investing

Together, these products give global clients a complete toolkit for exploring Taiwan’s equity market—from raw fundamentals to enriched alternative datasets and standardized systematic factors.

TEJ remains committed to supporting global investors with data that is accurate, transparent, and research-ready. We welcome continued dialogue with teams interested in exploring opportunities in the Taiwan market or seeking high-quality Asia-Pacific datasets for systematic investment research.

If you would like to learn more about TEJ datasets, schedule a product demo, or explore collaboration opportunities, please feel free to contact us. We look forward to working with you.

💡Contact us to request a custom Quantitative database demo